Mexico Building Energy Efficiency Systems Market Size, Share, Trends and Forecast by System Type, Building Type, Deployment Mode, Technology Type, and Region, 2025-2033

Mexico Building Energy Efficiency Systems Market Overview:

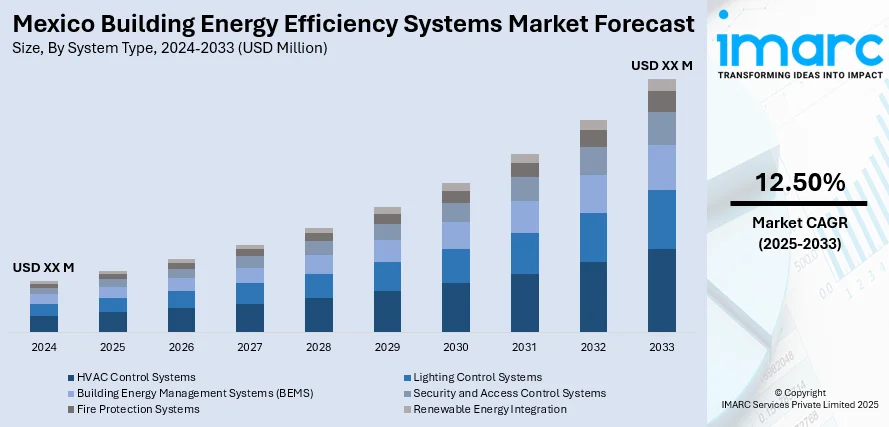

The Mexico building energy efficiency systems market size is projected to exhibit a growth rate (CAGR) of 12.50% during 2025-2033. At present, rising electricity costs are encouraging homeowners, businesses, and developers to seek ways to reduce power usage and lower utility bills, driving the demand for building energy efficiency systems. In addition, increasing investments in construction projects are positively influencing the market. Besides this, the growing integration with renewable energy sources, which enhances energy performance, is contributing to the expansion of the Mexico building energy efficiency systems market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Growth Rate 2025-2033 | 12.50% |

Mexico Building Energy Efficiency Systems Market Analysis:

- Major Market Drivers: Mexico building energy efficiency systems market share is growing because of rising government regulations, urbanization, and sustainability practices. Ensuring energy conservation and cost savings has become more prevalent among businesses and residences, driving market demand, with smart technologies adoption further stimulating growth.

- Key Market Trends: The integration of IoT-enabled devices, green energy solutions, and smart building management systems is revolutionizing the market. Customers are preferring smart, automated systems for maximizing energy usage, comfort level, and cost savings, which emphasizes Mexico building energy efficiency systems market analysis.

- Competitive Landscape: The market is dominated by a blend of local and global companies emphasizing product development, service excellence, and strategic alliances. The companies are utilizing technological innovation to differentiate products and enhance system efficiency, creating a competitive landscape with growing opportunities for investment.

- Challenges and Opportunities: High installation costs, insufficient skilled labor, and fragmented regulatory systems are the main hindrances. Yet, increasing awareness, government incentives, and green building practices offer opportunities for growth, propelling Mexico building energy efficiency systems market demand in residential, commercial, and industrial applications.

Mexico Building Energy Efficiency Systems Market Trends:

Increasing electricity costs

Rising electricity costs are fueling the market growth in the country. According to industry reports, in September 2024, the cost of residential electricity in Mexico reached MXN 1.988 for each kWh. The cost of electricity for companies was MXN 3.947 per kWh or USD 0.203. As power prices continue to increase, building owners are becoming more conscious about how much energy they are using for lighting, heating, cooling, and other daily operations. Energy efficiency systems, such as smart lighting, advanced insulation, and energy management software, help reduce overall electricity utilization. These technologies allow buildings to operate with minimal energy waste while maintaining comfort and performance. The financial savings from reduced electricity bills make the initial investment in efficiency systems more appealing and cost-effective in the long run. Commercial buildings and industrial facilities also benefit from lower operational costs and improved energy performance, giving them a competitive edge. Government incentives and programs that support energy-saving upgrades are further strengthening this trend. Rising electricity costs are also creating public awareness about energy conservation and sustainability. Consequently, more stakeholders in Mexico’s construction and real estate sectors are adopting building energy efficiency systems to stay ahead of increasing costs and meet rising expectations for responsible energy employment.

To get more information of this market, Request Sample

Growing investments in construction projects

Increasing investments in construction projects are impelling the Mexico building energy efficiency systems market growth. As new buildings are planned and developed, builders and developers prioritize systems that reduce energy usage and operating costs. These investments are supporting the adoption of advanced insulation, energy-optimized lighting and automated energy management tools. New construction projects often aim to meet green building standards, which require strong energy performance. With more capital flowing into residential, commercial, and industrial developments, there is a rising focus on sustainability and long-term cost savings. Energy-efficient buildings also attract environmentally conscious buyers and tenants. As the construction sector continues to thrive, the demand for integrated energy efficiency solutions is increasing, helping minimize Mexico’s overall energy use and carbon footprint. As per the INEGI, it was estimated that Mexico's construction sector grew by 4.1% in 2024.

