Mexico Bridge Construction Market Size, Share, Trends and Forecast by Type, Material, Application, and Region, 2025-2033

Mexico Bridge Construction Market Overview:

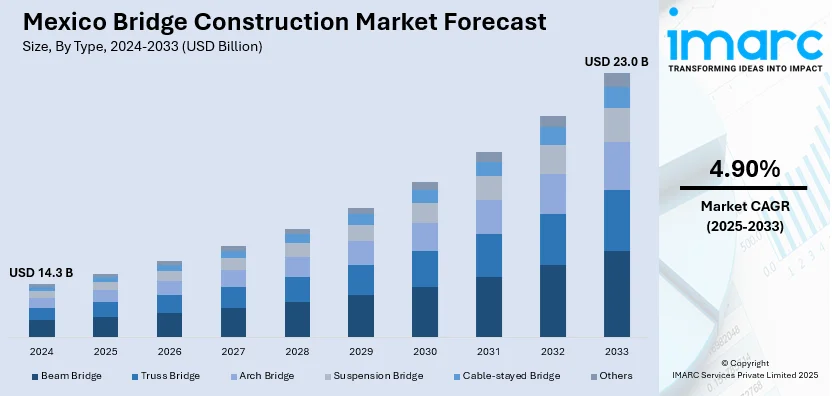

The Mexico bridge construction market size reached USD 14.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 23.0 Billion by 2033, exhibiting a growth rate (CAGR) of 4.90% during 2025-2033. The market is driven by the rising infrastructure demand due to urbanization and trade growth, government investments in transportation networks, and increasing Public-Private Partnerships (PPPs) for funding. Additionally, the adoption of sustainable construction practices and resilient designs, along with regulatory reforms, is further expanding the Mexico bridge construction market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 14.3 Billion |

| Market Forecast in 2033 | USD 23.0 Billion |

| Market Growth Rate 2025-2033 | 4.90% |

Mexico Bridge Construction Market Trends:

Growing Demand for Modular and Prefabricated Bridge Construction

The increasing adoption of modular and prefabricated techniques to reduce costs, accelerate timelines, and minimize disruptions is favoring the Mexico bridge construction market growth. Prefabricated bridge components, manufactured off-site and assembled on location, are gaining traction due to their efficiency, especially in urban areas where traditional construction can cause traffic delays. This trend is supported by advancements in 3D modeling and precision engineering, ensuring high-quality, standardized structures. Additionally, modular construction helps address labor shortages by reducing on-site workforce requirements. Government initiatives promoting fast-track infrastructure projects, such as highway expansions, water projects, and urban overpasses, are further driving demand. On 7th January 2025, Mexico launched a new six-year program called the "Mexico Plan" aimed at attracting USD 100 Billion in annual foreign direct investment (FDI), 1.5 million high-value jobs, and over USD 23.4 Billion to fund their energy infrastructure. This bold plan involves major investments in numerous sectors, such as transportation, chemicals, and semiconductors. This is supported by new regulations and incentives, including the Relocation Decree and IMMEX 4.0. Seventeen significant water projects and port expansions with enhanced bridge and infrastructure development are part of the initiative. The government plans to double the petrochemical production capacity as well as modernize more than 100 industrial zones across the country while emphasizing environmentally and socially responsible construction and support for the small and medium-sized enterprise (SME) sector. As Mexico seeks to modernize its transportation networks, prefabrication is expected to play a larger role in delivering cost-effective and durable bridges with shorter construction cycles.

