Mexico Cargo Containers Market Size, Share, Trends and Forecast by Type, Size, End User, and Region, 2025-2033

Mexico Cargo Containers Market Overview:

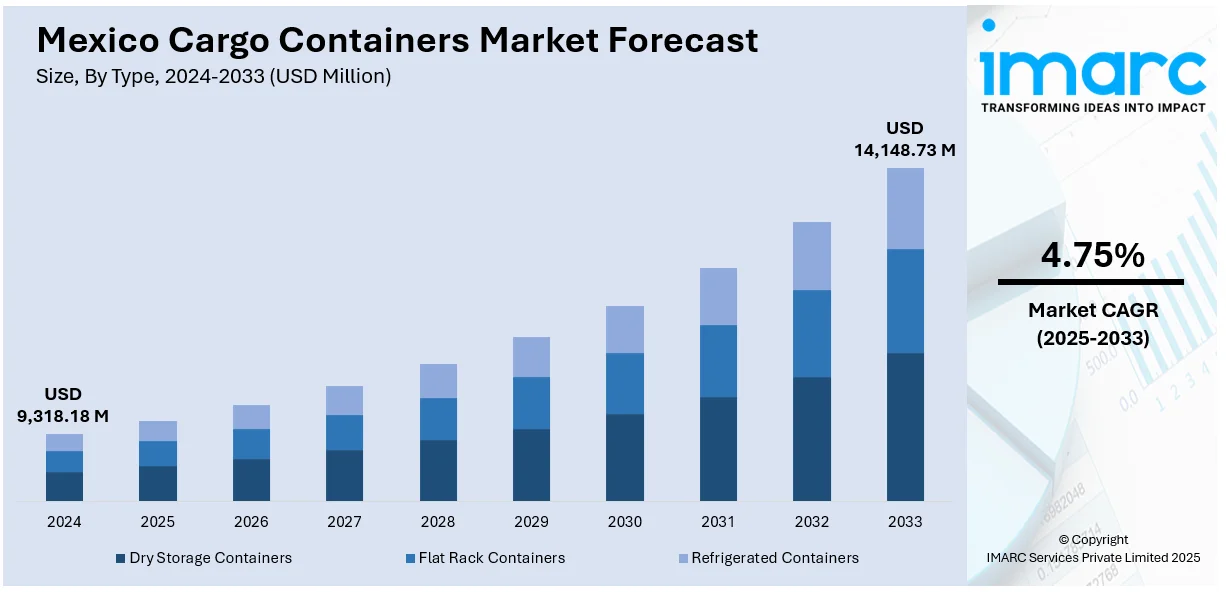

The Mexico cargo containers market size reached USD 9,318.18 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 14,148.73 Million by 2033, exhibiting a growth rate (CAGR) of 4.75% during 2025-2033. The market is witnessing growth fueled by increased connectivity and increased service capacity. New routes, including those introduced by MSC and seven Asian shipping lines, are enhancing transit times and reliability. Furthermore, these developments are expected to increase the Mexico cargo containers market share significantly.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 9,318.18 Million |

| Market Forecast in 2033 | USD 14,148.73 Million |

| Market Growth Rate 2025-2033 | 4.75% |

Mexico Cargo Containers Market Trends:

Enhanced Connectivity Between Asia and Mexico

The Mexican cargo containers market has experienced a significant rise in shipping connectivity, especially between Mexico and Asia. Due to growing demand for trade, shipping operators are consistently growing their service to integrate the movement of cargo. For instance, in March 2025, seven Asian shipping lines launched a new China-Mexico container service, which significantly boosted connectivity between China, South Korea, and Mexico. This new service, which has a 23-25 day transit time, is at the forefront in responding to growing logistics demand between Mexico and Asia. By streamlining the container transport efficiency, this service sees cargo arrive in Mexican ports earlier, which is essential for import-reliant businesses. As the trade between Asia and Mexico becomes stronger, the demand for quicker and more dependable shipping services grows more critical. With the introduction of this service, it is anticipated that the Mexico Cargo Containers market will have smoother operations, better capacity to accommodate increasing trade volumes, and higher reliability. This connectivity enhancement brings about an optimized logistics chain, avoiding transit times and maximizing the efficiency of logistics operations to the advantage of both importers and exporters in Mexico and beyond.

Expansion of Service Capacity and Network Reach

The market is experiencing a significant shift towards expanded service capacity and improved network reach, as more shipping companies focus on meeting growing demand in the region. For instance, in June 2024, MSC launched the Dahlia service, designed to enhance capacity for the Asia-Mexico West Coast trade. The service connects South China to Mexico and provides a premium loop rotation, adding greater frequency and improved network coverage. With this expansion, MSC strengthens its position in the market, offering better service options for customers and ensuring a more reliable shipping experience. This capacity expansion is critical in light of the growing import and export activities between Asia and Mexico, allowing for greater cargo movement and reducing bottlenecks at key ports like Manzanillo and Lazaro Cardenas. The increased service frequency and coverage directly contribute to the efficiency of Mexico's cargo transport network, facilitating quicker turnaround times for containers. This development also ensures that Mexican businesses can rely on consistent and timely deliveries, thereby boosting competitiveness. As the demand for containerized services continues to rise, this expansion in service capacity is a crucial factor in strengthening Mexico cargo containers market growth.

