Mexico Cell Therapy Market Size, Share, Trends and Forecast by Cell Type, Therapy Type, Therapeutic Area, End User, and Region, 2025-2033

Mexico Cell Therapy Market Overview:

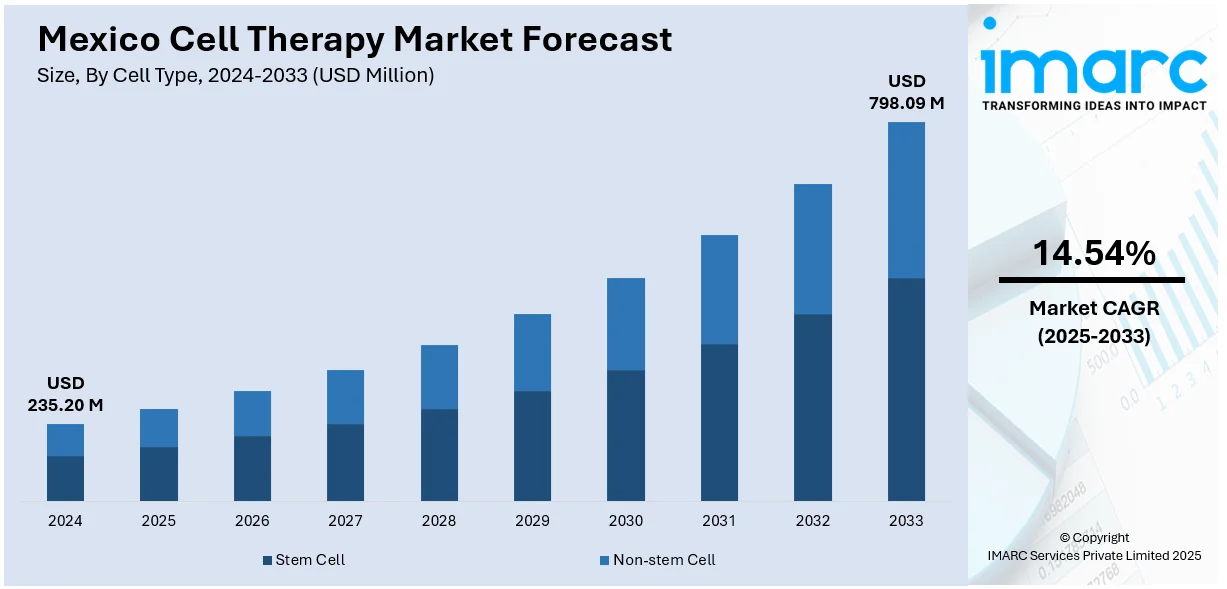

The Mexico cell therapy market size reached USD 235.20 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 798.09 Million by 2033, exhibiting a growth rate (CAGR) of 14.54% during 2025-2033. Healthcare modernization initiatives, international collaborations, regulatory enhancements by COFEPRIS, and government incentives for biotechnology companies are major market contributors. Expansion of medical tourism, affordable treatment offerings, clinical quality improvements, and rising domestic demand for regenerative therapies are additional factors. Insurance model evolution, university-led research growth, and patient access initiatives are some of the factors positively impacting the Mexico cell therapy market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 235.20 Million |

| Market Forecast in 2033 | USD 798.09 Million |

| Market Growth Rate 2025-2033 | 14.54% |

Mexico Cell Therapy Market Trends:

Advancement of National Healthcare Modernization Programs

One key driver shaping the market is the ongoing advancement of national healthcare modernization initiatives. The Mexican government is investing in upgrading healthcare infrastructure with a particular focus on expanding access to specialized medical services, including regenerative medicine and cell-based therapies. Through collaborations with international health organizations and private stakeholders, Mexico is facilitating technology transfer and capacity-building programs that enhance local expertise. New specialized hospitals and research centers are being established to support clinical application and commercialization of cell therapies. Regulatory improvements by agencies such as COFEPRIS are enabling a clearer and more efficient pathway for the approval of innovative therapies, enhancing both investor and public confidence. Additionally, government incentives for biotechnology startups and medical device companies are fostering a more dynamic innovation ecosystem. As a result, these strategic efforts are significantly driving Mexico cell therapy market growth across the country. Mexico’s large, diverse patient population also provides a fertile environment for clinical research and the validation of novel cell therapies. Partnerships with academic institutions are further reinforcing Mexico’s position as a developing hub for regenerative medicine, supporting the translation of scientific discoveries into patient-ready treatments across a range of therapeutic areas. On October 29, 2024, Terumo Blood and Cell Technologies announced its efforts to advance automated manufacturing of cell and gene therapies in Latin America, including Brazil, Colombia, and Mexico. The initiative focuses on improving efficiency and reducing costs in the production process, which is crucial for making these therapies more accessible to patients in the region, especially given the reliance on public healthcare systems.

Rising Medical Tourism and Regional Demand for Advanced Therapies

Another critical driver for the market is the rise of medical tourism, combined with increasing regional demand for cutting-edge therapeutic options. Mexico’s geographical proximity to the United States, combined with significantly lower treatment costs, makes it an attractive destination for patients seeking access to advanced cell-based therapies. Several specialized clinics and hospitals across major cities, such as Tijuana, Guadalajara, and Monterrey, are offering innovative regenerative treatments that meet international standards. This influx of foreign patients is stimulating further investment into clinical quality, regulatory compliance, and technological innovation. Simultaneously, the domestic demand for cell therapies is growing as awareness about regenerative medicine options spreads across different socioeconomic groups. Collaborative initiatives between public health authorities and private clinics are expanding patient access to approved regenerative therapies. On September 27, 2024, Johnson & Johnson announced that CARVYKTI® (ciltacabtagene autoleucel) has become the first and only cell therapy to significantly extend overall survival (OS) in patients with relapsed or lenalidomide-refractory multiple myeloma as early as second-line therapy. The Phase 3 CARTITUDE-4 study demonstrated a 45% reduction in the risk of death after a three-year follow-up, establishing CARVYKTI® as a transformative treatment for these patients. The evolution of insurance coverage models for specialized treatments is another significant factor facilitating wider adoption. Research and development efforts are also intensifying, with several Mexican universities playing an active role in clinical trials and laboratory innovation. Overall, the combination of cross-border healthcare demand, lower costs, high clinical expertise, and supportive government policies is strengthening Mexico’s emerging position in the global cell therapy landscape.