Integration of Smart Technology and Digitalization in Bridge Projects

Digital transformation is reshaping Mexico’s bridge construction sector, with increased use of Building Information Modeling (BIM), drones, and AI-powered analytics for project planning and monitoring. BIM enhances collaboration among stakeholders, reducing errors and optimizing designs, while drones provide real-time progress tracking and site inspections. On 11th October 2024, Graphisoft launched Archicad 28, with added AI-powered BIM tools, the addition of AR/VR technologies and the ability to collaborate remotely using BIMcloud in Mexico. This launch comes as 85% of construction companies recognize the importance of technology adoption for maintaining competitiveness. These advancements are especially relevant in the context of the expected 3–5% growth in Mexico's construction industry in 2024, enabling quicker and more sustainable infrastructure projects, particularly in the area of bridge construction, featuring more efficient workflows and enhanced energy efficiency. With Mexico’s transforming bridge construction sector, tools such as BIMmTool and DDScad are important in managing large-scale, data-driven projects. AI and machine learning are being used to predict maintenance needs and improve safety by analyzing structural data. Furthermore, IoT-enabled sensors embedded in bridges monitor stress, corrosion, and traffic loads, enabling predictive maintenance and extending lifespan. These technologies improve efficiency, cut costs, and enhance project transparency, attracting tech-savvy investors. As Mexico pushes for smarter infrastructure, the adoption of digital tools in bridge construction is rising, creating a positive Mexico bridge construction market outlook.

Mexico Bridge Construction Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, material, and application.

Type Insights:

- Beam Bridge

- Truss Bridge

- Arch Bridge

- Suspension Bridge

- Cable-stayed Bridge

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes beam bridge, truss bridge, arch bridge, suspension bridge, cable-stayed bridge, and others.

Material Insights:

- Steel

- Concrete

- Composite Materials

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes steel, concrete, and composite materials.

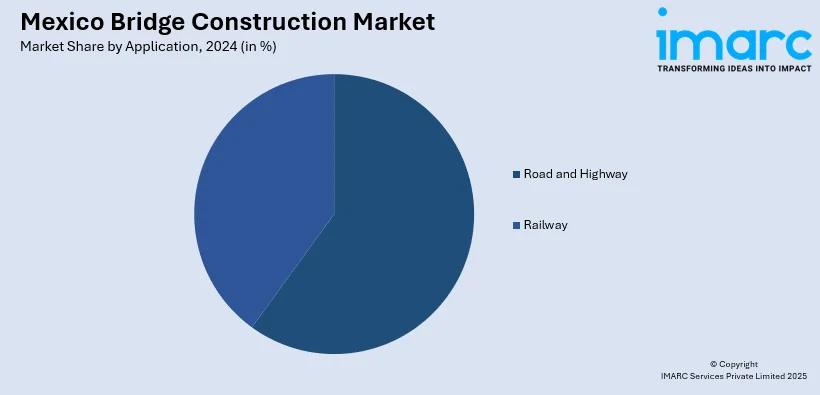

Application Insights:

- Road and Highway

- Railway

The report has provided a detailed breakup and analysis of the market based on the application. This includes road and highway, and railway.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Bridge Construction Market News:

- December 18, 2024: CPKC completed the USD 100 Million Patrick J. Ottensmeyer International Railway Bridge, a 1,170-foot dual-track bridge connecting Laredo, Texas, and Nuevo Laredo, Tamaulipas. This revised bridge aims to improve cross-border freight capacity substantially. An expansion of 4,500 feet of newly laid track and upgraded security features effectively doubles the rail traffic at North America’s busiest trade port. This achievement enhances Mexico’s bridge construction sector and reinforces its importance in the integrated logistics framework of North America.

Mexico Bridge Construction Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Beam Bridge, Truss Bridge, Arch Bridge, Suspension Bridge, Cable-stayed Bridge, Others |

| Materials Covered | Steel, Concrete, Composite Materials |

| Applications Covered | Road and Highway, Railway |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico bridge construction market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico bridge construction market on the basis of type?

- What is the breakup of the Mexico bridge construction market on the basis of material?

- What is the breakup of the Mexico bridge construction market on the basis of application?

- What is the breakup of the Mexico bridge construction market on the basis of region?

- What are the various stages in the value chain of the Mexico bridge construction market?

- What are the key driving factors and challenges in the Mexico bridge construction market?

- What is the structure of the Mexico bridge construction market and who are the key players?

- What is the degree of competition in the Mexico bridge construction market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico bridge construction market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico bridge construction market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico bridge construction industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)