Mexico Casein Market Size, Share, Trends and Forecast by Product Type, End Use, and Region, 2026-2034

Mexico Casein Market Summary:

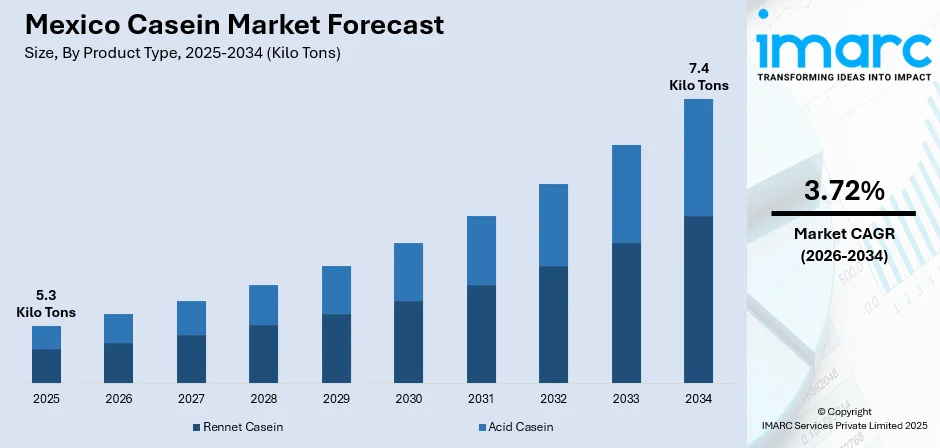

The Mexico casein market size reached 5.3 Kilo Tons in 2025 and is projected to reach 7.4 Kilo Tons by 2034, growing at a compound annual growth rate of 3.72% from 2026-2034.

The Mexican casein market is experiencing sustained expansion, driven by increasing consumer demand for high-protein functional foods and the robust growth of the food processing sector. Rising health consciousness among the population is accelerating the adoption of casein-based nutritional products, while the dairy industry continues to integrate casein as a key ingredient in cheese production, bakery items, and dietary supplements. Industrial applications further strengthen demand, as manufacturers increasingly utilize casein in sustainable adhesive formulations and textile coatings, contributing to the growing Mexico casein market share.

Key Takeaways and Insights:

-

By Product Type: Rennet casein dominates the market with a share of 62% in 2025, owing to its essential role in cheese manufacturing, superior texturizing properties, and widespread application in processed dairy products. The growing domestic cheese consumption continues to fuel segment expansion.

-

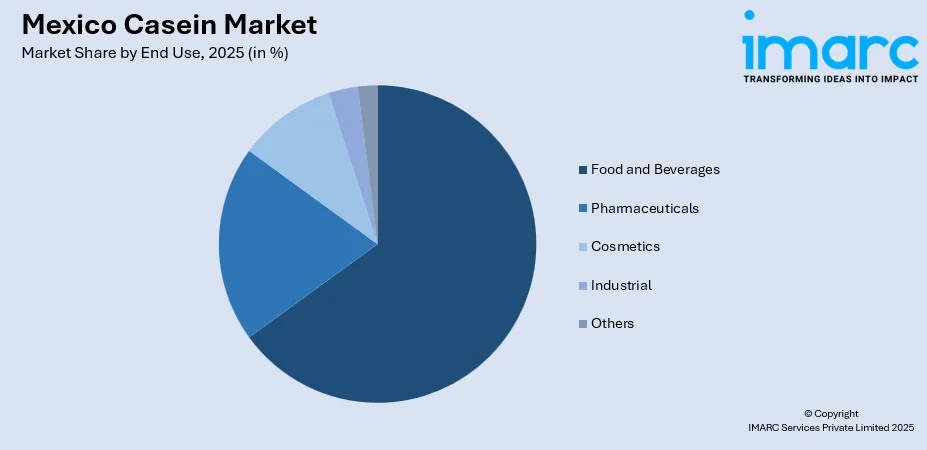

By End Use: Food and beverages lead the market with a share of 65% in 2025. This dominance is driven by the functional properties of casein, including emulsification, water-binding capabilities, and texture enhancement, in dairy drinks, bakery products, and nutritional supplements.

