Mexico Car Rental Services Market Size, Share, Trends and Forecast by Booking Type, Rental Length, Vehicle Type, Application, End User, and Region, 2026-2034

Mexico Car Rental Services Market Summary:

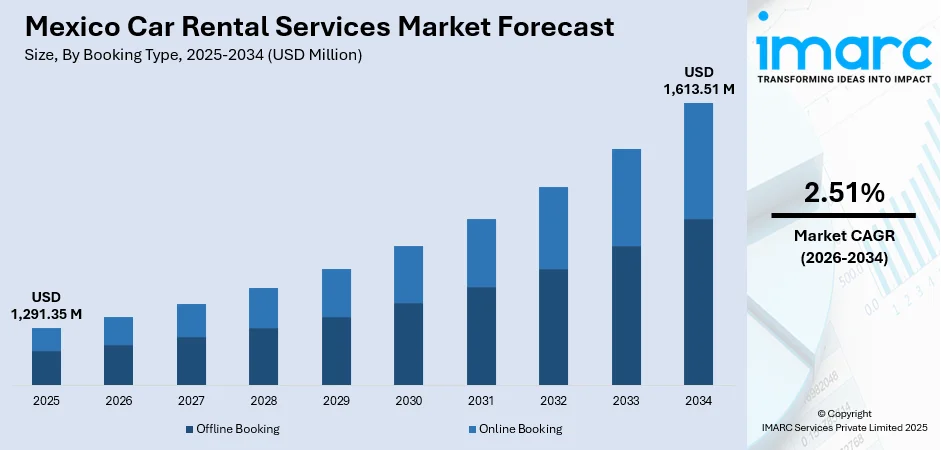

The Mexico car rental services market size was valued at USD 1,291.35 Million in 2025 and is projected to reach USD 1,613.51 Million by 2034, growing at a compound annual growth rate of 2.51% from 2026-2034.

The market is driven by the flourishing tourism sector, increasing business travel activities, expanding airport infrastructure, and rising preference for flexible transportation solutions among domestic and international travelers. Growth in road trip culture, partnerships with hospitality providers, technological advancements in booking platforms, and the emergence of eco-friendly vehicle options are further propelling demand. These factors collectively contribute to the expanding Mexico car rental services market share.

Key Takeaways and Insights:

-

By Booking Type: Offline booking dominates the market with a share of 56% in 2025, driven by preference for face-to-face interactions at rental counters, need for personalized assistance, and strong presence at airports.

-

By Rental Length: Short term leads the market with a share of 78% in 2025, owing to alignment with weekend tourism, business travel flexibility, cost-effective pricing, spontaneous trip planning, shorter vacation durations, nationwide demand.

-

By Vehicle Type: Economy represents the largest segment with a market share of 45% in 2025, driven by affordability, fuel efficiency, lower rental costs, ease of urban driving, parking convenience, budget-focused tourists, families, nationwide.

-

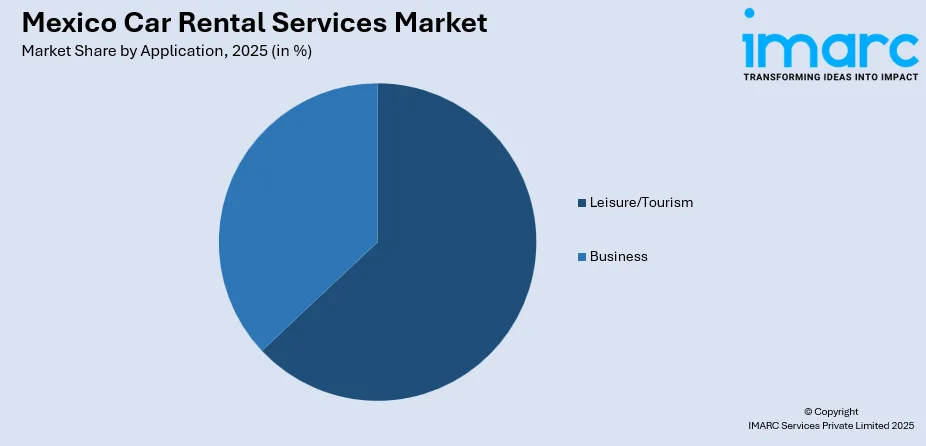

By Application: Leisure/Tourism dominates the market with a share of 63% in 2025, owing to strong inbound tourism, beach resorts, cultural destinations, heritage cities, archaeological sites, festivals, vacation-led demand, year-round travel inflows.

-

By End User: Self-driven leads the market with a share of 84% in 2025, driven by itinerary flexibility, privacy, lower costs, convenience, independent travel preferences, ease of booking, tourist mobility, business usage, widespread availability nationwide.

