Mexico Cement Additives Market Size, Share, Trends and Forecast by Type, Function, and Region, 2025-2033

Mexico Cement Additives Market Overview:

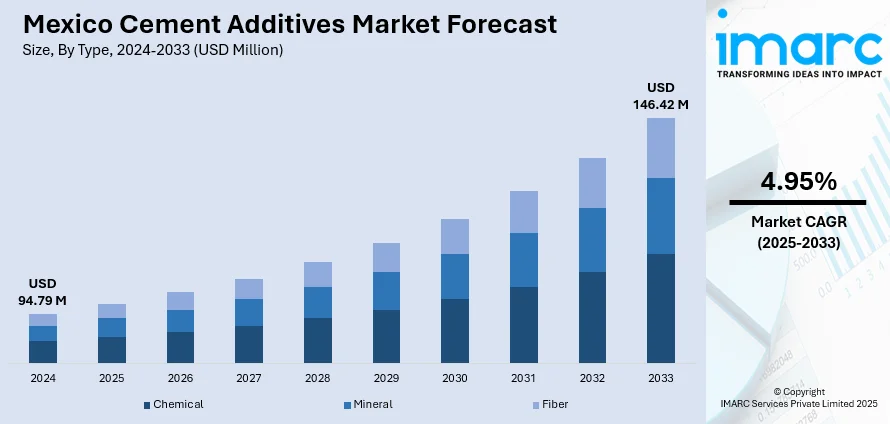

The Mexico cement additives market size reached USD 94.79 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 146.42 Million by 2033, exhibiting a growth rate (CAGR) of 4.95% during 2025-2033. Considerable growth in the construction industry is fueling the market for high-performance cement additives. Additionally, improved technologies in the manufacture of cement are propelling the usage of specialist additives to optimize the properties of cement and lower the environmental footprint. Moreover, the increasing need for green building materials is encouraging the industry towards eco-friendly, high-efficiency additives, thus augmenting the Mexico cement additives market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 94.79 Million |

| Market Forecast in 2033 | USD 146.42 Million |

| Market Growth Rate 2025-2033 | 4.95% |

Mexico Cement Additives Market Analysis:

- Major Market Drivers: Growth of Mexico's construction industry, fueled by fast-paced urbanization and infrastructure expansion, strongly drives market demand. Government spending on public infrastructure, residential construction, and commercial building development generates persistent demand for performance-enhancing cement additives that improve durability, workability, and environmental compatibility in varied construction applications.

- Key Market Trends: Innovations in cement technology are defining industry trends, with producers embracing environmentally friendly additives to minimize carbon footprint and enhance efficiency. The Mexico cement additives market research indicates growing use of specialized additives such as retarders, accelerators, and plasticizers that optimize cement properties for current construction standards and green building practices.

- Competitive Landscape: As per Mexico cement additives market analysis, the industry is dominated by established global firms and regional producers who compete in product development and strategic alliances. Firms are spending money on research and development to produce sophisticated cement additives that address changing construction needs while responding to environmental issues and regulatory compliance requirements.

- Challenges and Opportunities: Market risks are raw material price fluctuations and regulation-compliance expenses. Opportunities arise due to increasing demand for green building products, infrastructure upgrade projects, and technology developments improving additive performance with less environmental footprint and lower production costs.

To get more information on this market, Request Sample

Mexico Cement Additives Market Trends:

Construction Industry Expansion

The expansion of the construction sector is one of the major drivers of the market in Mexico. Rapid urbanization and infrastructure development in the country are some of the prominent reasons behind the expansion. As Mexico keeps spending on public infrastructure, housing, and commercial construction, there is a growing demand for high-performance cement that will be able to satisfy the requirements of new-generation construction standards. Cement additives, including retarders, accelerators, and plasticizers, improve the characteristics of cement to make it longer lasting, more workable, and compatible with a variety of environmental conditions. In response to these large construction activities, the demand for improved quality cement increases, and consequently, the market for cement additives grows. The Mexican government's focus on urbanization and infrastructure, backed by large investments in public and private sectors, has further increased demand for these specialized additives. Cement producers are increasingly using additives to enhance product performance, which further stimulates Mexico cement additives market growth. On June 5, 2024, Graphenemex, a prominent Mexican provider of graphene materials, introduced innovative concrete and cement additives using graphene oxide (GO) to enhance the durability and strength of concrete. These additives improve properties such as mechanical resistance, impermeability, and thermal insulation, making them ideal for infrastructure exposed to aggressive environments. The use of GO in concrete has shown to significantly increase compressive strength by up to 18.7%, reduce thermal conductivity, and enhance resistance to chloride penetration, offering both economic and environmental benefits in construction projects. With the ongoing demand for stronger, more sustainable structures, the market for cement additives is expected to experience steady growth over the coming years.

