Mexico Candles Market Size, Share, Trends and Forecast by Product, Wax Type, Distribution Channel, and Region, 2025-2033

Mexico Candles Market Overview:

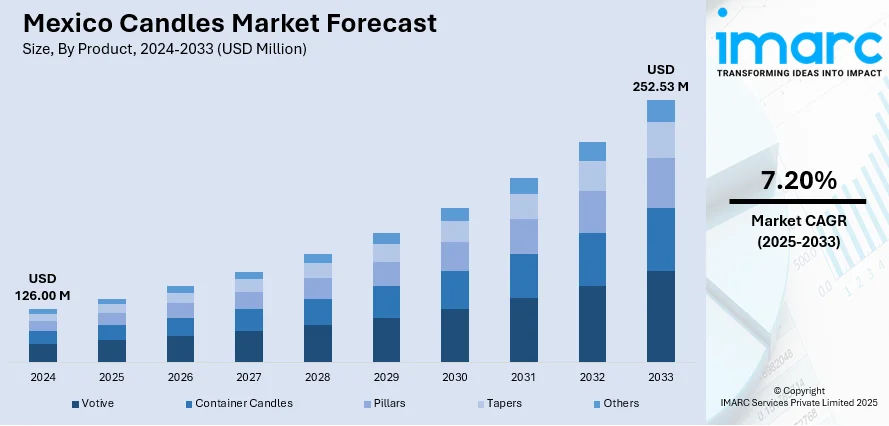

The Mexico candles market size reached USD 126.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 252.53 Million by 2033, exhibiting a growth rate (CAGR) of 7.20% during 2025-2033. The market is witnessing significant growth, driven by cultural traditions, rising wellness trends, and increasing demand for eco-friendly products. Traditional handcrafted candles remain popular for ceremonies, while scented and personalized candles gain traction among younger consumers. E-commerce growth and social media influence further contribute to the evolving Mexico candles market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 126.00 Million |

| Market Forecast in 2033 | USD 252.53 Million |

| Market Growth Rate 2025-2033 | 7.20% |

Mexico Candles Market Trends:

Cultural and Religious Significance

Candles hold deep-rooted cultural and religious significance in Mexico, profoundly influencing their widespread use and market demand. In Mexican culture, candles are frequently employed in religious practices, adorning home altars, and playing a vital role during significant celebrations like Día de Muertos and Candlemas Day. The act of lighting a candle is often intertwined with prayer, remembrance of loved ones, and the creation of sacred spaces within homes. Different colored candles and those depicting specific saints are imbued with particular meanings and intentions. This robust cultural integration ensures that candles are not merely decorative items but rather essential components in numerous households, fostering consistent demand across diverse demographics and various ceremonial occasions. This traditional usage establishes a substantial foundation for the overall candles market in Mexico.

Growing Emphasis on Home Décor and Ambiance

Mirroring global trends, there's a notable and increasing emphasis on home décor and the cultivation of a pleasant ambiance within Mexican households. Candles, particularly those that are scented and feature attractive designs, are gaining popularity as effective tools for enhancing the aesthetic appeal and overall atmosphere of living spaces. Consumers are actively incorporating candles to craft cozy and inviting environments for their personal enjoyment and to warmly welcome guests into their homes. The readily available wide array of styles, colors, and captivating fragrances effectively caters to diverse individual tastes and varying interior design preferences. This growing appreciation for candles as both decorative and sensory elements, extending beyond their traditional utilitarian functions, is making a significant contribution to the ongoing expansion of the Mexico candles market growth.

Expansion of Retail Channels and E-commerce

The ongoing development and strategic diversification of retail channels throughout Mexico, encompassing the growth of well-established supermarkets, prominent department stores, specialized home goods retailers, and, notably, burgeoning e-commerce platforms, have significantly improved the overall accessibility of candles to a wider range of consumers across the entire nation. Online shopping offers unparalleled convenience and a considerably broader selection of both domestically produced and internationally recognized brands, effectively reaching consumers even in geographical areas with limited access to traditional physical retail outlets. The steadily increasing rate of internet penetration and the growing adoption of online purchasing habits are making it considerably easier for consumers to thoroughly explore and subsequently purchase various types of candles. This enhanced accessibility, facilitated through a multitude of diverse retail avenues, stands as a crucial factor actively driving the continued growth and expanding reach of the Mexican candles market.

Mexico Candles Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, wax type, and distribution channel.

Product Insights:

- Votive

- Container Candles

- Pillars

- Tapers

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes votive, container candles, pillars, tapers and others.

Wax Type Insights:

- Paraffin

- Soy Wax

- Beeswax

- Palm Wax

- Others

A detailed breakup and analysis of the market based on the wax type have also been provided in the report. This includes paraffin, soy wax, beeswax, palm wax and others.

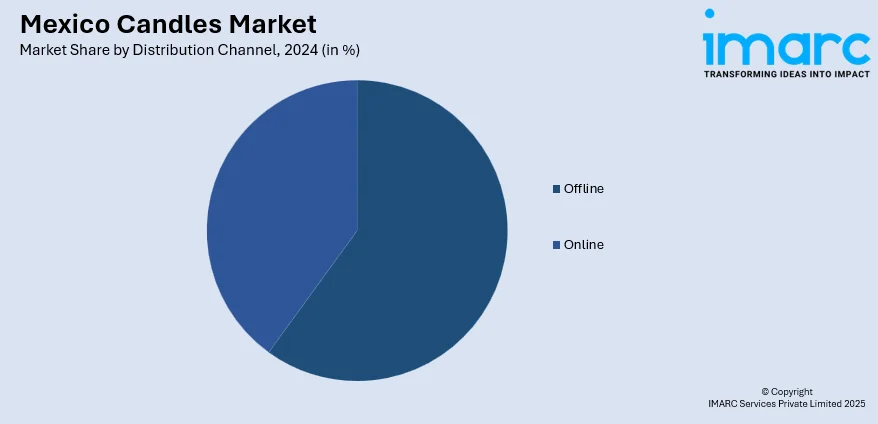

Distribution Channel Insights:

- Offline

- Online

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes offline and online.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Candles Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Votive, Container Candles, Pillars, Tapers, Others |

| Wax Types Covered | Paraffin, Soy Wax, Beeswax, Palm Wax, Others |

| Distribution Channels Covered | Offline, Online |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico candles market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico candles market on the basis of product?

- What is the breakup of the Mexico candles market on the basis of wax type?

- What is the breakup of the Mexico candles market on the basis of distribution channel?

- What is the breakup of the Mexico candles market on the basis of region?

- What are the various stages in the value chain of the Mexico candles market?

- What are the key driving factors and challenges in the Mexico candles market?

- What is the structure of the Mexico candles market and who are the key players?

- What is the degree of competition in the Mexico candles market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico candles market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico candles market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico candles industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)