Mexico Botulinum Toxin Market Size, Share, Trends and Forecast by Type, Application, End User, and Region, 2025-2033

Mexico Botulinum Toxin Market Overview:

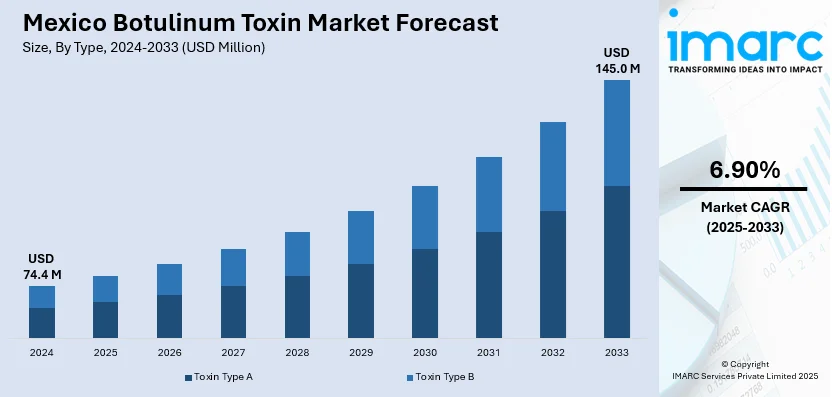

The Mexico botulinum toxin market size reached USD 74.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 145.0 Million by 2033, exhibiting a growth rate (CAGR) of 6.90% during 2025-2033. The market is growing due to rising demand for minimally invasive aesthetic procedures and therapeutic use in neurology. Regulatory approvals and expanding access to biosimilars are further pushing adoption across both clinical and cosmetic applications, strengthening the market outlook.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 74.4 Million |

| Market Forecast in 2033 | USD 145.0 Million |

| Market Growth Rate 2025-2033 | 6.90% |

Mexico Botulinum Toxin Market Trends:

Aesthetic Use Gaining Momentum

The use of botulinum toxin for aesthetic procedures in Mexico continues to rise as more individuals seek non-surgical facial treatments. The demand is supported by a growing middle-class population, wider acceptance of cosmetic procedures, and increased availability of certified aesthetic clinics across urban areas. Factors such as affordable pricing and shorter recovery time have made these treatments more accessible and appealing to a broader demographic. Midway through these developments, the popularity of products like Jeuveau and its biosimilar forms, including ABP-450, has increased due to their competitive positioning. Later, the entry of global brands with localized strategies has pushed awareness and trust, further stimulating uptake. Cosmetic dermatologists have also reported higher patient volumes, especially among younger adults pursuing preventive treatments. This behavioral shift has encouraged product makers to introduce targeted campaigns and region-specific marketing approaches, gradually turning aesthetic botulinum toxin use into a recurring demand trend in major cities like Mexico City, Monterrey, and Guadalajara.

Therapeutic Demand Expands Reach

Beyond cosmetic use, therapeutic applications of botulinum toxin in Mexico have gained attention. Conditions such as cervical dystonia, chronic migraines, and spasticity are increasingly being treated with botulinum toxin injections. Physicians are recognizing its effectiveness in managing neurological disorders, especially where conventional medications have limited results. Improved medical training and growing specialist availability have also contributed to a higher number of prescriptions for therapeutic use. In the lower part of this trend, AEON Biopharma’s ABP-450 biosimilar approval marked a significant step, as it created broader access to therapeutic-grade botulinum toxin. Following this, hospitals and clinics have begun to include these products in treatment plans, reflecting a slow but steady shift in clinical practice. Over time, this availability has helped normalize the use of botulinum toxin in neurology, expanding its role in the public and private healthcare sectors. Insurance coverage improvements and partnerships with manufacturers have also made treatments more affordable, aiding consistent demand from both urban and semi-urban areas.

Mexico Botulinum Toxin Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, application, and end user.

Type Insights:

- Toxin Type A

- Toxin Type B

The report has provided a detailed breakup and analysis of the market based on the type. This includes toxin type a and toxin type b.

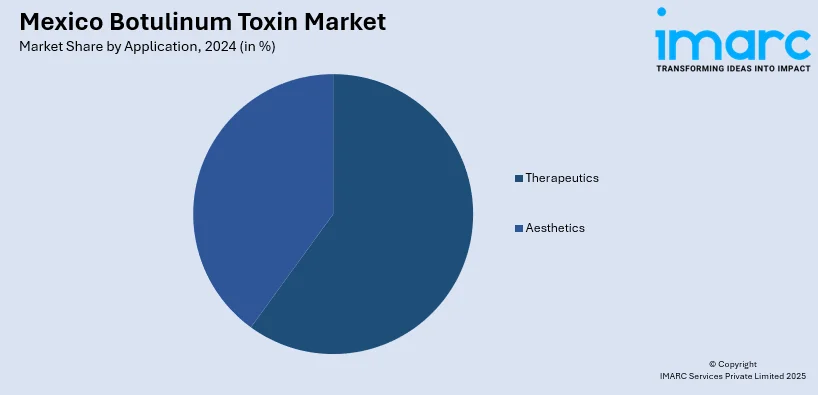

Application Insights:

- Therapeutics

- Aesthetics

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes therapeutics and aesthetics.

End User Insights:

- Hospitals and Clinics

- Dermatology Clinics

- Spas and Cosmetic Centers

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals and clinics, dermatology clinics, and spas and cosmetic centers.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Botulinum Toxin Market News:

- March 2025: AEON Biopharma joined the Leerink Global Healthcare Conference, highlighting its ABP-450 botulinum toxin complex, already approved as a biosimilar in Mexico. This strengthened confidence in regulated therapeutic applications, supporting market expansion and boosting clinical credibility in the Mexican botulinum toxin sector.

Mexico Botulinum Toxin Market Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Toxin Type A, Toxin Type B |

| Applications Covered | Therapeutics, Aesthetics |

| End Users Covered | Hospitals and Clinics, Dermatology Clinics, Spas and Cosmetic Centers |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico botulinum toxin market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico botulinum toxin market on the basis of type?

- What is the breakup of the Mexico botulinum toxin market on the basis of application?

- What is the breakup of the Mexico botulinum toxin market on the basis of end user?

- What are the various stages in the value chain of the Mexico botulinum toxin market?

- What are the key driving factors and challenges in the Mexico botulinum toxin market?

- What is the structure of the Mexico botulinum toxin market and who are the key players?

- What is the degree of competition in the Mexico botulinum toxin market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico botulinum toxin market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico botulinum toxin market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico botulinum toxin industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)