Mexico Casting and Forging Market Size, Share, Trends and Forecast by Component Type, Material Type, Manufacturing Process, Sales Channel, and Region, 2026-2034

Mexico Casting and Forging Market Summary:

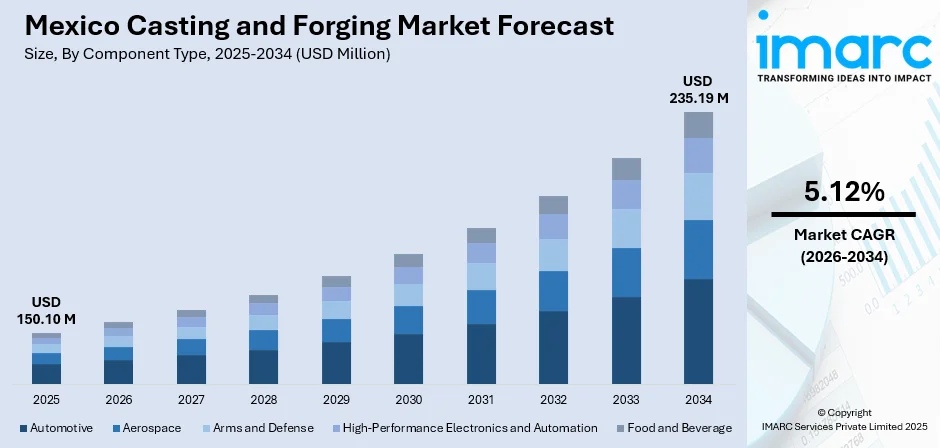

The Mexico casting and forging market size was valued at USD 150.10 Million in 2025 and is projected to reach USD 235.19 Million by 2034, growing at a compound annual growth rate of 5.12% from 2026-2034.

The market expansion is propelled by robust automotive manufacturing growth, strategic nearshoring advantages, and accelerating electromobility adoption throughout Mexico. The automotive sector's transition toward lightweight electric vehicle (EV) components drives substantial demand for precision-cast aluminum alloy parts and high-strength forged elements. Northern Mexico's concentrated automotive manufacturing infrastructure, combined with favorable trade agreements and proximity to North American markets, positions the region as a critical supplier of casting and forging components. The integration of advanced manufacturing technologies and automation solutions enhances production efficiency while addressing sustainability requirements, thereby expanding the Mexico casting and forging market share.

Key Takeaways and Insights:

-

By Component Type: Automotive dominates the market with a share of 58% in 2025, driven by lightweight material requirements and high-volume production efficiency.

-

By Material Type: Aluminum alloy 6xxx series lead the market with a share of 36% in 2025, owing to superior strength-to-weight ratios and corrosion resistance properties.

-

By Manufacturing Process: Casting process represents the largest segment with a market share of 54% in 2025, supported by the heightened implementation of technological advancements in die-casting methodologies.

-

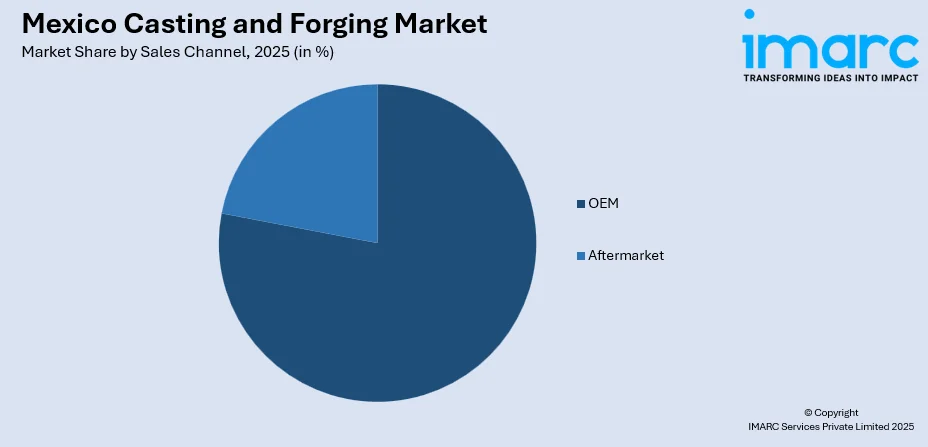

By Sales Channel: OEM leads the market with a share of 78% in 2025, reflecting direct supply relationships with major automotive manufacturers and providing high quality parts.

