Mexico Catheters Market Size, Share, Trends and Forecast by Product Type, End User, and Region, 2026-2034

Mexico Catheters Market Summary:

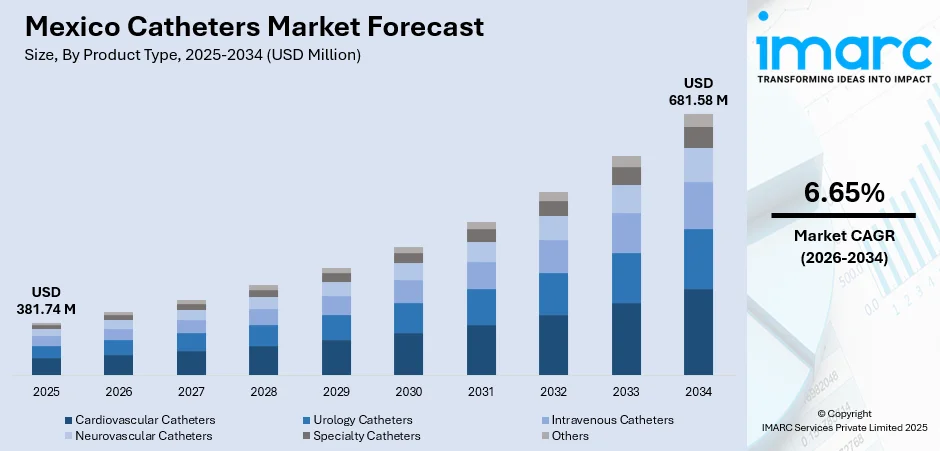

The Mexico catheters market size was valued at USD 381.74 Million in 2025 and is projected to reach USD 681.58 Million by 2034, growing at a compound annual growth rate of 6.65% from 2026-2034.

The Mexico catheters market is experiencing robust expansion driven by the nation's rapidly aging population and increasing prevalence of cardiovascular diseases, diabetes, and chronic kidney conditions. The healthcare sector transformation underway, including substantial government investments in hospital infrastructure and the adoption of minimally invasive surgical techniques, continues to stimulate demand for advanced catheter technologies across medical facilities nationwide. Additionally, the growing preference among healthcare providers for catheter-based interventional procedures that offer reduced recovery times and improved patient outcomes is reshaping treatment protocols across multiple therapeutic areas.

Key Takeaways and Insights:

- By Product Type: Cardiovascular Catheters dominate the market with a share of 28% in 2025, driven by the high burden of heart disease in Mexico, where cardiovascular conditions account for nearly a quarter of all deaths, creating sustained demand for diagnostic and interventional catheter solutions.

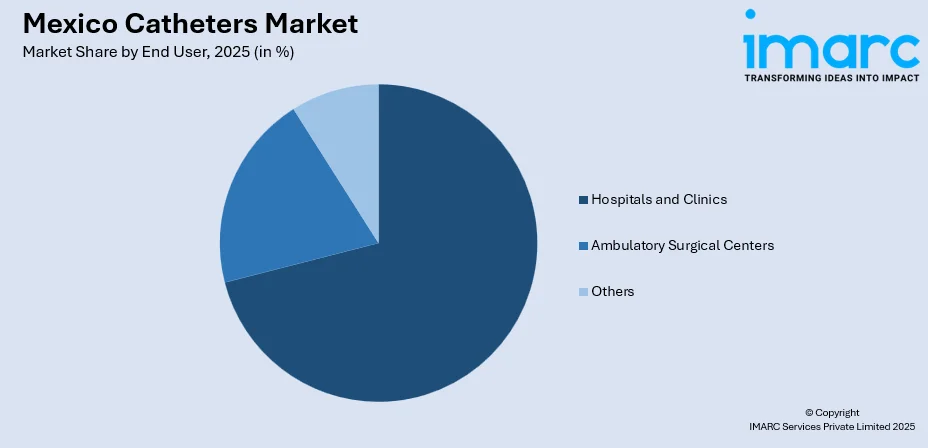

- By End User: Hospitals and Clinics lead the market with a share of 71% in 2025, owing to their comprehensive infrastructure for complex catheter-based procedures, availability of specialized medical personnel, and concentration of advanced diagnostic and therapeutic equipment.

