Mexico Bottled Water Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, Packaging Type, and Region, 2025-2033

Mexico Bottled Water Market Overview:

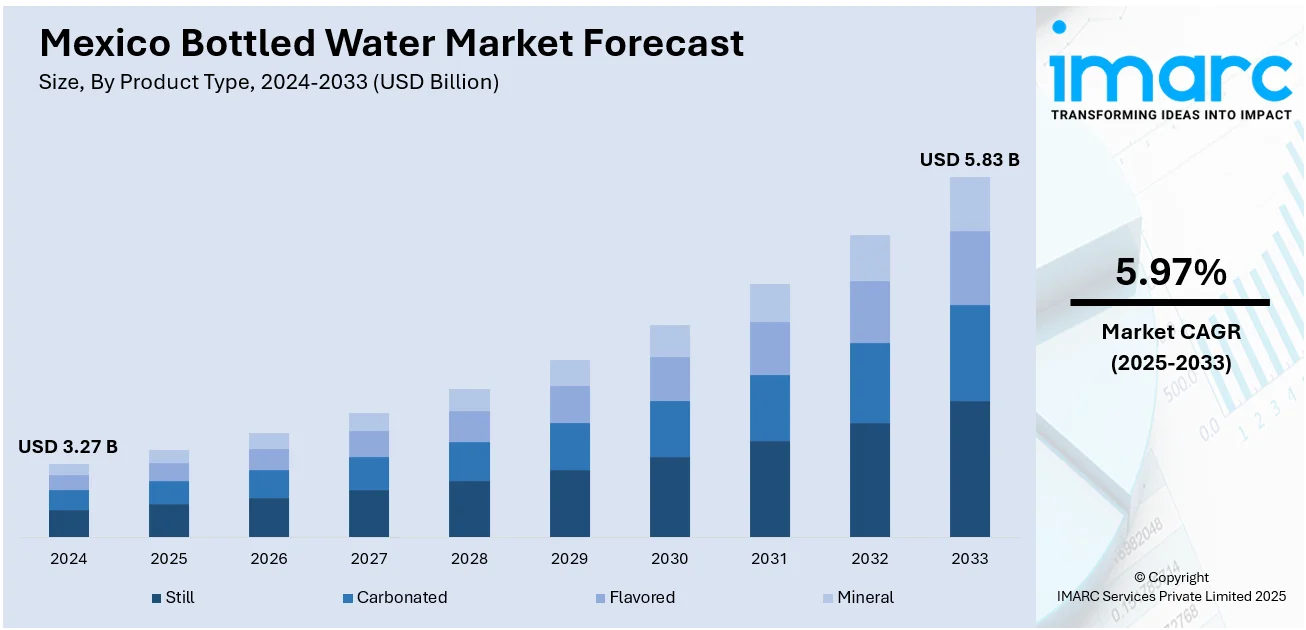

The Mexico bottled water market size reached USD 3.27 Billion in 2024. Looking forward, the market is projected to reach USD 5.83 Billion by 2033, exhibiting a growth rate (CAGR) of 5.97% during 2025-2033. The market is witnessing consistent growth, fueled by increasing health consciousness, urban development, and enhanced availability of clean water. Consumers increasingly prefer branded and purified options over tap water, favoring convenience and safety. Premium and flavored variants are gaining traction, especially among younger demographics, amid strong competition from local and international players, thereby driving Mexico bottled water market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.27 Billion |

| Market Forecast in 2033 | USD 5.83 Billion |

| Market Growth Rate 2025-2033 | 5.97% |

Mexico Bottled Water Market Trends:

Rapid Urbanization and Growing Disposable Incomes

The ongoing urbanization in Mexico is significantly driving up the consumption of bottled water. According to industry reports, as of July 2025, Mexico's population is approximately 132,022,427, with an estimated mid-year figure of 131,946,900. Urban residents make up 87.86% (about 115,925,945 people). As more individuals relocate to cities, accessing consistent and clean tap water remains problematic in some regions, leading to a preference for dependable bottled options. At the same time, rising disposable incomes are allowing consumers to focus on health and wellness by choosing safe, branded bottled water. This trend is especially noticeable in metropolitan and semi-urban areas where convenience and portability are crucial. Consumers are becoming increasingly discerning, opting for trusted brands that guarantee quality and purity. Additionally, the expanding middle-class population is enhancing market penetration within households and for on-the-go consumption. These socio-economic influences, coupled with urban lifestyle trends, continue to drive demand and influence the competitive landscape of the Mexico bottled water market growth.