-

By Region: Northern Mexico represents the largest segment with a market share of 45% in 2025, driven by concentrated automotive production facilities and established industrial clusters.

-

Key Players: The Mexico casting and forging market exhibits moderate competitive intensity, with multinational manufacturers competing alongside regional suppliers across automotive and industrial segments. Major players are also collaborating with international brands to expand their product portfolio and provide high-quality items to customers.

To get more information on this market Request Sample

Mexico has emerged as a strategic manufacturing hub for casting and forging operations, benefiting from skilled workforce availability and competitive operational costs. The automotive industry's electrification accelerates demand for lightweight aluminum castings and precision-forged components essential for electric vehicle platforms. In 2024, Ryobi Die Casting invested $50 million to expand its aluminum diecasting plant in Irapuato, Mexico, adding five large high-pressure diecasting machines to meet future electric vehicle component demand. The expansion is expected to be completed by April 2025, adding 91,500 square feet of space and creating 124 new jobs. Mexico's proximity to United States automotive markets, combined with favorable United States-Mexico-Canada Agreement provisions, strengthens the country's position as a preferred sourcing destination for casting and forging components. The establishment of automotive clusters in Nuevo León, Coahuila, and the Bajío region creates synergies among manufacturers, supporting innovation and operational efficiency improvements.

Mexico Casting and Forging Market Trends:

EV Transition Driving Lightweight Component Demand

Mexico's automotive sector undergoes substantial transformation as manufacturers transition toward electric vehicle production platforms, fundamentally reshaping casting and forging requirements. Data from the Electro Movilidad Asociación (EMA), founded in March 2024 with the ambitious targets of achieving 50% EV sales by 2030 and 100% by 2035, shows that the figures for early 2025 are remarkably encouraging. EVs demand significantly fewer forged parts compared to traditional internal combustion engines, approximately 100 components versus over 2000, while simultaneously requiring advanced lightweight aluminum castings for battery housings, structural reinforcements, and thermal management systems. This transition compels manufacturers to develop specialized capabilities in high-pressure die casting and vacuum casting processes that produce complex geometries with minimal porosity. The shift toward electromobility drives innovation in aluminum alloy formulations, particularly 6xxx series alloys that offer optimal combinations of formability, strength, and thermal conductivity essential for electric vehicle applications.

Advanced Manufacturing Technology Integration

Mexico's casting and forging industry embraces digital transformation through adoption of simulation software, automation systems, and Industry 4.0 technologies that enhance production precision and operational efficiency. Manufacturers implement advanced molding lines equipped with real-time monitoring capabilities, predictive maintenance algorithms, and quality control systems that reduce defect rates while optimizing energy consumption. The integration of artificial intelligence-driven process optimization enables manufacturers to achieve tighter tolerances and superior surface finishes critical for high-performance automotive and aerospace applications. In 2025, MAGMA Foundry Technologies Inc. announced the opening of their new office in San Pedro Garza García, Mexico, offering local technical support, tailored software solutions, and training through MAGMAacademy to enhance operational efficiency and production processes throughout Mexico's metal casting industry. These technological advancements support manufacturers in meeting increasingly stringent quality requirements while maintaining cost competitiveness in global markets.

Nearshoring Momentum Strengthening Regional Clusters

Mexico's strategic geographic position and robust trade relationships drive accelerated nearshoring investment as North American manufacturers seek to enhance supply chain resilience and reduce transportation costs. The concentration of automotive original equipment manufacturers and tier-one suppliers in northern Mexican states creates powerful industrial clusters that attract complementary casting and forging operations. These regional ecosystems benefit from shared technical expertise, logistics infrastructure, and supplier networks that lower barriers to market entry and support rapid production scaling. In 2024, Savelli Technologies secured a €78 million order, which includes installations in Mexico for MAT Foundry and Brembo, deploying advanced high-performance molding lines and sand preparation systems that strengthen the company's leadership position in serving multinational automotive clients. The nearshoring trend extends beyond automotive applications into aerospace and industrial equipment manufacturing, diversifying demand sources and supporting sustainable market growth across multiple end-use segments.

