Mexico Business Process Management Market Size, Share, Trends and Forecast by Deployment Type, Component, Business Function, Organization Size, Vertical, and Region, 2025-2033

Mexico Business Process Management Market Overview:

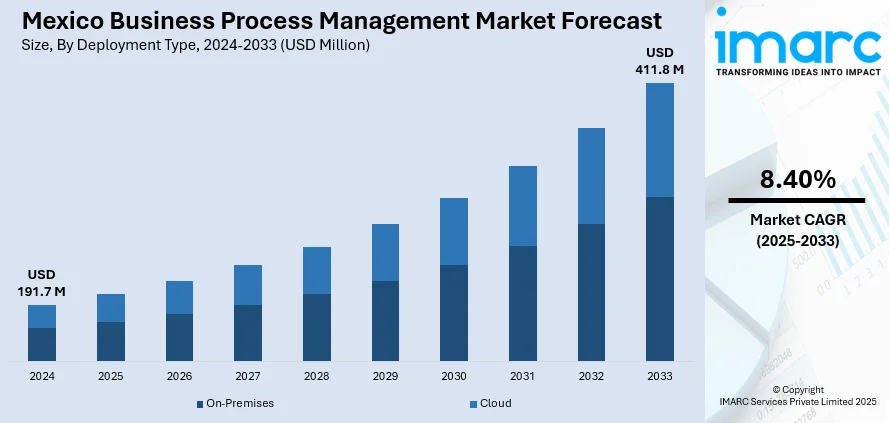

The Mexico business process management market size reached USD 191.7 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 411.8 Million by 2033, exhibiting a growth rate (CAGR) of 8.40% during 2025-2033. Factors driving the market include cost-effectiveness, skilled labor, proximity to the US, rising digital transformation, and increasing demand for specialized services. This fosters growth in outsourcing, automation, and process optimization across diverse industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 191.7 Million |

| Market Forecast in 2033 | USD 411.8 Million |

| Market Growth Rate 2025-2033 | 8.40% |

Mexico Business Process Management Market Trends:

Increased Adoption of Robotic Process Automation (RPA) and AI-Powered BPM Solutions

The Mexican BPM market is witnessing a significant surge in the adoption of RPA and AI-powered solutions. Businesses are increasingly leveraging these technologies to automate repetitive tasks, enhance operational efficiency, and reduce human error. For instance, as per industry reports, in Mexico, Puebla stands out as a leader in this movement, with over 75,000 businesses, which accounts to around 22% of the state’s total, having adopted AI in their production processes. Incorporation of AI algorithms supports smart process optimization, predictive analytics, and customer-centric experiences. The move is necessitated by the desire to automate processes, enhance efficiency, and retain competitiveness in a fast-changing business environment. Application of these technologies advances businesses' ability to redeploy human capital to more value-add and strategic functions, supporting innovation and growth.

Expansion of Industry-Specific BPM Solutions Tailored to Local Market Needs

There is an increasing trend towards the creation and deployment of industry-focused BPM solutions that are customized to the specific needs of the Mexican market. These solutions cater to the particular challenges and opportunities in major sectors like manufacturing, healthcare, and financial services. By providing customized BPM platforms, providers can provide greater value and streamline processes that are most relevant to local business practices and regulatory conditions. This specialization is a demonstration of greater insight into the Mexican business environment and a dedication to delivering solutions that deliver real results. For instance, as per industry reports, Mexico is becoming a new hub for Indian IT, especially in customer experience management (CXM), due to its proximity and cultural ties to the US and Canada. The Mexican CXM market is expanding, with the IT-ADM sector growing and utilizing skilled local engineers. Mexico City and Guadalajara offer strong talent pools and advanced infrastructure, attracting US firms seeking cost-effective solutions.

Mexico Business Process Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on deployment type, component, business function, organization size, and vertical.

Deployment Type Insights:

- On-Premises

- Cloud

The report has provided a detailed breakup and analysis of the market based on the deployment type. This includes on-premises and cloud.

