Mexico Cargo Insurance Market Size, Share, Trends and Forecast by Insurance Type, Distribution Channel, End User, and Region, 2025-2033

Mexico Cargo Insurance Market Overview:

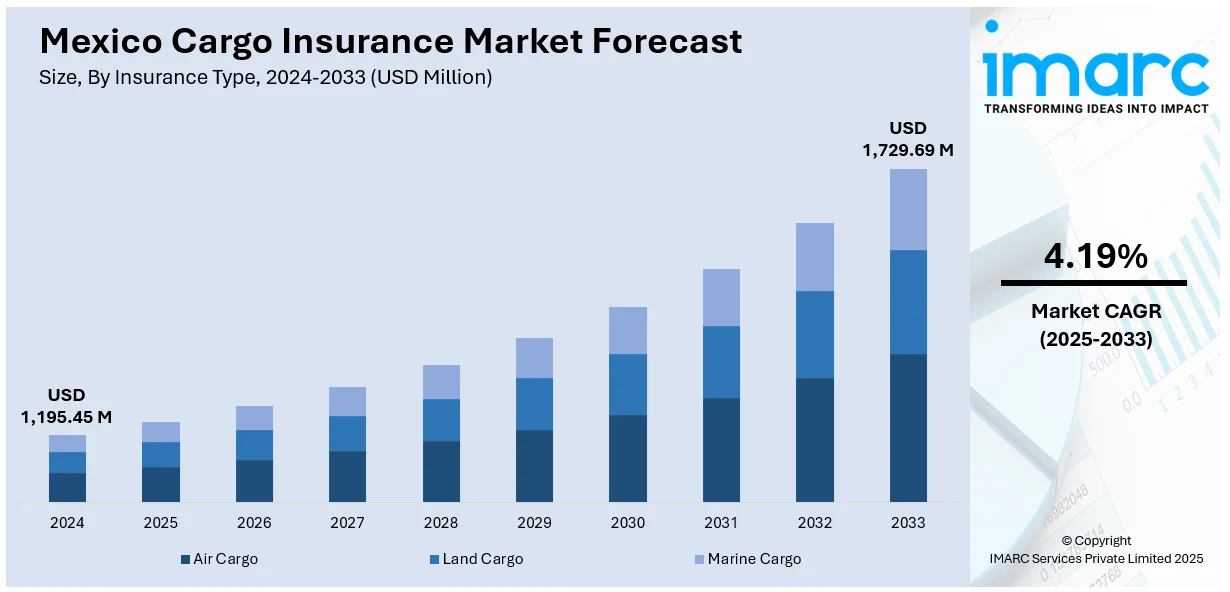

The Mexico cargo insurance market size reached USD 1,195.45 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,729.69 Million by 2033, exhibiting a growth rate (CAGR) of 4.19% during 2025-2033. Rising levels of trade, growing e-commerce, heightened awareness of risk mitigation, growing manufacturing and export industry, are supporting the market expansion. Additionally, development of the logistics infrastructure, regulatory compliance, value-added insurance product demand, natural catastrophes, adoption of digital technology, are contributing to the growth of the market. Alongside this, higher transportation costs, a strong vehicle industry, high frequency of damage and cargo theft are drivers fueling the Mexico cargo insurance market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,195.45 Million |

| Market Forecast in 2033 | USD 1,729.69 Million |

| Market Growth Rate 2025-2033 | 4.19% |

Mexico Cargo Insurance Market Analysis:

- Major Market Drivers: Mexico cargo insurance market share is being spurred on by expanding international trade, expansion of manufacturing exports, and expanding demand for risk mitigation throughout logistics networks, driven by more stringent regulations and greater concern regarding supply chain interruptions.

- Key Market Trends: Technological integration, such as digital platforms and blockchain for tracking and claims, is transforming Mexico's cargo insurance. Greater preference for tailored coverage and expansion of multimodal transport policies indicate changing logistics needs and client-centric insurance solutions.

- Competitive Landscape: As per Mexico cargo insurance market analysis the market is for robust growth, as global insurers increasingly expand their presence, domestic companies bolster networks and increasing alliances with logistics companies are made to increase flexibility of coverage, simplify claims, and enhance customer confidence in managing risk.

- Obstacles and Challenges: Challenges are associated with increased cargo theft, regulatory issues, and low insurance penetration across SMEs. Opportunities exist in digital transformations, customized products for high-value shipments, and increasing trade agreements that place Mexico as a strategic logistics and insurance center.

Mexico Cargo Insurance Market Trends:

Growing Trade Volumes

Increased volumes of trade in Mexico have been a significant driving force behind the market growth. Mexico is one of the world's largest exporters, which has surged the demand for good cargo insurance. According to the estimated World Bank figures in 2023, the total merchandise trade value of Mexico was USD 593 million. Due to such huge trade volumes, the businesses are also at greater risk, such as damage while in transit, loss through theft, or inadequate logistics. As a result, cargo insurance plays a crucial role in securing the good in transit through the borders. Mexico's position as a key North American trading player, with the thriving auto, electronics, and agricultural industries, only serves to highlight the necessity of insuring these high-value goods. With ongoing trade agreements, such as the United States-Mexico-Canada Agreement (USMCA), trade volume is projected to grow, fostering the Mexico Cargo Insurance Market forecast.

To get more information on this market, Request Sample

Rising E-commerce Sector

The growth of online commerce in Mexico has sparked the need for cargo insurance. As more individuals conduct online shopping, the volume of merchandise being transported across the country has increased dramatically. This online shopping surge has generated more goods in transit, which has increased the chances of damage to goods, delays, or theft. In 2024, Reliance Partners launched the Mexico Cargo Hijacking Data Portal, providing real-time data on cargo theft incidents across the country to help retailers and logistics companies better manage these risks. Therefore, retailers and logistics companies increasingly seek cargo insurance to mitigate against such risks. Moreover, expansion is a perennial prospect for the cargo insurance industry to grow even larger and offer tailored insurance products to e-commerce firms, which is favoring the Mexico cargo insurance market demand.

