Mexico Car Leasing Market Size, Share, Trends and Forecast by Type, Lease Type, Service Provider Type, Tenure, and Region, 2026-2034

Mexico Car Leasing Market Summary:

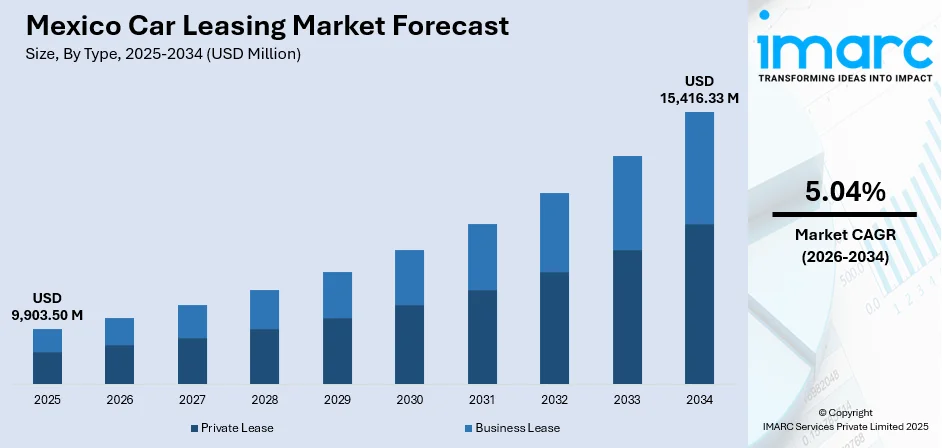

The Mexico car leasing market size was valued at USD 9,903.50 Million in 2025 and is projected to reach USD 15,416.33 Million by 2034, growing at a compound annual growth rate of 5.04% from 2026-2034.

The Mexico car leasing market is experiencing robust expansion driven by corporate demand for fleet management solutions and individual preferences for flexible vehicle access without ownership burdens. Enterprises across pharmaceuticals, retail, logistics, and government sectors increasingly adopt leasing arrangements to optimize operational costs while maintaining modern vehicle fleets. The proliferation of digital platforms and fintech innovations has streamlined leasing processes, enhancing customer experiences through automated applications, real-time vehicle monitoring, and seamless contract management. Financial institutions and specialized lessors continue expanding their service portfolios, offering diversified lease structures tailored to varying creditworthiness profiles and tenure preferences that collectively strengthen the Mexico car leasing market share.

Key Takeaways and Insights:

-

By Type: Business lease dominates the market with a share of 62.07% in 2025, driven by increasing corporate adoption of fleet leasing solutions that enable enterprises to maintain operational flexibility while eliminating asset depreciation risks. Pharmaceutical, logistics, and retail companies leverage business leasing to access modern vehicle fleets without substantial capital expenditure.

-

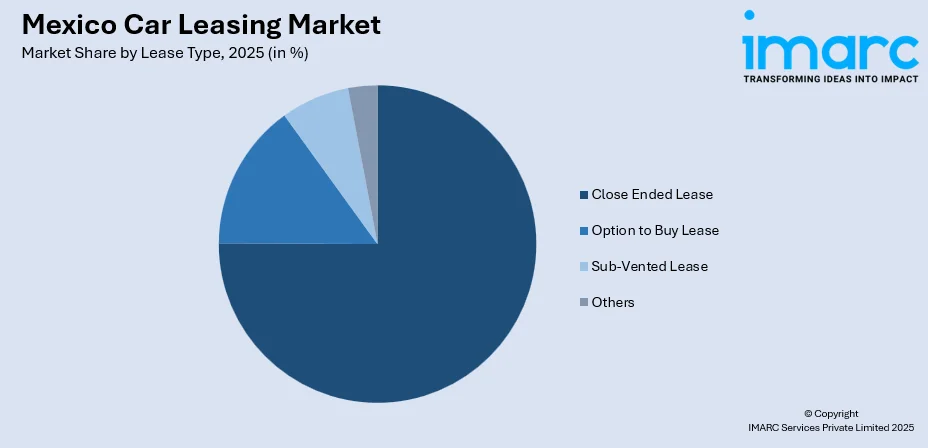

By Lease Type: Close ended lease leads the market with a share of 75.03% in 2025, attributed to the structure offering predictable monthly payments and clear end-of-term vehicle return options. Lessees prefer this arrangement as it eliminates residual value uncertainties and provides straightforward exit mechanisms without additional financial obligations.

