Mexico Ceramic Matrix Composites Market Size, Share, Trends and Forecast by Composite Type, Fiber Type, Fiber Material, Application, and Region, 2026-2034

Mexico Ceramic Matrix Composites Market Summary:

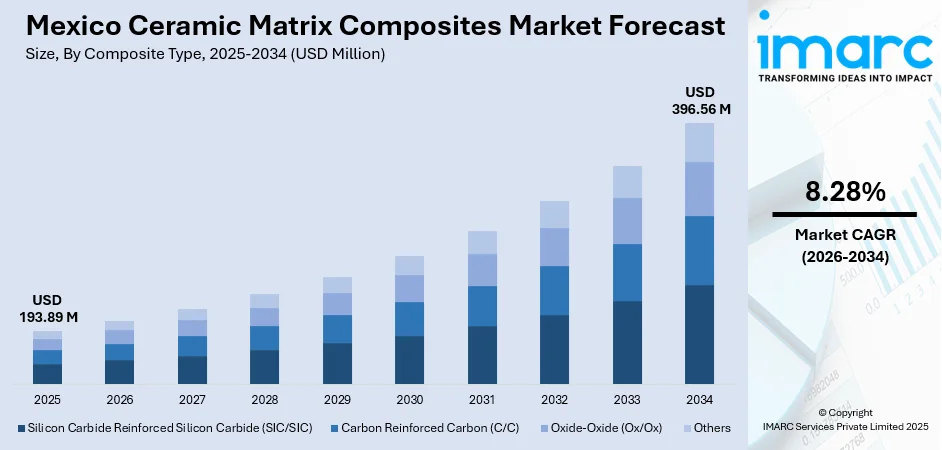

The Mexico ceramic matrix composites market size was valued at USD 193.89 Million in 2025 and is projected to reach USD 396.56 Million by 2034, growing at a compound annual growth rate of 8.28% from 2026-2034.

The Mexico ceramic matrix composites market is experiencing robust expansion driven by increasing aerospace and defense activities across the country. Growing demand for lightweight, high-temperature resistant materials in aircraft components and defense systems is accelerating adoption. The automotive sector's transition toward high-performance braking systems and energy-efficient components further support market growth. Industrial applications requiring superior thermal stability and wear resistance are contributing to rising demand for ceramic matrix composites market share.

Key Takeaways and Insights:

-

By Composite Type: Silicon Carbide Reinforced Silicon Carbide (SIC/SIC) dominates the market with a share of 35.20% in 2025, driven by its exceptional thermal stability, high strength-to-weight ratio, and superior performance in extreme temperature applications across aerospace and energy sectors.

-

By Fiber Type: Continuous fiber leads the market with a share of 69.39% in 2025, owing to its superior load-bearing capacity, enhanced mechanical properties, and ability to provide consistent reinforcement throughout the composite structure for critical aerospace applications.

-

By Fiber Material: SiC fiber represents the largest segment with a market share of 43.09% in 2025, attributed to its outstanding oxidation resistance, excellent creep resistance at elevated temperatures, and compatibility with advanced ceramic matrix systems used in jet engines.