-

By Region: Central Mexico dominates the market with a share of 40% in 2025, owing to major airports, Mexico City business hubs, dense population, tourist attractions, heritage towns, strong infrastructure, connectivity, rental networks, demand.

-

Key Players: The Mexico car rental services market exhibits moderate-to-high competitive dynamics, with established international rental corporations competing alongside regional service providers across diverse price segments and geographic locations throughout the country

To get more information on this market Request Sample

The Mexico car rental services market is experiencing robust growth driven by the country's thriving tourism industry, which attracts millions of international visitors annually to its renowned beach destinations, historical landmarks, and vibrant urban centers. The nation's strategic geographic positioning and diverse attractions, ranging from Caribbean coastlines to ancient Mayan ruins, create sustained demand for flexible ground transportation solutions. Increasing business travel activities, fueled by expanding trade relationships and foreign investment inflows, further contribute to market expansion. The growing middle class with rising disposable incomes is increasingly opting for rental vehicles to explore domestic destinations, while improvements in road infrastructure facilitate comfortable long-distance travel. In July 2025, Mexico City saw a 20% increase in urban car rentals, as residents increasingly choose short-term rentals over ownership, according to Drivana, highlighting shifting mobility preferences in the city. Additionally, the proliferation of digital booking platforms and mobile applications has enhanced accessibility and convenience, enabling travelers to seamlessly reserve vehicles that align with their specific requirements and preferences.

Mexico Car Rental Services Market Trends:

Digital Platform Integration and Mobile-First Booking Solutions

The car rental landscape in Mexico is witnessing accelerated digital transformation as service providers increasingly prioritize mobile application development and online booking platforms. Consumers are gravitating toward smartphone-based reservation systems that offer real-time vehicle availability, instant price comparisons, and seamless payment processing. In August 2025, Drivana launched its 2.0 app in Mexico, offering over 3,000 cars to 20,000 users, with AI-powered booking, enhanced interface, and seamless digital rentals, transforming urban mobility. Moreover, this technological shift enables rental companies to capture broader customer bases while delivering enhanced user experiences through intuitive interfaces and personalized recommendations. The integration of artificial intelligence-powered chatbots and virtual assistants is streamlining customer service operations, providing instant query resolution, and offering tailored vehicle suggestions based on user preferences and travel patterns.

Expansion of Eco-Friendly and Electric Vehicle Fleets

Environmental consciousness is reshaping fleet composition strategies as rental companies progressively incorporate hybrid and electric vehicles into their offerings. This trend aligns with growing consumer awareness regarding sustainability and carbon footprint reduction during travel. Service providers are establishing partnerships with automotive manufacturers to secure eco-friendly vehicle supplies while developing charging infrastructure at key rental locations. As per sources, in August 2025, UNEX EV signed an LOI with Didi Mobility to deploy UOTTA™ battery-swapping electric vehicles for ride-hailing and car rentals in Mexico, advancing eco-friendly fleet adoption and green mobility. Further, the introduction of green mobility options appeals particularly to environmentally conscious tourists and corporate clients with sustainability mandates, creating differentiation opportunities in the competitive marketplace while positioning companies favourably for anticipated regulatory developments promoting clean transportation.

Strategic Partnerships with Tourism and Hospitality Sectors

Collaborative arrangements between car rental providers and hospitality establishments are intensifying across Mexico's tourism ecosystem. Hotels, resorts, airlines, and travel agencies are increasingly offering integrated mobility packages that bundle accommodation with vehicle rental services, creating convenience for travelers while generating cross-promotional benefits. These partnerships extend to loyalty program integration, enabling customers to accumulate and redeem rewards across multiple service categories. Airport authorities are also facilitating improved rental service accessibility through dedicated infrastructure development, enhancing the seamless transition from air travel to ground transportation for arriving visitors.

Market Outlook 2026-2034:

The Mexico car rental services market is set for steady revenue growth over the forecast period, driven by rising international tourism, expanding domestic travel, and ongoing infrastructure upgrades at major transport hubs. Increasing digitalization of bookings, broader vehicle portfolios, and expansion into emerging tourist destinations support revenues. Favorable urbanization trends, growing disposable incomes, and shifting mobility preferences continue to boost demand for flexible rental solutions across leisure and business travel segments. The market generated a revenue of USD 1,291.35 Million in 2025 and is projected to reach a revenue of USD 1,613.51 Million by 2034, growing at a compound annual growth rate of 2.51% from 2026-2034.

