Mexico Cement Clinker Market Size, Share, Trends and Forecast by Type, Distribution Channel, Application, End-Use Industry, and Region, 2025-2033

Mexico Cement Clinker Market Overview:

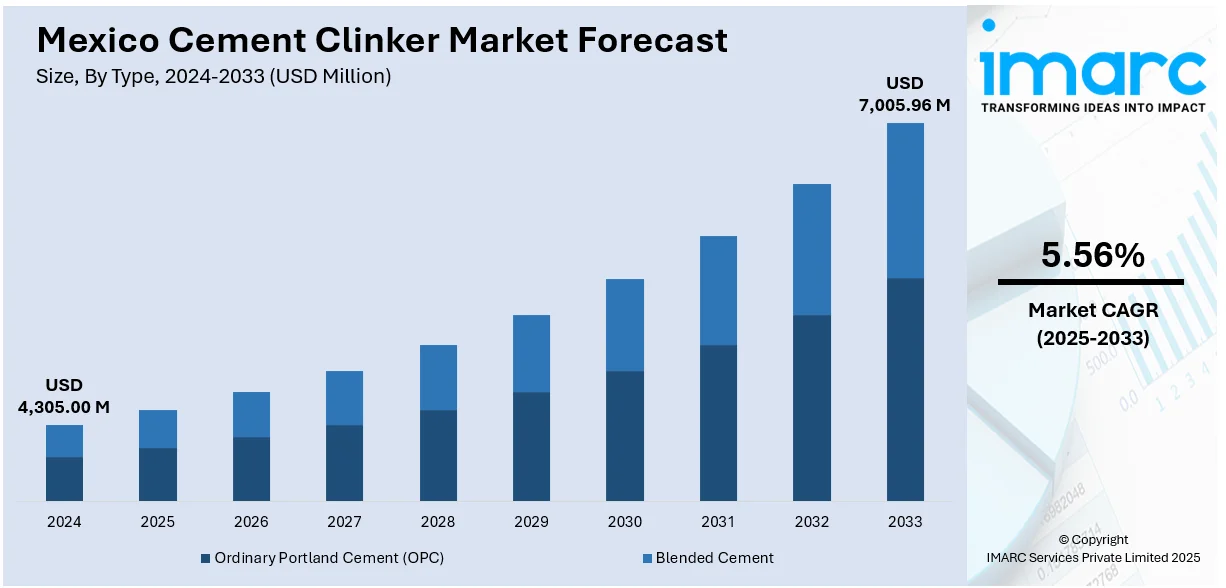

The Mexico cement clinker market size reached USD 4,305.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 7,005.96 Million by 2033, exhibiting a growth rate (CAGR) of 5.56% during 2025-2033. Infrastructure development and rising renewable energy demand are driving the market. As urban populations grow, construction of housing, commercial spaces, and transport networks catalyzes the overall demand. Additionally, renewable energy projects, such as wind, solar, and hydropower, require substantial cement for their infrastructure, thereby contributing to the expansion of the Mexico cement clinker market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4,305.00 Million |

| Market Forecast in 2033 | USD 7,005.96 Million |

| Market Growth Rate 2025-2033 | 5.56% |

Mexico Cement Clinker Market Analysis:

- Major Market Drivers: Large-scale infrastructure projects, residential construction, and industrial development primarily drive the Mexico cement clinker market. Transportation, housing, and urbanization projects driven by government investment spur consumption. Growth in the demand for durable, cost-efficient building materials also provides support to clinker's role as a fundamental input into cement manufacturing.

- Key Market Trends: Sustainability is becoming a trending theme, with growing usage of energy-efficient kiln technologies and substitute fuels in a bid to lower emissions. Green building standards coupled with cement plant modernization is informing innovation. Mexico cement clinker market demand is rising in both local construction requirements and export opportunity in local trade.

- Competitive Landscape: The market is characterized by fierce competition with producers seeking to maximize production efficiency and extend distribution channels. Regional manufacturers are emphasizing product quality, logistics capacity, and medium to long-term supply contracts with construction firms. Investment in advanced technologies ensures differentiation for the participants and a more dynamic and robust competitive arena.

- Challenges and Opportunities: Growing environmental issues and energy prices create operational hurdles for clinker manufacturing. But the opportunities exist in embracing low-carbon technology, creating substitute raw materials, and using trade agreements to push export markets further. Finding the balance between sustainability and cost effectiveness can unlock tremendous growth potential in the growing Mexico cement clinker market.

Mexico Cement Clinker Market Trends:

Infrastructure Development

As urban population grows, the demand for housing, commercial spaces, and transportation networks intensifies, leading to a surge in the need for cement. Cement clinker, a crucial component in cement production, is directly influenced by these construction trends. Infrastructure projects, such as roads, bridges, airports, and public utilities, are vital in meeting the needs of the growing urban centers. As large-scale construction activities proliferate, the demand for cement clinker escalates to support these developments. A significant instance of this expansion is Mexico's national development strategy revealed by President Claudia Sheinbaum in 2024, featuring the building of 3,000 km of new railway lines, 1 million housing units, and 100 industrial zones. This bold initiative included the creation of 10 industrial corridors and notable highway renovations designed to enhance connectivity and draw in investment. The strategy also emphasized the expansion of the Maya Train and the revitalization of the Querétaro rail system to improve connectivity and draw investment. Moreover, considerable highway renovations and the creation of 10 industrial corridors were also part of efforts to enhance infrastructure and promote regional growth. These extensive infrastructure initiatives throughout Mexico are catalyzing the demand for cement and clinker, as the requirement for materials to build transportation networks, housing, and industrial structures escalates quickly. This ongoing infrastructure expansion, driven by both government initiatives and private investment, is impelling the Mexico cement clinker market analysis and growth.