Market Outlook 2026-2034:

The Mexico casting and forging market demonstrates strong growth potential driven by expanding automotive production, accelerating electrification trends, and continued nearshoring investment throughout the forecast period. The market generated a revenue of USD 150.10 Million in 2025 and is projected to reach a revenue of USD 235.19 Million by 2034, growing at a compound annual growth rate of 5.12% from 2026-2034. Original equipment manufacturers (OEMs) increasingly prioritize supply chain localization strategies that favor Mexican manufacturing capabilities, particularly for aluminum die-cast components and precision-forged parts essential for next-generation vehicle platforms.

Mexico Casting and Forging Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Component Type | Automotive | 58% |

| Material Type | Aluminum Alloy 6xxx Series | 36% |

| Manufacturing Process | Casting Process | 54% |

| Sales Channel | OEM | 78% |

| Region | Northern Mexico | 45% |

Component Type Insights:

- Automotive

- Engine Components

- Transmission Components

- Structural Components

- Suspension Components

- Exhaust System Components

- Powertrain Components

- Interior Components

- Exterior Components

- Others

- Aerospace

- Safety Critical Structural Parts

- Non-Safety Critical Parts

- Arms and Defense

- Mobility

- Arms and Gear

- High-Performance Electronics and Automation

- Heat Management

- Electronic-Housings

- Automation Structural Parts

- Food and Beverage

- Structural Components

- Functional Components

Automotive dominates with a market share of 58% of the total Mexico casting and forging market in 2025.

The automotive segment maintains dominant market position reflecting Mexico's status as the world's seventh-largest passenger vehicle manufacturer, producing 3.5 million automobiles annually with 88% destined for export markets. Casting and forging operations supply critical components including engine blocks, transmission housings, suspension elements, and structural reinforcements that require exceptional strength-to-weight ratios and dimensional precision. The pressure die casting segment’s growth is driven by cost-effectiveness for high-volume production and capability to produce complex geometries with tight tolerances essential for modern vehicle architectures. Major automotive manufacturers operate extensive production facilities throughout Mexico, creating sustained demand for locally sourced casting and forging components that support just-in-time manufacturing strategies.

The automotive sector's electrification trajectory fundamentally reshapes component requirements as manufacturers transition from internal combustion powertrains to battery-electric platforms. Electric vehicles demand specialized aluminum castings for battery enclosures, thermal management systems, and structural elements that must withstand significant mechanical stresses while minimizing weight to maximize driving range. The engine parts segment experiences particularly robust growth, driven by demand for lightweight, high-performance components such as cylinder heads, transmission cases, and various housings requiring exceptional dimensional accuracy and thermal conductivity. Mexico's advanced manufacturing capabilities, strategic geographic position, and presence of leading automakers and tier-one suppliers support establishment of dedicated facilities for high-precision aluminum die-cast automotive engine components production throughout northern and central regions.

Material Type Insights:

- Aluminum Alloy 2xxx Series

- Aluminum Alloy 3xxx Series

- Aluminum Alloy 5xxx Series

- Aluminum Alloy 6xxx Series

- Aluminum Alloy 7xxx Series

Aluminum alloy 6xxx series leads with a share of 36% of the total Mexico casting and forging market in 2025.

Aluminum alloy 6xxx series maintains substantial market share reflecting superior properties that align with automotive industry requirements for lightweight, high-strength structural components and body panels. These medium-strength alloys, primarily composed of magnesium and silicon, offer excellent formability, weldability, and corrosion resistance characteristics essential for automotive body-in-white structures, closure systems, and safety-critical components. The alloy series' natural aging capabilities and precipitation hardening response enable manufacturers to achieve desired mechanical properties through controlled heat treatment processes, supporting production of components that meet stringent performance specifications.