Growing Awareness of Risk Mitigation

There is a growing recognition by Mexico's businesses regarding the necessity of risk mitigation, particularly in shipping and logistics business. Since there is higher risk exposure by numerous threats like theft, destruction, and weather, business has increasingly sought cargo insurance. Businesses involved in logistics and transportation in Mexico cited risk management as a primary concern, with insurance being a key solution. This shift towards prioritizing risk mitigation can be attributed to several factors, including the increasing frequency of criminal activities targeting cargo, such as hijackings and theft, as well as the challenges posed by natural disasters like hurricanes and earthquakes. As companies become more cognizant of these risks, they are more likely to invest in cargo insurance to protect their goods and operations, which is further driving the Mexico cargo insurance market growth.

Mexico Cargo Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on insurance type, distribution channel, and end user.

Insurance Type Insights:

- Air Cargo

- Land Cargo

- Marine Cargo

The report has provided a detailed breakup and analysis of the market based on the insurance type. This includes air cargo, land cargo, and marine cargo.

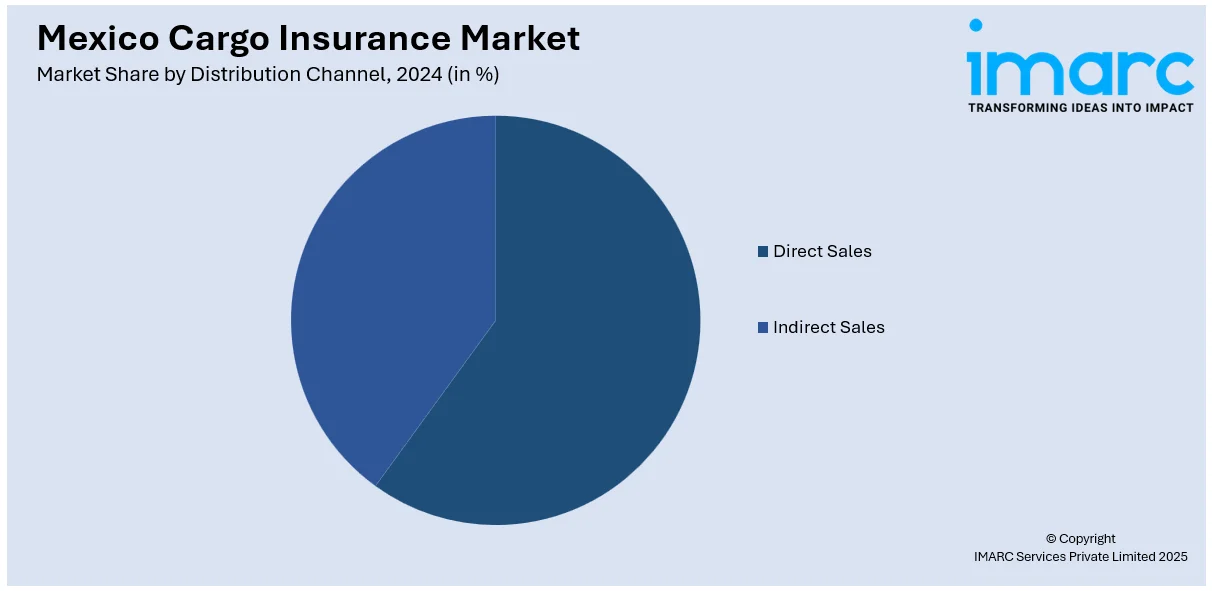

Distribution Channel Insights:

- Direct Sales

- Indirect Sales

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes direct sales and indirect sales.

End User Insights:

- Traders

- Cargo Owners

- Ship Owners

- Others

The report has provided a detailed breakup and analysis of the market based on end user. This includes traders, cargo owners, ship owners, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Cargo Insurance Market News:

- In 2025, Borderless Coverage introduced BC+, offering tailored international cargo insurance with coverage limits ranging from USD 2 million to USD 50 million per shipment, addressing the needs of high-value shippers in Mexico.

- In 2024, Hub International partnered with Mas Seguros, Mexico's largest trucking insurance broker, to enhance cross-border trucking insurance solutions across the U.S., Canada, and Mexico, aiming to streamline insurance processes for fleets operating in all three countries.

- In July 2024, Workforce Insurance Underwriters, LLC has launched a specialized insurance policy for Mexican B-1 Visa Truck Drivers operating in the U.S. The policy combines occupational accident and travel insurance, providing medical, disability, evacuation, and repatriation coverage, addressing coverage gaps and safeguarding both drivers and U.S.-based motor carriers.

Mexico Cargo Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Insurance Types Covered | Air Cargo, Land Cargo, Marine Cargo |

| Distribution Channels Covered | Direct Sales, Indirect Sales |

| End Users Covered | Traders, Cargo Owners, Ship Owners, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico cargo insurance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico cargo insurance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico cargo insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cargo insurance market in Mexico was valued at USD 1,195.45 Million in 2024.

The Mexico cargo insurance market is projected to exhibit a (CAGR) of 4.19% during 2025-2033, reaching a value of USD 1,729.69 Million by 2033.

Growth drivers for the Mexico cargo insurance market are the nation's increasing international trade, rising e-commerce shipments, and risk exposure due to theft, damage, and natural catastrophes. Well-developed logistics and manufacturing industries continued free trade agreements such as USMCA, and increased recognition of risk protection are motivating companies to implement full-fledged cargo insurance products to safeguard products in transit and maintain the continuity of supplies.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)