Mexico Carbon Black Market Size, Share, Trends and Forecast by Type, Grade, Application, and Region, 2025-2033

Mexico Carbon Black Market Overview:

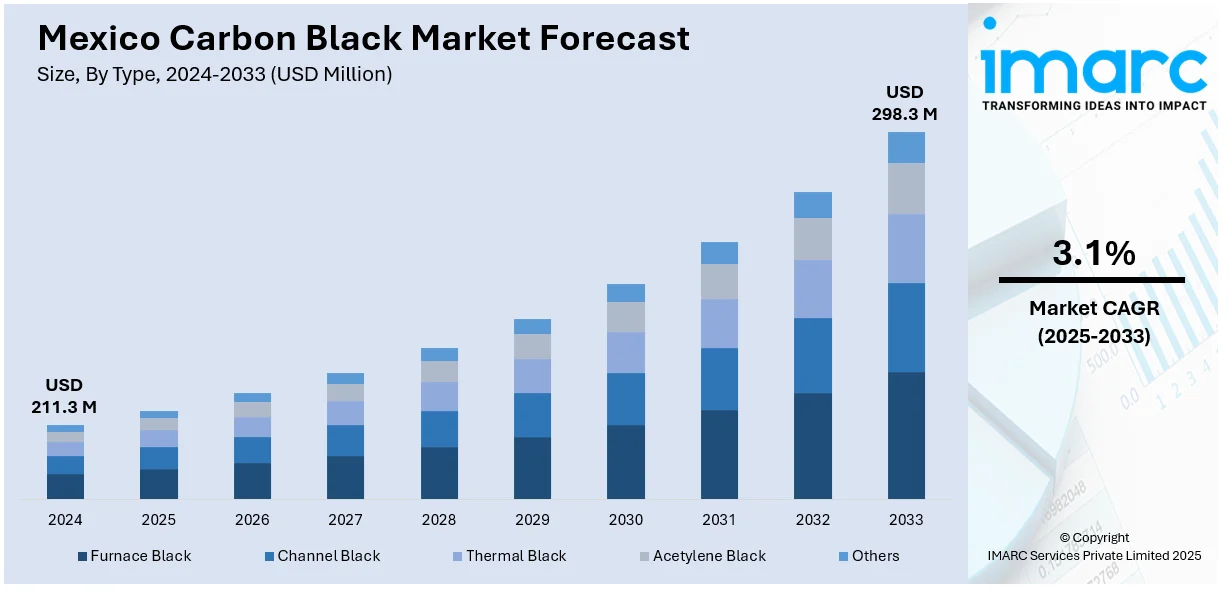

The Mexico carbon black market size reached USD 211.3 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 298.3 Million by 2033, exhibiting a growth rate (CAGR) of 3.1% during 2025-2033. The market is witnessing strong growth, fueled by growing demand in the automotive, tire, and rubber sectors. The transition towards eco-friendly production processes and new applications in electronics, coatings, and plastics is also driving the market forward. Sustained industrial growth, along with enhanced manufacturing capabilities, continues to drive market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 211.3 Million |

| Market Forecast in 2033 | USD 298.3 Million |

| Market Growth Rate 2025-2033 | 3.1% |

Mexico Carbon Black Market Trends:

Growing Demand from the Automotive Sector

The Mexican automobile industry has proved to be one of the key drivers in the market due to increased demand for premium rubber products and tires. Carbon black plays a critical role in strengthening the performance, strength, and durability of tires, hence being crucial to auto manufacturers. As demand for vehicles increases in local and export markets, tire manufacturers are relying on carbon black for improved product characteristics like wear and traction. In recent years, several automakers have boosted production in Mexico due to the country's location and trade deals like the USMCA. This has led to a rise in tire production, further boosting demand for carbon black. Moreover, the growing demand for electric vehicles (EVs) and their emphasis on lightweight, high-performance materials are inducing the creation of advanced carbon black grades with enhanced thermal conductivity and reduced weight. This trend is expected to drive the market in the coming years as manufacturers increasingly use cutting-edge technologies in tire and automotive part manufacturing.

Sustainability and Technological Innovations

Sustainability trends are increasingly characterizing the Mexican carbon black industry. Manufacturers are seeking cleaner alternatives, including recycled raw materials and cleaner production with lower environmental impact. One of the key trends is the advent of "green" carbon black, produced from renewable materials or waste tire pyrolysis. Greener alternatives are becoming popular with manufacturers interested in environmentally responsible products and compliance with tighter environmental regulations. Advances in technology, such as high-performance carbon black production for specialized uses in electronics and coatings, are further pushing market growth. Carbon black finds application across a broad range of electronic equipment for its conductivity and electrostatic discharge protection. As electric vehicles and consumer electronics gain traction, demand for quality, specialty carbon black has risen sharply. This is driving investment in research and development to develop new grades of carbon black with defined properties. Further, uses of carbon black in coatings and paints, particularly automotive and industrial coatings, continue to grow, further driving the market's upward trend. With technology and sustainability intersecting, the Mexico carbon black market is destined for long-term growth and innovation.

