Mexico Cell and Gene Therapy Market Size, Share, Trends and Forecast by Therapy Type, Indication, Delivery Mode, End User, and Region, 2025-2033

Mexico Cell and Gene Therapy Market Overview:

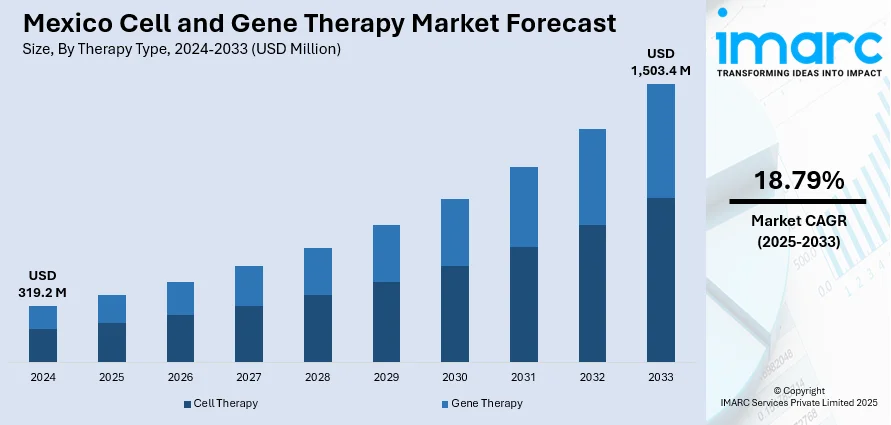

The Mexico cell and gene therapy market size reached USD 319.2 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,503.4 Million by 2033, exhibiting a growth rate (CAGR) of 18.79% during 2025-2033. The market is driven by the rising prevalence of chronic disorders like cancer, diabetes, and orphan genetic diseases, unprecedented advances in biomedical research and development (R&D), and development of dedicated guidelines, and fast-track approval mechanisms for treatments targeting high-unmet medical needs or orphan diseases.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 319.2 Million |

| Market Forecast in 2033 | USD 1,503.4 Million |

| Market Growth Rate 2025-2033 | 18.79% |

Mexico Cell and Gene Therapy Market Trends:

Growing Prevalence of Chronic and Genetic Disorders

The rising prevalence of chronic disorders like cancer, diabetes, and orphan genetic diseases in Mexico is driving the need for innovative therapeutics, such as cell and gene therapies. These new treatments have the potential to cure or improve conditions that were previously considered incurable. For example, inherited diseases like hemophilia, sickle cell anemia, and lysosomal storage diseases are being addressed through gene therapies for correcting or substituting defective genes. Likewise, cell therapies using stem cells or Chimeric Antigen Receptor T-cell (CAR-T cells) are transforming oncology by expanding the immune system's capacity for recognizing and targeting tumor cells. This increasing disease burden is also fueling patient and healthcare professional interest in curative rather than lifelong management of symptoms. Consequently, the demand for novel biotechnological solutions and in-vitro diagnostics is accelerating, propelling the market growth. Furthermore, the IMARC Group predicts that the Mexico in-vitro diagnostics market size is expected to reach USD 3.5 Billion by 2033.

Advancements in Research and Local Biotech Infrastructure

Mexico is experiencing unprecedented advances in biomedical research and development (R&D), which are very important for developing and marketing cell and gene therapies. Universities like the National Autonomous University of Mexico (UNAM) and institutes like the National Institute of Genomic Medicine (INMEGEN) are all actively engaging in genetic studies, clinical trials, and translational medicine. These institutions not only promote innovation but also act as training centers for talented professionals in cell and molecular biology. In addition, the Mexican government and private investors are increasingly investing in the development of infrastructure, such as specialized laboratories, bioprocessing facilities, and clinical-grade manufacturing plants. These investments are critical to increase production scale and guarantee regulatory compliance for ATMPs. In 2024, President Claudia Sheinbaum unveiled the New Consolidated Procurement Model for Medicines and Medical Supplies for the 2025-2026 timeframe, which will require an investment of 130 billion pesos.

