Mexico Cement Board Market Size, Share, Trends and Forecast by Product Type, Application, End Use Industry, and Region, 2025-2033

Mexico Cement Board Market Overview:

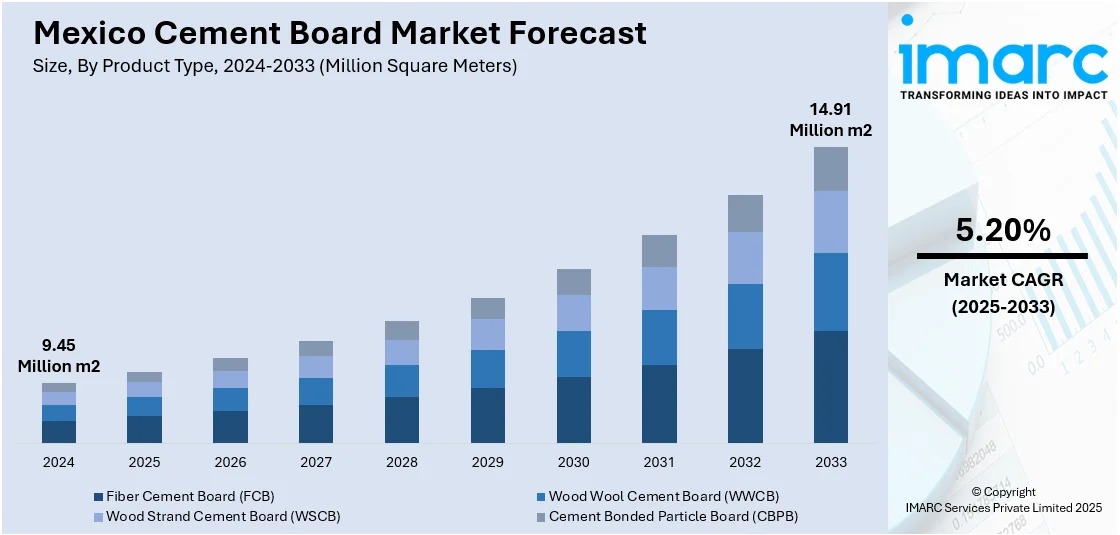

The Mexico cement board market size reached 9.45 Million Square Meters in 2024. Looking forward, IMARC Group expects the market to reach 14.91 Million Square Meters by 2033, exhibiting a growth rate (CAGR) of 5.20% during 2025-2033. The market is driven by booming urbanization, the growing need for sustainable construction materials, and commercial and residential building construction. Enhanced emphasis on water resistance as well as fire protection also encourages adoption of cement boards, boosting the Mexico cement board market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 9.45 Million Square Meters |

| Market Forecast in 2033 | 14.91 Million Square Meters |

| Market Growth Rate 2025-2033 | 5.20% |

Mexico Cement Board Analysis:

- Major Drivers: Urbanization and infrastructure development initiatives in Mexico are fueling significant demand for cement boards. Public infrastructure investments by the government and increasing foreign direct investment result in stable construction activity, which increases the Mexico cement board market demand.

- Key Market Trends: Advances in the technology of cement board production have improved product strength and fire resistance. Innovation in light weight and flexible board design is broadening application possibilities, bolstering the Mexico cement board market analysis for additional growth.

- Market Challenges: Volatile raw material prices and supply chain volatility challenge manufacturers. Competition from substitute building materials and regulatory compliance needs could affect market penetration and pricing programs.

- Market Opportunities: According to the Mexico cement board market forecast, the rising focus on sustainable building materials offers major opportunities. The move towards fire retardant and water retardant building solutions provides new market niches for niche cement board products.

Mexico Cement Board Market Trends:

Urbanization and Infrastructure Development

Mexico’s rapid urbanization and infrastructure development are significant factors driving the cement board market. For instance, according to industry reports, Mexico attracted a record USD 36.87 Billion in Foreign Direct Investment (FDI) in 2024, representing a 2.3% increase from 2023. This surge in FDI, coupled with the proposed 2024 budget showing a 4.9% GDP deficit, indicates sustained investment across various sectors, including infrastructure. As urban areas grow and new residential, commercial, and industrial developments arise, the need for functional and long-lasting building materials such as cement boards grows. These boards are especially useful in densely populated urban centers, where fire resistance and water resistance take precedence. The development of public and private infrastructure projects nationwide further drives demand, as cement boards find more applications in new constructions and even repairs. With the increasing growth in urbanization, the Mexico cement board market growth is likely to persist, with cement boards becoming a norm in the construction sector.

To get more information on this market, Request Sample

Technological Advancements and Innovation

Advancements in cement board manufacturing technology have led to improved product performance and cost-efficiency, spurring growth in the Mexico cement board market. The development of lighter, stronger, and more versatile boards has expanded their range of applications, from exterior facades to interior walls and ceilings. Innovations have also enhanced moisture resistance, making cement boards suitable for humid environments like kitchens and bathrooms. Additionally, new manufacturing processes have reduced production costs, allowing cement boards to become more affordable for a wider range of projects. For instance, in April 2025, Cemex Ventures made an investment in OPTIMITIVE, a Spanish firm leveraging AI and advanced analytics to optimize processes in energy-intensive sectors, including cement. This collaboration focuses on reducing energy consumption and boosting efficiency at Cemex facilities. OPTIMITIVE’s AI software offers real-time process optimization and a no-code design, facilitating widespread adoption. The partnership supports Cemex’s goal of achieving carbon neutrality through enhanced energy efficiency and more sustainable production practices. These technological improvements are driving increased adoption of cement boards in Mexico, contributing to the overall Mexico cement board market share and its expansion in the construction sector.