- Key Players: The Mexico catheters market exhibits a competitive landscape characterized by a blend of multinational medical device corporations and regional distributors. Major global players leverage extensive distribution networks and advanced manufacturing capabilities to maintain market presence.

To get more information on this market Request Sample

The Mexico catheters market is positioned for sustained growth as healthcare modernization efforts continue to expand access to advanced medical technologies. In 2025, the Mexican government announced the inauguration of 31 new hospitals and 12 primary-care clinics nationwide, enhancing public healthcare infrastructure and supporting increased demand for medical devices including catheters. Rising healthcare expenditure, coupled with government initiatives to strengthen public healthcare systems through new hospital construction and equipment upgrades, is creating favorable conditions for catheter adoption. Furthermore, Mexico's emergence as a leading medical tourism destination attracts patients seeking high-quality, cost-effective procedures, further bolstering demand for sophisticated catheter products across various clinical applications.

Mexico Catheters Market Trends:

Growing Adoption of Minimally Invasive Catheter-Based Procedures

Healthcare providers across Mexico are increasingly transitioning toward minimally invasive catheter-based procedures for cardiovascular, urological, and neurovascular interventions. For example, in December 2024 Sahajanand Medical Technologies (SMT) launched its Hydra TAVR system in Mexico, a transcatheter valve‑replacement technology that supports minimally invasive structural heart interventions. This shift reflects broader clinical preferences for techniques that reduce patient trauma, shorten hospital stays, and accelerate recovery. Medical centers in major metropolitan areas are expanding their interventional capabilities, training specialists in advanced catheter manipulation, and investing in compatible imaging systems to support these procedures.

Expansion of Antimicrobial and Advanced Coating Technologies

The Mexican healthcare sector is witnessing rising demand for catheters featuring antimicrobial coatings and enhanced lubricity properties. For instance, Bactiguard’s central venous catheters, designed with infection prevention coating technology, were approved for use in Mexico by the national health authority. Healthcare facilities are prioritizing infection prevention and improved biocompatibility to reduce catheter-associated complications. This trend aligns with broader quality improvement initiatives focused on patient safety and reflects evolving procurement standards across both public and private healthcare institutions seeking to optimize clinical outcomes.

Integration of Digital Health Technologies with Catheter Systems

The convergence of digital health solutions with catheter-based care represents an emerging trend in Mexico's medical device landscape. A recent comprehensive study of digital health in Mexico found that about 78.1% of hospitals have internet access, and roughly 45% of surveyed physicians already conduct virtual consultations or rely on digital tools for medical data — showing the growing fundamental digital infrastructure in Mexican hospitals. Healthcare providers are exploring smart catheter systems equipped with sensors and connectivity features that enable real-time monitoring and data collection. This technological integration supports remote patient management, enhances chronic condition oversight, and aligns with the healthcare sector's digital transformation objectives.

Market Outlook 2026-2034:

The Mexico catheters market outlook remains positive as demographic transitions and epidemiological shifts create sustained demand for catheter products across therapeutic applications. Government healthcare expansion programs, including new hospital construction and operating room upgrades, are expected to enhance procedural capacity nationwide. The market generated a revenue of USD 381.74 Million in 2025 and is projected to reach a revenue of USD 681.58 Million by 2034, growing at a compound annual growth rate of 6.65% from 2026-2034.

Mexico Catheters Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Cardiovascular Catheters | 28% |

| End User | Hospitals and Clinics | 71% |

Product Type Insights:

- Cardiovascular Catheters

- Urology Catheters

- Intravenous Catheters

- Neurovascular Catheters

- Specialty Catheters

- Others

The cardiovascular catheters dominate with a market share of 28% of the total Mexico catheters market in 2025.