-

By Service Provider Type: Bank affiliated providers represent the largest segment with a market share of 58.06% in 2025, reflecting consumer trust in established financial institutions that offer competitive interest rates, integrated banking services, and extensive branch networks. Major Mexican banks continue expanding automotive financing divisions with dedicated leasing products.

-

By Tenure: Long-term exhibits a clear dominance with a 66.02% share in 2025, as businesses and individuals seek stability through extended contract periods spanning thirty-six to sixty months. These arrangements offer lower monthly payments and comprehensive maintenance packages that reduce total cost of ownership.

-

By Region: Central Mexico comprises the largest region with 35% share in 2025, driven by the concentration of economic activity around Mexico City metropolitan area and major automotive manufacturing corridors. Higher population density and corporate headquarters presence fuel substantial leasing demand in this region.

-

Key Players: Leading market participants are strengthening their competitive positions through digital platform investments, diversified lease product portfolios, and strategic partnerships with automotive manufacturers. These companies focus on enhancing customer experience through streamlined application processes and value-added services including maintenance and insurance packages.

To get more information on this market Request Sample

The Mexico car leasing market continues transitioning from traditional ownership models toward flexible leasing arrangements that align with evolving consumer preferences and corporate financial strategies. This transformation is accelerated by rising interest rates making conventional vehicle purchases less attractive, while leasing offers predictable expenses without substantial down payments. Mexico's position as the fifth-largest global vehicle producer supports a robust automotive ecosystem that benefits leasing infrastructure development. The integration of telematics and digital fleet management solutions enables real-time monitoring and predictive maintenance scheduling that optimizes vehicle utilization. Service providers across banking, OEM-affiliated, and independent segments compete through differentiated offerings addressing diverse customer requirements across personal and commercial applications.

Mexico Car Leasing Market Trends:

Digital Transformation Reshaping Leasing Operations

The car leasing industry in Mexico is undergoing significant digital transformation as service providers deploy cloud-based platforms for streamlined contract management and customer engagement. Advanced digital tools enable real-time vehicle monitoring, automated maintenance scheduling, and seamless documentation processing that reduces administrative overhead. Major financial institutions now offer fully digital automotive financing simulations and applications through online platforms, enabling customers to secure approvals without physical branch visits. These technological investments enhance operational efficiency while improving customer experiences through convenient self-service capabilities.

Rising Adoption of Subscription-Based Mobility Models

Vehicle subscription platforms are gaining momentum in Mexico as contemporary alternatives to traditional leasing structures, particularly appealing to urban consumers prioritizing convenience and flexibility. These models bundle monthly payments with comprehensive services including insurance, maintenance, and roadside assistance, eliminating hidden costs and administrative burdens. The approach resonates with younger demographics and professionals seeking hassle-free mobility solutions without long-term commitments. Subscription-based arrangements allow drivers to exchange vehicles according to evolving lifestyle needs, representing an increasing preference for convenient, on-demand transportation solutions that correlate with changing work habits and urbanization patterns.

Electric and Hybrid Vehicle Leasing Expansion

The transition toward sustainable mobility is accelerating electric and hybrid vehicle adoption within Mexican leasing portfolios as environmental awareness and favorable tax policies converge. Leasing arrangements particularly suit electric vehicles by addressing consumer concerns about battery technology evolution and depreciation uncertainties through predictable costs and upgrade flexibility. This structure enables lessees to access next-generation vehicles without substantial initial investments while mitigating risks associated with rapidly advancing automotive technologies. Major banks are expanding dedicated financing products for electric vehicles with preferential interest rates to capture growing demand across corporate and individual segments.

Market Outlook 2026-2034:

The Mexico car leasing market demonstrates strong growth potential through the forecast period as corporate fleet optimization strategies and individual preferences for ownership-free mobility continue expanding. Digital innovation will remain central to competitive differentiation, with artificial intelligence and data analytics enabling personalized lease structuring and risk assessment. The market generated a revenue of USD 9,903.50 Million in 2025 and is projected to reach a revenue of USD 15,416.33 Million by 2034, growing at a compound annual growth rate of 5.04% from 2026-2034. Electrification trends will reshape lease portfolios as regulatory incentives and infrastructure expansion support green vehicle adoption across commercial and personal segments.