Mexico Car Rental Services Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Booking Type |

Offline Booking |

56% |

|

Rental Length |

Short Term |

78% |

|

Vehicle Type |

Economy |

45% |

|

Application |

Leisure/Tourism |

63% |

|

End User |

Self-Driven |

84% |

|

Region |

Central Mexico |

40% |

Booking Type Insights:

- Offline Booking

- Online Booking

Offline booking dominates with a market share of 56% of the total Mexico car rental services market in 2025.

Offline booking maintains its leading position in the Mexico car rental services market, driven primarily by the strong preference among travelers for personalized service interactions and immediate assistance during the vehicle selection process. Many customers, particularly first-time renters and international visitors unfamiliar with local driving conditions, value the opportunity to discuss insurance options, route recommendations, and vehicle specifications directly with rental agents. The physical presence of rental desks at strategic locations including airports, hotels, and city centers ensures convenient accessibility for walk-in customers. In March 2025, Avis México inaugurated its new Cancún International Airport facility, featuring 13 service counters, 157 ready-line spaces, a 15-meter video wall, and 524 solar panels to enhance customer experience.

Additionally, offline booking accommodates travelers who may lack reliable internet connectivity or prefer conducting financial transactions in person for security considerations. Corporate clients often maintain established relationships with rental agencies that facilitate streamlined booking procedures through dedicated account managers. The offline segment also serves demographics less accustomed to digital platforms, ensuring inclusive service accessibility across diverse customer profiles while maintaining the personal touch that distinguishes premium service experiences.

Rental Length Insights:

- Short Term

- Long Term

Short term leads with a share of 78% of the total Mexico car rental services market in 2025.

Short term dominates the Mexico car rental services market, reflecting the predominant travel patterns of tourists and business visitors who typically require vehicles for periods ranging from single days to approximately one week. This segment aligns perfectly with vacation durations, weekend getaways, and brief business trips that characterize most ground transportation needs within the country. The flexibility offered by short-term arrangements enables travelers to rent vehicles precisely for planned activities without committing to extended periods, optimizing cost efficiency.

Furthermore, short term accommodates spontaneous travel decisions and itinerary modifications that frequently occur during leisure trips. The segment benefits from streamlined pickup and return processes at conveniently located stations, including airport facilities that service the substantial volume of arriving tourists. Rental companies have optimized their operations around short-term demand patterns, implementing efficient fleet rotation strategies and dynamic pricing models that respond to seasonal fluctuations in tourism activity across different regions and destinations throughout Mexico

Vehicle Type Insights:

- Luxury

- Executive

- Economy

- SUVs

- Others

The economy exhibits a clear dominance with a 45% share of the total Mexico car rental services market in 2025.

Economy commands the largest share of the Mexico car rental services market, driven by widespread consumer preference for affordable, fuel-efficient transportation options that minimize overall travel expenditure. In July 2024, car rental searches at Felipe Ángeles International Airport (AIFA) surged 200%, with travelers predominantly seeking affordable economy cars for cost-efficient ground transportation. Moreover, budget-conscious tourists, particularly those planning extended exploration itineraries, prioritize compact vehicles that deliver optimal fuel economy while adequately accommodating typical luggage requirements. The practical dimensions of economy cars facilitate easier navigation through congested urban environments and narrow streets characteristic of Mexico's colonial towns and historic centers.

Economy also appeals to younger travelers and digital nomads who prioritize mobility functionality over luxury amenities, allocating savings toward experiences rather than premium transportation. Rental companies maintain extensive economy fleets to satisfy this dominant demand segment, ensuring consistent availability across locations. The competitive pricing of economy rentals enables broader market accessibility, attracting price-sensitive customers who might otherwise opt for alternative transportation modes while providing entry-level options for customers who may subsequently upgrade based on positive rental experiences.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Leisure/Tourism

- Business

Leisure/tourism dominates with a market share of 63% of the total Mexico car rental services market in 2025.

Leisure/tourism represents the largest share of Mexico car rental services market, reflecting the country's prominent position as a globally renowned travel destination. Tourists seeking independence and flexibility in exploring diverse attractions, from Pacific and Caribbean beaches to archaeological sites and colonial cities, increasingly recognize rental vehicles as essential enablers of comprehensive travel experiences. The freedom to customize itineraries, visit off-the-beaten-path destinations, and travel at preferred paces drives sustained leisure rental demand throughout the year.

