Mexico Carton Packaging Market Size, Share, Trends and Forecast by Material Type, Product Type, End User, and Region, 2026-2034

Mexico Carton Packaging Market Summary:

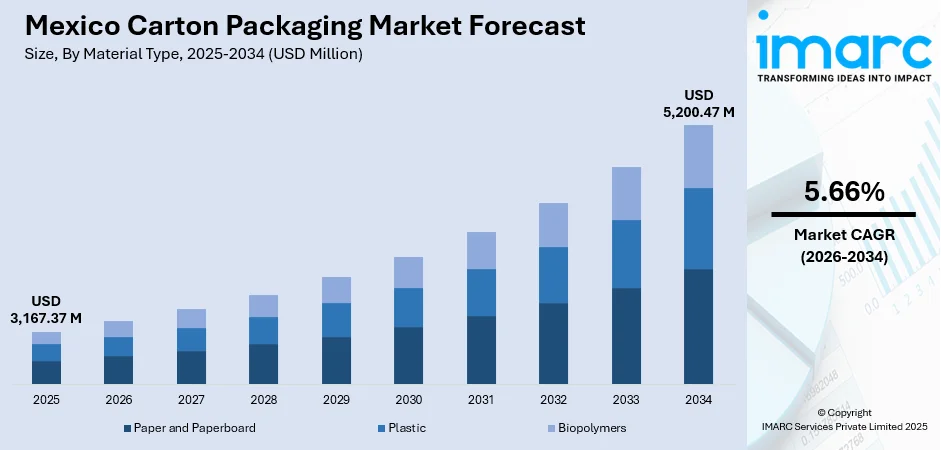

The Mexico carton packaging market size was valued at USD 3,167.37 Million in 2025 and is projected to reach USD 5,200.47 Million by 2034, growing at a compound annual growth rate of 5.66% from 2026-2034.

The Mexico carton packaging market is experiencing robust growth, propelled by escalating demand from diverse end-use industries, particularly the food and beverage (F&B) and healthcare sectors. The heightened consumer awareness about environmental sustainability is supporting the shift towards recyclable and biodegradable packaging materials. Expanding e-commerce activities across the country are generating substantial demand for durable and protective packaging solutions. Government regulations aimed at promoting eco-friendly alternatives and restricting single-use plastics are further strengthening the adoption of paper-based carton packaging.

Key Takeaways and Insights:

- By Material Type: Paper and paperboard dominate the market with a share of 78% in 2025, owing to their superior recyclability, biodegradability, and widespread availability as sustainable alternatives. Growing environmental consciousness among consumers and stringent government regulations against plastic packaging are propelling the preference for paper-based solutions across multiple industries.

- By Product Type: Folding cartons lead the market with a share of 52% in 2025. This dominance is driven by its versatility, cost-effectiveness, and excellent printability for brand customization. Folding cartons offer superior protection while maintaining lightweight characteristics essential for reducing transportation costs and meeting sustainability objectives.

