Mexico Business Travel Market Size, Share, Trends and Forecast by Type, Purpose Type, Expenditure, Age Group, Service Type, Travel Type, End User, and Region, 2025-2033

Mexico Business Travel Market Overview:

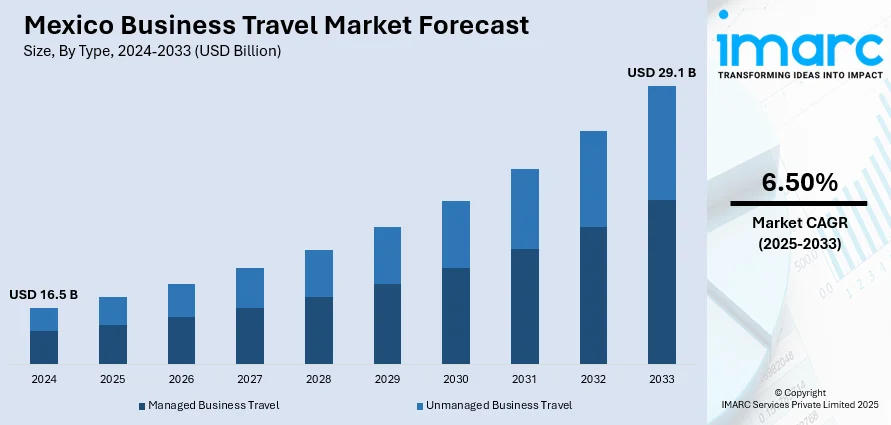

The Mexico business travel market size reached USD 16.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 29.1 Billion by 2033, exhibiting a growth rate (CAGR) of 6.50% during 2025-2033. The market is driven by strong U.S.-Mexico trade ties, growing foreign direct investment, nearshoring trends, infrastructure development, and the resurgence of corporate meetings and exhibitions. Improved connectivity, rising demand for regional air travel, and government support for business tourism further fuel market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 16.5 Billion |

| Market Forecast in 2033 | USD 29.1 Billion |

| Market Growth Rate 2025-2033 | 6.50% |

Mexico Business Travel Market Trends:

Nearshoring Boosting Regional Corporate Mobility

The shift in global supply chains toward nearshoring has significantly increased corporate travel within Mexico. As international firms relocate manufacturing and logistics operations closer to North America, business executives, engineers, and supply chain professionals frequently travel between industrial hubs like Monterrey, Querétaro, and Tijuana. This has resulted in elevated demand for short-haul flights, intercity rail, and executive ground transport. Hospitality groups are responding with targeted offerings, such as flexible check-ins and multilingual business concierge services, to support these corporate travelers. For instance, in July 2024, Marriott International launched Business Access by Marriott Bonvoy, a booking platform tailored for small to medium-sized businesses in regions including the U.S., Canada, Europe, and Latin America. The program offers discounted Marriott Bonvoy hotel rates, integrated booking for hotels, flights, rail, and rentals, along with expense management, travel policy tools, and real-time reporting. It aims to simplify corporate travel while rewarding companies and employees through Marriott Bonvoy’s loyalty benefits and enhanced travel program features. Additionally, regional governments are investing in infrastructure upgrades and business parks, further intensifying travel flows. The trend underscores how Mexico’s strategic location and manufacturing capacity are reshaping business travel routes and creating growth opportunities for mobility and hospitality providers.

Technology Integration Enhancing Traveler Efficiency

Digital transformation is reshaping the business travel experience in Mexico. From AI-powered booking tools to real-time itinerary management apps, corporate travelers now expect seamless digital interactions across all stages of their journey. Airlines, hotels, and ground transport providers are integrating platforms that support expense tracking, loyalty program management, and remote check-ins. Meanwhile, corporate travel managers increasingly use data analytics to optimize routes, control costs, and personalize services for frequent travelers. Mobile-first solutions have become particularly important, with app-based navigation, translation, and safety features tailored for international guests. This push toward technology integration reflects a broader demand for efficiency, transparency, and flexibility, positioning Mexico as a digitally agile destination for global business travel. For instance, as per industry reports, BCD Travel Mexico is adapting its corporate travel services by focusing on personalized, tech-driven solutions amid shifting traveler expectations. The company is leveraging tools like the TripSource mobile app, AI-based identity management, and the data-focused DecisionSource platform to enhance traveler experience and improve decision-making. BCD is growing over 10% annually in Mexico, focusing on mobile innovation and adapting tech to local needs. The company’s goal is to streamline travel and boost value through personalization and data-driven insights.

Mexico Business Travel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional levels for 2025-2033. Our report has categorized the market based on type, purpose type, expenditure, age group, service type, travel type, and end user.

