Mexico Cardiovascular Devices Market Size, Share, Trends and Forecast by Device Type, Application, End User, and Region, 2025-2033

Mexico Cardiovascular Devices Market Overview:

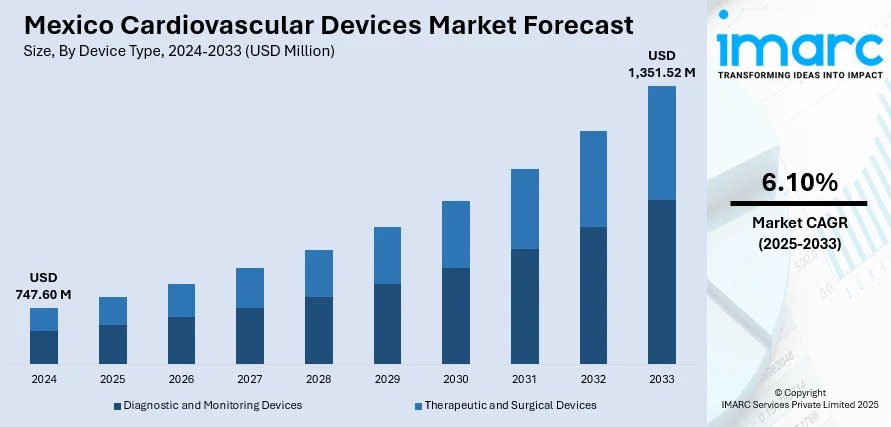

The Mexico cardiovascular devices market size reached USD 747.60 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,351.52 Million by 2033, exhibiting a growth rate (CAGR) of 6.10% during 2025-2033. The market is driven by boosting demand for minimally invasive (MI) procedures, embrace of remote monitoring technologies, and a move toward preventive care. These are all indicators of an emerging healthcare system that is centered on efficiency, accessibility, and early intervention. With heightening public awareness and digital infrastructure, demand for innovative cardiac solutions will grow, underlining a favorable growth outlook for the Mexico cardiovascular devices market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 747.60 Million |

| Market Forecast in 2033 | USD 1,351.52 Million |

| Market Growth Rate 2025-2033 | 6.10% |

Mexico Cardiovascular Devices Market Trends:

Rising Demand for Minimally Invasive Cardiovascular Procedures

Mexico is witnessing a growing preference for minimally invasive (MI) cardiovascular procedures, driven by their shorter recovery periods, lower risk of complications, and reduced hospital stays. This trend is particularly significant in urban medical centers where access to advanced diagnostic and interventional technologies is increasing. Minimally invasive procedures, including catheter-based procedures and percutaneous valve replacement, are becoming the norm in the treatment of conditions such as coronary artery disease and heart valve disease. Surgeons and cardiologists are highly being trained in these methods, which has increased access to contemporary care. Notably, Mexico cardiovascular devices market growth will be driven by the continuing shift away from open procedures to minimally invasive ones, as in line with international healthcare efficiency standards. With public and private healthcare systems advancing procedural capabilities, dependence on cutting-edge devices to facilitate these procedures is set to boost, solidifying long-term traction in this medical technology market. For instance, in October 2023, Forefront Medical Technology opened a 68,000 sq.ft. manufacturing facility in Juárez, Mexico, offering capabilities like injection molding, extrusion, clean room assembly, and automated high-volume production.

Integration of Remote Monitoring and Diagnostic Technologies

Integration of remote cardiac monitoring and diagnostic capabilities is transforming cardiovascular care delivery in Mexico. They allow for round-the-clock monitoring of patients, enhance early diagnosis of cardiac episodes, and enable post-discharge management, especially for patients living in remote or underserved populations. For example, in October 2023, AliveCor gained COFEPRIS approval to introduce KardiaMobile in Mexico, teaming up with Inpharamo to grow its AI-powered, mobile ECG technology, with the goal of enhancing heart health management across the country. Furthermore, portable ECGs and wearable cardiac monitors are becoming popular in hospitals as well as home settings, which allow clinicians to make informed decisions in a timely manner. This intensifying dependence on digital diagnostics is also lessening the load on tertiary care centers, providing a cost-effective route for chronic disease management. Improved digital infrastructure and wider internet penetration are also facilitating this shift. The Mexico cardiovascular devices market scenario is positive as the healthcare system welcomes telemedicine, aided by government-initiated digitization initiatives and heightening patient awareness. These developments are expected to take the lead in defining the country's future of cardiovascular care.

