Mexico Brakes and Clutches Market Size, Share, Trends and Forecast by Technology, Product Type, Sales Channel, End Use Industry, and Region, 2025-2033

Mexico Brakes and Clutches Market Overview:

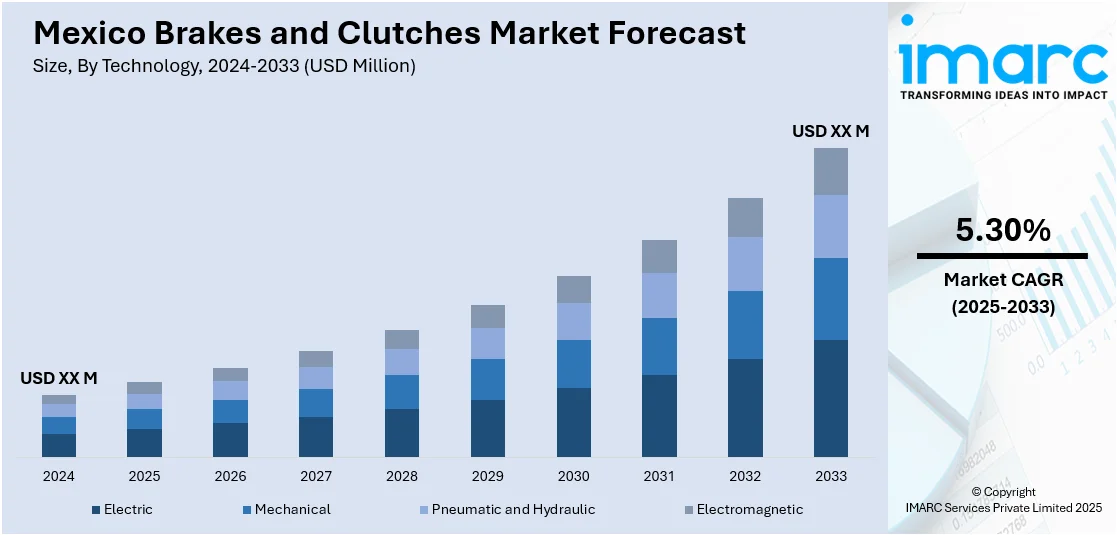

The Mexico brakes and clutches market size is projected to exhibit a growth rate (CAGR) of 5.30% during 2025-2033. The market is transforming at a fast pace with the implementation of mechatronic systems, eco-friendly materials, and expanding aftermarket needs. Higher safety requirements and increased use of vehicles and machinery are driving the demand for high-tech, lighter, and tougher components. Spreading industrial automation and customized solutions enhance domestic and export prospects. These forces are transforming the competitive scene and contributing heavily to the growth of the Mexico brakes and clutches market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Growth Rate 2025-2033 | 5.30% |

Mexico Brakes and Clutches Market Analysis:

- Key Drivers: Rising automotive manufacturing, growing vehicle ownership, and escalating demand for safety features propel Mexico brakes and clutches market demand. The growth of manufacturing bases and foreign direct investment in the automotive industry solidifies supply chains. Industrial growth support from the government and growing aftermarket demand further accelerate adoption in passenger and commercial vehicles.

- Important Market Trends: The industry is moving towards light, strong, and environmentally friendly braking and clutch systems. The adoption of new technologies like electronic clutches, ABS, and regenerative braking is on the rise. Electric and hybrid cars are fueling demand for new braking solutions. Digitized supply chains, automation, and intelligent components also drive product design and distribution.

- Market Challenges: Excessive dependence on imports for sophisticated technologies increases costs and risk exposure to supply chain disruptions. Counterfeit goods and quality issues affect brand confidence in the aftermarket. Increased raw material costs and environmental regulations stress manufacturers. Furthermore, the shift to electric vehicles disrupts traditional clutch demand, demanding innovation and adjustment by suppliers.

- Market Opportunities: According to the Mexico brakes and clutches market analysis, the motor vehicle manufacturing center presents enormous growth prospects. Growing EV adoption in turn drives demand for sophisticated braking solutions. Growth of the aftermarket, from aging vehicles, favors replacement parts sales. Global supplier collaborations, domestic innovation, and regulatory pressures on tailoring safety and sustainability provide scope for market growth.