Cardiovascular catheters constitute the leading product segment in Mexico's catheters market, reflecting the substantial burden of heart disease across the country. These specialized devices are essential for diagnostic procedures such as coronary angiography and therapeutic interventions including angioplasty and stent placement. The high prevalence of cardiovascular risk factors, including hypertension (about 29.4% of adults) and widespread diabetes, continues to drive demand for these catheter products.

The expansion of interventional cardiology capabilities across Mexican hospitals has accelerated the adoption of advanced cardiovascular catheter technologies. Healthcare facilities are increasingly performing complex percutaneous coronary interventions and catheter-based valve procedures, necessitating sophisticated catheter systems. The growing preference for minimally invasive cardiac procedures over traditional open-heart surgery further supports the sustained demand for cardiovascular catheters across both public and private healthcare sectors.

End User Insights:

Access the Comprehensive Market Breakdown Request Sample

- Hospitals and Clinics

- Ambulatory Surgical Centers

- Others

The hospitals and clinics lead with a share of 71% of the total Mexico catheters market in 2025.

Hospitals and clinics represent the dominant end-user segment in Mexico's catheters market, attributable to their comprehensive capabilities for performing catheter-based diagnostic and interventional procedures. These facilities possess the necessary infrastructure, including catheterization laboratories, imaging equipment, and specialized medical staff required for complex catheter procedures. Mexico's hospital infrastructure, comprising approximately 3,587 hospitals with over 7,774 operating rooms, provides substantial capacity for catheter utilization.

The concentration of advanced medical technologies and specialized personnel within hospital settings positions these facilities as primary catheter consumption centers. Major public healthcare institutions under IMSS and ISSSTE, along with leading private hospital networks, are continuously enhancing their interventional capabilities through infrastructure investments and equipment upgrades. Government initiatives to construct new hospitals and expand healthcare access are expected to further strengthen the position of hospitals and clinics as the primary end-user segment.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico represents a significant market for catheters, characterized by advanced healthcare infrastructure concentrated in industrial cities along the border region. The area benefits from proximity to United States medical practices, well-developed hospital networks in metropolitan centers like Monterrey and Tijuana, and a growing medical tourism sector attracting patients seeking catheter-based procedures.

Central Mexico, anchored by Mexico City and surrounding metropolitan areas, commands a substantial market presence due to the concentration of major hospitals, specialized medical centers, and tertiary care facilities. This region houses the nation's most advanced interventional cardiology and catheterization programs, driving significant demand for sophisticated catheter technologies.

Southern Mexico presents emerging growth opportunities for the catheters market, though healthcare infrastructure development remains less advanced compared to northern and central regions. Government initiatives to expand healthcare access in underserved areas and establish new medical facilities are gradually improving catheter availability across southern states.

Other regions across Mexico contribute to the catheters market through their evolving healthcare systems and regional medical centers. Ongoing federal programs to strengthen healthcare infrastructure in these areas are expected to progressively enhance catheter adoption as facilities upgrade their capabilities.

Market Dynamics:

Growth Drivers:

Why is the Mexico Catheters Market Growing?

Rising Prevalence of Cardiovascular Diseases and Chronic Conditions

Mexico continues to face a rising burden of cardiovascular diseases, which remain among the primary causes of mortality and long-term disability. In 2024, INEGI reported that cardiovascular diseases accounted for approximately 192,518 deaths, making them the leading cause of mortality in the country. Growing cases of hypertension, diabetes, and related complications are driving sustained demand for diagnostic and therapeutic catheter procedures. As lifestyle-related risk factors persist across the population, hospitals and specialty centers are expanding catheterization labs to handle increasing patient volumes. These investments support timely diagnosis, minimally invasive treatments, and long-term management of chronic cardiovascular and metabolic conditions.