Regulatory Support and International Collaborations

Mexico's regulatory framework is getting updated to support the intricacies of cell and gene therapies. The Federal Commission for the Protection against Sanitary Risk (COFEPRIS) is actively working to streamline clinical trial approvals and commercialization of advanced treatments. This entails the development of dedicated guidelines and fast-track approval mechanisms for treatments targeting high-unmet medical needs or orphan diseases. These regulatory improvements have the purpose to balance innovation with patient safety so that the business climate becomes favorable for biopharmaceutical investment. In addition, Mexico is actively participating in global partnerships with North American and European biotechnology companies. Such alliances enable knowledge exchange, access to advanced technologies, and involvement in global clinical trials. The blend of regulatory flexibility and international integration greatly enhances the market's potential and its congruence with global standards. In 2025, Stem Vitality Mexico started accepting new patients who are looking for safe and effective stem cell therapy for various conditions. By providing treatments at a fraction of the price usually found in the United States and Canada, the clinic offers an affordable alternative for those dealing with chronic pain, autoimmune diseases, orthopedic conditions, and age-related problems. Foreign patients are assisted by Stem Vitality Mexico's medical tourism program, which features complimentary initial consultations, bilingual care coordinators, and complete travel assistance, providing a hassle-free experience from the San Diego border to the doors of the clinic.

Mexico Cell and Gene Therapy Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on therapy type, indication, delivery mode, and end user.

Therapy Type Insights:

- Cell Therapy

- Stem Cell

- Pluripotent Stem Cell

- Cancer Stem Cell

- Adult Stem Cell

- Non-Stem Cell

- T-Cell

- Natural Killer Cell

- Others

- Stem Cell

- Gene Therapy

The report has provided a detailed breakup and analysis of the market based on the therapy type. This includes cell therapy {stem cell (pluripotent stem cell, cancer stem cell, and adult stem cell) and non-stem cell (T-cell, natural killer cell, and others)} and gene therapy.

Indication Insights:

- Cardiovascular Disease

- Oncology Disorder

- Genetic Disorder

- Infectious Disease

- Neurological Disorder

- Others

A detailed breakup and analysis of the market based on the indication have also been provided in the report. This includes cardiovascular disease, oncology disorder, genetic disorder, infectious disease, neurological disorder, and others.

Delivery Mode Insights:

- In-Vivo

- Ex-Vivo

A detailed breakup and analysis of the market based on the delivery mode have also been provided in the report. This includes in-vivo and ex-vivo.

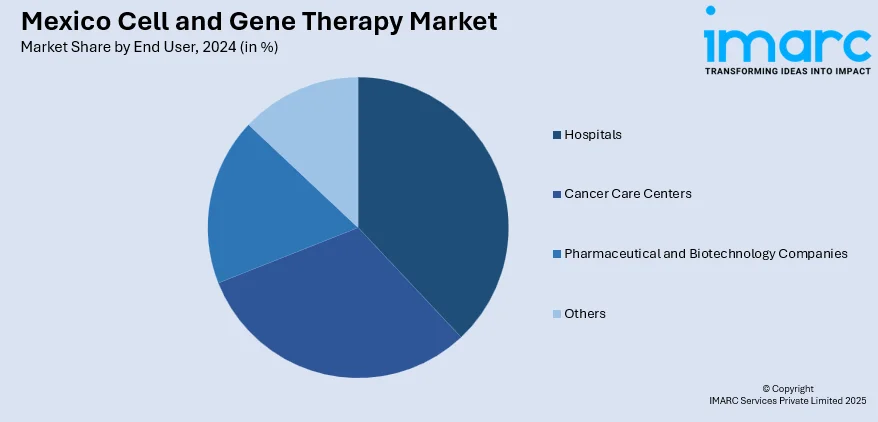

End User Insights:

- Hospitals

- Cancer Care Centers

- Pharmaceutical and Biotechnology Companies

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals, cancer care centers, pharmaceutical and biotechnology companies, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Cell and Gene Therapy Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Therapy Types Covered |

|

| Indications Covered | Cardiovascular Disease, Oncology Disorder, Genetic Disorder, Infectious Disease, Neurological Disorder, Others |

| Delivery Modes Covered | In-Vivo, Ex-Vivo |

| End Users Covered | Hospitals, Cancer Care Centers, Pharmaceutical & Biotechnology Companies, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico cell and gene therapy market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico cell and gene therapy market on the basis of therapy type?

- What is the breakup of the Mexico cell and gene therapy market on the basis of indication?

- What is the breakup of the Mexico cell and gene therapy market on the basis of delivery mode?

- What is the breakup of the Mexico cell and gene therapy market on the basis of end user?

- What is the breakup of the Mexico cell and gene therapy market on the basis of region?

- What are the various stages in the value chain of the Mexico cell and gene therapy market?

- What are the key driving factors and challenges in the Mexico cell and gene therapy market?

- What is the structure of the Mexico cell and gene therapy market and who are the key players?

- What is the degree of competition in the Mexico cell and gene therapy market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico cell and gene therapy market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico cell and gene therapy market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico cell and gene therapy industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)