-

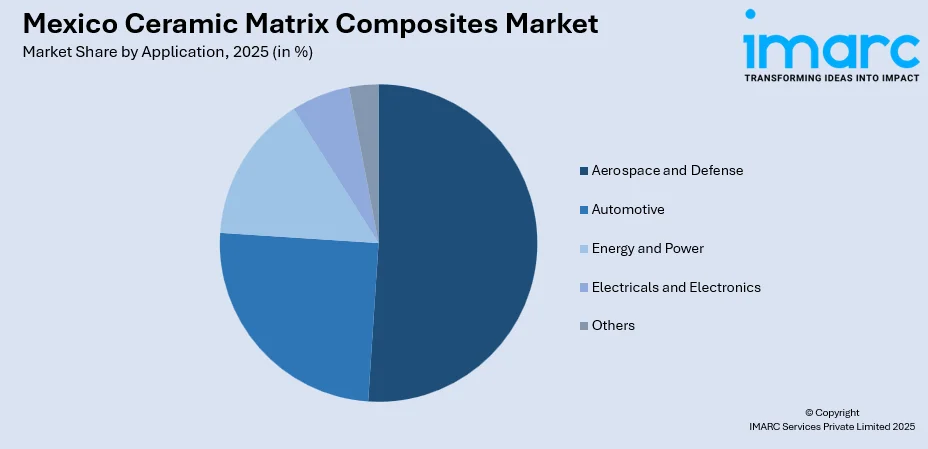

By Application: Aerospace and defense exhibit clear dominance with a 51.10% share in 2025, fueled by rising aircraft manufacturing activities, defense modernization programs, and increasing adoption of advanced materials for turbine components and thermal protection systems.

-

Key Players: The Mexico ceramic matrix composites market exhibits moderate competitive intensity, with multinational advanced materials manufacturers competing alongside specialized composite producers. Market participants focus on technological innovation, strategic partnerships with aerospace OEMs, and capacity expansion to strengthen market positioning.

To get more information on this market Request Sample

The Mexico ceramic matrix composites market is characterized by significant technological advancement and growing industrial adoption. The country's strategic position in North American manufacturing supply chains enhances its attractiveness for ceramic matrix composite production and consumption. Increasing investments in aerospace manufacturing infrastructure across multiple states are catalyzing market growth. The presence of major aerospace clusters in Northern and Central Mexico provides essential ecosystem support for advanced materials development. In 2025, GE Aerospace announced a US$29.4 million investment to expand and enhance its manufacturing operations in Mexico, underscoring the increasing role of advanced aerospace manufacturing within the country’s industrial landscape. Government initiatives promoting high-technology manufacturing and foreign direct investment in aerospace sector contribute to market expansion. Research collaborations between academic institutions and industry players are advancing local ceramic matrix composite capabilities. The market benefits from proximity to major aerospace markets in the United States, enabling efficient supply chain integration and technology transfer.

Mexico Ceramic Matrix Composites Market Trends:

Growing Aerospace Manufacturing Ecosystem

Mexico's aerospace sector continues expanding with over 350 industrial facilities operating across 19 states, employing more than 60,000 skilled workers. The country has evolved from producing simple components to manufacturing complex aerostructures, landing gear systems, and propulsion components. This advancement creates substantial demand for high-performance ceramic matrix composites in aircraft turbine components, thermal protection systems, and exhaust structures requiring exceptional heat resistance. This growth also drives investment in research, development, and adoption of advanced materials and manufacturing technologies.

Automotive Lightweighting Initiatives

The automotive industry in Mexico is increasingly adopting ceramic matrix composites for high-performance braking systems and thermal management components. In May 2025, Tata AutoComp Systems and Monterrey‑based supplier Katcon Global formed a joint venture in Mexico to manufacture advanced lightweight composite materials for the North American automotive market, signaling stronger local capabilities in composite technologies. Growing environmental regulations and fuel efficiency requirements are driving manufacturers toward lightweight materials that offer superior performance characteristics. Ceramic matrix composite brake discs provide enhanced stopping power, reduced weight, and extended service life compared to conventional materials, making them attractive for premium vehicle applications.

Technology Transfer and Local Capability Development

Strategic partnerships between international aerospace companies and Mexican manufacturers are facilitating technology transfer in advanced composite materials. At the 2025 Feria Aeroespacial México (FAMEX 2025), several aerospace clusters in Mexico signed collaboration agreements that include technical exchanges and supplier certifications to strengthen supply chains and innovation across regions, underscoring growing cooperation between global OEMs and domestic industry players. Research centers and technical universities across aerospace clusters are developing specialized programs focused on composite materials engineering. These initiatives are building local expertise in ceramic matrix composite processing, testing, and quality assurance, supporting market growth through enhanced domestic capabilities.

Market Outlook 2026-2034:

The Mexico ceramic matrix composites market outlook remains positive throughout the forecast period, supported by sustained growth in aerospace manufacturing and the steady expansion of industrial applications. Rising adoption across defense, automotive, and energy sectors is expected to further accelerate market expansion. Additionally, continued foreign direct investment in aerospace manufacturing infrastructure, along with a growing emphasis on advanced materials research, innovation, and high-performance component development, will collectively support long-term market growth and competitiveness. The market generated a revenue of USD 193.89 Million in 2025 and is projected to reach a revenue of USD 396.56 Million by 2034, growing at a compound annual growth rate of 8.28% from 2026-2034.

