Mexico Ceiling Light Market Size, Share, Trends and Forecast by Light Source, Mounting Type, Application, Smart Features, Style, and Region, 2026-2034

Mexico Ceiling Light Market Summary:

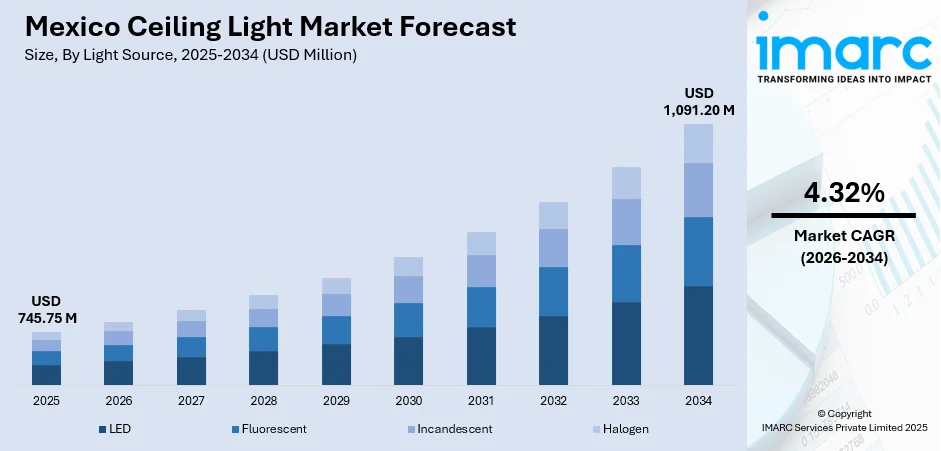

The Mexico ceiling light market size was valued at USD 745.75 Million in 2025 and is projected to reach USD 1,091.20 Million by 2034, growing at a compound annual growth rate of 4.32% from 2026-2034.

The Mexico ceiling light market is experiencing robust expansion driven by rising demand for energy-efficient LED lighting, rapid urbanization, and growing consumer preference for smart and aesthetic lighting solutions. Government efforts toward sustainability are driving adoption of environment-friendly products across residential and commercial sectors. Furthermore, increased building construction activity combined with the ease and variety provided by e-commerce platforms is contributing to increasing Mexico ceiling light market share, enabling customers to easily acquire stylish and innovative ceiling lights from different regions.

Key Takeaways and Insights:

-

By Light Source: LED dominates the market with a share of 64.03% in 2025, attributed to its superior energy efficiency, extended lifespan, lower maintenance requirements, and declining price points that make it increasingly accessible for residential and commercial applications.

-

By Mounting Type: Recessed holds the largest share of 46.05% in 2025, underpinned by its clean aesthetic appeal, space-saving design, and popularity in modern architectural projects where seamless integration with ceiling surfaces is preferred.

-

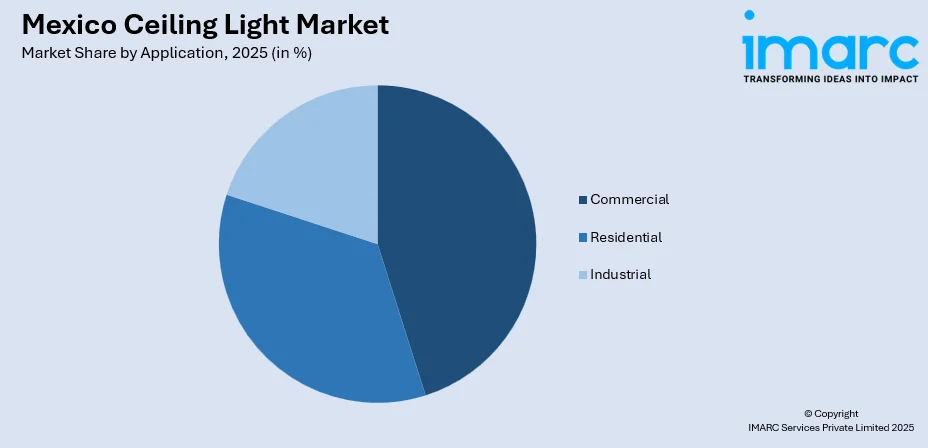

By Application: Commercial leads the market with a share of 45.02% in 2025, reflecting substantial investments in office buildings, retail spaces, hospitality venues, and healthcare facilities requiring professional-grade illumination solutions.