-

Key Players: Key players drive the Mexico casein market by expanding processing capabilities, strengthening distribution networks, and investing in product innovations. Their focus on quality enhancement, sustainable sourcing practices, and strategic partnerships with food manufacturers boosts market penetration and ensures consistent supply across diverse application segments.

To get more information on this market Request Sample

The Mexican casein market demonstrates strong growth potential supported by favorable demographic trends and evolving consumer preferences. The country's expanding middle-class population increasingly prioritizes protein-rich dietary options, driving the demand for casein-fortified products across retail and foodservice channels. The Mexico fitness supplements market, valued at USD 277.44 Million in 2024, reflects the broader health and wellness movement propelling casein consumption. The integration of casein into sports nutrition formulations, weight management products, and clinical nutrition solutions further diversifies application opportunities. Additionally, government initiatives aimed at promoting domestic dairy production and the modernization of dairy processing infrastructure create favorable conditions for sustained market development throughout the forecast period. Rising demand for ready-to-consume nutrition products further strengthens market momentum. The growing awareness about sustained-release protein benefits positions casein as a preferred ingredient for long-term nutritional support.

Mexico Casein Market Trends:

Rising Demand for Protein-Enriched Functional Foods

Mexican consumers are increasingly gravitating towards protein-fortified food and beverage (F&B) products, as health awareness intensifies across demographic segments. In May 2025, Alpura, a dairy firm based in Mexico, revealed a forthcoming investment of MXD10 Billion (USD 517 Million) over the next five years. The company planned to devote funding to creating new technology, pioneering packaging, protein-fortified products, and vitamin development, along with upgrading current machinery. Casein's slow-release amino acid profile makes it particularly attractive for night-time recovery formulations and sustained energy products.

Growing Adoption of Sustainable Industrial Applications

Environmental consciousness is driving increased utilization of casein in biodegradable adhesive formulations and sustainable coating solutions across Mexican industries. Manufacturers are transitioning from synthetic polymers to casein-based alternatives in response to regulatory pressures and consumer preferences for eco-friendly products. The thriving textile industry employs casein-based coatings for fabric finishing applications, while the industrial packaging sector explores casein's potential in biodegradable film development. As per IMARC Group, the Mexico industrial packaging market size reached USD 768.0 Million in 2024. These industrial diversifications strengthen market resilience and create new revenue streams beyond traditional food applications.

Expansion of Clean-Label Dairy Ingredients

Consumer preference for natural, minimally processed ingredients is accelerating the demand for clean-label casein products throughout the Mexican market. Food manufacturers are reformulating products to eliminate artificial additives while maintaining functional properties through casein incorporation. This trend aligns with broader transparency movements, as consumers scrutinize ingredient lists and seek recognizable, wholesome components. Premium positioning opportunities emerge for manufacturers offering traceable, high-quality casein derived from sustainable dairy operations meeting rigorous quality certifications.

Market Outlook 2026-2034:

The Mexico casein market outlook remains optimistic, as structural growth drivers continue to strengthen throughout the forecast period. Expanding food processing capacity, rising disposable incomes, and intensifying health consciousness will sustain demand across application segments. The market size was estimated at of 5.3 Kilo Tons in 2025 and is expected to reach 7.4 Kilo Tons by 2034, reflecting a compound annual growth rate of 3.72% over the forecast period 2026-2034. Strategic investments by major dairy companies in production infrastructure and distribution networks will enhance market accessibility while innovations in functional applications create differentiation opportunities.

Mexico Casein Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Rennet Casein | 62% |

| End Use | Food and Beverages | 65% |

Product Type Insights:

- Rennet Casein

- Acid Casein

Rennet casein dominates with a market share of 62% of the total Mexico casein market in 2025.