The tourism patterns generate pronounced demand peaks during holiday periods, summer vacations, and winter escape seasons when international visitors flood popular resort destinations. The expanding domestic tourism sector, fueled by rising middle-class prosperity, further strengthens leisure rental demand as Mexican families increasingly undertake road trips exploring national parks, cultural heritage sites, and regional attractions. Tour operators and travel agencies frequently incorporate rental vehicle options into comprehensive vacation packages, facilitating seamless travel experiences for customers seeking all-inclusive arrangements. According to sources, in 2025, Hertz Mexico reinforced its leadership in rentals at Tianguis Turístico 2025, strengthening alliances with airlines, travel agencies, and cultural tourism initiatives across the country.

End User Insights:

- Self-Driven

- Chauffeur-Driven

Self-driven leads with a share of 84% of the total Mexico car rental services market in 2025.

Self-driven dominates Mexico car rental services market, reflecting strong traveler preference for autonomous mobility and personal control over transportation logistics. Independent travelers value the freedom to modify routes spontaneously, make unscheduled stops at points of interest, and maintain privacy during journeys without the presence of hired drivers. The cost advantages of self-driven rentals compared to chauffeur services make independent options financially attractive across diverse customer segments seeking economical ground transportation solutions.

Modern navigation technology, including GPS systems and smartphone mapping applications, has reduced barriers to self-driving in unfamiliar territories, empowering confident independent travel even among first-time visitors. Younger demographic segments particularly embrace self-driven options as extensions of their independent travel philosophies, while families appreciate the convenience of personal vehicle control when traveling with children. Business travelers also frequently prefer self-driven rentals for the flexibility they provide in managing tight schedules and the professional privacy they afford during transit between appointments.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Central Mexico dominates with a market share of 40% of the total Mexico car rental services market in 2025.

Central Mexico leads the Mexico car rental services market, driven by the concentration of major airports, business districts, and internationally significant tourist attractions within this geographic zone. Mexico City, as the national capital and largest metropolitan area, generates substantial rental demand from both business travelers and tourists exploring its museums, historical landmarks, and cultural offerings. According to sources, Mexico City recorded 38,364 daily and weekly car rentals, reflecting significant growth in short-term vehicle rentals across urban and non-tourist areas nationwide. Moreover, the region's extensive highway network facilitates convenient connections to surrounding states featuring colonial cities, archaeological zones, and natural attractions.

The presence of multiple international airports serving Central Mexico ensures consistent inflows of visitors requiring ground transportation services upon arrival. Business activity concentrated in the capital region generates weekday demand that complements leisure-oriented weekend patterns, supporting stable year-round rental operations. The diverse attractions accessible from Central Mexico, including pyramids, colonial towns, and natural reserves, encourage extended rental periods as travelers base themselves in the region while undertaking day trips to surrounding destinations.

Market Dynamics:

Growth Drivers:

Why is the Mexico Car Rental Services Market Growing?

Flourishing Tourism Industry and International Visitor Arrivals

Mexico's position as one of the world's leading travel destinations serves as a fundamental growth driver for the car rental services market, with millions of international tourists arriving annually seeking convenient ground transportation solutions. As per sources in 2025, Mexico welcomed a historic 8.3 Million international visitors, marking a 10.7% increase from October 2024 and generating an economic impact of $2.44 Billion. Moreover, the country's diverse tourism offerings, spanning beach resorts, archaeological treasures, colonial heritage sites, and natural wonders, create sustained demand for rental vehicles enabling comprehensive destination exploration. Government initiatives promoting tourism development, including infrastructure investments at key attractions and marketing campaigns in source markets, continue amplifying visitor volumes. The recovery of international travel following recent disruptions has reinvigorated tourist arrivals, particularly from major source markets including the United States and Canada, whose visitors demonstrate strong propensities for rental vehicle utilization during Mexican vacations. Cruise ship tourism also contributes to rental demand as passengers seek shore excursion mobility options at port destinations.

Expanding Business Travel and Corporate Rental Programs

The growth of commercial activities in Mexico, strengthened by trade agreements and foreign direct investment (FDI) inflows, is driving increased business travel that generates consistent corporate rental demand. As per sources in November 2025, SIXT entered Mexico, establishing operations at Cancún, Mexico City, Guadalajara, and Monterrey airports, expanding its Latin America and Caribbean footprint to 26 countries. Moreover, multinational corporations operating in Mexico maintain corporate rental agreements facilitating employee mobility across national operations and client meetings. The manufacturing sector's expansion, particularly in automotive, aerospace, and electronics industries, creates regular inter-city travel requirements for executives, engineers, and sales personnel. Business travelers typically demonstrate preferences for reliable, professionally maintained vehicles and value-added services including GPS navigation, mobile connectivity, and flexible scheduling accommodations. The development of industrial corridors and special economic zones across multiple regions generates geographically distributed business travel patterns, encouraging rental companies to expand location networks beyond traditional tourism-focused destinations.