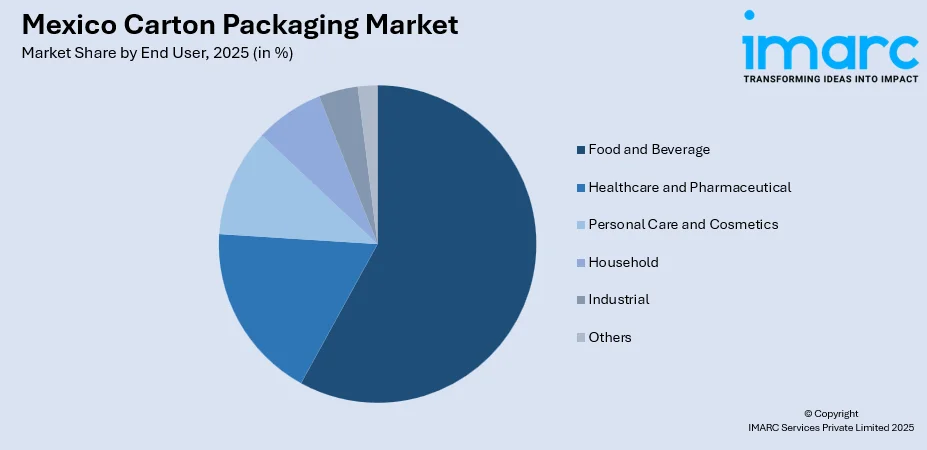

- By End User: Food and beverage represent the largest segment with a market share of 58% in 2025, reflecting the sector's substantial contribution to Mexico's economy and the critical need for safe, hygienic packaging that extends product shelf life while meeting regulatory compliance standards for food contact materials.

- By Region: Northern Mexico comprises the largest region with 38% share in 2025, driven by the concentration of manufacturing facilities, proximity to United States export markets, well-developed logistics infrastructure, and the presence of major industrial clusters in states, including Nuevo León, Chihuahua, and Baja California.

- Key Players: Key players drive the Mexico carton packaging market by investing in sustainable production technologies, expanding manufacturing capacities, and developing innovative packaging solutions. Their strategic focus on recyclable materials, automation, and regional expansion strengthens market penetration and positions them to capitalize on increasing demand from food processing and pharmaceutical sectors.

To get more information on this market Request Sample

The Mexico carton packaging market shows a positive growth outlook, supported by high demand across the food, beverage, pharmaceutical, and personal care industries. Rising preferences for lightweight, sturdy, and economical packaging solutions are encouraging wider adoption of carton formats. Growth in packaged and ready-to-consume food products is driving consistent demand for beverage cartons, liquid food packaging, and shelf-stable solutions. Sustainability awareness is further strengthening market prospects, as cartons are perceived as recyclable and resource-efficient compared to alternative materials. Expanding retail networks and e-commerce activities increase the need for protective and visually appealing packaging. Urbanization and changing consumer lifestyles support higher consumption of packaged goods, reinforcing demand for cartons. As per macrotrends, in Mexico, the urban population was 105,844,290 in 2023. Technological advancements in printing and barrier coatings enhance product safety and branding opportunities. Local manufacturing expansion improves supply reliability and cost efficiency.

Mexico Carton Packaging Market Trends:

Rising Adoption of Sustainable and Recyclable Packaging Materials

The Mexico carton packaging market is witnessing a pronounced shift towards sustainable and recyclable materials, as environmental consciousness permeates consumer purchasing decisions and corporate sustainability initiatives. Paper and paperboard packaging solutions are gaining significant traction as alternatives to conventional plastic packaging, driven by their biodegradability and compatibility with existing recycling infrastructure. Brand owners are increasingly specifying recycled content requirements in procurement contracts, creating substantial demand for packaging manufactured from post-consumer recovered fibers. Tetra Pak established alliances with eighteen recycling allies across Mexico, collectively reprocessing 55 Million Tons of material in 2024, illustrating the expanding circular economy ecosystem supporting sustainable carton packaging.

E-Commerce Expansion Driving Packaging Innovation

The rapid expansion of e-commerce platforms across Mexico is fundamentally reshaping carton packaging requirements. As per IMARC Group, the Mexico e-commerce market size reached USD 54.4 Billion in 2025. This digital commerce transformation is generating heightened demand for durable, protective packaging solutions capable of withstanding extended shipping and handling cycles while maintaining product integrity. Carton packaging manufacturers are responding with innovative designs featuring enhanced cushioning properties, easy-open mechanisms, and compact configurations that optimize dimensional weight for cost-effective logistics. The growth of direct-to-consumer (D2C) shipping models is accelerating investments in customized packaging formats that balance protection requirements with sustainability objectives.