Mexico Ceramic Matrix Composites Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Composite Type |

Silicon Carbide Reinforced Silicon Carbide (SIC/SIC) |

35.20% |

|

Fiber Type |

Continuous Fiber |

69.39% |

|

Fiber Material |

SiC Fiber |

43.09% |

|

Application |

Aerospace and Defense |

51.10% |

Composite Type Insights:

- Silicon Carbide Reinforced Silicon Carbide (SIC/SIC)

- Carbon Reinforced Carbon (C/C)

- Oxide-Oxide (Ox/Ox)

- Others

The silicon carbide reinforced silicon carbide (SIC/SIC) dominates with a market share of 35.20% of the total Mexico ceramic matrix composites market in 2025.

Silicon carbide reinforced silicon carbide composites have emerged as the preferred choice for high-temperature aerospace applications due to their exceptional thermal stability and mechanical strength retention at elevated temperatures. Major aerospace OEMs and material producers are expanding SiC‑based CMC capabilities. In 2025, GE Aerospace, leveraging joint ventures and an expanded manufacturing footprint, increased production of CMC raw materials and parts, highlighting growing industry momentum for high‑temperature composites. These composites maintain structural integrity at temperatures exceeding conventional metallic alloys, making them essential for next-generation turbine engine components.

The rising use of ceramic matrix composites in aerospace is driven by substantial weight savings over traditional superalloys, which improve fuel efficiency and lower emissions. Advanced manufacturing methods, such as chemical vapor infiltration and polymer infiltration pyrolysis, are boosting production efficiency and reducing costs. These innovations support wider adoption of CMCs across Mexico’s growing aerospace sector, where expanding manufacturing capabilities are increasingly integrating high-performance materials into turbine engines and structural components.

Fiber Type Insights:

- Short Fiber

- Continuous Fiber

The continuous fiber leads with a share of 69.39% of the total Mexico ceramic matrix composites market in 2025.

Continuous fiber reinforcement provides superior mechanical properties essential for demanding aerospace and defense applications. The uninterrupted fiber architecture enables efficient load transfer throughout the composite structure, resulting in enhanced tensile strength, improved fracture toughness, and reliable performance under cyclic loading conditions. In 2025, Continuous Composites secured multi‑million‑dollar U.S. Air Force funding to advance its CF3D® continuous fiber 3D printing technology for high‑performance aerospace parts, demonstrating industry confidence in continuous fiber composite processes for mission‑critical applications.

Demand for continuous fiber composites is rising across Mexico’s aerospace clusters, driven by their predictable failure modes and damage tolerance essential for flight-critical components. Advances in fiber processing and weaving technologies are broadening design possibilities while preserving performance advantages, ensuring compliance with stringent aerospace certification standards. These developments position continuous fiber composites as key enablers of lighter, more efficient, and reliable structures in Mexico’s expanding aerospace manufacturing ecosystem.

Fiber Material Insights:

- Alumina Fiber

- Refractory Ceramic Fiber (RCF)

- SiC Fiber

- Others

The SiC fiber dominates with a market share of 43.09% of the total Mexico ceramic matrix composites market in 2025.

Silicon carbide fibers offer outstanding high-temperature performance, critical for advanced aerospace propulsion systems. They retain mechanical strength and resist oxidation at extreme temperatures that degrade alternative fibers, ensuring dependable operation in jet engine hot sections and thermal protection systems. Their durability under severe thermal and mechanical stresses makes them ideal for next-generation aerospace applications, supporting enhanced engine efficiency, safety, and lifespan while enabling components to withstand conditions that traditional materials cannot tolerate.