Mexico Carbon Black Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, grade, and application.

Type Insights:

- Furnace Black

- Channel Black

- Thermal Black

- Acetylene Black

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes furnace black, channel black, thermal black, acetylene black, and others.

Grade Insights:

- Standard Grade

- Specialty Grade

A detailed breakup and analysis of the market based on the grade have also been provided in the report. This includes standard grade and specialty grade.

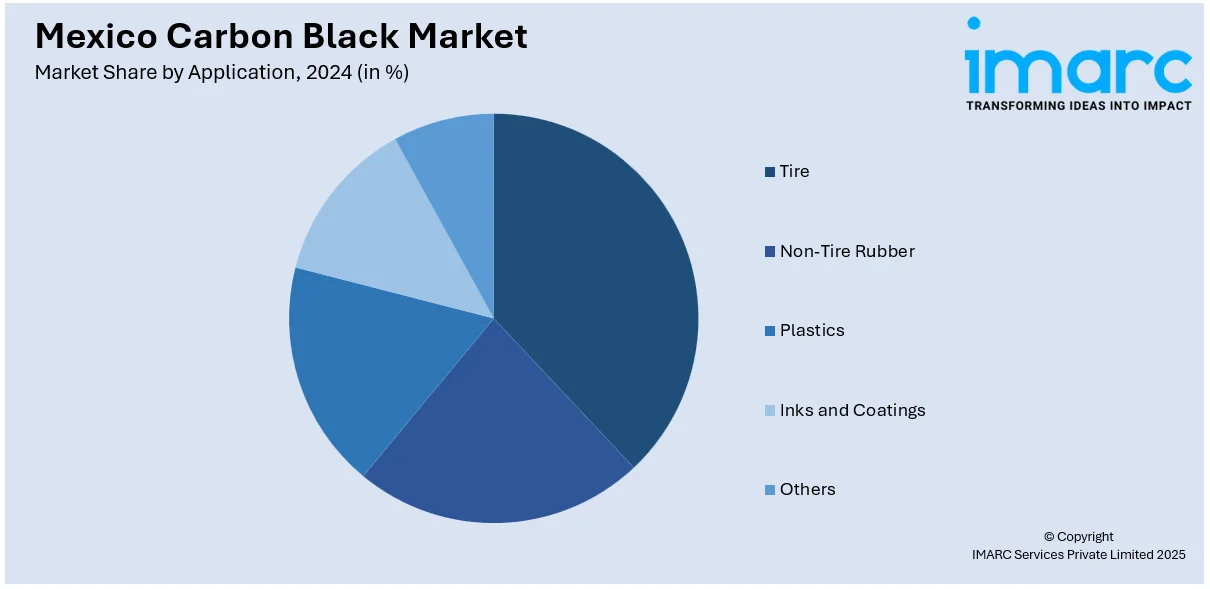

Application Insights:

- Tire

- Non-Tire Rubber

- Plastics

- Inks and Coatings

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes tire, non-tire rubber, plastics, inks and coatings, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Carbon Black Market News:

- June 2024: Cabot Corp. resumed full operations at its Altamira, Mexico plant after disruptions caused by heavy rains. The plant, a key producer of carbon black additives, faced production halts due to a severe drought. This return to full capacity positively impacted the carbon black market by stabilizing supply in the region.

- October 2024: Hankook Tire began mass production of tires using ISCC-certified carbon black derived from pyrolysis oil of end-of-life tires. This breakthrough, achieved through collaboration with 12 companies, marked a significant step toward a circular economy, reducing reliance on petrochemicals and lowering carbon emissions.

Mexico Carbon Black Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Furnace Black, Channel Black, Thermal Black, Acetylene Black, Others |

| Grades Covered | Standard Grade, Specialty Grade |

| Applications Covered | Tire, Non-Tire Rubber, Plastics, Inks and Coatings, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, and Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico carbon black market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico carbon black market on the basis of type?

- What is the breakup of the Mexico carbon black market on the basis of grade?

- What is the breakup of the Mexico carbon black market on the basis of application?

- What are the various stages in the value chain of the Mexico carbon black market?

- What are the key driving factors and challenges in the Mexico carbon black market?

- What is the structure of the Mexico carbon black market and who are the key players?

- What is the degree of competition in the Mexico carbon black market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico carbon black market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico carbon black market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico carbon black industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)