-

By Smart Feature: Dimmable dominates the market with a share of 37.06% in 2025, driven by consumer demand for customizable lighting intensity, energy conservation capabilities, and enhanced ambiance control across residential and commercial environments.

-

By Style: Modern leads the market with a share of 48.02% in 2025, fueled by contemporary architectural preferences, minimalist design trends, and consumer affinity for sleek, understated lighting fixtures that complement modern interior aesthetics.

-

By Region: Central Mexico dominated the market with a share of 34% in 2025, propelled by the concentration of commercial activities in Mexico City metropolitan area, robust real estate development, and substantial presence of retail and hospitality establishments.

-

Key Players: The Mexico ceiling light market demonstrates a competitive landscape characterized by international lighting manufacturers alongside domestic players. Market participants differentiate through product innovation, energy efficiency ratings, design aesthetics, and smart technology integration capabilities.

To get more information on this market Request Sample

The Mexico ceiling light market is undergoing significant transformation propelled by technological advancements in LED and smart lighting systems. In 2025, MLS Mexico, a global LED lighting leader, announced a USD 261.7 million investment to establish a new LED manufacturing and technology complex in Durango, enhancing local production and modern lighting capacity. Consumers and businesses increasingly prioritize energy efficiency, cost reduction, and sustainability when selecting lighting solutions. The expanding middle class coupled with improving living standards is enabling broader adoption of premium lighting fixtures across residential applications. Infrastructure development in secondary cities is further extending market reach beyond traditional metropolitan centers. Government initiatives focused on energy efficiency and smart city development demonstrate policy support toward promoting modern lighting solutions across the country.

Mexico Ceiling Light Market Trends:

Accelerating Transition to LED Technology

Mexico is rapidly shifting toward LED ceiling lighting due to its energy efficiency, long lifespan, and lower costs compared to traditional lighting. In October 2024, Cree LED, with IDC Componentes and Ilumiled, replaced 1,600 lamps in Santiago de Querétaro with efficient LEDs, cutting energy use over 50% while preserving heritage. Households, businesses, and municipalities are replacing incandescent and fluorescent options with LEDs, benefiting from reduced electricity bills and maintenance needs. Government incentives boost LED adoption; manufacturers expand innovative, efficient designs.

Rising Demand for Smart and Connected Lighting

The growing popularity of smart homes and buildings is driving demand for ceiling lights with automation, remote control, and energy-monitoring capabilities. According to reports, Tecnolite Connect expanded its smart lighting range with cloud‑connected IoT solutions, offering voice and app control, highlighting Mexican manufacturers’ shift toward smarter, high-demand lighting technologies. Consumers seek compatibility with voice assistants and smartphone apps, while commercial spaces adopt occupancy sensing, daylight harvesting, and programmable schedules to optimize energy use. IoT-enabled lighting solutions are redefining how Mexicans interact with and control their lighting environments.

Growth in Aesthetic and Designer Lighting Solutions

Designer ceiling lights with contemporary aesthetics, premium materials, and unique styles are increasingly sought after in Mexican homes and hospitality settings. In June 2024, Unilumin opened a Mexico City showroom, highlighting premium, design-focused LED lighting for architects and designers. Consumers now view lighting as a key element of interior design, not just functionality. Manufacturers offer varied collections from minimalist to industrial or decorative designs, catering to diverse tastes. Premiumization among middle- and high-income households fuels demand for high-quality, branded fixtures enhancing home aesthetics.

Market Outlook 2026-2034:

The Mexico ceiling light market is set for steady growth over the forecast period, fueled by rising adoption of LED technology, the integration of smart home solutions, and increased residential and commercial construction activities. Market prospects are strengthened by expanding demand for energy-efficient lighting, connected and IoT-enabled systems, and premium designer fixtures. These trends create significant opportunities for manufacturers and suppliers aiming to capitalize on Mexico’s evolving lighting landscape. The market generated a revenue of USD 745.75 Million in 2025 and is projected to reach a revenue of USD 1,091.20 Million by 2034, growing at a compound annual growth rate of 4.32% from 2026-2034.