Mexico Car Leasing Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Business Lease | 62.07% |

| Lease Type | Close Ended Lease | 75.03% |

| Service Provider Type | Bank Affiliated | 58.06% |

| Tenure | Long-Term | 66.02% |

| Region | Central Mexico | 35% |

Type Insights:

- Private Lease

- Business Lease

Business lease dominates with a market share of 62.07% of the total Mexico car leasing market in 2025.

Businesses across Mexico increasingly recognize fleet leasing as a strategic financial instrument that preserves capital for core business investments while ensuring access to modern, well-maintained vehicle fleets. The business lease segment benefits from favorable tax treatment allowing companies to deduct leasing expenses, effectively reducing total cost of ownership compared to outright vehicle purchases. Organizations in pharmaceuticals, consumer goods, logistics, and government sectors drive substantial demand as they seek to optimize fleet operations without asset management complexities. This approach enables companies to redirect financial resources toward revenue-generating activities rather than depreciating transportation assets.

Business leasing arrangements typically encompass comprehensive service packages including maintenance, insurance, and roadside assistance that simplify fleet administration while ensuring consistent vehicle performance and regulatory compliance. These bundled services eliminate the need for dedicated internal fleet management departments, allowing organizations to focus on core competencies. This segment continues attracting multinational corporations establishing operations in Mexico who prefer leveraging local leasing expertise rather than navigating vehicle ownership complexities in unfamiliar regulatory environments, thereby accelerating market entry timelines and reducing operational risks associated with unfamiliar procurement processes.

Lease Type Insights:

Access the comprehensive market breakdown Request Sample

- Close Ended Lease

- Option to Buy Lease

- Sub-Vented Lease

- Others

Close ended lease leads with a share of 75.03% of the total Mexico car leasing market in 2025.

Close ended lease structures dominate the Mexican market due to their straightforward terms that appeal to both individual consumers and corporate fleet managers seeking predictability and risk mitigation. Under these arrangements, lessees return vehicles at contract conclusion without obligations regarding residual value discrepancies, transferring depreciation risks entirely to lessors. This structure suits Mexican consumers who prioritize fixed monthly budgets and clear exit mechanisms over potential end-of-lease ownership opportunities. The simplicity of walk-away provisions provides peace of mind throughout the lease term, eliminating anxieties about future vehicle valuations or market conditions.

The prevalence of close ended leases reflects broader consumer preferences for hassle-free arrangements that eliminate concerns about vehicle remarketing or market value fluctuations. Lessees appreciate the transparency these contracts provide, knowing precisely their financial obligations from inception through termination. Leasing companies benefit from standardized portfolio management and predictable vehicle return schedules that support efficient remarketing operations through established dealer networks. This mutual clarity strengthens trust between parties and encourages repeat business relationships, contributing to sustained market growth and customer loyalty across diverse demographic segments.

Service Provider Type Insights:

- Original Equipment Manufacturer (OEM)

- Bank Affiliated

- Nonbank Financial Companies (NBFCs)

Bank affiliated providers exhibit a clear dominance with a 58.06% share of the total Mexico car leasing market in 2025.

Major Mexican banking institutions have established dedicated automotive financing divisions that leverage their extensive branch networks, long-standing customer relationships, and substantial capital resources to capture dominant market positions within the car leasing sector. Bank-affiliated providers benefit from competitive funding costs derived from diverse deposit bases, translating into attractive interest rates that appeal to cost-conscious lessees across personal and commercial segments. Their integrated banking ecosystems enable streamlined credit assessments utilizing existing customer financial histories, accelerating approval processes while reducing documentation requirements compared to standalone leasing companies entering the competitive landscape. Major Mexican financial institutions leverage their institutional credibility and access to low-cost capital to offer competitive leasing terms. For instance, BBVA Mexico leads automotive financing with approximately 25% market share, managing a portfolio exceeding 50 Billion pesos.

