Mexico Bridge Construction and Maintenance Market Size, Share, Trends and Forecast by Bridge Type, Material Used, Construction Type, Application, Maintenance Activity, and Region, 2025-2033

Mexico Bridge Construction and Maintenance Market Overview:

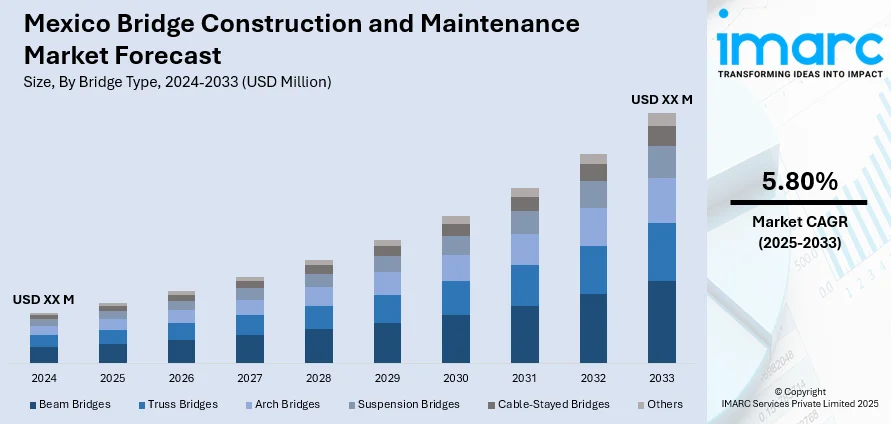

The Mexico bridge construction and maintenance market size is expected to exhibit a growth rate (CAGR) of 5.80% during 2025-2033. The market is driven by rapid urbanization and infrastructure development, requiring new bridges and the maintenance of existing ones to improve connectivity. Government investments in large-scale projects, such as the Maya Train and airport expansion, supports the continuous demand for bridge construction and upgrades. The increasing traffic volume and heightened safety concerns further augment the need for regular maintenance and the construction of more resilient bridges, expanding the Mexico bridge construction and maintenance market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Growth Rate 2025-2033 | 5.80% |

Mexico Bridge Construction and Maintenance Market Analysis:

- Major Market Drivers: Mexico bridge construction and maintenance market demand is driven by government investments in infrastructure, urbanization, and increasing transport demands. Increasing traffic congestion and the need for robust, safe, and effective bridges over highways and city areas further drive market growth.

- Key Market Trends: Growing use of prefabricated pieces, state-of-the-art construction material, and intelligent monitoring systems is influencing bridge building and maintenance. Green design practices, online inspection equipment, and resilience solutions are boosting project efficiency, safety, and durability of bridges in Mexico's developing transport infrastructure.

- Competitive Landscape: Mexico bridge construction and maintenance market forecast indicates the presence of opportunities for local and foreign companies. Technology, cost-effectiveness, and the execution of projects are the points where companies compete. Strategic alliances, government tenders, and joint ventures are still the tactics used to acquire long-term projects and market share.

- Challenges and Opportunities: Funding constraints, regulatory challenges, and environmental compliance issues continue to prevail. Opportunities lie in updating aging bridges, the construction of seismic-resistant infrastructure, and the use of new construction and maintenance technologies, enabling enhanced connectivity, safety, and efficiency across Mexico's national transportation network.

Mexico Bridge Construction and Maintenance Market Trends:

Government Investment in Infrastructure

Government investments in infrastructure are a key driver of the bridge construction and maintenance market in Mexico. The Mexican government has made substantial commitments to improving the country’s transportation and infrastructure systems, with a particular focus on enhancing the road networks. Programs aimed at modernizing highways, developing new intercity connections, and upgrading older infrastructure are central to these efforts. For example, on May 7, 2025, Mexico announced plans to invest 370 billion pesos (USD 18.9 billion) in road infrastructure by 2030, with funding allocated to projects by the Infrastructure, Communications, and Transportation Ministry (SICT) and the federal roads and bridges company Capufe. This investment will cover key works including 2,220 km of priority roads, 16 km of bridges and interchanges, 904 km under the Lázaro Cárdenas del Río program, and maintenance of 48,653 km of existing federal roads. Additionally, 56.6 billion pesos (USD 2.8 billion) will be invested this year in ongoing and new projects, including the rehabilitation of 68 bridges and improvements to rural roads, with a focus on hurricane-affected Guerrero state. The government has allocated funding to both the construction of new bridges and the refurbishment of aging structures to meet modern standards. Additionally, federal and state-level investments have fostered partnerships with private companies, further accelerating the completion of these infrastructure projects. These public investments not only help improve connectivity across the country but also stimulate demand for bridge construction and maintenance services, thereby resulting in Mexico bridge construction and maintenance market growth.

To get more information of this market, Request Sample

Increasing Traffic and Safety Concerns

The growing volume of traffic across Mexico’s roads has heightened the need for regular bridge maintenance and the construction of new bridges. With economic growth, more vehicles are on the road, putting additional stress on existing infrastructure. Bridges must be regularly maintained and repaired to accommodate this higher traffic load and ensure the safety of drivers. Additionally, the increasing incidence of natural disasters such as earthquakes and floods in certain regions of Mexico has contributed to the necessity for improved bridge resilience. Bridges must not only withstand the growing traffic load but also be able to endure environmental stress. As a result, the Mexican government and private sector have increased their focus on bridge maintenance and retrofitting to ensure safety standards are met. On February 7, 2025, Canadian Pacific Kansas City (CPKC) officially opened the Patrick J. Ottensmeyer International Railway Bridge, enhancing trade capacity between the U.S. and Mexico. The USD 100 million project increases the border’s freight railway capacity by allowing simultaneous two-way operations, streamlining the transport of goods across North America’s largest inland trade corridor. This infrastructure expansion strengthens economic ties, supports regional businesses, and ensures long-term trade efficiency with advanced security features like X-ray railcar inspection systems. The heightened awareness of safety and structural integrity has spurred the demand for both the construction of new, more durable bridges and the maintenance of existing structures, driving growth as per Mexico bridge construction and maintenance market analysis.

