Mexico Cancer Immunotherapy Market Size, Share, Trends and Forecast by Therapy Type, Application, End User, and Region, 2025-2033

Mexico Cancer Immunotherapy Market Overview:

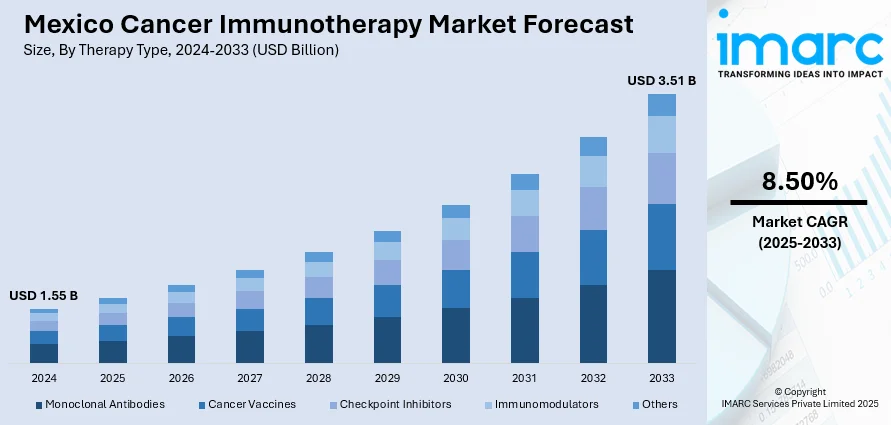

The Mexico cancer immunotherapy market size reached USD 1.55 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.51 Billion by 2033, exhibiting a growth rate (CAGR) of 8.50% during 2025-2033. The market is expanding with the increased application of checkpoint inhibitors, cancer vaccine uses expanded, and multipurpose roles of immunomodulators across a range of cancers. The treatments are becoming part of national oncology standards, led by clinical need and immune-based therapy advances. As adoption amplifies and applications expand among different cancers, the Mexico cancer immunotherapy market share continues to grow steadily and strategically.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.55 Billion |

| Market Forecast in 2033 | USD 3.51 Billion |

| Market Growth Rate 2025-2033 | 8.50% |

Mexico Cancer Immunotherapy Market Trends:

Growing Use of Checkpoint Inhibitors

Mexico is seeing a sharp rise in the use of checkpoint inhibitors as they prove to be effective in curing other types of cancer as well, most notably melanoma and non-small cell lung cancer. They attack the cancer cells by optimizing the ability of the immune system to identify and kill the cancer cells, providing longer remission than traditional cancer treatments. Public and private healthcare facilities are highly adopting checkpoint inhibitor therapies as part of routine treatment protocols, a move towards personalized medicine. Immune-based regimens are now the preferred clinical protocols, especially among patients who are resistant to chemotherapy or radiation. Mexico cancer immunotherapy market growth continue to look good as patient demand and medical awareness evolve in parallel. As per the sources. in March 2023, Mexico started CAR-T cell therapy clinical trials for blood cancers at Dr. José Eleuterio González Hospital, UANL, in collaboration with ImmunoACT, National Polytechnic Institute, and Salvador Zubirán Institute. Furthermore, progress in diagnostic technologies and availability of biomarker testing has further facilitated the rational use of these therapies, solidifying their inclusion in treatment guidelines. Increasing dependence on immune checkpoint inhibitors is remodeling the therapeutic paradigm and raising the bar for cancer treatment in Mexico.

Cancer Vaccine Expansion

The vaccine against cancer is slowly growing in Mexico, being boosted by increased investments in prevention and therapeutic approaches to immunization. The vaccines are being explored and used for not just cervical and liver cancer but are reaching the investigative stage for lung and colorectal cancers. The need is fueled by a mix of local epidemiologic evidence and an urgent need to induce long-lasting immune memory for tumor antigens. Health authority programs and educational campaigns are contributing to raising awareness and early diagnosis, which will be critical in the successful administration of therapeutic cancer vaccines. Research centers are also actively involved in trials examining vaccine effectiveness in conjunction with other immunotherapies. As healthcare policy continues to favor advanced oncology care, Mexico cancer immunotherapy development is projected to pick up pace. The emphasis on targeted and immune-based therapies is setting the stage for cancer vaccines to become an accepted part of immuno-oncology standard practice in the nation.