BBVA Mexico also exemplifies bank-affiliated provider expansion by allocating substantial monthly financing volumes toward hybrid and electric vehicles while partnering with Chinese automakers like BYD entering the Mexican market. Apart from this, banks leverage their treasury capabilities to structure competitive lease pricing across various tenure options while maintaining profitability margins. The integration of leasing products within broader financial service portfolios enables seamless customer experiences and strengthens relationship depth across multiple banking touchpoints.

Tenure Insights:

- Short-Term

- Long-Term

Long-term represents the leading segment with a 66.02% share of the total Mexico car leasing market in 2025.

Long-term lease arrangements spanning thirty-six to sixty months remain the preferred choice among Mexican businesses and individuals seeking stable, predictable transportation expenses distributed over extended periods. These contracts typically offer lower monthly payments compared to shorter alternatives while incorporating comprehensive maintenance and service packages that reduce administrative burdens. Corporate fleet managers particularly favor long-term structures that align with vehicle replacement cycles and budget planning horizons, enabling synchronized fleet renewals that optimize operational efficiency. The extended duration provides sufficient time for lessees to maximize vehicle utility while avoiding the complications associated with frequent contract renegotiations or vehicle transitions.

Extended tenure agreements benefit lessors through improved customer retention and predictable revenue streams while lessees enjoy price protection against potential rate increases throughout the contract duration. This arrangement creates mutually advantageous relationships where both parties achieve financial planning certainty. The segment continues attracting substantial demand from multinational corporations operating Mexican subsidiaries who align local fleet arrangements with global vehicle management policies typically structured around multi-year planning frameworks, ensuring consistency across international operations and simplified corporate governance oversight.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Central Mexico dominates the market with a 35% share of the total Mexico car leasing market in 2025.

Central Mexico encompasses the metropolitan area surrounding the capital and serves as the nation's economic, financial, and corporate headquarters hub where leasing demand concentrates significantly. The region hosts major banking institutions, multinational corporate offices, and substantial consumer populations with higher income levels that support premium leasing services. Mexico City's automotive corridor represents critical infrastructure connecting manufacturing facilities, distribution centers, and commercial operations that collectively generate substantial fleet leasing requirements across diverse industry sectors.

The concentration of professional services, technology companies, and administrative functions creates sustained demand for reliable corporate transportation solutions. The valley in Central Mexico around the capital concentrates approximately one quarter of the country's total population, creating substantial addressable markets for leasing service providers seeking scalable growth opportunities. Urban professionals and corporate employees within this region demonstrate higher propensity for leasing arrangements that complement metropolitan lifestyles emphasizing convenience over ownership responsibilities. Central Mexico's established infrastructure, regulatory familiarity, and skilled workforce attract continued corporate investment that sustains strong fleet leasing demand growth relative to other national regions, positioning this territory as the primary market driver.

Market Dynamics:

Growth Drivers:

Why is the Mexico Car Leasing Market Growing?

Expanding Corporate Fleet Optimization Strategies

Mexican enterprises across pharmaceuticals, retail, cargo transportation, last-mile delivery, and government sectors increasingly adopt fleet leasing as a strategic tool for optimizing operational expenditures while maintaining access to modern, reliable vehicle fleets. Corporate finance departments recognize leasing advantages including preserved capital for core business investments, predictable monthly expenses that simplify budgeting, and elimination of asset depreciation management complexities. Industry associations consistently report expanding lease portfolios year over year, confirming that leasing is emerging as a preferred scheme for companies and government entities seeking efficient transportation solutions. This sustained growth trajectory reflects fundamental shifts in corporate transportation strategies prioritizing flexibility and operational efficiency over traditional ownership models, as organizations across diverse sectors embrace asset-light approaches that enhance financial agility.

Digital Innovation Enhancing Customer Experiences

The deployment of sophisticated digital technologies across the car leasing value chain is transforming customer experiences while improving operational efficiency for service providers. Cloud-based risk management platforms, automated compliance systems, and digital contract processing enable faster approvals and enhanced transparency throughout the leasing lifecycle. Industry participants report that approximately sixty percent of Mexican light vehicles are now financed through various credit mechanisms, with digital platforms from providers like BitCar significantly expanding access. Real-time vehicle monitoring capabilities, automated maintenance scheduling, and mobile application interfaces provide lessees with unprecedented convenience and control while reducing administrative overhead for lessors seeking competitive differentiation.