The body assemblies segment constitutes the largest application area for aluminum die casting, attributed to aluminum's lightweight properties and design flexibility for body-in-white structural components and closure trims. Common die-cast aluminum body assembly components include bumper beams, door intrusion beams, shock towers, body reinforcements, and structural nodes that contribute substantially to vehicle weight reduction efforts. The segment's strength benefits from Mexico's skilled technical workforce and competitive labor costs that attract major international players and domestic companies investing in state-of-the-art die casting facilities equipped with advanced equipment and automated production processes. The automotive industry's continuous push for lightweight solutions to improve fuel efficiency and reduce emissions sustains robust demand for aluminum alloy castings throughout the forecast period.

Manufacturing Process Insights:

- Casting Process

- Sand Casting

- Die Casting

- High Pressure Die Casting

- Others

- Forging Process

- Open Die Forging

- Closed Die Forging

- Upset Forging

- Precision Forging

- Rheocasting Process

- Others

Casting process exhibits a clear dominance with a 54% share of the total Mexico casting and forging market in 2025.

The casting process segment maintains market leadership reflecting versatility in producing complex geometries, cost-effectiveness for high-volume production, and continuous technological advancements that enhance component quality and manufacturing efficiency. High-pressure die casting technology represents the predominant manufacturing method, enabling production of intricate automotive and industrial components with exceptional dimensional accuracy and superior surface finishes. The process involves injecting molten metal under significant pressure into precision-engineered steel dies, creating components with thin walls, complex internal features, and minimal post-processing requirements that reduce overall production costs. In 2024, GIFA Mexico FUNDIEXPO 2024, held at Centro Citibanamex in Mexico City, attracted key industry players as a major trade fair for the foundry industry, showcasing advancements in metal casting technologies and reinforcing Mexico's pivotal role in die-casting technology and aluminum casting applications.

The majority of metal die-casting production in Mexico consists of aluminum, gray iron, and ductile iron, with the automotive sector accounting for more than half of total output at approximately 63%. Manufacturers invest in advanced molding equipment, sand preparation systems, and automated material handling solutions that enhance production throughput while maintaining consistent quality standards. The vacuum die casting segment projects the fastest growth rate, attributed to superior ability to produce high-quality, complex parts with minimal porosity, making it increasingly popular for manufacturing critical automotive casting components. The technology's capability to enhance mechanical properties of cast components while reducing defects proves particularly attractive for producing safety-critical parts and high-performance components essential for electric vehicle applications, coupled with growing emphasis on quality and reliability in automotive manufacturing.

Sales Channel Insights:

Access the comprehensive market breakdown Request Sample

- OEM

- Aftermarket

OEM leads with a share of 78% of the total Mexico casting and forging market in 2025.

The OEM sales channel maintains dominant market position reflecting established supply relationships between casting and forging manufacturers and major automotive original equipment manufacturers operating production facilities throughout Mexico. Original equipment manufacturers prioritize supply chain integration strategies that ensure consistent component quality, delivery reliability, and technical collaboration essential for new vehicle platform development. Casting and forging suppliers establish dedicated production lines, implement manufacturer-specific quality control protocols, and maintain proximity to assembly facilities that support just-in-time manufacturing operations and minimize logistics costs. Major automotive manufacturers increasingly adopt pressure die casting technology due to capability to deliver consistent quality while maintaining high production rates and lower per-unit costs, essential factors in meeting growing demand for automotive metal parts throughout the region.

Mexico's automotive production landscape encompasses established presence of various well-known international players and emerging EV manufacturers, creating diverse opportunities for casting and forging suppliers. The concentration of automotive assembly plants in northern states including Baja California, Sonora, Chihuahua, Coahuila, Nuevo León, and San Luis Potosí, along with central region facilities in Guanajuato, Aguascalientes, Jalisco, and Puebla, drives substantial demand for locally manufactured components. Supply chain localization requirements under United States-Mexico-Canada Agreement provisions strengthen OEM direct sourcing strategies, supporting continued growth in original equipment sales channel throughout the forecast period as manufacturers seek to optimize regional content compliance and enhance supply chain resilience.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico exhibits a clear dominance with a 45% share of the total Mexico casting and forging market in 2025.