Lightweight Packaging Trend Gaining Momentum

The lightweight packaging trend is gaining substantial momentum across the Mexico carton packaging market as manufacturers seek to reduce material consumption, transportation costs, and carbon emissions throughout supply chains. Advanced manufacturing technologies are enabling the production of thinner yet structurally robust carton packaging that maintains protective performance while utilizing fewer raw materials. This optimization aligns with sustainability objectives by reducing the environmental footprint per packaging unit and decreasing fuel consumption during product distribution. Consumer goods companies are embracing lightweight carton solutions that preserve shelf appeal and functionality while demonstrating corporate commitment to environmental stewardship and resource efficiency.

Market Outlook 2026-2034:

The Mexico carton packaging market outlook remains strongly positive, as multiple growth catalysts converge to drive sustained expansion through the forecast period. Increasing urbanization, rising disposable incomes, and shifting consumption patterns towards packaged convenience products are creating substantial demand across end-use sectors. The market generated a revenue of USD 3,167.37 Million in 2025 and is projected to reach a revenue of USD 5,200.47 Million by 2034, growing at a compound annual growth rate of 5.66% from 2026-2034. Nearshoring trends are attracting multinational manufacturing investments, generating incremental packaging demand from automotive, electronics, and consumer goods sectors. Government initiatives promoting sustainable packaging and restricting single-use plastics are expected to accelerate the transition towards carton-based solutions across multiple industries.

Mexico Carton Packaging Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Material Type | Paper and Paperboard | 78% |

| Product Type | Folding Cartons | 52% |

| End User | Food and Beverage | 58% |

| Region | Northern Mexico | 38% |

Material Type Insights:

- Paper and Paperboard

- Plastic

- Biopolymers

Paper and paperboard dominate with a market share of 78% of the total Mexico carton packaging market in 2025.

Paper and paperboard materials command the dominant position in the Mexico carton packaging market, reflecting strong consumer and corporate preference for recyclable and biodegradable packaging solutions. The material's inherent sustainability credentials, combined with excellent printability and structural versatility, make it the preferred choice across food, beverage, pharmaceutical, and consumer goods applications.

The expanding regulatory framework restricting single-use plastics is accelerating the transition towards paper-based carton packaging across multiple end-use sectors. Leading domestic producers have invested substantially in expanding recycled paperboard manufacturing capacity to meet growing demand from brand owners seeking sustainable packaging alternatives. The material segment benefits from established collection and recycling infrastructure that supports closed-loop material flows and circular economy initiatives. Additionally, cost competitiveness and ease of customization enable paper and paperboard cartons to meet both mass-market and premium packaging requirements, further reinforcing their dominant position in the market.

Product Type Insights:

- Folding Cartons

- Rigid Cartons

- Liquid Cartons

Folding cartons lead with a share of 52% of the total Mexico carton packaging market in 2025.

Folding cartons maintain market leadership owing to their exceptional versatility, cost-effectiveness, and suitability for high-speed automated packaging operations across diverse industries. The product format offers superior brand differentiation opportunities through high-quality printing, embossing, and specialty finishes that enhance shelf appeal and consumer engagement. Food and pharmaceutical manufacturers particularly favor folding cartons for their ability to provide adequate product protection while complying with stringent regulatory requirements for packaging materials in contact with consumable products.

The segment continues expanding as manufacturers invest in advanced converting equipment that enables shorter production runs and faster changeovers to accommodate growing demand for customized packaging solutions. Grupo Gondi operates fourteen converting plants and seven recycled paper machines across Mexico, producing over 1.1 Million tons of paper annually to serve domestic and export markets. Digital printing technology adoption is enabling cost-effective short-run production that serves craft beverage producers and specialty food manufacturers seeking differentiated packaging.

End User Insights:

Access the comprehensive market breakdown Request Sample

- Food and Beverage

- Healthcare and Pharmaceutical

- Personal Care and Cosmetics

- Household

- Industrial

- Others

Food and beverage exhibit a clear dominance with a 58% share of the total Mexico carton packaging market in 2025.