Diversification of Immunomodulator Use Across Cancer Types

Immunomodulators, which have long been employed to manipulate immune response, are increasingly being used in diverse forms of cancer in Mexico, such as breast, prostate, and head and neck cancers. For instance, in July 2024, Zydus Lifesciences introduced its Bevacizumab biosimilar in Mexico, while CAR-T trials, CHIPSA's treatments, and Immunocine's dendritic cell therapies broadened immunotherapy choices in 2023–2024. Moreover, these drugs are being more commonly incorporated into multimodal treatment regimens as adjuncts to surgery, radiation, and chemotherapy. Their capacity to rebalance immune function makes them especially useful in cancers that are otherwise unresponsive to other types of immunotherapies. With growing clinical insights into tumor microenvironments, immunomodulators are being redesigned for more selective application, optimizing patient outcomes. Physicians are also investigating sequential and combination treatments including immunomodulators to prevent treatment resistance. Growing clinical uptake of these therapies has resulted in their inclusion within national treatment guidelines. Mexico cancer immunotherapy share is therefore continuously growing, underpinned by developments in formulation technologies and immune profiling. The trend indicates a developing environment where the manipulation of immune systems is core to obtaining extended therapeutic effects in oncology.

Mexico Cancer Immunotherapy Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on therapy type, application, and end user.

Therapy Type Insights:

- Monoclonal Antibodies

- Cancer Vaccines

- Checkpoint Inhibitors

- Immunomodulators

- Others

The report has provided a detailed breakup and analysis of the market based on the therapy type. This includes monoclonal antibodies, cancer vaccines, checkpoint inhibitors, and immunomodulators, others.

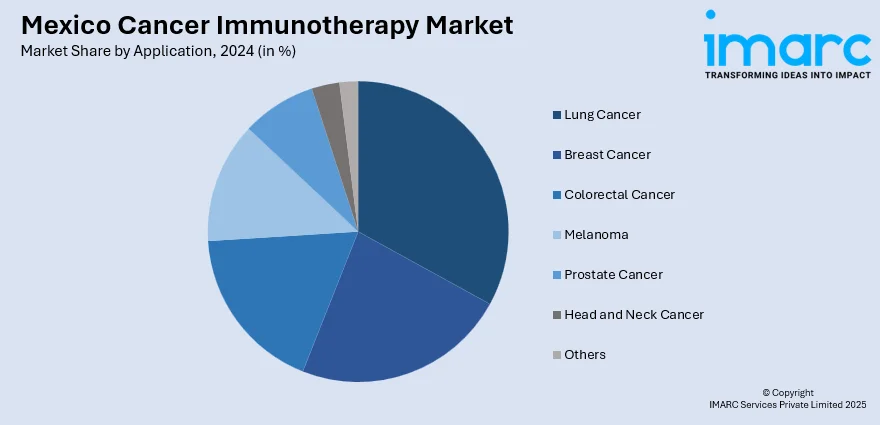

Application Insights:

- Lung Cancer

- Breast Cancer

- Colorectal Cancer

- Melanoma

- Prostate Cancer

- Head and Neck Cancer

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes lung cancer, breast cancer, colorectal cancer, melanoma, prostate cancer, head and neck cancer, and others.

End User Insights:

- Hospitals

- Cancer Research Centers

- Clinics

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospitals, cancer research centers, clinics, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Cancer Immunotherapy Market News:

- In February 2025, Astellas and Pfizer announced long-term Phase 3 EV-302 trial outcomes for PADCEV® (enfortumab vedotin) plus KEYTRUDA® (pembrolizumab), demonstrating greater efficacy in first-line therapy of locally advanced or metastatic urothelial cancer. The combination dramatically improved progression-free survival and overall survival, cementing its standard of care position.

Mexico Cancer Immunotherapy Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Therapy Types Covered | Monoclonal Antibodies, Cancer Vaccines, Checkpoint Inhibitors, Immunomodulators, Others |

| Applications Covered | Lung Cancer, Breast Cancer, Colorectal Cancer, Melanoma, Prostate Cancer, Head and Neck Cancer, Others |

| End Users Covered | Hospitals, Cancer Research Centers, Clinics, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico cancer immunotherapy market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico cancer immunotherapy market on the basis of therapy type?

- What is the breakup of the Mexico cancer immunotherapy market on the basis of application?

- What is the breakup of the Mexico cancer immunotherapy market on the basis of end user?

- What is the breakup of the Mexico cancer immunotherapy market on the basis of region?

- What are the various stages in the value chain of the Mexico cancer immunotherapy market?

- What are the key driving factors and challenges in the Mexico cancer immunotherapy?

- What is the structure of the Mexico cancer immunotherapy market and who are the key players?

- What is the degree of competition in the Mexico cancer immunotherapy market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico cancer immunotherapy market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico cancer immunotherapy market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico cancer immunotherapy industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)