Mexico Catalyst Market Size, Share, Trends and Forecast by Type, Process, Raw Material, Application, and Region, 2025-2033

Mexico Catalyst Market Overview:

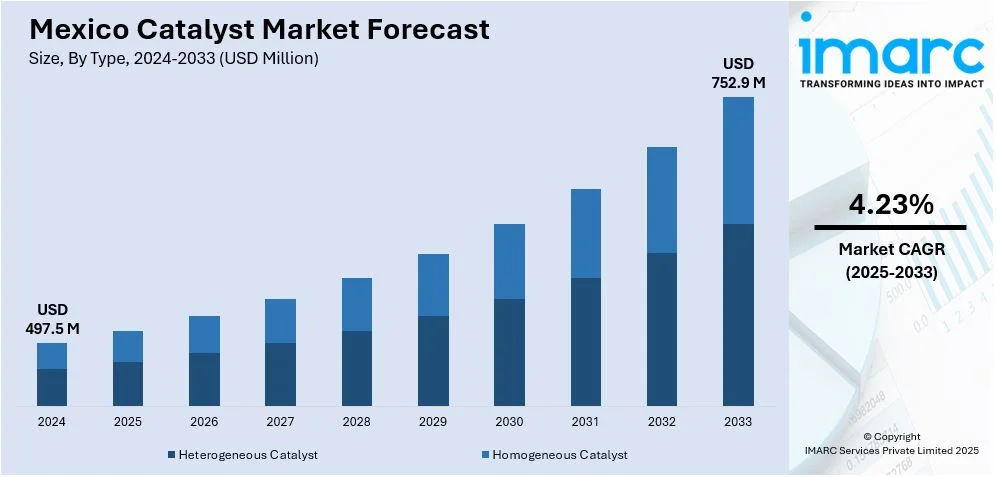

The Mexico catalyst market size reached USD 497.5 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 752.9 Million by 2033, exhibiting a growth rate (CAGR) of 4.23% during 2025-2033. Growing demand in oil refining, rising petrochemical production, increased automotive manufacturing, and stricter environmental regulations promoting cleaner fuel technologies are some of the factors contributing to Mexico catalyst market share. Industrial expansion and investments in sustainable chemical processes further support catalyst usage across multiple downstream sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 497.5 Million |

| Market Forecast in 2033 | USD 752.9 Million |

| Market Growth Rate 2025-2033 | 4.23% |

Mexico Catalyst Market Trends:

Boost in Advanced Processing Capacity

A newly built hydrotreating reactor has been deployed to support operations at a key facility in Mexico. The unit, designed with advanced metallurgy and equipped for impurity removal from hydrocarbon streams, plays a central role in catalytic treatment stages of fuel production. Its integration marks a boost in domestic capabilities, particularly for upgrading fuel quality by targeting sulfur and nitrogen content. This enhancement in processing infrastructure is expected to reinforce activity within catalytic treatment chains, potentially increasing the consumption of specialty catalyst grades. The focus on deep hydrotreating also points to a broader shift toward cleaner fuel outputs, indirectly shaping demand for catalyst technologies tailored to meet stringent emission standards and operational efficiency goals. These factors are intensifying the Mexico catalyst market growth. For example, in April 2024, L&T manufactured a 1,751 MT hydrotreating reactor for Mexico’s Antonio Dovali Jaime Refinery in Salina Cruz. Built in Gujarat’s Hazira Complex within 15 months, the reactor uses Axens’ technology and advanced Cr-Mo-V metallurgy. It plays a role in catalytic conversion during oil refining, helping remove impurities like sulfur and nitrogen from hydrocarbons. This development supports Mexico’s refining capacity and strengthens catalyst demand linked to hydrotreating processes.