Mexico Ceiling Light Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Light Source |

LED |

64.03% |

|

Mounting Type |

Recessed |

46.05% |

|

Application |

Commercial |

45.02% |

|

Smart Feature |

Dimmable |

37.06% |

|

Style |

Modern |

48.02% |

|

Region |

Central Mexico |

34% |

Light Source Insights:

- LED

- Fluorescent

- Incandescent

- Halogen

The LED dominates with a market share of 64.03% of the total Mexico ceiling light market in 2025.

LED technology represents the cornerstone of Mexico's ceiling light industry owing to its exceptional energy efficiency, extended operational lifespan, and continuously declining price points. The technology offers substantial electricity cost savings compared to traditional incandescent and fluorescent alternatives while providing superior light quality and color rendering characteristics. Government energy efficiency programs and utility rebate structures are accelerating LED adoption across residential, commercial, and municipal applications throughout the country. In late 2025, Super Lighting began a Monterrey facility, its North American HQ, boosting local advanced LED production for residential and commercial markets.

The dominance of the Mexican LED ceiling light segment is strengthened by increasing environmental awareness, as consumers prioritize sustainable solutions with lower carbon footprints. Manufacturers are continuously launching innovative designs offering higher lumen output, advanced thermal management, and smart connectivity features. Additionally, LED technology’s adaptability across multiple mounting options and style categories enhances its appeal, reinforcing its leadership in the market and driving widespread adoption across residential, commercial, and municipal applications.

Mounting Type Insights:

- Recessed

- Surface-Mounted

- Pendant

- Chandelier

The recessed leads with a share of 46.05% of the total Mexico ceiling light market in 2025.

Recessed ceiling lights continue commanding market preference owing to their clean aesthetic appearance, space-saving design, and seamless integration with modern architectural styles. The installation method creates a streamlined ceiling surface that complements contemporary interior design preferences while providing effective illumination without visual obstruction. In 2025, Italian lighting brand Buzzi & Buzzi completed a high‑end architectural project in Baja California Sur, integrating invisible recessed LED fixtures into a private villa to enhance aesthetics and functionality, reflecting demand for subtle, impactful lighting in premium Mexican properties.

Building on this dominance, recessed ceiling lights are increasingly favored across both residential and commercial spaces in Mexico. Their subtle, flush-mounted design allows for flexible placement, enhancing ambient and task lighting without interrupting the ceiling’s visual flow. Architects and interior designers prefer them for creating minimalist, modern interiors that balance functionality and elegance. Rising consumer awareness of energy-efficient LED options further strengthens their appeal, ensuring recessed fixtures remain the preferred choice for stylish, efficient illumination solutions.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

- Industrial

The commercial dominates with a market share of 45.02% of the total Mexico ceiling light market in 2025.

In Mexico, commercial applications are the key driver of ceiling light demand, fueled by growing investments in office buildings, retail outlets, hotels, and healthcare facilities. Businesses increasingly seek professional-grade lighting to enhance productivity, showcase products effectively, and create comfortable environments for customers and staff. Selection of ceiling lights focuses on energy efficiency, superior illumination quality, and low maintenance requirements, reflecting the need for durable, cost-effective, and visually appealing lighting solutions in modern commercial spaces.

Continuing this trend, commercial ceiling lighting is witnessing steady growth due to ongoing urban development and modernization across Mexican cities. Businesses increasingly adopt advanced LED and smart lighting systems that offer superior energy efficiency, longer lifespans, and customizable illumination. Office complexes, shopping centers, and hotels focus on lighting solutions that enhance ambiance, visual comfort, and operational efficiency. As commercial spaces expand and refurbish, demand for high-performance, aesthetically versatile ceiling lights remains a key market driver.

Smart Features Insights:

- Dimmable

- Color-Changing

- Voice-Controlled

- Smart Home Integration

The dimmable leads with a share of 37.06% of the total Mexico ceiling light market in 2025.

