Mexico Cable Management Market Size, Share, Trends and Forecast by Product, Material, End User, and Region, 2025-2033

Mexico Cable Management Market Overview:

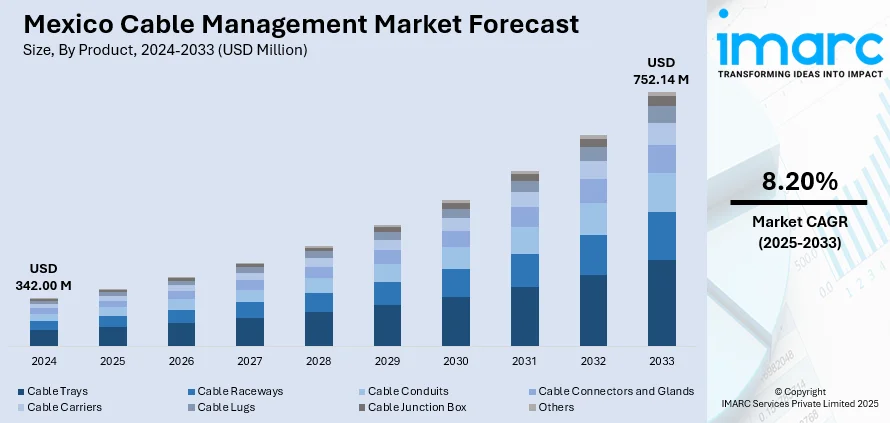

The Mexico cable management market size reached USD 342.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 752.14 Million by 2033, exhibiting a growth rate (CAGR) of 8.20% during 2025-2033. The market is propelled by rapid industrialization, expansion of data centers, and increasing adoption of automation across sectors. Government investments in infrastructure and energy, particularly renewable projects, further boost demand. Rising safety regulations in electrical systems continue to support the increase in Mexico cable management market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 342.00 Million |

| Market Forecast in 2033 | USD 752.14 Million |

| Market Growth Rate 2025-2033 | 8.20% |

Mexico Cable Management Market Trends:

Integration of Smart Infrastructure and IoT

A notable trend influencing the Mexico cable management market growth is the increasing integration of smart infrastructure powered by the Internet of Things (IoT). Urban development projects, especially smart city initiatives, demand advanced cabling solutions that ensure efficiency, adaptability, and space optimization. IoT-enabled infrastructure requires a dense network of interconnected devices, necessitating reliable cable routing and protection. This pushes the demand for intelligent cable trays, raceways, and flexible conduits capable of supporting complex, evolving systems. For instance, as per industry reports, in Q2 2024, Mexico's Televisa invested USD 76 Million in its cable business, focusing on expanding its fiber-to-the-home (FTTH) network, which now reaches 19.8 million homes. Additionally, smart buildings equipped with automated lighting, security, and HVAC systems increase the need for organized and accessible cabling structures. As the country continues to embrace smart infrastructure to enhance public services and energy efficiency, the cable management market is expected to expand steadily, driving substantial Mexico cable management market growth.

Rising Demand in Renewable Energy Projects

The accelerating deployment of renewable energy infrastructure across Mexico, particularly in solar and wind sectors, is significantly influencing cable management system requirements. These projects necessitate robust, weather-resistant cable routing solutions to handle high voltages and variable environmental conditions. Ground-mounted solar farms and wind turbine installations often operate in remote and harsh environments, requiring specially engineered cable trays, ducts, and supports to ensure long-term performance and safety. Additionally, renewable energy projects often involve complex cabling architectures that must remain organized and accessible for maintenance and efficiency. The strategic focus on reducing dependence on fossil fuels and expanding renewable capacity directly supports sustained Mexico cable management market growth by creating new avenues for product innovation and demand. For instance, in 2024, Affordable Wire Management (AWM), a leader in utility-scale solar and BESS cable management systems, doubled its installed gigawatts and tripled its workforce. With over 350 projects and 20 GW deployed, AWM expanded globally, including in Mexico and India. It introduced innovations like Ampacity Optimization and new products such as the Hail Stow-Hanger. AWM focuses on efficiency, resilience, and clean energy adoption, supporting global solar infrastructure while meeting U.S. Inflation Reduction Act requirements through domestic sourcing and advanced engineering solutions.