To get more information on this market, Request Sample

Rising Demand from Renewable Energy Sector

The increasing focus on renewable energy initiatives is boosting the need for cement clinker, as these initiatives necessitate considerable quantities of cement for their foundational and structural components. Infrastructure for renewable energy, including wind farms, solar power facilities, and hydropower initiatives, requires notable amounts of concrete, highlighting cement's importance in their development. As Mexico progresses toward cleaner energy options, extensive renewable energy projects are becoming prevalent, particularly in areas rich in natural resources. This transition is driving the need for cement, which, in turn, catalyzes the demand for cement clinker, an essential component for these energy initiatives. A notable instance of this is Mexico's announcement of a US$23 billion investment in its National Strategy for the Electricity Sector 2024–2030 in 2024. The strategy intended to greatly enlarge Mexico's energy framework, with funds allocated to improve the Federal Electricity Commission (CFE) and private initiatives. This involved increasing power generation capacity by 13,024 MW, enhancing grid reliability, and providing improved energy access. The funding was designated with US$12.3 billion for generation, US$7.5 billion for transmission, and US$3.6 billion for distribution. Such investments in renewable energy will necessitate comprehensive infrastructure, featuring cement-heavy elements, which will fuel the demand for cement clinker.

Mexico Cement Clinker Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, distribution channel, application, and end-use industry.

Type Insights:

- Ordinary Portland Cement (OPC)

- Blended Cement

The report has provided a detailed breakup and analysis of the market based on the type. This includes ordinary Portland cement (OPC) and blended cement.

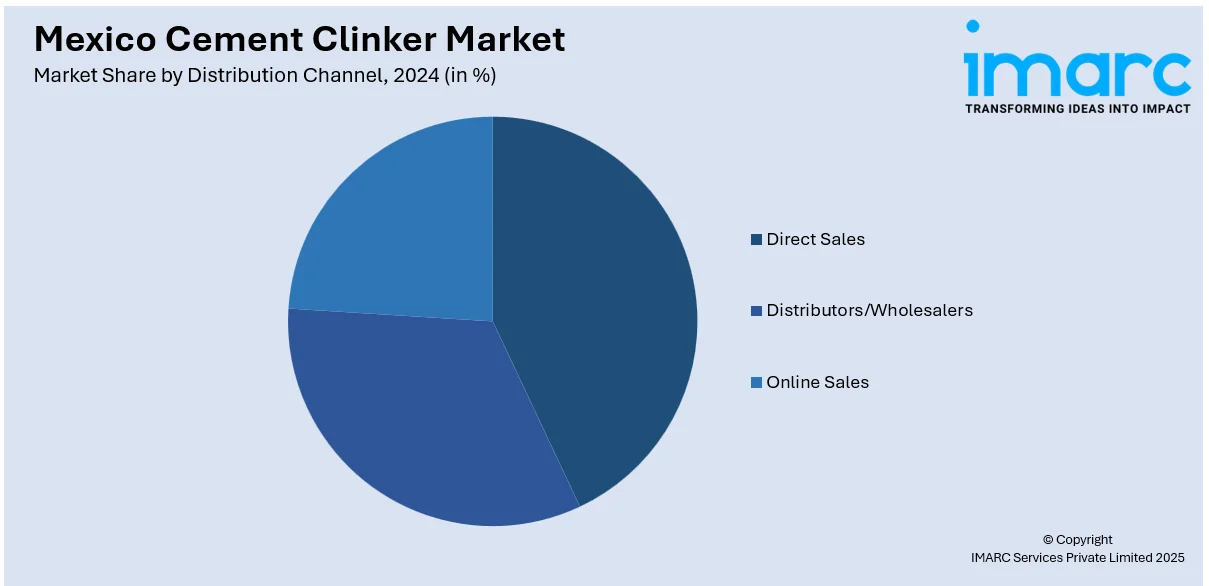

Distribution Channel Insights:

- Direct Sales

- Distributors/Wholesalers

- Online Sales

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes direct sales, distributors/wholesalers, and online sales.

Application Insights:

- Residential

- Commercial

- Infrastructure

The report has provided a detailed breakup and analysis of the market based on the application. This includes residential, commercial, and infrastructure.

End-Use Industry Insights:

- Construction

- Manufacturing

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes construction and manufacturing.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Cement Clinker Market News:

- In November 2024, Cemex, based in Monterrey, Mexico, was recognized at COP29 with the Net-Zero Industries Award for its solar clinker breakthrough. Using concentrated solar power developed with Synhelion, Cemex aimed to decarbonize cement production. This marked a major sustainability milestone for Mexico’s industrial sector.

Mexico Cement Clinker Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Ordinary Portland Cement (OPC), Blended Cement |

| Distribution Channels Covered | Direct Sales, Distributors/Wholesalers, Online Sales |

| Applications Covered | Residential, Commercial, Infrastructure |

| End-Use Industries Covered | Construction, Manufacturing |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico cement clinker market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico cement clinker market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico cement clinker industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cement clinker market in Mexico was valued at USD 4,305.00 Million in 2024.

The Mexico cement clinker market is projected to exhibit a CAGR of 5.56% during 2025-2033, reaching a value of USD 7,005.96 Million by 2033.

The key factors driving the Mexico cement clinker market include rapid urbanization, growing infrastructure investments, and rising demand for residential and commercial construction. Government-backed development projects, coupled with increased industrial activity, fuel clinker consumption. Additionally, modernization of production facilities and emphasis on sustainable building practices support long-term market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)