Mexico Boiler Market Size, Share, Trends and Forecast by Boiler Type, End User, and Region, 2025-2033

Mexico Boiler Market Overview:

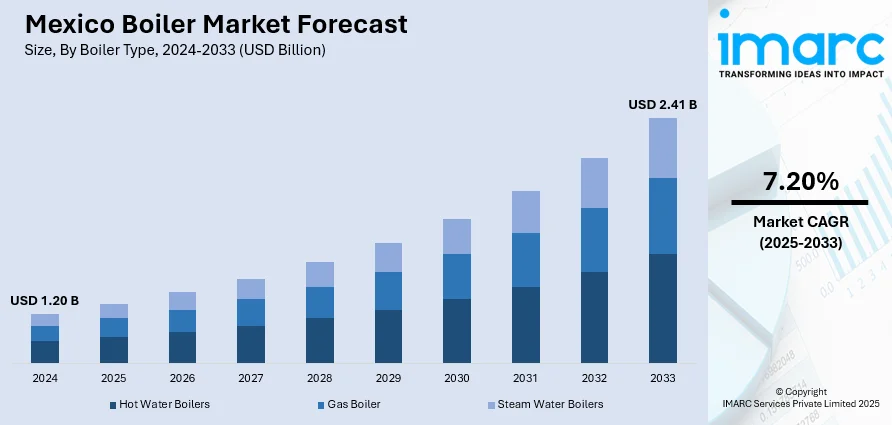

The Mexico boiler market size reached USD 1.20 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.41 Billion by 2033, exhibiting a growth rate (CAGR) of 7.20% during 2025-2033. The market is driven by rising industrialization, demand for energy-efficient heating systems, and increased investments in manufacturing and food processing sectors. Government support for low-emission technologies also fuels adoption of advanced boilers. These factors are contributing significantly to the increasing Mexico boiler market share across various industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.20 Billion |

| Market Forecast in 2033 | USD 2.41 Billion |

| Market Growth Rate 2025-2033 | 7.20% |

Mexico Boiler Market Analysis:

- Major Drivers: The boiler market in Mexico is fueled by its expanding industries such as manufacturing, energy and petrochemicals that rely heavily on a dependable source of steam and heat. The growing demand for energy-efficient systems, in conjunction with increased pressure to mitigate operational costs and environmental footprints, drives companies to adopt modern boiler technologies in their operations.

- Key Market Trends: The market is shifting towards sustainable and energy-efficient boiler systems that have low-emission systems and integrated smart-monitoring technologies. Organizations are manufacturing environmentally-friendly designs with automated controls that include more safety features in response to the global trend towards cleaner and efficient industrial operations and addressing changing regulatory and environmental compliance.

- Market Challenges: According to the Mexico boiler market forecast, a few of the primary challenges of the market are high upfront costs, costly installation and complexity, and maintenance hurdles. Companies will need to weigh energy efficiency and regulatory compliance directives with affordability. There is the possibility of limited technical oversight, outdated infrastructure in rural areas, and the equipment-need to retrofit previous boiler technologies to address potential challenges for the uptake of next-gen technologies across the industry.

- Market Opportunities: Opportunities exist in renewable energy integration, waste heat recovery, and adoption of advanced boiler designs for efficiency improvements. Emerging sectors and industrial expansion provide potential markets for modern systems. Collaboration with local industries for customized solutions, along with digital and smart technologies, can further drive Mexico boiler market demand and innovation.

Mexico Boiler Market Trends:

Technological Integration and Smart Boilers

One of the significant trends influencing the Mexico boiler market analysis is the incorporation of smart technologies and automation into boilers. The use of IoT-capable boilers and remote monitoring systems is increasingly popular among industrial consumers looking for operational efficiency and predictive maintenance. These developments enable real-time performance monitoring, fault detection, and energy consumption optimisation, and hence substantially lower downtime and costs. Further, smart boilers enable compliance with environmental regulations through optimal combustion and emission control. For instance, in February 2025, Lointek completed a notable project in Mexico, delivering two vertical HRSG (Heat Recovery Steam Generator) boilers for a cogeneration plant in the paper industry. The design features post-combustion, natural circulation, and a modular structure to ease on-site assembly and maintenance. This innovative vertical configuration suits space-constrained facilities and highlights Lointek’s ability to offer efficient, tailored solutions. The project reinforces Lointek’s position in the global energy market and commitment to sustainability, quality, and engineering excellence in cogeneration systems.