Mexico Cable Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, material, and end user.

Product Insights:

- Cable Trays

- Cable Raceways

- Cable Conduits

- Cable Connectors and Glands

- Cable Carriers

- Cable Lugs

- Cable Junction Box

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes cable trays, cable raceways, cable conduits, cable connectors and glands, cable carriers, cable lugs, cable junction box, and others.

Material Insights:

- Metallic

- Non-Metallic

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes metallic and non-metallic.

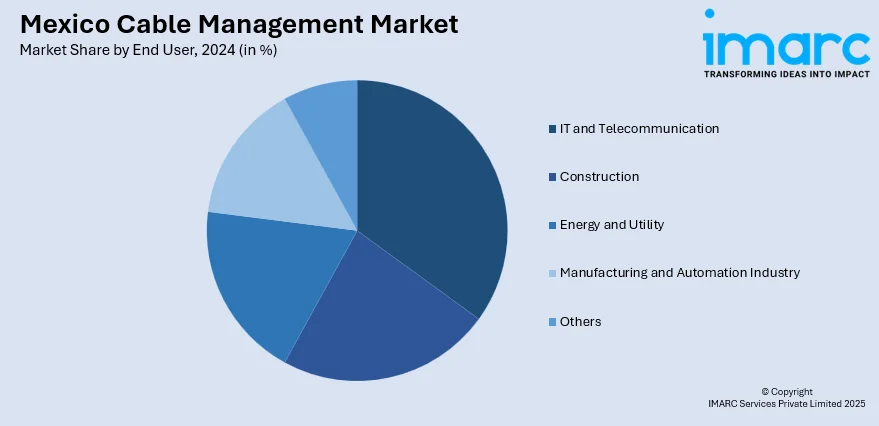

End User Insights:

- IT and Telecommunication

- Construction

- Energy and Utility

- Manufacturing and Automation Industry

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes IT and telecommunication, construction, energy and utility, manufacturing and automation industry, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Cable Management Market News:

- In May 2024, ABB and Niedax Group formed a 50/50 joint venture, Abnex Inc., to serve the North American cable management market, including Mexico. The company will provide advanced cable tray solutions for electrical contractors, distributors, and systems integrators. Abnex Inc. leverages both partners’ expertise to expand product offerings and improve manufacturing efficiency through automation and sustainability.

- In August 2024, LS Cable & System begun construction of bus duct and EV battery part plants in Queretaro, Mexico, aiming to boost its presence in the North American market. The facilities, spanning 16,800 m², will begin mass production by late 2025. Mexico was chosen for its strategic location, lower labor costs, and USMCA benefits. The plants will serve industries like EVs, semiconductors, and data centers.

- In August 2024, Yangtze Optical Fibre and Cable (YOFC) launched its first Mexican facility, Yangtze Optics Mexico Cable S.A. de C.V., in Jalisco. This move marks a major step in YOFC’s global expansion strategy, aiming to meet rising telecom demand in Mexico. The plant will produce high-quality fibre optic cables, generate local jobs, and foster economic and technological growth.

Mexico Cable Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Cable Trays, Cable Raceways, Cable Conduits, Cable Connectors and Glands, Cable Carriers, Cable Lugs, Cable Junction Box, Others |

| Materials Covered | Metallic, Non-Metallic |

| End Users Covered | IT and Telecommunication, Construction, Energy and Utility, Manufacturing and Automation Industry, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico cable management market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico cable management market on the basis of product?

- What is the breakup of the Mexico cable management market on the basis of material?

- What is the breakup of the Mexico cable management market on the basis of end user?

- What is the breakup of the Mexico cable management market on the basis of region?

- What are the various stages in the value chain of the Mexico cable management market?

- What are the key driving factors and challenges in the Mexico cable management?

- What is the structure of the Mexico cable management market and who are the key players?

- What is the degree of competition in the Mexico cable management market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico cable management market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico cable management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico cable management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)