Northern Mexico maintains dominant regional market position reflecting concentration of automotive manufacturing facilities, established industrial infrastructure, and strategic proximity to United States market that facilitates efficient cross-border logistics and trade. The region encompasses key manufacturing states including Baja California, Sonora, Chihuahua, Coahuila, Nuevo León, and San Luis Potosí, where automotive manufacturers are primarily concentrated and original equipment manufacturer plants operate extensive assembly operations. Coahuila secured second place nationally with $15.8 billion in manufacturing exports representing 11.8% of national total in Q1 2025, driven primarily by automotive production and metal-mechanic industry activities.

The automotive sector represents more than half of northern border states' manufacturing production, with Coahuila contributing a major part of total national auto parts production, establishing the area as the country's primary automotive manufacturing corridor. Nuevo León serves as Mexico's electromobility hub, hosting Kia assembly operations, numerous tier-one suppliers, and emerging electric vehicle component manufacturers that drive demand for advanced casting and forging capabilities. The state's automotive industry represents the top employer and leading export sector, with automotive exports rising. The northern region benefits from established automotive clusters, skilled technical workforce, competitive operational costs, and well-developed transportation infrastructure that supports sustained market growth throughout the forecast period.

Market Dynamics:

Growth Drivers:

Why is the Mexico Casting and Forging Market Growing?

Robust Automotive Manufacturing Expansion

Mexico's automotive industry experiences sustained growth trajectory, establishing the country as the world's seventh-largest passenger vehicle manufacturer and creating substantial demand for casting and forging components. The automotive sector comprises 3.6% of Mexico's Gross Domestic Product, 18% of manufacturing GDP, and employs over one million people nationwide, demonstrating the industry's fundamental importance to national economic development. The automotive sector represents more than half of Coahuila's manufacturing production, while Northern Mexico accounts for a major portion of the country's total auto parts production. Mexico's strategic position as a major automotive exporter, with 88% of vehicles produced destined for international markets and 76% specifically for United States consumption, sustains robust demand for high-quality casting and forging components that meet stringent original equipment manufacturer specifications across diverse vehicle platforms and manufacturing requirements.

Availability of Skilled Labor and Established Metallurgical Know-How

Mexico has a long operating history in metal casting and forging, supported by vocational training institutes, engineering programs, and on-the-job skill development within industrial clusters. The labor force participation rate in Mexico was 65.4% in Q1 2025, as per the OECD Employment Outlook 2025. Foundries and forging shops benefit from technicians experienced in mold design, heat treatment, metallurgy control, and quality testing. This workforce base lowers ramp-up risks for new projects and supports consistent output for high-volume as well as custom components. Over time, many suppliers have upgraded from basic ferrous castings to more complex ductile iron, steel, and aluminum products, along with precision forgings for safety-critical uses. Knowledge transfer from global OEMs and Tier 1 suppliers has also raised process discipline and quality systems across the industry. As manufacturers seek reliable regional partners rather than low-cost, low-visibility suppliers, Mexico’s technical depth and production experience strengthen its appeal as a long-term casting and forging location.

Infrastructure and Industrial Cluster Development

Mexico's government and private sector investments in manufacturing infrastructure, technical education, and industrial cluster development strengthen the country's competitive position for casting and forging operations serving automotive, aerospace, and industrial equipment sectors. The establishment of automotive clusters creates synergies among original equipment manufacturers, tier-one suppliers, and specialized component producers that enhance innovation capabilities, reduce logistics costs, and support rapid technology adoption. In 2024, Brakes India announced $70 million investment to build its first foundry plant in Aguascalientes, marking significant expansion in the global automotive market with project development in two phases and completion expected by January 2026, creating new employment opportunities while boosting regional economic growth.

Market Restraints:

What Challenges the Mexico Casting and Forging Market is Facing?

Raw Material Price Volatility

Fluctuations in aluminum, steel, and other metal prices significantly impact production costs and profitability for manufacturers operating within Mexico's casting and forging industry. These price variations create challenges for maintaining stable pricing strategies and predictable profit margins, particularly affecting manufacturers serving automotive original equipment manufacturers operating under long-term supply contracts with fixed pricing provisions. The volatility in raw material costs stems from global supply-demand dynamics, geopolitical tensions affecting trade flows, and changes in environmental regulations influencing mining and refining operations. Manufacturers must implement sophisticated hedging strategies, maintain strategic material inventories, and develop flexible pricing mechanisms that balance customer relationships with operational sustainability requirements.