Dimmable ceiling lights represent the most adopted smart feature owing to their practical energy conservation capabilities and enhanced ambiance control functionality. The ability to adjust lighting intensity according to activity requirements and time of day provides substantial value for residential and commercial users. In 2025, Philips Hue partnered with Sonos to enable voice control of smart lights, letting users adjust brightness via Sonos Voice Control, showcasing enhanced convenience and smart home integration. Dimmable fixtures enable customized lighting experiences while reducing electricity consumption during periods requiring lower illumination levels.

Building on this trend, the popularity of dimmable ceiling lights is further reinforced by their compatibility with modern smart home and commercial automation systems. Users increasingly integrate these fixtures with voice control, mobile apps, and occupancy sensors to optimize convenience and energy savings. In addition to enhancing visual comfort and mood settings, dimmable solutions contribute to sustainability goals by minimizing unnecessary power usage, making them a preferred choice for energy-conscious consumers and businesses seeking versatile, efficient lighting.

Style Insights:

- Modern

- Traditional

- Contemporary

- Industrial

- Coastal

The modern dominates with a market share of 48.02% of the total Mexico ceiling light market in 2025.

Modern-style ceiling lights lead market demand, fueled by contemporary architectural trends and consumers’ preference for clean, minimalist aesthetics. Characterized by sleek lines, geometric shapes, and understated elegance, these fixtures complement residential and commercial interiors, enhancing visual appeal and spatial harmony. Young urban buyers particularly favor modern lighting for its ability to elevate sophistication and style in living spaces. As a result, manufacturers continue to innovate within this segment, offering designs that balance functionality with refined, contemporary aesthetics.

Expanding on this preference, modern ceiling lights continue to lead market demand due to their versatility and ability to seamlessly integrate with diverse interior themes. Their streamlined designs not only enhance aesthetic appeal but also support functional lighting requirements in both homes and workplaces. The rise of open-plan layouts and smart home integration further boosts adoption, as consumers seek fixtures that combine style, energy efficiency, and adaptability, reinforcing modern lighting as the dominant choice in Mexico’s ceiling light market.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Central Mexico exhibits a clear dominance with a 34% share of the total Mexico ceiling light market in 2025.

Central Mexico leads regional demand due to the concentration of commercial activities in Mexico City and nearby states such as State of Mexico, Puebla, and Querétaro. The area features extensive office, retail, hospitality, and healthcare infrastructure that requires professional lighting solutions. Strong distribution networks and proximity to key suppliers further improve product availability, ensuring efficient access to advanced lighting systems across both urban and suburban markets throughout the region.

Fueling this trend, Central Mexico maintains a leading position in ceiling light demand owing to rapid urbanization and continuous infrastructure growth. Expanding residential developments, corporate offices, and commercial centers drive the need for advanced, efficient lighting solutions. The region’s robust logistics network and strong supplier presence ensure easy access to a wide range of products. Consequently, Central Mexico continues to serve as a key market hub, influencing national ceiling light adoption patterns and industry growth.

Market Dynamics:

Growth Drivers:

Why is the Mexico Ceiling Light Market Growing?

Government Energy Efficiency Initiatives

Mexican government energy efficiency programs and sustainability initiatives are creating substantial demand for modern LED ceiling lighting solutions. Under the Proyecto Nacional de Eficiencia Energética en Alumbrado Público Municipal (PNEEAPM), the national government provides technical assistance and financing to municipalities to upgrade public lighting systems to more energy‑efficient LED technologies, helping accelerate modernization across cities. Municipal agencies are progressively transitioning from conventional lighting technologies to contemporary LED systems primarily to reduce energy consumption, decrease maintenance expenses, and enhance public safety. National projects providing technical support for LED lighting implementation across cities are accelerating market growth.

Urbanization and Construction Activity

Rapid urbanization and expanding construction activities across residential and commercial sectors are generating substantial demand for ceiling lighting solutions. The development of new housing projects, office buildings, retail centers, and hospitality venues creates consistent requirement for quality lighting fixtures. Growing middle-class population with increasing disposable incomes is enabling investment in premium lighting products for home improvement. Infrastructure development in tier-2 cities is extending market reach beyond traditional metropolitan centers.