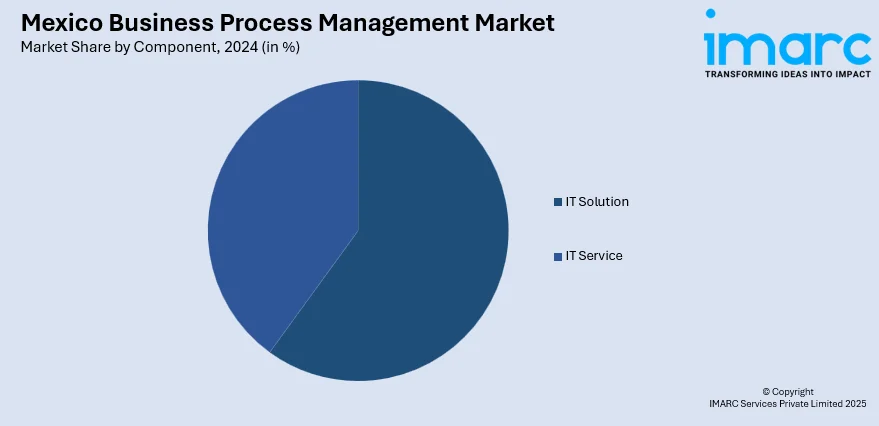

Component Insights:

- IT Solution

- Process Improvement

- Automation

- Content and Document Management

- Integration

- Monitoring and Optimization

- IT Service

- System Integration

- Consulting

- Training and Education

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes IT solution (process improvement, automation, content and document management, integration, and monitoring and optimization) and IT service (system integration, consulting, and training and education).

Business Function Insights:

- Human Resource

- Accounting and Finance

- Sales and Marketing

- Manufacturing

- Supply Chain Management

- Operation and Support

- Others

A detailed breakup and analysis of the market based on the business function have also been provided in the report. This includes human resource, accounting and finance, sales and marketing, manufacturing, supply chain management, operation and support, and others.

Organization Size Insights:

- SMEs

- Large Enterprises

A detailed breakup and analysis of the market based on the organization size have also been provided in the report. This includes SMEs and large enterprises.

Vertical Insights:

- Government and Defense

- BFSI

- IT and Telecom

- Healthcare

- Retail

- Manufacturing

- Others

A detailed breakup and analysis of the market based on the vertical have also been provided in the report. This includes government and defense, BFSI, IT and telecom, healthcare, retail, manufacturing, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Business Process Management Market News:

- In March 2024, Aeries Technology announced that it is expanding its Mexican operations, leveraging its "Purpose-Built Model" from India to serve US clients through nearshoring. Strategic hires also aim to enhance digital transformation services. Serving diverse sectors, Aeries anticipates a 50% growth in its Mexican footprint by year-end 2024.

Mexico Business Process Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Deployment Types Covered | On-Premises, Cloud |

| Components Covered |

|

| Business Functions Covered | Human Resource, Accounting and Finance, Sales and Marketing, Manufacturing, Supply Chain Management, Operation and Support, Others |

| Organization Sizes Covered | SMEs, Large Enterprises |

| Verticals Covered | Government and Defense, BFSI, IT and Telecom, Healthcare, Retail, Manufacturing, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico business process management market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico business process management market on the basis of deployment type?

- What is the breakup of the Mexico business process management market on the basis of component?

- What is the breakup of the Mexico business process management market on the basis of business function?

- What is the breakup of the Mexico business process management market on the basis of organization size?

- What is the breakup of the Mexico business process management market on the basis of vertical?

- What are the various stages in the value chain of the Mexico business process management market?

- What are the key driving factors and challenges in the Mexico business process management market?

- What is the structure of the Mexico business process management market and who are the key players?

- What is the degree of competition in the Mexico business process management market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico business process management market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico business process management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico business process management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)