Type Insights:

- Managed Business Travel

- Unmanaged Business Travel

The report has provided a detailed breakup and analysis of the market based on the type. This includes managed business travel and unmanaged business travel.

Purpose Type Insights:

- Marketing

- Internal Meetings

- Trade Shows

- Product Launch

- Others

A detailed breakup and analysis of the market based on the purpose type have also been provided in the report. This includes marketing, internal meetings, trade shows, product launch, and others.

Expenditure Insights:

- Travel Fare

- Lodging

- Dining

- Others

The report has provided a detailed breakup and analysis of the market based on the expenditure. This includes travel fare, lodging, dining, and others.

Age Group Insights:

- Travelers Below 40 Years

- Travelers Above 40 Years

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes travelers below 40 years and travelers above 40 years.

Service Type Insights:

- Transportation

- Food and Lodging

- Recreational Activities

- Others

The report has provided a detailed breakup and analysis of the market based on the service type. This includes transportation, food and lodging, recreational activities, and others.

Travel Type Insights:

- Group Travel

- Solo Travel

A detailed breakup and analysis of the market based on the travel type have also been provided in the report. This includes group travel and solo travel.

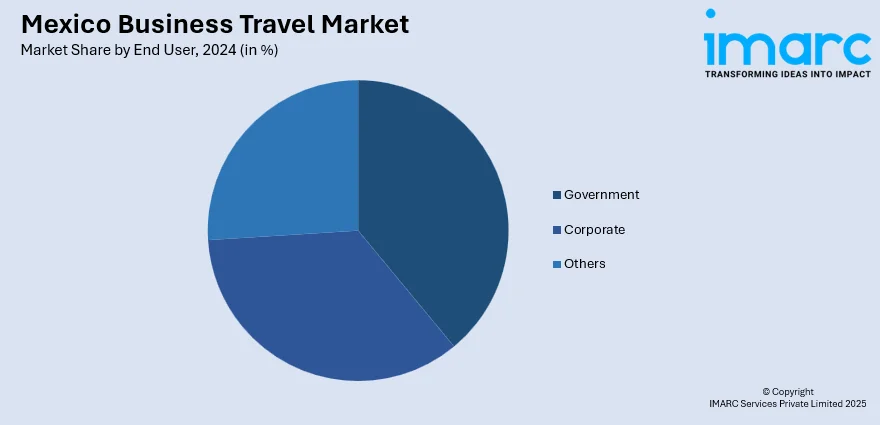

End User Insights:

- Government

- Corporate

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes government, corporate, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, and Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Business Travel Market News:

- In April 2025, Onfly, a Brazil-based B2B travel tech firm, announced that it has secured USD 40 Million in Series B funding to scale its AI-driven platform and expand into Mexico, Latin America’s second-largest corporate travel market. The company aims to digitize outdated travel systems, offering automation, real-time booking, expense tracking, and smart infrastructure. Onfly has grown at a 110% CAGR, expects USD 250 Million GMV by 2025, and plans to onboard 2,500 Mexican enterprises by 2027. The expansion supports Latin America’s shift toward modern corporate mobility solutions.

- In April 2025, Corporate Travel Management (CTM) added VB Group Mexico to its Global Partner Network, expanding its corporate travel, meetings, and destination management services in Latin America. VB Group operates across Spain and Mexico, with over 60% of its business in corporate travel. The partnership enhances CTM’s regional offerings and supports VB Group’s international growth ambitions.

Mexico Business Travel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Managed Business Travel, Unmanaged Business Travel |

| Purpose Types Covered | Marketing, Internal Meetings, Trade Shows, Product Launch, Others |

| Expenditures Covered | Travel Fare, Lodging, Dining, Others |

| Age Groups Covered | Travelers Below 40 Years, Travelers Above 40 Years |

| Service Types Covered | Transportation, Food and Lodging, Recreational Activities, Others |

| Travel Types Covered | Group Travel, Solo Travel |

| End Users Covered | Government, Corporate, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico business travel market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico business travel market on the basis of type?

- What is the breakup of the Mexico business travel market on the basis of purpose type?

- What is the breakup of the Mexico business travel market on the basis of expenditure?

- What is the breakup of the Mexico business travel market on the basis of age group?

- What is the breakup of the Mexico business travel market on the basis of service type?

- What is the breakup of the Mexico business travel market on the basis of travel type?

- What is the breakup of the Mexico business travel market on the basis of end user?

- What is the breakup of the Mexico business travel market on the basis of region?

- What are the various stages in the value chain of the Mexico business travel market?

- What are the key driving factors and challenges in the Mexico business travel market?

- What is the structure of the Mexico business travel market and who are the key players?

- What is the degree of competition in the Mexico business travel market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico business travel market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico business travel market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico business travel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)