Mexico Cement Board Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, application, and end use industry.

Product Type Insights:

- Fiber Cement Board (FCB)

- Wood Wool Cement Board (WWCB)

- Wood Strand Cement Board (WSCB)

- Cement Bonded Particle Board (CBPB)

The report has provided a detailed breakup and analysis of the market based on the product type. This includes fiber cement board (FCB), wood wool cement board (WWCB), wood strand cement board (WSCB), and cement bonded particle board (CBPB).

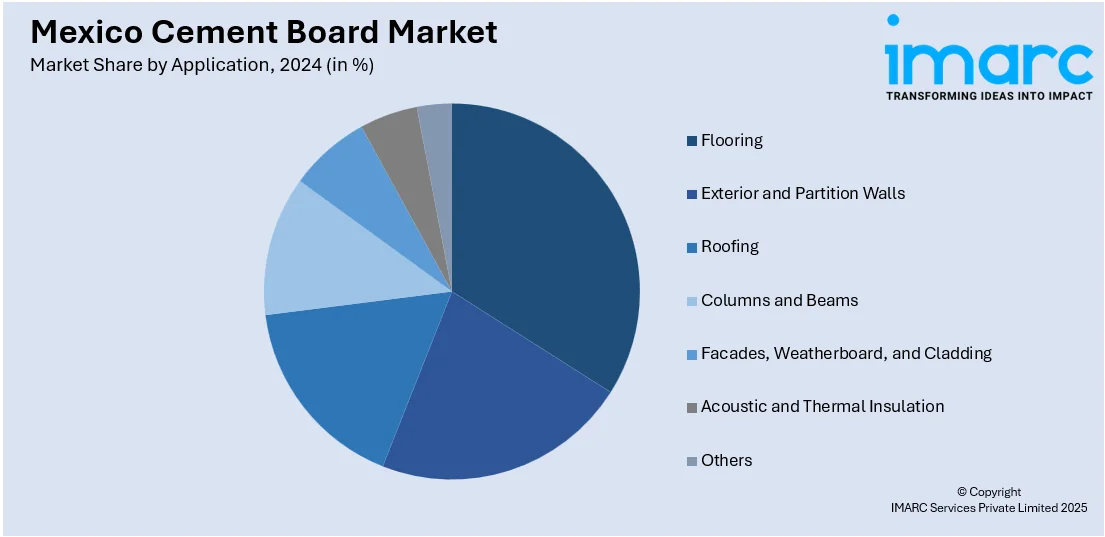

Application Insights:

- Flooring

- Exterior and Partition Walls

- Roofing

- Columns and Beams

- Facades, Weatherboard, and Cladding

- Acoustic and Thermal Insulation

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes flooring, exterior and partition walls, roofing, columns and beams, facades, weatherboard, and cladding, acoustic and thermal insulation, and others.

End Use Industry Insights:

- Residential

- Commercial

- Industrial and Institutional

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes residential, commercial, and industrial and institutional.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Cement Board Market News:

- In September 2024, Cemex has introduced a new water-repellent cement under its Vertua brand to tackle dampness and extend the lifespan of construction projects. The specialty cement mixes like traditional grey cement without dosing and offers a smooth, uniform finish. Launched at the Construrama Convention on 12 September 2024, the product provides added protection against humidity, addressing a common challenge across Mexican construction sites.

- In August 2024, Cemento Cruz Azul inaugurated a new industrial byproducts processing line at its Tepezalá plant in Aguascalientes, Mexico. The $8.5 million facility will create 100 jobs and convert 66,000 tons of post-consumer materials into energy for cement production. This project aligns with sustainability goals and environmental preservation.

Mexico Cement Board Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Square Meters |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Fiber Cement Board (FCB), Wood Wool Cement Board (WWCB), Wood Strand Cement Board (WSCB), Cement Bonded Particle Board (CBPB) |

| Applications Covered | Flooring, Exterior and Partition Walls, Roofing, Columns and Beams, Facades, Weatherboard, and Cladding, Acoustic and Thermal Insulation, Others |

| End-User Industries Covered | Residential, Commercial, Industrial and Institutional |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico cement board market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico cement board market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico cement board industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cement board market in Mexico was valued at 9.45 Million Square Meters in 2024.

The Mexico cement board market is projected to exhibit a CAGR of 5.20% during 2025-2033, reaching a value of 14.91 Million Square Meters by 2033.

The market is driven by rapid urbanization, infrastructure development projects, growing demand for fire-resistant and water-resistant building materials, technological advancements in manufacturing processes, and increasing foreign direct investment of USD 36.87 billion in 2024 supporting construction sector growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)