Infrastructure Development and Road Network Improvements

Ongoing investments in transportation infrastructure across Mexico are enhancing the attractiveness and feasibility of rental vehicle utilization throughout the country. Highway expansion projects connecting major cities and tourist destinations reduce travel times while improving journey comfort and safety standards. Airport modernization initiatives create enhanced facilities for rental operations, including dedicated counters, convenient parking structures, and streamlined pickup procedures. According to sources, in June 2025, SICT announced that sixty-two Mexican airports will be expanded and rehabilitated, with 33,728 million pesos allocated for 2025, enhancing connectivity and supporting rental vehicle operations. Further, the development of modern service plazas along major routes provides travelers with rest stops, fuel stations, and amenities that facilitate comfortable long-distance journeys. Moreover, these infrastructure improvements extend the practical reach of rental vehicles into previously less accessible regions, opening new tourism circuits and business travel routes that generate incremental rental demand while improving overall customer experiences through superior road conditions and supporting facilities.

Market Restraints:

What Challenges the Mexico Car Rental Services Market is Facing?

Seasonal Demand Fluctuations and Capacity Utilization Challenges

The Mexico car rental services market faces inherent constraints from pronounced seasonal demand variations that create operational inefficiencies and financial pressures. Peak tourism periods generate demand surges that strain fleet capacity, while off-peak seasons leave substantial vehicle inventories underutilized, creating cost burdens from maintenance, depreciation, and storage requirements. These fluctuations complicate fleet optimization strategies and workforce planning, requiring companies to balance investment decisions against uncertain demand projections across different periods and locations.

Security Concerns and Regional Travel Advisories

Safety perceptions and travel advisories affecting certain Mexican regions present ongoing constraints on market expansion potential. International visitors may limit travel itineraries to established tourism corridors, reducing rental demand in regions perceived as higher risk regardless of actual security conditions. Insurance cost structures reflect security considerations, potentially increasing rental pricing in certain areas while complicating coverage arrangements for travelers venturing beyond primary tourist destinations.

Public Transportation Alternatives and Ride-Hailing Competition

The availability of alternative transportation options constrains car rental market growth, particularly in urban environments with extensive public transit networks and widespread ride-hailing service coverage. Budget-conscious travelers, especially those visiting single destinations without planned intercity movements, may find alternative modes more economical and convenient than rental arrangements requiring parking considerations and fuel expenditure. The expanding presence of ride-hailing platforms provides flexible mobility options competing directly with traditional rental services for certain trip types.

Competitive Landscape:

The Mexico car rental services market exhibits a competitive landscape marked by established international operators and numerous regional and local providers competing across varied segments. Leading players benefit from large fleet sizes, extensive location networks, and strong brand visibility, while regional companies leverage localized knowledge and niche focus. Competitive differentiation is driven by pricing, service quality, loyalty programs, fleet diversity, and digital capabilities such as mobile apps and online booking. Strategic partnerships with airlines, hotels, and travel agencies enhance reach. Ongoing consolidation and the emergence of technology-driven platforms continue reshaping market dynamics.

Recent Developments:

-

In November 2025, National Car Rental launched a new “bleisure” service in Mexico, combining business trips with leisure activities, while celebrating its 50th anniversary. The initiative responds to growing demand, with over 320,000 daily or weekly rentals recorded last year, underscoring the evolving role of car rentals in corporate and leisure mobility.

Mexico Car Rental Services Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Booking Types Covered | Offline Booking, Online Booking |

| Rental Lengths Covered | Short Term, Long Term |

| Vehicle Types Covered | Luxury, Executive, Economy, SUVs, Others |

| Applications Covered | Leisure/Tourism, Business |

| End Users Covered | Self-Driven, Chauffeur-Driven |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico car rental services market size was valued at USD 1,291.35 Million in 2025.

The Mexico car rental services market is expected to grow at a compound annual growth rate of 2.51% from 2026-2034 to reach USD 1,613.51 Million by 2034.

Offline booking held the largest Mexico car rental services market share, driven by strong airport counter demand, walk-in customers, established travel agency partnerships, consumer trust in in-person transactions, and preference for on-site vehicle inspection and immediate support.

Key factors driving the Mexico car rental services market include the flourishing tourism industry attracting millions of international visitors, expanding business travel activities, infrastructure improvements enhancing road networks, and growing adoption of digital booking platforms.

Major challenges include seasonal demand fluctuations affecting capacity utilization, security concerns limiting travel to certain regions, competition from ride-hailing services and public transportation alternatives, fuel price volatility, and operational complexities in managing geographically distributed fleet networks.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)