The food and beverage sector drives the majority of carton packaging demand in Mexico, reflecting the industry's substantial economic contribution and critical packaging requirements for product safety and shelf-life extension. Rising consumer preference for convenient, ready-to-eat (RTE) meals and packaged snacks is generating sustained demand for protective carton solutions that maintain product freshness throughout distribution channels.

Major food and beverage companies continue to invest in Mexican manufacturing operations, creating incremental carton packaging demand. Arca Continental, the Coca-Cola system's bottler, revealed intentions to invest 9.35 Billion pesos in Mexico in 2024 to improve its production processes and distribution abilities. The beverage segment particularly drives liquid carton demand for dairy products, juices, and other shelf-stable beverages requiring aseptic packaging solutions that eliminate cold-chain requirements.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico represents the leading segment with a 38% share of the total Mexico carton packaging market in 2025.

Northern Mexico commands the largest regional market share, anchored by its strategic geographic position adjacent to United States markets and well-established manufacturing infrastructure supporting diverse industries. The region encompasses major industrial centers, including Monterrey, Ciudad Juárez, Tijuana, and Chihuahua that host substantial food processing, beverage production, automotive, and electronics manufacturing operations generating significant carton packaging demand.

Strong cross-border trade activities further accelerate packaging demand, as export-oriented manufacturers require high-quality, durable carton solutions compliant with international standards. The presence of advanced logistics networks, industrial parks, and maquiladora operations supports large-scale packaging consumption across supply chains. Rising investments in nearshoring and contract manufacturing continue to attract global brands to Northern Mexico, increasing packaged goods output. Additionally, proximity to raw material suppliers and recycling facilities enhances operational efficiency for carton producers.

Market Dynamics:

Growth Drivers:

Why is the Mexico Carton Packaging Market Growing?

Expansion of Manufacturing and Industrial Activities

Mexico’s expanding manufacturing base significantly drives demand for carton packaging across industrial supply chains. The growth in sectors, such as automotive, electronics, pharmaceuticals, personal care, and household goods, increases the need for reliable secondary and tertiary packaging. Cartons are widely used for product protection, bulk handling, and logistics efficiency during storage and transportation. Nearshoring trends are strengthening domestic production, leading to higher output volumes that require scalable packaging solutions. Manufacturers prefer cartons due to their stackability, strength, and cost efficiency for both domestic distribution and exports. Industrial clients also value cartons for customization, labeling clarity, and branding during transit. As industrial parks and production hubs expand in the country, demand for standardized carton formats rises steadily. In November 2025, Chesisa launched the first of six industrial parks intended for the municipalities of Tultitlan and Tultepec, signaling the beginning of an expansion initiative worth MXD 3.5 Billion and generating over 2,800 new jobs in the State of Mexico. Packaging suppliers benefit from long-term contracts with manufacturers seeking consistent quality and supply reliability. Overall, industrial expansion reinforces sustained demand for carton packaging as an essential component of Mexico’s manufacturing ecosystem.

Growth of E-commerce and Modern Retail Channels

The rapid expansion of e-commerce and organized retail is accelerating carton packaging adoption in Mexico. Online shopping requires durable, lightweight, and protective packaging solutions to ensure products reach consumers safely. Cartons are ideal for shipping due to their cushioning properties and ability to accommodate protective inserts. Growth in D2C brands further supports demand for visually appealing cartons that enhance unboxing experiences. Modern retail formats, including supermarkets and hypermarkets, rely on cartons for shelf-ready packaging that improves stocking efficiency. Cartons enable clear branding, product information display, and promotional messaging, supporting marketing objectives. As digital retail grows across electronics, food, personal care, and household categories, demand for standardized carton sizes increases. The AMVO Online Sales Study indicated that in 2024, there were 67.2 Million Mexicans engaging in online shopping, which accounted for 15.8% of overall retail. Efficient reverse logistics and recyclability also make cartons suitable for e-commerce returns management. This shift toward digital and organized retail channels continues to create consistent packaging demand across Mexico’s evolving retail landscape.

