Mexico Building Insulation Market Size, Share, Trends and Forecast by Type, Application, End User, and Region, 2025-2033

Mexico Building Insulation Market Overview:

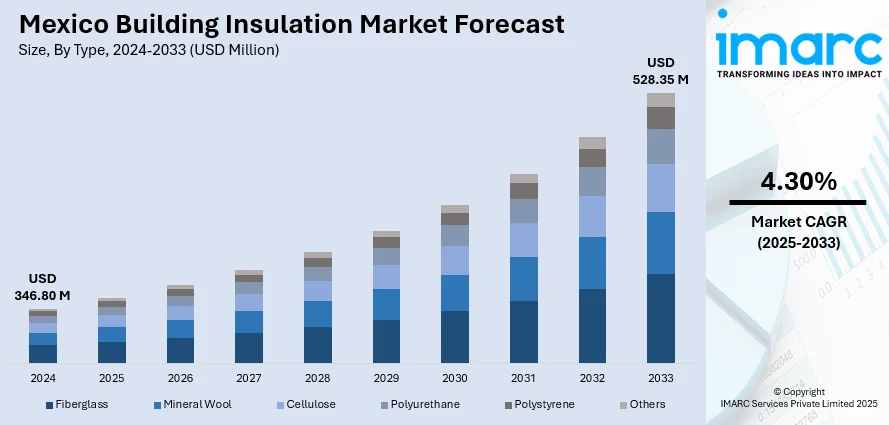

The Mexico building insulation market size reached USD 346.80 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 528.35 Million by 2033, exhibiting a growth rate (CAGR) of 4.30% during 2025-2033. The market is propelling with increased energy efficiency requirements, use of green building certifications, and technology advancement in insulation systems. Fiberglass, mineral wool, and polyurethane materials are increasingly favored for their performance in heat insulation and sustainability. Green construction technologies and advanced insulation systems are finding extensive applications across residential and commercial segments. These advancements are complementing each other for the growth of the Mexico building insulation market share across major application segments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 346.80 Million |

| Market Forecast in 2033 | USD 528.35 Million |

| Market Growth Rate 2025-2033 | 4.30% |

Mexico Building Insulation Market Trends:

Growing Demand for Energy-Efficient Insulation Products

In Mexico, the increasing focus on energy efficiency is determining the demand for high-end insulation materials in building construction. As a growing awareness of environmental footprint and energy usage, there has been an increased shift towards incorporating materials that enhance thermal performance and save energy. Options such as fiberglass, mineral wool, and cellulose insulation are becoming increasingly popular because they offer excellent thermal resistance, keeping indoor spaces comfortable while minimizing the use of energy-consuming heating and cooling systems. The growing interest in green building practices is an underlying motive for this trend, supporting Mexico's targets to lower carbon emissions and increase energy efficiency in domestic and commercial buildings. Consequently, the uptake of energy-efficient insulation products remains instrumental in Mexico building insulation market growth, which is predicted to pick up pace over the next few years because of these green-friendly innovations.

Increase in Green Building Standards and Certifications

As a reaction to the world's move toward sustainability, Mexico has experienced an increased demand for green building levels and certifications like LEED (Leadership in Energy and Environmental Design). The trend indicates increasing demand for building projects that pass strict environmental tests. Insulation is central in achieving this through enhanced energy efficiency and overall building performance. Green building projects focus on materials that not only provide better insulation but also are recyclable or produced from renewable resources. The use of sustainable insulation materials like cellulose and mineral wool fits these certifications, increasing the popularity of green buildings even further. The growing use of such standards is driving Mexico building insulation expansion, as more builders and property owners aim to meet codes while investing in long-term energy savings.

Technological Advances in Insulation Materials

Advances in insulation materials technology have made a great impact on the Mexican construction sector through their enhanced performance and installability. For instances, in May 2023, Knauf Insulation launched OmniFit® Slab 32, a 32 lambda glass mineral wool slab offering improved thermal, fire, and acoustic performance with lower embodied carbon, addressing Mexico's demand for energy-efficient building insulation. Moreover, advances in material formulation, including the creation of polyurethane and polystyrene insulation, offer greater thermal resistance without compromising on the weight and affordability of the products. These products have been successful in both domestic and commercial use, providing better thermal and sound insulation characteristics. In addition, the incorporation of intelligent insulation systems that respond to temperature fluctuations is increasing, with greater control over energy consumption. Such technology not only aids in better insulation efficiency but also helps builders comply with changing building codes and energy regulations. The availability of such high-performance offerings is a key driver in Mexico building insulation development, with construction firms and residents increasingly looking for advanced insulation technologies to enhance comfort and lower energy costs.

Mexico Building Insulation Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, application, and end user.

Type Insights:

- Fiberglass

- Mineral Wool

- Cellulose

- Polyurethane

- Polystyrene

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes fiberglass, mineral wool, cellulose, polyurethane, polystyrene, and others.

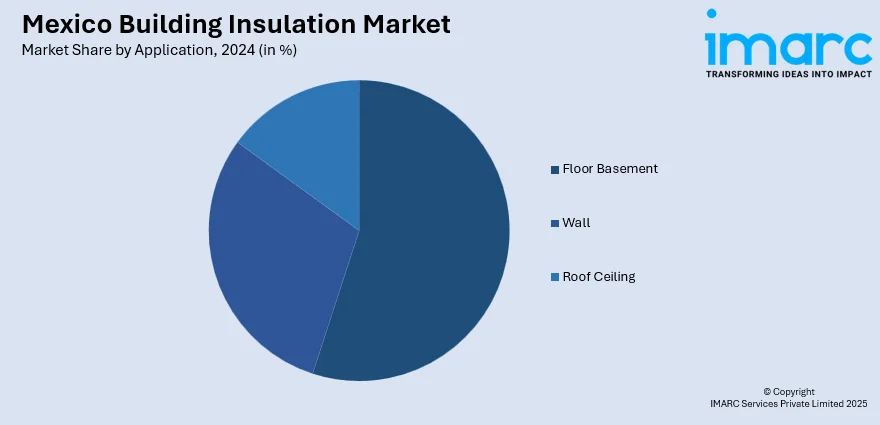

Application Insights:

- Floor Basement

- Wall

- Roof Ceiling

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes floor basement, wall, and roof ceiling.

End User Insights:

- Residential

- Non-Residential

The report has provided a detailed breakup and analysis of the market based on the end user. This includes residential and non-residential.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Building Insulation Market News:

- In February 2025, BASF launched Basotect EcoBalanced, a melamine foam manufactured from 100% green electricity and renewable raw materials. With up to 50% reduced product carbon footprint, it delivers the same performance as conventional grades, helping insulation and acoustic manufacturers achieve NetZero aspirations with certified environmental clarity.

Mexico Building Insulation Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Fiberglass, Mineral Wool, Cellulose, Polyurethane, Polystyrene, Others |

| Applications Covered | Floor Basement, Wall, Roof Ceiling |

| End Users Covered | Residential, Non-Residential |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico building insulation market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico building insulation market on the basis of type?

- What is the breakup of the Mexico building insulation market on the basis of application?

- What is the breakup of the Mexico building insulation market on the basis of end user?

- What is the breakup of the Mexico building insulation market on the basis of region?

- What are the various stages in the value chain of the Mexico building insulation market?

- What are the key driving factors and challenges in the Mexico building insulation?

- What is the structure of the Mexico building insulation market and who are the key players?

- What is the degree of competition in the Mexico building insulation market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico building insulation market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico building insulation market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico building insulation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)