Rennet casein maintains market leadership owing to its indispensable role in cheese manufacturing processes across Mexico's expanding dairy sector. The ingredient provides essential texturizing capabilities that influence cheese structure, flavor development, and meltability characteristics. The Mexico cheese market, valued at USD 1.4 Billion in 2024, creates substantial demand for rennet casein as domestic production facilities scale operations to meet growing consumer preferences for diverse cheese varieties, including queso fresco, oaxaca, and manchego.

Beyond traditional cheese applications, rennet casein finds extensive utilization in processed cheese products, cheese spreads, and dairy-based sauces where its emulsifying properties ensure consistent texture and extended shelf stability. The ingredient's calcium-bonded micellar structure delivers superior functional performance compared to alternative protein sources, reinforcing its position across premium food formulations. Manufacturers continue to innovat with rennet casein to develop novel cheese varieties and value-added dairy products targeting evolving consumer taste preferences.

End Use Insights:

Access the comprehensive market breakdown Request Sample

- Food and Beverages

- Pharmaceuticals

- Cosmetics

- Industrial

- Others

Food and beverages lead with a share of 65% of the total Mexico casein market in 2025.

The food and beverages segment commands market leadership driven by casein's multifunctional properties essential for modern food processing operations. Mexican food manufacturers increasingly incorporate casein in bakery products, dairy beverages, nutritional bars, and infant formula formulations where protein enrichment and textural enhancement are paramount.

Casein's slow digestion characteristics make it particularly valuable for sustained-release nutritional products targeting health-conscious consumers and athletes seeking prolonged protein delivery. The ingredient's neutral flavor profile enables seamless integration across diverse food matrices without compromising taste characteristics. Growing urbanization and busy lifestyles are fueling the demand for convenient protein-fortified ready-to-eat (RTE) products where casein provides both nutritional value and functional benefits, including improved mouthfeel and stability, during processing and storage. As per macrotrends, the urban population in 2023 stood at 105,844,290 in Mexico.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico represents a significant consumption hub for casein products, owing to the concentration of major dairy processing facilities and proximity to export markets. States, including Durango, Chihuahua, and Coahuila, host large-scale dairy operations that integrate casein into cheese manufacturing and dairy beverage production. The region benefits from established cold-chain infrastructure enabling efficient distribution of casein-based products across domestic and cross-border markets.

Central Mexico, anchored by Mexico City and surrounding metropolitan areas, drives substantial casein demand through concentrated food manufacturing activities and dense consumer populations. The region's robust retail and foodservice sectors create diverse application opportunities for casein-containing products, ranging from artisanal cheeses to functional beverages.

Southern Mexico holds prominence in the market due to strong dairy farming activities, favorable climatic conditions, and the presence of milk-processing clusters. The region supports steady raw milk availability, enabling consistent casein production. Growing local demand from food manufacturers, nutrition brands, and broadening distribution networks further fuel the market expansion in the region.

Market Dynamics:

Growth Drivers:

Why is the Mexico Casein Market Growing?

Rising Demand for Protein-Rich Diets

Growing awareness around nutrition and balanced diets is a major driver of the Mexico casein market expansion. Consumers across urban and semi-urban regions are increasingly focusing on protein intake to support muscle health, weight management, and overall wellness. Casein, being a slow-digesting milk protein, fits well into daily diets, especially for sustained energy and satiety. This trend is visible among fitness enthusiasts, working professionals, and aging population seeking long-lasting nutritional benefits. According to Trading Economics, the count of employed individuals in Mexico rose to 59533449 in the third quarter of 2025, up from 59440760 in the second quarter of 2025. As dietary habits shift away from carbohydrate-heavy meals toward protein-enriched foods, manufacturers are incorporating casein into dairy products, nutritional powders, and functional foods. The growing influence of global health trends and social media nutrition awareness is further reinforcing protein consumption. As a result, steady demand for casein continues to rise across both retail and institutional food segments in Mexico.