Advancements in Carton Design and Printing Technologies

Technological advancements in carton manufacturing and printing are driving the market growth by improving functionality and visual appeal. Enhanced printing techniques enable high-quality graphics, vibrant colors, and precise branding that attract consumer attention at retail points. Structural innovations allow cartons to offer better strength while using less material, supporting cost efficiency and sustainability goals. Smart packaging features, such as traceability labels, are increasingly integrated into cartons, adding value for brands and consumers. Improved die-cutting and folding technologies enable customized shapes suited for diverse product requirements. Shorter production cycles and digital printing also support small batch runs, benefiting emerging brands. These innovations help carton packaging compete effectively with alternative materials. As packaging becomes both a protective and marketing tool, continuous design and technology improvements strengthen the role of cartons in Mexico’s packaging industry.

Market Restraints:

What Challenges the Mexico Carton Packaging Market is Facing?

Raw Material Price Volatility Affecting Production Costs

Raw material price volatility poses significant challenges for carton packaging manufacturers, as fluctuations in recovered fiber, virgin pulp, and energy costs directly impact production economics and pricing stability. Supply chain disruptions and currency fluctuations exacerbate raw material planning complexities, forcing manufacturers to implement cost pass-through mechanisms that affect customer procurement decisions.

Trade Policy Uncertainty and Tariff Implications

Trade policy uncertainty and changing tariff implications challenge the Mexico carton packaging market by increasing cost volatility for imported paperboard, chemicals, and machinery. Unclear trade rules complicate long-term contracts and investment planning for manufacturers. Export-focused packaging suppliers also face demand instability from key markets, limiting capacity expansion and pressuring profit margins across the value chain.

Infrastructure Limitations in Certain Regions

Infrastructure limitations in certain Mexican regions present challenges for carton packaging distribution and recycling collection that affect market development. Inadequate transportation and storage infrastructure in remote areas can hinder supply chain efficiency and increase logistics costs. The concentration of manufacturing and recycling capabilities in northern and central regions leaves southern markets relatively underserved.

Competitive Landscape:

The Mexico carton packaging market features a competitive landscape, comprising established global players and domestic manufacturers focused on capacity expansion, sustainability innovation, and product differentiation. Leading companies are investing in advanced converting technologies, recycled content capabilities, and digitalization to enhance operational efficiency and meet evolving customer requirements. Strategic mergers and acquisitions are reshaping competitive dynamics as global players seek scale advantages and regional market access. Domestic manufacturers leverage proximity advantages and established customer relationships while expanding capabilities to compete with multinational entrants. Competition intensifies around sustainability credentials as brand owners increasingly specify environmental performance requirements in packaging procurement.

Mexico Carton Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Material Types Covered | Paper and Paperboard, Plastic, Biopolymers |

| Product Types Covered | Folding Cartons, Rigid Cartons, Liquid Cartons |

| End Users Covered | Food and Beverage, Healthcare and Pharmaceutical, Personal Care and Cosmetics, Household, Industrial, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico carton packaging market size was valued at USD 3,167.37 Million in 2025.

The Mexico carton packaging market is expected to grow at a compound annual growth rate of 5.66% from 2026-2034 to reach USD 5,200.47 Million by 2034.

Paper and paperboard dominated the market with a share of 78%, driven by its superior recyclability, biodegradability, and alignment with sustainability regulations restricting single-use plastics across multiple Mexican states.

Key factors driving the Mexico carton packaging market include expanding F&B industry demand, government regulations promoting sustainable packaging alternatives, e-commerce expansion creating new packaging requirements, and nearshoring trends attracting manufacturing investments.

Major challenges include raw material price volatility affecting production costs, trade policy uncertainty and potential tariff implications on imported materials, infrastructure limitations in certain regions, and supply chain disruptions impacting material availability.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)