To get more information on this market, Request Sample

Expansion in Commercial and Residential Segments

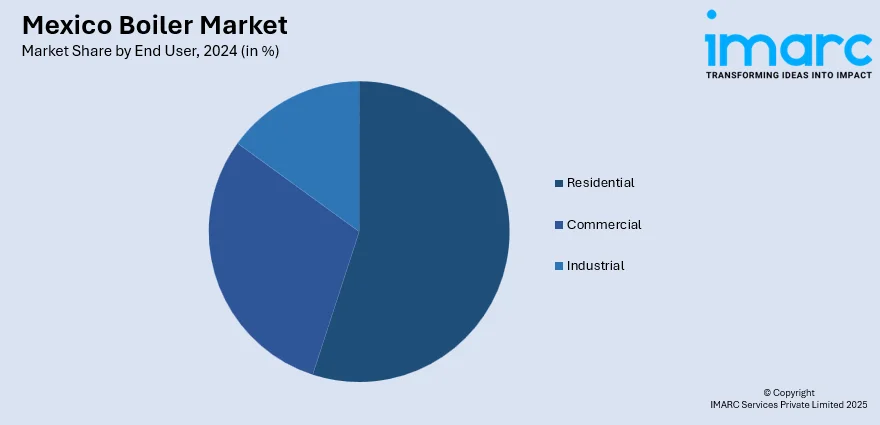

In recent years, the Mexico boiler market growth has extended beyond industrial sectors, with rising demand in commercial and residential applications. Urban expansion, increasing awareness of energy-efficient home heating, and rising incomes have contributed to the adoption of compact and efficient boilers in homes, hospitals, and commercial buildings. For instance, a 2024 report indicates that the residential sector in Mexico is the third-largest consumer of power, using an estimated 790 PJ, with 76% dedicated to thermal energy and 24% to electricity. Among Latin American and Caribbean countries, Mexico has achieved an Energy Transition Index of 62%. In many countries, heating and cooling account for the highest portion of residential energy consumption. While air conditioners, appliances, and lighting typically run on electricity, fossil fuels like natural gas, oil, coal, and biomass remain common for heating and cooking. Oil products make up 34% of total residential final energy consumption in the country. Condensing boilers, known for their high energy efficiency and reduced emissions, are gaining popularity in both new constructions and retrofits. Additionally, the growing hospitality sector and development of smart infrastructure projects across major cities are fueling demand for modern heating solutions. This diversification of end-user segments is creating new growth avenues and promoting competitive innovation, thereby supporting a steady increase in the Mexico Boiler market share.

Mexico Boiler Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on boiler type and end user.

Boiler Type Insights:

- Hot Water Boilers

- Gas Boiler

- Steam Water Boilers

The report has provided a detailed breakup and analysis of the market based on the boiler type. This includes hot water boilers, gas boiler, and steam water boilers.

End User Insights:

- Residential

- Commercial

- Industrial

The report has provided a detailed breakup and analysis of the market based on the end user. This includes residential, commercial, and industrial.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- In December 2024, Solvay inaugurated a biodigester at its Ciudad Juarez site, generating biomethane from organic waste to partially replace natural gas in boilers and kilns, cutting CO2 emissions by 12% from 2021 levels. Developed with Franco y Asociados, the project overcame feedstock, processing, and system adaptation challenges. It supports Solvay’s global sustainability goals, reduces environmental impact, and demonstrates locally tailored energy transition solutions while benefiting the community and workforce.

Mexico Boiler Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Boiler Types Covered | Hot Water Boilers, Gas Boiler, Steam Water Boilers |

| End Users Covered | Residential, Commercial, Industrial |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico boiler market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico boiler market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico boiler industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The boiler market in Mexico was valued at USD 1.20 Billion in 2024.

The Mexico boiler market is projected to exhibit a CAGR of 7.20% during 2025-2033, reaching a value of USD 2.41 Billion by 2033.

The Mexico boiler market is driven by industrial growth in sectors like manufacturing, petrochemicals, and power generation, which demand reliable steam and heat. Rising energy costs and the need for operational efficiency encourage adoption of modern, fuel-efficient boilers. Additionally, stricter environmental regulations and growing awareness of carbon reduction are pushing industries to invest in low-emission, energy-saving boiler technologies. Expansion of renewable fuel integration also supports market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)