Mexico Brakes and Clutches Market Trends:

Integration of Mechatronic Innovations into Braking and Clutch Systems

The brakes and clutches of Mexico are more and more driven by the integration of mechatronic technologies, which blend mechanical systems with electronic sensors as well as actuators. This integration enables real-time diagnostics, adaptive responsiveness, and increased system accuracy. For automotive use, particularly with the proliferation of electric as well as hybrid cars, electronically controlled braking and clutch systems are becoming absolutely necessary. These systems promote smoother transitions, less energy consumption, and predictive maintenance, all contributing to improved efficiency in vehicles and machinery. Mechatronics is also used in automated industrial processes, which guarantee accurate torque control and optimal performance in manufacturing environments. This is evidence of a greater industrial movement toward digitalization and automation. With intelligent manufacturing gaining momentum in the country, the market for technologically advanced increases in the Mexico brakes and clutches market outlook. Mexico brakes and clutches market growth is being strongly driven by this pattern of modernization, which positions the market at the center for cutting-edge component innovation in North America. As per the reports, in February 2024, Brakes India invested $70M to establish its first foundry plant in Aguascalientes, Mexico, solidifying its global reach and cementing the region's status in the automotive manufacturing sector.

To get more information on this market, Request Sample

Transition To Lightweight, Eco-Friendly Component Materials

The shift toward lightweight and eco-friendly materiality is becoming a characteristic trend in the brakes and clutches industry in Mexico. Companies are substituting old-style heavy metals like cast iron with high-performance composites, aluminum alloys, and carbon fiber-reinforced plastics. These products provide higher strength-to-weight ratios, decrease overall component weight, and increase thermal resistance, while providing improved energy efficiency in transportation and industrial equipment. In transportation, this transition helps provide improved fuel efficiency and emissions reduction, which is in accord with global sustainability standards. For industrial equipment, lighter components result in less mechanical stress and longer run lives. Moreover, the recyclability of these materials is also attractive to manufacturers who want to reduce their environmental footprint. Through aligning production processes with international green standards and green consumer sentiments, this material development is redefining the value chain. Sustainability focus is one of the primary drivers of Mexico brakes and clutches growth, affirming the nation's interest in sustainable manufacturing practices.

Growth in Customization and Aftermarket Segments

In Mexico, there is expanding interest in customization and aftermarket options in the brakes and clutches market, motivated by rising vehicle ownership, aging fleets, and industrial diversity. End-users are looking for customized products that meet definite performance and environmental requirements—whether in passenger cars, agricultural machinery, or factory systems. According to the reports, in January-February 2024, Yucatán spearheaded Mexico's production of brakes and clutches with a growth of 84.48% to $41 million, aided by sustained performance improvements in allied manufacturing of auto parts throughout Zacatecas and Durango. Moreover, the trend encompasses the creation of modular brake pads, variable friction clutches, and ready-to-install replacement kits. Aftermarket also enables small and midsize repair shops with cost-effective solutions and local accessibility, which tend to have higher durability and service life. With digital tools, real-time diagnostics and consumer-based configuration are becoming a reality, enhancing user satisfaction and long-term equipment performance. With the trend towards customers having greater control over maintenance and performance results, the value of the segment is increasing at a fast pace. This has also motivated localized manufacturing and inventory models. The resulting market response and innovation in the aftermarket are pivotal to Mexico brakes and clutches growth, improving accessibility and market coverage nationwide.

Mexico Brakes and Clutches Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on technology, product type, sales channel, and end use industry.

Technology Insights:

- Electric

- Mechanical

- Pneumatic and Hydraulic

- Electromagnetic

The report has provided a detailed breakup and analysis of the market based on the technology. This includes electric, mechanical, pneumatic and hydraulic, and electromagnetic.

Product Type Insights:

- Dry

- Oil Immersed

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes dry and oil immersed.