Mexico Cargo Containers Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on type, size, and end user.

Type Insights:

- Dry Storage Containers

- Flat Rack Containers

- Refrigerated Containers

The report has provided a detailed breakup and analysis of the market based on the type. This includes dry storage containers, flat rack containers, and refrigerated containers.

Size Insights:

- Small Containers (20 ft)

- Medium Containers (40 ft)

- Large Containers (Above 40 ft)

The report has provided a detailed breakup and analysis of the market based on the size. This includes small containers (20 ft), medium containers (40 ft), and large containers (above 40 ft).

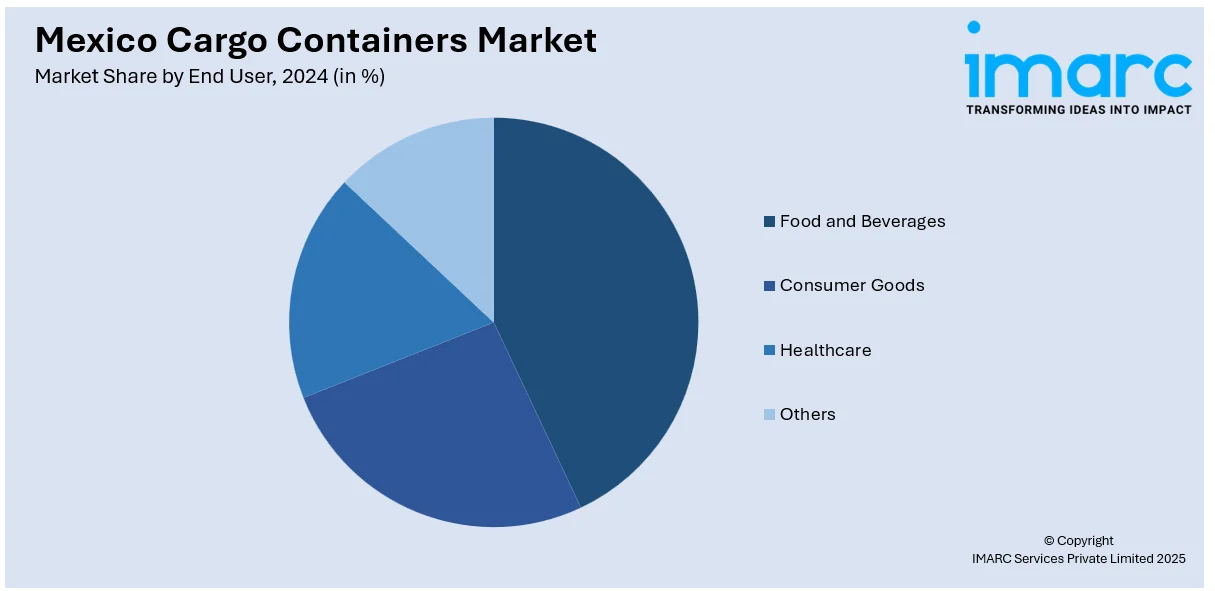

End User Insights:

- Food and Beverages

- Consumer Goods

- Healthcare

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes food and beverages, consumer goods, healthcare, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Cargo Containers Market News:

- April 2025: Sinolines launched its first Asia-Mexico route, connecting Shanghai, Qingdao, Busan, and Manzanillo. This service reduced transit times, with just 24 days from Shanghai and 22 days from Qingdao to Manzanillo, enhancing efficiency and lowering logistics costs in the Mexico cargo containers market.

- March 2025: Crowley launched its Mexico Gulf Express service, enhancing cargo movement between Mexico, the US Midwest, and Canada. The service combines a three-day ocean transit with rail, optimizing efficiency and reducing congestion. This development is expected to improve logistics speed and reliability in the Mexico cargo containers market.

Mexico Cargo Containers Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Dry Storage Containers, Flat Rack Containers, Refrigerated Containers |

| Sizes Covered | Small Containers (20 ft), Medium Containers (40 ft), Large Containers (Above 40 ft) |

| End Users Covered | Food and Beverages, Consumer Goods, Healthcare, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, and Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico cargo containers market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico cargo containers market on the basis of type?

- What is the breakup of the Mexico cargo containers market on the basis of size?

- What is the breakup of the Mexico cargo containers market on the basis of end user?

- What is the breakup of the Mexico cargo containers market on the basis of region?

- What are the various stages in the value chain of the Mexico cargo containers market?

- What are the key driving factors and challenges in the Mexico cargo containers market?

- What is the structure of the Mexico cargo containers market and who are the key players?

- What is the degree of competition in the Mexico cargo containers market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico cargo containers market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico cargo containers market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico cargo containers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)