Mexico Cell Therapy Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on cell type, therapy type, therapeutic area, and end user.

Cell Type Insights:

- Stem Cell

- Bone Marrow

- Blood

- Umbilical Cord-Derived

- Adipose-Derived Stem Cell

- Others

- Non-stem Cell

The report has provided a detailed breakup and analysis of the market based on the cell type. This includes stem cell (bone marrow, blood, umbilical cord-derived, adipose-derived stem cell, and others) and non-stem cell.

Therapy Type Insights:

- Autologous

- Allogeneic

The report has provided a detailed breakup and analysis of the market based on the therapy type. This includes autologous and allogeneic.

Therapeutic Area Insights:

- Malignancies

- Musculoskeletal Disorders

- Autoimmune Disorders

- Dermatology

- Others

The report has provided a detailed breakup and analysis of the market based on the therapeutic area. This includes malignancies, musculoskeletal disorders, autoimmune disorders, dermatology, and others.

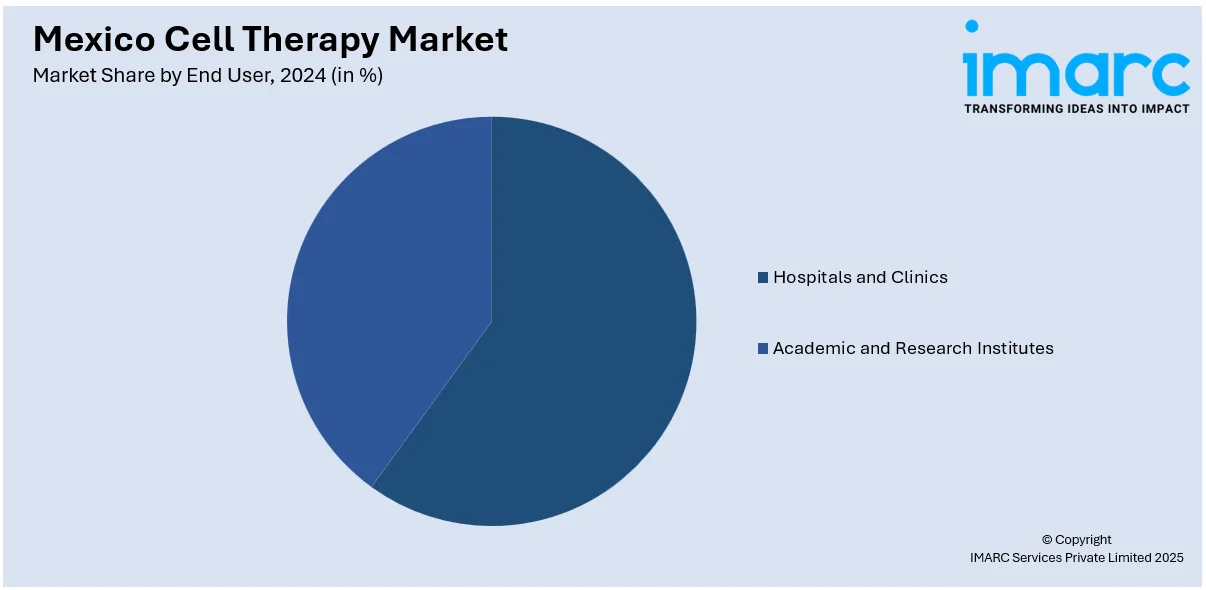

End User Insights:

- Hospitals and Clinics

- Academic and Research Institutes

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospitals and clinics and academic and research institutes.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Cell Therapy Market News:

- On April 8, 2025, Stem Vitality Mexico announced that it is expanding access to affordable stem cell treatments for patients from the U.S. and Canada, offering therapies for a range of conditions, including chronic pain, autoimmune disorders, and orthopedic issues. The clinic is leveraging Mexico's established medical tourism infrastructure to provide bilingual support, travel assistance, and personalized care.

Mexico Cell Therapy Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Cell Types Covered |

|

| Therapy Types Covered | Autologous, Allogeneic |

| Therapeutic Areas Covered | Malignancies, Musculoskeletal Disorders, Autoimmune Disorders, Dermatology, Others |

| End Users Covered | Hospitals and Clinics, Academic and Research Institutes |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico cell therapy market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico cell therapy market on the basis of cell type?

- What is the breakup of the Mexico cell therapy market on the basis of therapy type?

- What is the breakup of the Mexico cell therapy market on the basis of therapeutic area?

- What is the breakup of the Mexico cell therapy market on the basis of end user?

- What is the breakup of the Mexico cell therapy market on the basis of region?

- What are the various stages in the value chain of the Mexico cell therapy market?

- What are the key driving factors and challenges in the Mexico cell therapy market?

- What is the structure of the Mexico cell therapy market and who are the key players?

- What is the degree of competition in the Mexico cell therapy market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico cell therapy market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico cell therapy market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico cell therapy industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)