Smart Home Technology Adoption

The expanding trend of smart homes and connected buildings is significantly boosting demand for ceiling lights with integrated automation capabilities. The Mexico smart homes market size reached USD 1.7 Billion in 2024, highlighting the growing consumer interest in connected home technologies, and is projected to expand further in the coming years. Consumers increasingly seek lighting solutions compatible with voice assistants and smartphone applications enabling convenient control and energy monitoring. Commercial establishments are adopting intelligent lighting systems offering occupancy sensing and programmable scheduling features that optimize energy consumption. The proliferation of IoT-enabled lighting solutions is transforming consumer expectations and driving market growth.

Market Restraints:

What Challenges the Mexico Ceiling Light Market is Facing?

Price Sensitivity in Mass Market Segments

Price sensitivity among mass market consumers creates competitive pressure on manufacturers and limits premium product adoption. Lower-income households prioritize affordability over advanced features and energy efficiency considerations when selecting lighting fixtures. The prevalence of budget alternatives from unbranded manufacturers constrains market growth for established players offering quality products.

Installation Complexity for Retrofit Applications

Installation requirements and electrical infrastructure limitations in existing buildings create barriers for ceiling light upgrades. Older construction may lack suitable ceiling cavity depth for recessed installations or adequate electrical capacity for advanced lighting systems. Professional installation costs add to total ownership expenses, potentially deterring budget-conscious consumers from purchasing premium ceiling light solutions.

Competition from Alternative Lighting Forms

Alternative lighting solutions including wall-mounted fixtures, floor lamps, and track lighting systems compete for consumer attention and budget allocation. Some architectural designs favor distributed lighting approaches over traditional ceiling-mounted solutions. The diversity of available lighting options requires manufacturers to differentiate their ceiling light offerings effectively to capture consumer preference.

Competitive Landscape:

The Mexico ceiling light market features a diverse competitive environment with international lighting manufacturers competing alongside domestic players and regional distributors. Global companies leverage brand recognition, technology leadership, and extensive product portfolios while local manufacturers compete through pricing strategies and distribution network advantages. The market structure encourages continuous innovation as players compete across energy efficiency, smart features, design aesthetics, and service dimensions. Strategic investments in LED technology development and smart lighting capabilities are strengthening competitive positions. Competition intensifies with manufacturers enhancing product offerings, expanding retail presence, and developing e-commerce channels to capture growing consumer demand.

Recent Developments:

-

In January 2025, Coleto Brands was established as the parent company of Kichler and Progress Lighting following Kingswood Capital’s 2024 acquisitions. Both brands remain independent while sharing resources, a unified sales force, refreshed showrooms, and joint industry events, leveraging combined strengths to better serve customers and drive innovation in lighting.

Mexico Ceiling Light Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Light Sources Covered | LED, Fluorescent, Incandescent, Halogen |

| Mounting Types Covered | Recessed, Surface-Mounted, Pendant, Chandelier |

| Applications Covered | Residential, Commercial, Industrial |

| Smart Features Covered | Dimmable, Color-Changing, Voice-Controlled, Smart Home Integration |

| Styles Covered | Modern, Traditional, Contemporary, Industrial, Coastal |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico ceiling light market size was valued at USD 745.75 Million in 2025.

The Mexico ceiling light market is expected to grow at a compound annual growth rate of 4.32% from 2026-2034 to reach USD 1091.20 Million by 2034.

LED dominates the Mexico ceiling light market with a 64.03% share, driven by superior energy efficiency, extended operational lifespan, declining price points, and growing environmental consciousness among consumers.

Key factors driving the Mexico ceiling light market include government energy efficiency initiatives, rapid urbanization and construction activity, smart home technology adoption, and growing consumer preference for aesthetic and sustainable lighting solutions.

Major challenges include price sensitivity in mass market segments, installation complexity for retrofit applications in older buildings, competition from alternative lighting forms, and the need for electrical infrastructure upgrades to support advanced lighting systems.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)