Refining Output Reallocation Impacting Supply Channels

Based on the Mexico catalyst market outlook, a recent shift in fuel shipments from a new domestic refinery has highlighted ongoing challenges in internal distribution systems. Despite intentions to strengthen local supply, part of the output was redirected internationally due to logistical limitations. This reflects a reallocation of refined product flows, potentially influencing the demand and usage patterns for supporting chemical inputs. Such movements suggest short-term recalibrations in downstream supply chains, particularly affecting operations reliant on stable domestic refining output. The development may also affect procurement strategies and scheduling cycles for key processing agents within the sector. Overall, the redistribution of refined volumes underlines the importance of infrastructure readiness in maintaining alignment between production and regional consumption needs. For instance, in April 2025, Mexico exported its first cargo of ultra-low sulfur diesel (ULSD) from the newly operational Olmeca refinery in Dos Bocas, Tabasco. The shipment, approximately 300,000 barrels, was transported to Florida and Puerto Rico. Despite the refinery's aim to enhance domestic fuel production, infrastructure challenges necessitated this export.

Mexico Catalyst Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, process, raw material, and application.

Type Insights:

- Heterogeneous Catalyst

- Homogeneous Catalyst

The report has provided a detailed breakup and analysis of the market based on the type. This includes heterogeneous catalyst and homogeneous catalyst.

Process Insights:

- Recycling

- Regeneration

- Rejuvenation

A detailed breakup and analysis of the market based on the process have also been provided in the report. This includes recycling, regeneration, and rejuvenation.

Raw Material Insights:

- Chemical Compounds

- Peroxides

- Acids

- Amines

- Others

- Metals

- Precious Metals

- Base Metals

- Zeolites

- Others

The report has provided a detailed breakup and analysis of the market based on the raw material. This includes chemical compounds (peroxides, acids, amines, and others), metals (precious metals and base metals), zeolites, and others.

Application Insights:

.webp)

- Chemical Synthesis

- Chemical Catalysts

- Adsorbents

- Syngas Production

- Others

- Petroleum Refining

- Fluid Catalytic Cracking (FCC)

- Alkylation

- Hydrotreating

- Catalytic Reforming

- Purification

- Bed Grading

- Others

- Polymers and Petrochemicals

- Ziegler Natta

- Reaction Initiator

- Chromium

- Urethane

- Solid Phosphorous Acid Catalyst

- Others

- Environmental

- Light-duty Vehicles

- Motorcycles

- Heavy-duty Vehicles

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes chemical synthesis (chemical catalysts, adsorbents, syngas production, and others), petroleum refining (fluid catalytic cracking (FCC), alkylation, hydrotreating, catalytic reforming, purification, bed grading, and others), polymers and petrochemicals (Ziegler Natta, reaction initiator, chromium, urethane, solid phosphorous acid catalyst, and others), and environmental (light-duty vehicles, motorcycles, heavy-duty vehicles, and others).

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Catalyst Market News:

- In July 2024, KBR launched KCOTKlean, a low-carbon version of its catalytic olefins technology designed to cut emissions in petrochemical production. The move holds relevance for Mexico's catalyst market, where efforts to modernize petrochemical infrastructure are growing. As the country looks to adopt cleaner and more efficient processing methods, such catalyst-based innovations could support sustainable upgrades across refining and petrochemical facilities.

Mexico Catalyst Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Heterogeneous Catalyst, Homogeneous Catalyst |

| Processes Covered | Recycling, Regeneration, Rejuvenation |

| Raw Materials Covered |

|

| Applications Covered |

|

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico catalyst market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico catalyst market on the basis of type?

- What is the breakup of the Mexico catalyst market on the basis of process?

- What is the breakup of the Mexico catalyst market on the basis of raw material?

- What is the breakup of the Mexico catalyst market on the basis of application?

- What is the breakup of the Mexico catalyst market on the basis of region?

- What are the various stages in the value chain of the Mexico catalyst market?

- What are the key driving factors and challenges in the Mexico catalyst market?

- What is the structure of the Mexico catalyst market and who are the key players?

- What is the degree of competition in the Mexico catalyst market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico catalyst market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico catalyst market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico catalyst industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)