Government Investments in Healthcare Infrastructure Expansion

The Mexican government is actively strengthening national healthcare capacity through widespread infrastructure development. New hospitals are being built, older facilities are being modernized, and surgical departments are being upgraded to accommodate advanced treatment technologies. Public institutions such as IMSS are central to this expansion, creating broader access to specialized care across regions. These efforts are enabling greater adoption of catheter-based procedures, improving service delivery in underserved areas, and supporting wider integration of modern medical devices in clinical practice.

Demographic Shifts and Aging Population Dynamics

Mexico is experiencing major demographic change, with lower birth rates and longer life expectancy contributing to a steadily aging population. For example, in 2024 people aged 65 and older accounted for roughly 9.68% of the total Mexican population — a historic high for that age‑group. As the proportion of older adults grows, demand for catheter products is rising due to the higher prevalence of cardiovascular disease, urinary complications, and chronic medical conditions in this age group. Healthcare providers are adapting care models to better support elderly patients who require regular monitoring and minimally invasive interventions. This demographic evolution is becoming a key driver of catheter utilization across the country.

Market Restraints:

What Challenges the Mexico Catheters Market is Facing?

Regional Healthcare Infrastructure Disparities

Significant disparities in healthcare infrastructure between urban and rural areas, as well as between northern and southern regions, constrain market expansion. Southern states possess less developed healthcare facilities with limited capacity for advanced catheter-based procedures, restricting market penetration in these underserved areas.

Skilled Healthcare Professional Shortages

Mexico faces shortages of specialized medical professionals trained in catheter-based interventional procedures, particularly in cardiovascular and neurovascular applications. This workforce limitation restricts the number of facilities capable of performing complex catheterization procedures and limits market growth potential in certain regions.

Healthcare Budget Constraints and Cost Pressures

Public healthcare budget limitations and cost pressures affect procurement of advanced catheter technologies, particularly in government healthcare institutions. Budget constraints may delay equipment upgrades and restrict adoption of premium catheter products, influencing market growth rates across the public sector.

Competitive Landscape:

The Mexico catheters market features a competitive landscape shaped by multinational medical device suppliers, regional distributors, and a growing base of local manufacturers. Global players benefit from strong distribution networks, regulatory proficiency, and technologically advanced product portfolios, allowing them to sustain a solid market presence. Market participants increasingly emphasize product innovation, collaboration with healthcare institutions, and expanded service solutions to enhance competitiveness. Evolving regulatory frameworks, including recent efforts to simplify medical device approvals, are reshaping competition by enabling faster market access and encouraging broader participation across the industry.

Recent Developments:

- In May 2025, Quasar Medical announced its acquisition of Nordson MEDICAL’s design and development business, including the Tecate, Mexico facility. The move expands Quasar’s global CDMO capabilities and strengthens its position in catheter and interventional device manufacturing, leveraging Nordson MEDICAL’s design expertise.

- In September 2025, Nordson Corporation confirmed the divestiture of its contract-manufacturing design and development units to Quasar Medical. The move enables Nordson MEDICAL to refocus on its proprietary medical-component portfolio, while strengthening Quasar’s CDMO capabilities.

Mexico Catheters Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Cardiovascular Catheters, Urology Catheters, Intravenous Catheters, Neurovascular Catheters, Specialty Catheters, Others |

| End Users Covered | Hospitals and Clinics, Ambulatory Surgical Centers, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico catheters market size was valued at USD 381.74 Million in 2025.

The Mexico catheters market is expected to grow at a compound annual growth rate of 6.65% from 2026-2034 to reach USD 681.58 Million by 2034.

Cardiovascular catheters held the largest market share at 28%, driven by the high prevalence of cardiovascular diseases and increasing adoption of minimally invasive cardiac interventions across Mexican healthcare facilities.

Key factors driving the Mexico catheters market include rising prevalence of cardiovascular diseases and chronic conditions, government investments in healthcare infrastructure expansion, aging population demographics, and growing adoption of minimally invasive surgical procedures.

Major challenges include regional healthcare infrastructure disparities between urban and rural areas, shortages of skilled healthcare professionals trained in catheter-based procedures, healthcare budget constraints in public institutions, and varying quality of medical facilities across different regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)