Transition Towards Preventive Cardiac Healthcare Solutions

One of the prominent trends in Mexico is the transition towards preventive cardiac healthcare from reactive, backed by pre-emptive screening programs and public education campaigns regarding cardiovascular health. This forward-looking strategy is generating amplified demand for diagnostic cardiovascular equipment, particularly in primary healthcare centers. Sustainable surveillance of conditions like blood pressure, heartbeat, and levels of cholesterol, for instance, are becoming standardized in medical screenings, propelling the adoption of easy-to-access and easy-to-use diagnostic products. In addition, aging populations and lifestyle illnesses are fueling demand for preventative options. Consequently, Mexico cardiovascular devices market share in the diagnostic segment is expected to spur as the emphasis on early intervention increases. The trend conforms to international public health policy that prioritizes prevention in a bid to curb long-term treatment costs and mortality rates. In Mexico, this practice is highly being incorporated into policy mechanisms and healthcare delivery, framing a sustainable model of healthcare.

Mexico Cardiovascular Devices Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on device type, application, and end user.

Device Type Insights:

- Diagnostic and Monitoring Devices

- Electrocardiogram (ECG)

- Remote Cardiac Monitoring

- Others

- Therapeutic and Surgical Devices

- Cardiac Rhythm Management (CRM) Devices

- Catheter

- Stents

- Heart Valves

- Others

The report has provided a detailed breakup and analysis of the market based on the device type. This includes diagnostic and monitoring devices (electrocardiogram (ECG), remote cardiac monitoring, others), and therapeutic and surgical devices (cardiac rhythm management (CRM) devices, catheter, stents, heart valves, others).

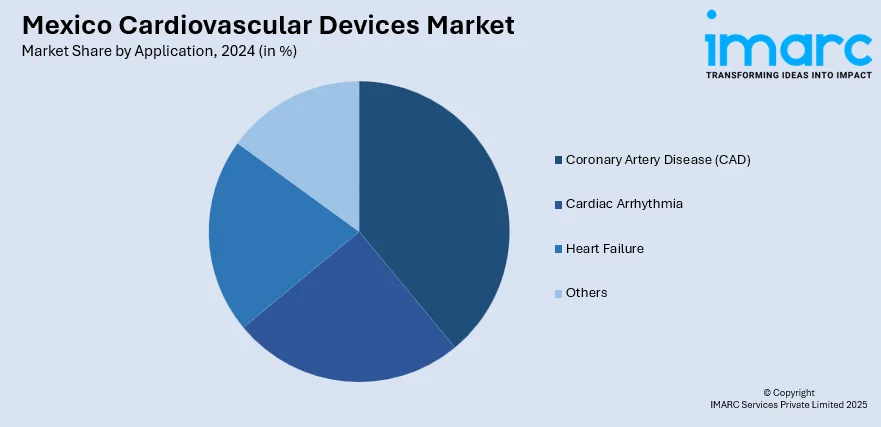

Application Insights:

- Coronary Artery Disease (CAD)

- Cardiac Arrhythmia

- Heart Failure

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes coronary artery disease (cad), cardiac arrhythmia, heart failure, and others.

End User Insights:

- Hospitals

- Specialty Clinics

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospitals, specialty clinics, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Cardiovascular Devices Market News:

- In May 2024, COFEPRIS cleared Mexico's first high-tech software as a medical device to treat myocardial infarction, and a smartwatch-based device for monitoring atrial fibrillation. These are milestones in Mexico's regulatory harmonization of medical software devices, coming after equivalence deals with the FDA.

Mexico Cardiovascular Devices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Device Types Covered |

|

| Applications Covered | Coronary Artery Disease (CAD), Cardiac Arrhythmia, Heart Failure, Others |

| End Users Covered | Hospitals, Specialty Clinics, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico cardiovascular devices market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico cardiovascular devices market on the basis of device type?

- What is the breakup of the Mexico cardiovascular devices market on the basis of application?

- What is the breakup of the Mexico cardiovascular devices market on the basis of end user?

- What is the breakup of the Mexico cardiovascular devices market on the basis of region?

- What are the various stages in the value chain of the Mexico cardiovascular devices market?

- What are the key driving factors and challenges in the Mexico cardiovascular devices?

- What is the structure of the Mexico cardiovascular devices market and who are the key players?

- What is the degree of competition in the Mexico cardiovascular devices market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico cardiovascular devices market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico cardiovascular devices market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico cardiovascular devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)