To get more information on this market, Request Sample

Growing Sustainable Packaging Trends

The landscape of the bottled water market in Mexico is undergoing a significant transformation towards sustainable packaging. Manufacturers are increasingly utilizing lightweight bottles, recycled PET (rPET), and biodegradable materials to lessen their environmental impact and meet changing consumer expectations. For instance, in December 2024, Beika's founder, Roberto Noriega, is prioritizing sustainability by partnering with O-I for eco-friendly glass packaging. By utilizing solar energy to capture moisture from the air, Beika aims to produce environmentally friendly bottled water. The brand is set to launch in Mexico by 2025 and will focus on appealing to environmentally conscious consumers with premium offerings. This trend is fueled by rising awareness of environmental issues, regulatory pressures regarding plastic consumption, and the sustainability goals of various companies. By using lightweight bottles, manufacturers can not only reduce the amount of material required but also cut down on transportation emissions and costs. Recycled PET is becoming a popular eco-friendly substitute for virgin plastic, assisting brands in achieving circular economy objectives. Moreover, there are new developments in biodegradable and compostable packaging, particularly among premium and specialty water brands. This commitment to sustainability not only allows companies to stand out in the market but also attracts consumers who prioritize environmental responsibility, thereby driving growth in Mexico's bottled water market through innovative and responsible packaging solutions.

Mexico Bottled Water Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, distribution channel, and packaging type.

Product Type Insights:

- Still

- Carbonated

- Flavored

- Mineral

The report has provided a detailed breakup and analysis of the market based on the product type. This includes still, carbonated, flavored, and mineral.

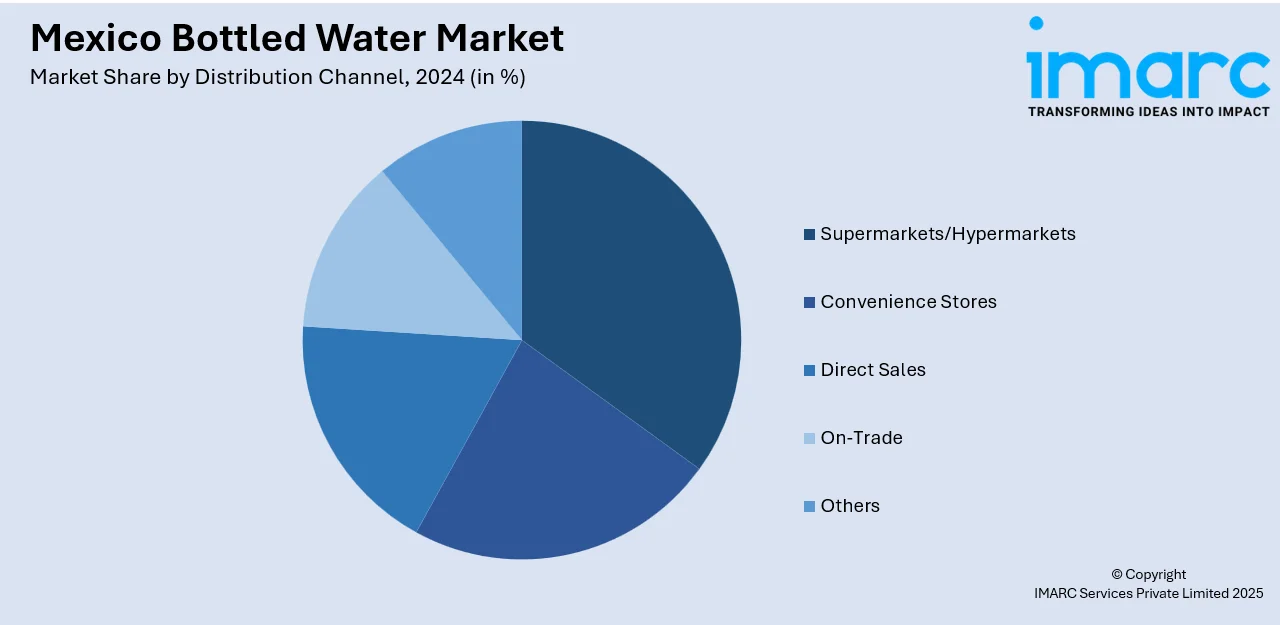

Distribution Channel Insights:

- Supermarkets/Hypermarkets

- Convenience Stores

- Direct Sales

- On-Trade

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets/hypermarkets, convenience stores, direct sales, on-trade, and others.

Packaging Type Insights:

- PET Bottles

- Metal Cans

- Others

The report has provided a detailed breakup and analysis of the market based on the packaging type. This includes PET bottles, metal cans, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Bottled Water Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Still, Carbonated, Flavored, Mineral |

| Distribution Channels Covered | Supermarkets/Hypermarkets, Convenience Stores, Direct Sales, On-Trade, Others |

| Packaging Types Covered | PET Bottles, Metal Cans, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico bottled water market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico bottled water market on the basis of product type?

- What is the breakup of the Mexico bottled water market on the basis of distribution channel?

- What is the breakup of the Mexico bottled water market on the basis of packaging type?

- What is the breakup of the Mexico bottled water market on the basis of region?

- What are the various stages in the value chain of the Mexico bottled water market?

- What are the key driving factors and challenges in the Mexico bottled water market?

- What is the structure of the Mexico bottled water market and who are the key players?

- What is the degree of competition in the Mexico bottled water market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico bottled water market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico bottled water market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico bottled water industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)