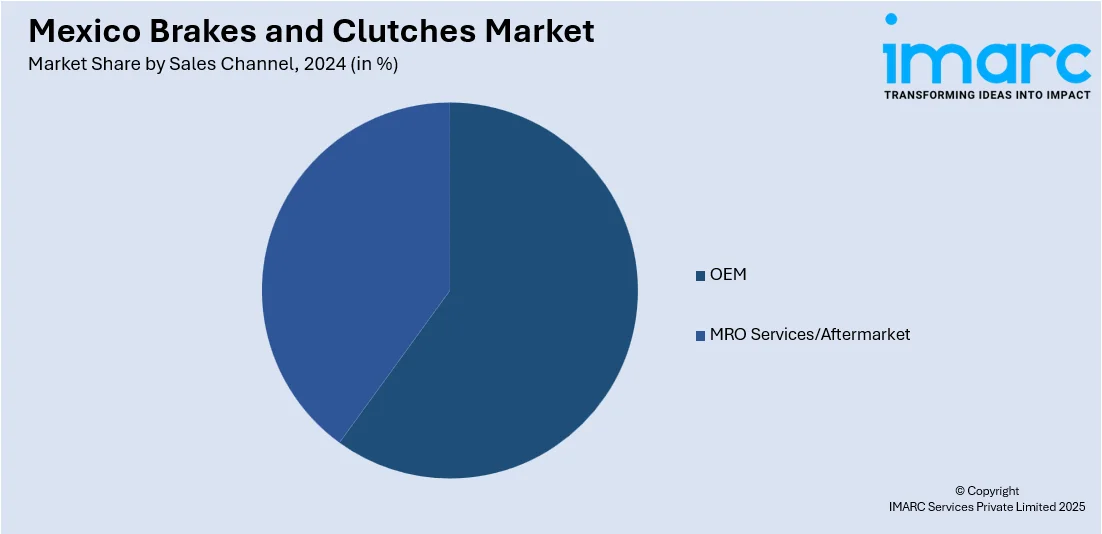

Sales Channel Insights:

- OEM

- MRO Services/Aftermarket

The report has provided a detailed breakup and analysis of the market based on the sales channel. This includes OEM and MRO services/aftermarket.

End Use Industry Insights:

- Mining and Metallurgy Industry

- Construction Industry

- Power Generation Industry

- Industrial Production

- Commercial

- Logistics and Material Handling Industry

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes mining and metallurgy industry, construction industry, power generation industry, industrial production, commercial, and logistics and material handling industry.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- In February 2024, MasterLab launched a state-of-the-art brake pad manufacturing facility and research center in Querétaro, Mexico. Dedicated to aftermarket private labels, the plant targets export markets in the USA, Canada, and Europe. With an annual capacity of 1.5 million sets, the facility leverages skilled local labor, strategic proximity to borders and seaports, and optimized logistics to deliver high-quality brake pads, supporting the growing global automotive aftermarket industry with efficiency and reliability.

Mexico Brakes and Clutches Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Electric, Mechanical, Pneumatic and Hydraulic, Electromagnetic |

| Product Types Covered | Dry, Oil Immersed |

| Sales Channels Covered | OEM, MRO Services/Aftermarket |

| End-Use Industries Covered | Mining and Metallurgy Industry, Construction Industry, Power Generation Industry, Industrial Production, Commercial, Logistics and Material Handling Industry |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico brakes and clutches market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico brakes and clutches market on the basis of technology?

- What is the breakup of the Mexico brakes and clutches market on the basis of product type?

- What is the breakup of the Mexico brakes and clutches market on the basis of sales channel?

- What is the breakup of the Mexico brakes and clutches market on the basis of end use industry?

- What is the breakup of the Mexico brakes and clutches market on the basis of region?

- What are the various stages in the value chain of the Mexico brakes and clutches market?

- What are the key driving factors and challenges in the Mexico brakes and clutches?

- What is the structure of the Mexico brakes and clutches market and who are the key players?

- What is the degree of competition in the Mexico brakes and clutches market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico brakes and clutches market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico brakes and clutches market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico brakes and clutches industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)