Technological Advancements in Cement Production

Advancements in cement production technologies are significantly influencing the demand for cement additives in Mexico. As cement manufacturers strive for greater efficiency and reduced environmental impact, they are adopting new production methods that require the use of specific additives to optimize the manufacturing process. The increasing focus on reducing the carbon footprint of cement production has led to the development of more eco-friendly additives, such as those that enhance the efficiency of the cement mixing process or improve the curing time. Innovations in additive technology allow for enhanced control over the properties of cement, enabling manufacturers to meet specific project requirements and improve overall quality. As the industry embraces these technological advancements, the need for additives that support sustainability and improve cement performance becomes even more prominent. Cemex, a leader in cement and construction materials, is innovating with cement additives to reduce CO₂ emissions, including its Vertua line, which achieves a 30% reduction in CO₂ compared to traditional products. By the end of 2023, Cemex surpassed its target of having 50% of its total sales come from lower-carbon products, demonstrating significant market acceptance despite regulatory challenges. The rise of green construction practices and the demand for sustainable building materials have further pushed the market toward the development and use of specialized cement additives, providing both environmental benefits and cost-effective solutions for manufacturers. These technological improvements in cement production continue to shape the market, driving further Mexico cement additives market demand for advanced additive solutions.

Mexico Cement Additives Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and function.

Type Insights:

- Chemical

- Mineral

- Fiber

The report has provided a detailed breakup and analysis of the market based on the type. This includes chemical, mineral, and fiber.

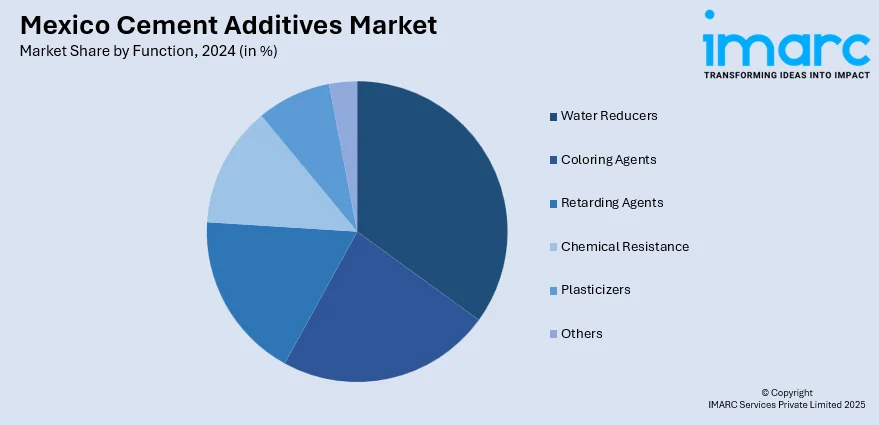

Function Insights:

- Water Reducers

- Coloring Agents

- Retarding Agents

- Chemical Resistance

- Plasticizers

- Others

The report has provided a detailed breakup and analysis of the market based on the function. This includes water reducers, coloring agents, retarding agents, chemical resistance, plasticizers, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Recent News and Developments:

- In September 2024, Cemex launched its Vertua damp-proof cement at the Construrama Convention. The water-repellent cement, designed to address humidity issues, requires no special dosing and mixes like standard grey cement, offering enhanced structural protection and a smoother finish for construction projects across Mexico.

Mexico Cement Additives Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Chemical, Mineral, Fiber |

| Functions Covered | Water Reducers, Coloring Agents, Retarding Agents, Chemical Resistance, Plasticizers, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico cement additives market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico cement additives market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico cement additives industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cement additives market in Mexico was valued at USD 94.79 Million in 2024.

The Mexico cement additives market is projected to exhibit a CAGR of 4.95% during 2025-2033, reaching a value of USD 146.42 Million by 2033.

The market is driven by considerable growth in the construction industry, improved cement manufacturing technologies, increasing demand for green building materials, rapid urbanization, infrastructure development investments, and the need for high-performance cement additives that enhance durability and environmental compatibility.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)