Rising employment of smart technologies

Increasing use of smart technologies is offering a favorable market outlook. The growing use of industrial smart sensors and energy management software is strengthening the market, as they help building owners track utilization patterns and identify areas for improvement. According to the IMARC Group, the Mexico industrial smart sensors market size reached USD 573.30 Million in 2024. These technologies automatically adjust lighting, heating, and cooling based on occupancy and time of day, reducing unnecessary energy use. In commercial buildings, smart systems optimize operations to balance comfort and efficiency. In homes, users gain control through mobile apps, making energy-saving decisions easier and more effective. Integration with renewable energy sources is further enhancing energy performance. As smart technology is becoming more affordable and widely available, more construction projects and retrofits are adopting these systems.

Mexico Building Energy Efficiency Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on system type, building type, deployment mode, and technology type.

System Type Insights:

- HVAC Control Systems

- Lighting Control Systems

- Building Energy Management Systems (BEMS)

- Security and Access Control Systems

- Fire Protection Systems

- Renewable Energy Integration

The report has provided a detailed breakup and analysis of the market based on the system type. This includes HVAC control systems, lighting control systems, building energy management systems (BEMS), security and access control systems, fire protection systems, and renewable energy integration.

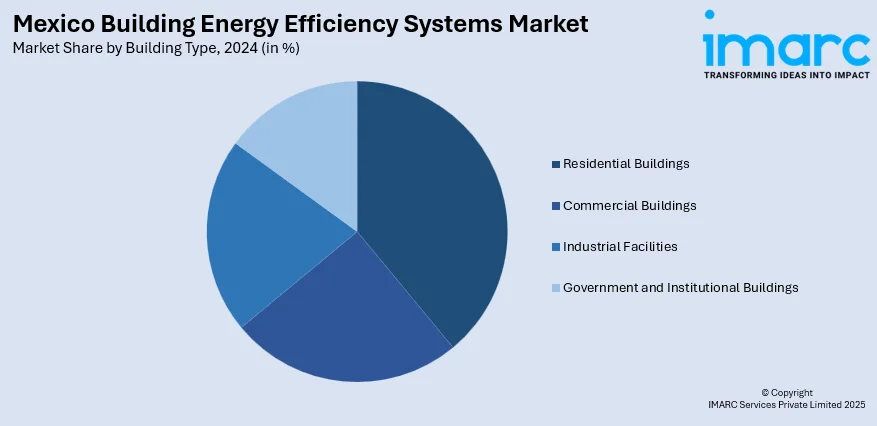

Building Type Insights:

- Residential Buildings

- Commercial Buildings

- Industrial Facilities

- Government and Institutional Buildings

A detailed breakup and analysis of the market based on the building type have also been provided in the report. This includes residential buildings, commercial buildings, industrial facilities, and government and institutional buildings.

Deployment Mode Insights:

- On-Premises

- Cloud-Based

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes on-premises and cloud-based.

Technology Type Insights:

- Wired Systems

- Wireless Systems

A detailed breakup and analysis of the market based on the technology type have also been provided in the report. This includes wired systems and wireless systems.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- In September 2025, the Partnership for Energy Efficiency in Buildings (PEEB) initiated its first Cool-funded project in Mexico. Assisted by NAFIN, Green Climate Fund, and AFD financing, the project encourages sustainable construction, minimizes greenhouse gas emissions, and enhances capacities for energy-efficient building practices across the country.

- In February 2025, The MAF project has certified 101 financial specialists in energy efficiency finance, strengthening sustainable investing skills in Mexico and Latin America. Advanced IEEFP courses, the program certified 10 Energy Efficiency Financing Specialists, fostering SME sustainability, climate action, and increased female presence in the industry.

Mexico Building Energy Efficiency Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| System Types Covered | HVAC Control Systems, Lighting Control Systems, Building Energy Management Systems (BEMS), Security and Access Control Systems, Fire Protection Systems, Renewable Energy Integration |

| Building Types Covered | Residential Buildings, Commercial Buildings, Industrial Facilities, Government and Institutional Buildings |

| Deployment Modes Covered | On-Premises, Cloud-Based |

| Technology Types Covered | Wired Systems, Wireless Systems |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico building energy efficiency systems market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico building energy efficiency systems market on the basis of system type?

- What is the breakup of the Mexico building energy efficiency systems market on the basis of building type?

- What is the breakup of the Mexico building energy efficiency systems market on the basis of deployment mode?

- What is the breakup of the Mexico building energy efficiency systems market on the basis of technology type?

- What is the breakup of the Mexico building energy efficiency systems market on the basis of region?

- What are the various stages in the value chain of the Mexico building energy efficiency systems market?

- What are the key driving factors and challenges in the Mexico building energy efficiency systems?

- What is the structure of the Mexico building energy efficiency systems market and who are the key players?

- What is the degree of competition in the Mexico building energy efficiency systems market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico building energy efficiency systems market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico building energy efficiency systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico building energy efficiency systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)