Stringent Environmental Compliance Requirements

Compliance with stringent emissions and waste management regulations adds substantial complexity and operational costs to casting and forging operations throughout Mexico. Manufacturers must adhere to both local and international environmental standards, including proper handling of hazardous waste materials, air pollution controls, water discharge management, and energy consumption optimization. The regulatory framework requires significant investment in pollution control equipment, waste treatment systems, and environmental monitoring technologies that increase capital requirements and ongoing operational expenses. Foundry operations face particular scrutiny regarding particulate emissions, volatile organic compound releases, and proper disposal of sand casting residues, necessitating implementation of advanced filtration systems, enclosed production areas, and comprehensive waste recycling programs that maintain compliance while managing cost implications.

Skilled Labor Shortage and Technology Gaps

Operating advanced casting and forging technologies requires specialized technical expertise and skilled professionals capable of managing sophisticated manufacturing equipment, quality control systems, and process optimization protocols. The shortage of qualified workers presents challenges for sustained growth and competitiveness within Mexico's casting and forging market, particularly as manufacturers adopt automation solutions, digital manufacturing systems, and advanced material processing technologies. Technical education infrastructure struggles to keep pace with rapidly evolving manufacturing requirements, creating mismatches between workforce capabilities and industry needs. Manufacturers must invest substantially in employee training programs, technical certification initiatives, and knowledge transfer systems that develop internal expertise while competing for limited pools of qualified technical personnel across automotive and industrial manufacturing sectors.

Competitive Landscape:

The Mexico casting and forging market demonstrates moderate competitive intensity characterized by presence of multinational corporations operating alongside specialized regional manufacturers across automotive, aerospace, and industrial equipment supply chains. Major international players maintain significant market positions through established relationships with original equipment manufacturers, advanced manufacturing capabilities, and strategic facility locations near major automotive assembly operations. These industry leaders invest continuously in automation technologies, process innovation, and capacity expansion initiatives that strengthen competitive advantages and enable service of demanding automotive applications requiring exceptional quality and delivery performance. Regional manufacturers complement multinational operations by providing specialized capabilities in custom forgings, small-batch production, and niche applications serving diverse industrial segments. The competitive landscape emphasizes technical expertise, quality certifications, supply chain integration, and responsive customer service as key differentiators supporting long-term business relationships and market position sustainability across evolving automotive and industrial requirements.

Mexico Casting and Forging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Component Types Covered |

|

| Material Types Covered | Aluminium Alloy 2xxx Series, Aluminium Alloy 3xxx Series, Aluminium Alloy 5xxx Series, Aluminium Alloy 6xxx Series, Aluminium Alloy 7xxx Series |

| Manufacturing Processes Covered |

|

| Sales Channels Covered | OEM, Aftermarket |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico casting and forging market size was valued at USD 150.10 Million in 2025.

The Mexico casting and forging market is expected to grow at a compound annual growth rate of 5.12% from 2026-2034 to reach USD 235.19 Million by 2034.

Automotive components dominated the market with 58% share, driven by Mexico's position as a major global vehicle manufacturing hub and the concentration of original equipment manufacturers requiring precision-cast and forged components for diverse vehicle platforms including electric vehicle applications.

Key factors driving the Mexico casting and forging market include robust automotive manufacturing expansion with production exceeding annually, strategic nearshoring advantages attracting foreign direct investment, accelerating electromobility adoption creating demand for lightweight aluminum castings, established industrial clusters in northern and central regions providing infrastructure support, and growing aerospace sector requirements for high-performance components serving critical aircraft applications.

Major challenges include raw material price volatility affecting production costs and profitability margins, stringent environmental compliance requirements demanding investment in pollution control and waste management systems, skilled labor shortages limiting advanced manufacturing technology adoption, intense competition from global manufacturing locations, and evolving automotive industry requirements necessitating continuous innovation in casting and forging capabilities across materials, processes, and quality standards.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)