Mexico Bridge Construction and Maintenance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on bridge type, material used, construction type, application, and maintenance activity.

Bridge Type Insights:

- Beam Bridges

- Truss Bridges

- Arch Bridges

- Suspension Bridges

- Cable-Stayed Bridges

- Others

The report has provided a detailed breakup and analysis of the market based on the bridge type. This includes beam bridges, truss bridges, arch bridges, suspension bridges, cable-stayed bridges, and others.

Material Used Insights:

- Concrete

- Steel

- Composite Materials

- Pre-Stressed Structures

The report has provided a detailed breakup and analysis of the market based on the material used. This includes concrete, steel, composite materials, and pre-stressed structures.

Construction Type Insights:

- New Bridge Construction

- Bridge Rehabilitation and Retrofitting

The report has provided a detailed breakup and analysis of the market based on the construction type. This includes new bridge construction and bridge rehabilitation and retrofitting.

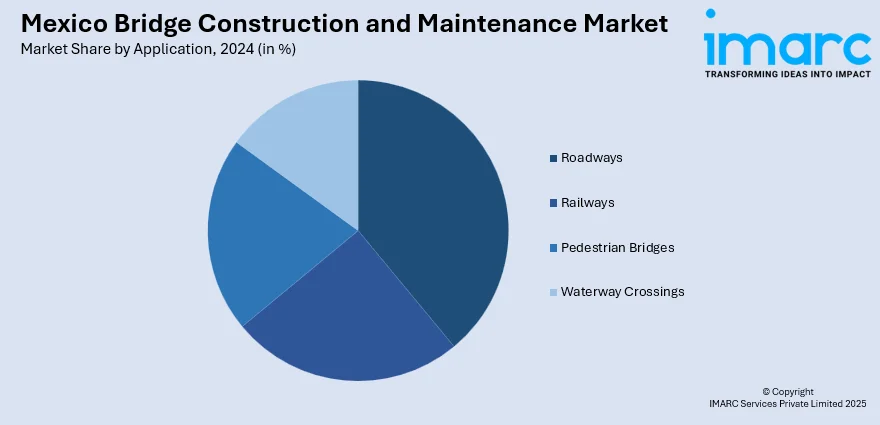

Application Insights:

- Roadways

- Railways

- Pedestrian Bridges

- Waterway Crossings

The report has provided a detailed breakup and analysis of the market based on the application. This includes roadways, railways, pedestrian bridges, and waterway crossings.

Maintenance Activity Insights:

- Structural Repairs

- Resurfacing and Coating

- Safety Enhancements

- Load Capacity Upgrades

The report has provided a detailed breakup and analysis of the market based on the maintenance activity. This includes structural repairs, resurfacing and coating, safety enhancements, and load capacity upgrades.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has provided a comprehensive analysis of all major regional markets. This includes Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- In August 2025, Cameron County, Texas, authorized construction of a $10 million, two-lane pedestrian bridge across the Rio Grande by Cameron County officials linking Brownsville to Matamoros, Mexico. The addition of the Gateway International Bridge is designed to simplify pedestrian traffic, increase retail tourism, and enhance cross-border connectivity between the two cities.

- In June 2025, Green Corridors was approved to construct the Green Corridors International Bridge, a 165-mile autonomous cargo railway between Laredo, Texas, and Monterrey, Mexico. The $10 billion project will have elevated guideways, freight terminals, and autonomous shuttles in an effort to make U.S.-Mexico trade more efficient and decrease congestion.

Mexico Bridge Construction and Maintenance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Bridge Types Covered | Beam Bridges, Truss Bridges, Arch Bridges, Suspension Bridges, Cable-Stayed Bridges, Others |

| Materials Used Covered | Concrete, Steel, Composite Materials, Pre-Stressed Structures |

| Construction Types Covered | New Bridge Construction, Bridge Rehabilitation & Retrofitting |

| Applications Covered | Roadways, Railways, Pedestrian Bridges, Waterway Crossings |

| Maintenance Activities Covered | Structural Repairs, Resurfacing and Coating, Safety Enhancements, Load Capacity Upgrades |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico bridge construction and maintenance market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico bridge construction and maintenance market on the basis of bridge type?

- What is the breakup of the Mexico bridge construction and maintenance market on the basis of material used?

- What is the breakup of the Mexico bridge construction and maintenance market on the basis of construction type?

- What is the breakup of the Mexico bridge construction and maintenance market on the basis of application?

- What is the breakup of the Mexico bridge construction and maintenance market on the basis of maintenance activity?

- What is the breakup of the Mexico bridge construction and maintenance market on the basis of region?

- What are the various stages in the value chain of the Mexico bridge construction and maintenance market?

- What are the key driving factors and challenges in the Mexico bridge construction and maintenance market?

- What is the structure of the Mexico bridge construction and maintenance market and who are the key players?

- What is the degree of competition in the Mexico bridge construction and maintenance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico bridge construction and maintenance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico bridge construction and maintenance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico bridge construction and maintenance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)