Mexico C4 Raffinate Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

Mexico C4 Raffinate Market Overview:

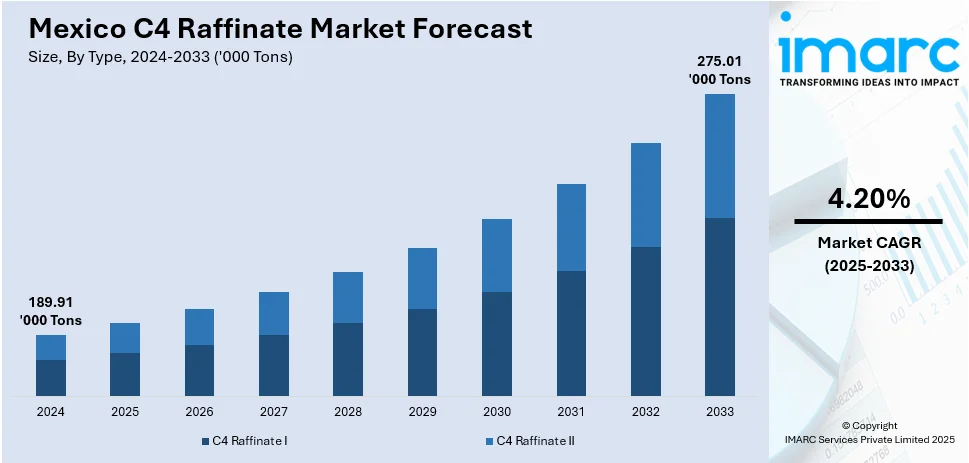

The Mexico C4 raffinate market size reached 189.91 Thousand Metric Tons in 2024. Looking forward, IMARC Group expects the market to reach 275.01 Thousand Metric Tons by 2033, exhibiting a growth rate (CAGR) of 4.20% during 2025-2033. The rising focus on urban development, coupled with increasing private investments in real estate, is fueling the market growth. This trend, in confluence with the increasing demand for high-performance materials in electronic items, which help create protective casings, is contributing to the expansion of the Mexico C4 raffinate market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 189.91 Thousand Metric Tons |

| Market Forecast in 2033 | 275.01 Thousand Metric Tons |

| Market Growth Rate 2025-2033 | 4.20% |

Mexico C4 Raffinate Market Trends:

Increasing construction activities

The growing construction activities are positively influencing the market. As per the data provided by Mexico’s National Institute of Statistics and Geography (INEGI), the construction production volume index saw a 6.3% year-on-year (YoY) rise in the initial nine months of 2024. This expansion was driven by a notable increase in construction (8.4%), steady growth in civil engineering projects (2.3%), and a small rise in specialized operations (0.8%). In construction, products like sealants, adhesives, roofing materials, insulation, and piping often require synthetic rubber for better durability, flexibility, and resistance to weather. As Mexico is investing in infrastructure projects, incorporating residential complexes, roads, bridges, and commercial buildings, the need for high-performance construction materials is growing. C4 raffinate, processed into chemicals like butadiene, supports the production of these essential construction components. Additionally, modern construction techniques demand materials that offer energy efficiency, strength, and long life. These are the qualities that synthetic rubber-based items help achieve. The government's focus on urban development and private investment in real estate is creating the need for construction materials, further driving the demand for C4 raffinate-derived products. Mexico’s strategic location as a manufacturing and logistics hub is leading to continuous improvements in industrial infrastructure, requiring advanced building materials.

Rising demand for electronic items

The escalating demand for electronic items is impelling the Mexico C4 raffinate market growth. As the electronics industry is thriving, materials like synthetic rubber and plastics are needed for products, such as smartphones, computers, and household electronics. These materials help create protective casings, flexible cables, seals, and other components essential for electronic devices to function properly. The rising trend of connected devices and the expansion of consumer electronics is further driving the demand for high-quality materials in Mexico. With more electronics being exported, the need for packaging solutions is increasing, further catalyzing the demand for materials derived from C4 raffinate. Moreover, the expansion of e-commerce portals is enhancing the availability of electronic items, promoting the employment of C4 raffinate. As per the IMARC Group, the Mexico e-commerce market is set to attain USD 176.6 Billion by 2033, showing a growth rate (CAGR) of 14.5% during 2025-2033.

Growing vehicle production

Increasing vehicle production is offering a favorable market outlook. According to the National Institute of Statistics and Geography (INEGI), between January and May 2024, Mexico experienced sales of 585,721 new vehicles, marking a 12.7% rise compared to the 519,534 units sold in the same timeframe in 2023. As more vehicles are manufactured, the demand for tires, belts, hoses, seals, and other rubber-based automotive parts is growing. These parts require high-quality synthetic rubber for durability, flexibility, and safety. C4 raffinate, being a major feedstock for butadiene production, is becoming essential in supporting this rising demand. Mexico’s strong position as a manufacturing hub for both domestic use and export markets is further enhancing vehicle output, which in turn, is increasing the utilization of synthetic rubber products.

Mexico C4 Raffinate Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- C4 Raffinate I

- C4 Raffinate II

The report has provided a detailed breakup and analysis of the market based on the type. This includes C4 raffinate I and C4 raffinate II.

Application Insights:

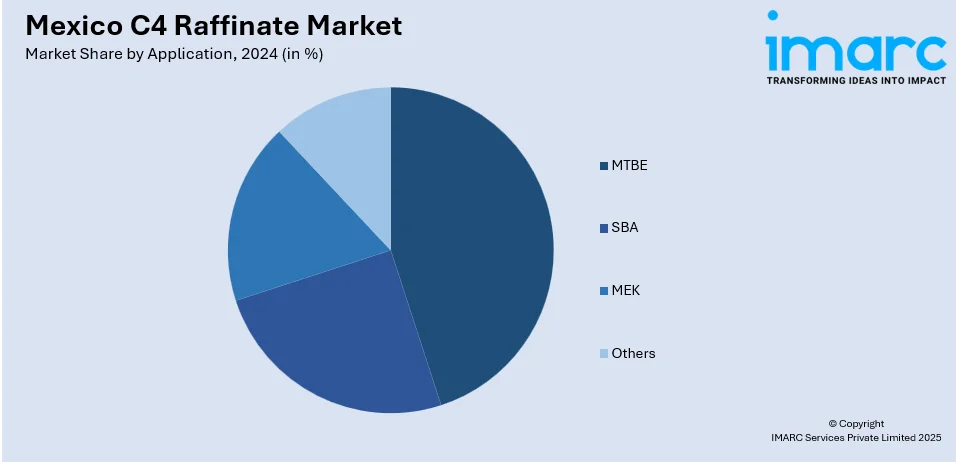

- MTBE

- SBA

- MEK

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes MTBE, SBA, MEK, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico C4 Raffinate Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Thousand Metric Tons |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | C4 Raffinate I, C4 Raffinate II |

| Applications Covered | MTBE, SBA, MEK, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico C4 raffinate market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico C4 raffinate market on the basis of type?

- What is the breakup of the Mexico C4 raffinate market on the basis of application?

- What is the breakup of the Mexico C4 raffinate market on the basis of region?

- What are the various stages in the value chain of the Mexico C4 raffinate market?

- What are the key driving factors and challenges in the Mexico C4 raffinate market?

- What is the structure of the Mexico C4 raffinate market and who are the key players?

- What is the degree of competition in the Mexico C4 raffinate market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico C4 raffinate market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico C4 raffinate market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico C4 raffinate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)