Favorable Tax Incentives Supporting Leasing Adoption

Mexican tax regulations provide compelling incentives that favor leasing arrangements over outright vehicle purchases, particularly for business applications where deductibility significantly impacts total cost of ownership calculations. The maximum tax write-off for purchasing new cars remains considerably lower than deduction thresholds permitted under leasing arrangements, representing substantially enhanced tax efficiency for enterprises choosing lease structures. Furthermore, Mexico has implemented policies making electric and hybrid vehicles increasingly tax-deductible, improving affordability and fueling growth in green vehicle leasing across corporate fleets. These regulatory advantages compound over multiple vehicle cycles, creating sustained financial motivation for enterprises to prefer leasing structures that maximize deductible expenses while accessing newer, more efficient vehicles that align with evolving environmental compliance requirements.

Market Restraints:

What Challenges the Mexico Car Leasing Market is Facing?

Interest Rate Volatility Impacting Affordability

Fluctuating interest rate environments create challenges for leasing providers seeking to structure competitive offerings while maintaining profitability margins. Economic uncertainties prompt central bank policy adjustments that cascade through financial services pricing, potentially reducing consumer affordability and dampening demand growth. Extended financing periods reaching up to seventy-two months have emerged as market responses to cost pressures, though these longer commitments create additional risks for both lessees and lessors.

Limited Electric Vehicle Charging Infrastructure

Despite growing interest in electric and hybrid vehicle leasing, inadequate charging infrastructure outside major metropolitan areas constrains adoption rates across substantial portions of Mexico. Range anxiety concerns persist among potential lessees who require reliable mobility across diverse geographic regions lacking sufficient public charging networks. This infrastructure gap particularly impacts fleet operators serving routes extending beyond urban centers where charging station availability remains inconsistent.

Cultural Preference for Vehicle Ownership

Traditional Mexican consumer preferences favoring outright vehicle ownership over usership models create persistent market education challenges for leasing providers seeking broader adoption. Historical patterns indicate most consumers manage fewer than two car loans during their lifetimes, reflecting cultural attachment to asset ownership despite potential financial advantages of leasing alternatives. Overcoming these entrenched preferences requires sustained marketing investments and consumer education initiatives to demonstrate leasing value propositions.

Competitive Landscape:

The Mexico car leasing market features diverse competition among bank-affiliated institutions, original equipment manufacturer financing arms, independent lessors, and emerging fintech platforms each pursuing distinct customer segments and value propositions. Established banking players leverage extensive branch networks, competitive funding costs, and integrated financial services to maintain market leadership while investing in digital transformation to match customer experience expectations. OEM-affiliated lessors benefit from manufacturer relationships providing preferred vehicle access and aligned brand positioning. Meanwhile, fintech entrants deploy innovative risk assessment technologies and flexible product structures to capture underserved segments including gig economy workers traditionally excluded from conventional financing. This competitive intensity drives continuous service enhancement and pricing optimization that ultimately benefits Mexican consumers and businesses seeking optimal leasing solutions.

Mexico Car Leasing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Private Lease, Business Lease |

| Lease Types Covered | Close Ended Lease, Option to Buy Lease, Sub-Vented Lease, Others |

| Service Provider Types Covered | Original Equipment Manufacturer (OEM), Bank Affiliated, Nonbank Financial Companies (NBFCs) |

| Tenures Covered | Short-Term, Long-Term |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico car leasing market size was valued at USD 9,903.50 Million in 2025.

The Mexico car leasing market is expected to grow at a compound annual growth rate of 5.04% from 2026-2034 to reach USD 15,416.33 Million by 2034.

Business lease dominated the market with a share of 62.07%, driven by increasing corporate adoption of fleet leasing solutions enabling operational flexibility while eliminating depreciation risks and capital requirements.

Key factors driving the Mexico car leasing market include expanding corporate fleet optimization strategies, digital innovation enhancing customer experiences, favorable tax incentives supporting leasing adoption, and growing demand for flexible mobility solutions among businesses and individuals.

Major challenges include interest rate volatility impacting affordability, limited electric vehicle charging infrastructure in remote areas, cultural preferences for vehicle ownership over leasing, economic uncertainties affecting consumer confidence, and competition intensification requiring continuous service differentiation investments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)