Expansion of the Sports Nutrition Industry

The expanding sports and fitness culture in Mexico is strongly supporting the growth of the casein market. Gyms, fitness centers, and organized sports activities are gaining popularity, especially among younger consumers. Casein is widely used in sports nutrition products due to its slow-release amino acid profile, making it ideal for overnight muscle recovery. This has increased its use in protein powders, meal replacements, and recovery supplements. Local and international brands are actively promoting casein-based products tailored to fitness goals such as muscle building and endurance. Additionally, rising participation in amateur sports and recreational fitness has widened the consumer base beyond professional athletes. As disposable incomes are growing, consumers are more willing to invest in premium nutrition products, creating favorable conditions for long-term casein market growth in Mexico.

Growth of the Dairy Processing Industry

Mexico’s well-established dairy industry plays a crucial role in driving the casein market growth. Increasing milk production and improvements in dairy processing infrastructure are enabling higher extraction and utilization of milk proteins. A report from the USDA Global Agricultural Information Network indicates that Mexico's milk production is projected to increase by 1% in 2025 relative to 2024. Casein is widely used in cheese production, dairy-based beverages, and processed foods, making it an important value-added ingredient. As dairy processors focus on maximizing returns from raw milk, casein extraction offers an efficient way to enhance profitability. Technological advancements in dairy processing have also improved product quality and consistency, supporting broader application of casein across food and industrial sectors. Additionally, the growing presence of multinational dairy companies in Mexico is accelerating the adoption of standardized ingredients like casein. This ongoing expansion of dairy processing capacity continues to create stable and sustained demand for casein within the country.

Market Restraints:

What Challenges the Mexico Casein Market is Facing?

Competition from Plant-Based Protein Alternatives

Rising consumer interest in plant-based diets presents competitive pressure on dairy-derived proteins, including casein. Manufacturers of pea, soy, and rice protein products actively target health-conscious consumers with marketing emphasizing environmental sustainability and allergen-free formulations. This trend particularly impacts segments where casein traditionally commanded premium positioning.

Import Dependency and Supply Chain Vulnerabilities

Mexico relies significantly on casein imports from major producing nations, including Ireland and New Zealand, to satisfy domestic demand. Currency fluctuations, trade policy changes, and global supply disruptions introduce pricing volatility that impacts manufacturer margins and end-product affordability. Strengthening domestic production capabilities remains a priority for reducing external dependencies.

Raw Material Price Volatility

Casein production costs remain sensitive to milk price fluctuations influenced by feed costs, weather conditions, and global dairy market dynamics. Periodic price spikes challenge manufacturers maintaining stable product pricing while preserving profitability. Small and medium enterprises (SMEs) face particular difficulties absorbing cost increases without passing them to price-sensitive consumer segments.

Competitive Landscape:

The Mexico casein market exhibits a moderately consolidated competitive structure, characterized by the presence of established domestic dairy processors and international ingredient suppliers. Leading companies compete through product quality differentiation, technical support services, and strategic distribution partnerships with food manufacturers. Market participants are investing in research and development (R&D) activities to introduce functional casein variants meeting evolving application requirements. Vertical integration strategies strengthen supply chain control while geographic expansion initiatives target underserved regional markets. Sustainability certifications and traceability programs increasingly influence procurement decisions, as food manufacturers prioritize responsible sourcing practices.

Mexico Casein Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Kilo Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Rennet Casein, Acid Casein |

| End Uses Covered | Food and Beverages, Pharmaceuticals, Cosmetics, Industrial, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico casein market size reached 5.3 Kilo Tons in 2025.

The Mexico casein market is expected to grow at a compound annual growth rate of 3.72% from 2026-2034 to reach 7.4 Kilo Tons by 2034.

Rennet casein dominated the market with a share of 62%, driven by its crucial function in cheese production methods, excellent texturizing properties, and extensive use in processed dairy items throughout Mexico.

Key factors driving the Mexico casein market include expanding F&B processing industry with growing cheese production, rising health consciousness and demand for protein-enriched functional food items, industrial diversification into sustainable adhesives and biodegradable applications, and the growing sports nutrition and dietary supplement sector.

Major challenges include competition from plant-based protein alternatives gaining consumer preference, import dependency on major producing nations creating supply chain vulnerabilities, raw material price volatility affecting production costs, and regulatory compliance requirements for food-grade applications.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)