Rising demand for fuel-efficient, high-temperature aircraft engines is driving wider adoption of silicon carbide fibers. Third-generation SiC fibers with near-stoichiometric compositions deliver superior creep resistance and microstructural stability, essential for long-term aerospace performance. Expanded production capacity, combined with ongoing cost-reduction initiatives, is facilitating broader integration of these fibers into both aerospace and industrial applications, supporting the development of more efficient, durable, and reliable high-performance components in turbine engines, thermal systems, and other extreme-environment technologies.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Aerospace and Defense

- Automotive

- Energy and Power

- Electricals and Electronics

- Others

The aerospace and defense leads with a share of 51.10% of the total Mexico ceramic matrix composites market in 2025.

The aerospace and defense sector represents the primary consumption segment for ceramic matrix composites due to stringent performance requirements for high-temperature structural components. Aircraft turbine engines, thermal protection systems, and exhaust structures demand materials capable of maintaining mechanical integrity under extreme thermal and mechanical loading conditions encountered during flight operations. In December 2025, Safran began a major expansion of its Safran Aero Composites facility in Querétaro to add production lines for advanced composite parts used in LEAP engine fan modules, reinforcing Mexico’s role in supplying high‑performance aerospace components to global OEMs.

Mexico’s strategic role in global aerospace supply chains is driving sustained demand growth for ceramic matrix composites. Major OEMs and tier-one suppliers across multiple manufacturing hubs generate significant end-use consumption. Defense modernization initiatives and expanding aircraft fleets further fuel market growth, as CMCs deliver enhanced performance, higher temperature resistance, and lower maintenance needs. These factors position Mexico as a key market for advanced composite adoption in aerospace propulsion, structures, and thermal protection systems.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico represents the dominant regional market, anchored by major aerospace clusters in Baja California, Chihuahua, Sonora, and Nuevo León. The region hosts numerous aerospace companies and a skilled workforce. Proximity to United States markets facilitates supply chain integration and technology transfer, while established manufacturing infrastructure supports advanced composite materials processing.

Central Mexico, led by the Querétaro aerospace cluster, represents a strategic hub for ceramic matrix composites demand. The region hosts major aerospace OEMs including turbine engine manufacturers and houses the largest aeronautical engineering center in Latin America. Dedicated aerospace industrial parks, research institutions, and technical universities support advanced materials development and skilled workforce availability.

Southern Mexico presents emerging opportunities for ceramic matrix composites market development, supported by growing industrial diversification efforts. The region is developing capabilities in automotive and energy sectors that utilize advanced composite materials. Government initiatives promoting industrial development and infrastructure investments are creating foundations for expanded aerospace and high-technology manufacturing activities.

Other regions across Mexico contribute to ceramic matrix composites demand through distributed industrial activities and emerging manufacturing capabilities. Growing automotive production facilities and energy sector investments in various states create supplementary demand. Infrastructure development and industrial policy support are enabling capability building for advanced materials applications across developing industrial zones.

Market Dynamics:

Growth Drivers:

Why is the Mexico Ceramic Matrix Composites Market Growing?

Expanding Aerospace Manufacturing Ecosystem

Mexico's aerospace industry has grown into an important global manufacturing center. The sector has attracted significant foreign investment and become a competitive destination for major OEMs and suppliers. According to recent reports, the country has attracted over $3.7 billion in foreign direct investment into its aerospace sector, with Baja California, Chihuahua, Nuevo León, and Querétaro leading, reinforcing its position as a competitive destination for global OEMs and suppliers. Major aerospace clusters in Baja California, Chihuahua, Sonora, Querétaro, and Nuevo León specialize in manufacturing complex aerostructures, propulsion components, and avionics systems. This extensive manufacturing ecosystem creates substantial demand for high-performance ceramic matrix composites in turbine engine components, thermal protection systems, and structural applications requiring exceptional heat resistance.

Defense Modernization and Security Requirements

Growing defense sector investments and military modernization programs are driving increased demand for advanced materials in Mexico. Ceramic matrix composites offer critical performance advantages for defense applications including missile components, armor systems, and hypersonic vehicle structures. The materials' exceptional thermal stability, impact resistance, and lightweight characteristics make them essential for next-generation defense systems. At the 2025 Mexico Aerospace Fair (FAMEX), the Mexican Federation of the Aerospace Industry (FEMIA) signed a memorandum of understanding with Brazil’s Association of Defense and Security Material Industries (Abimde) to enhance aerospace and defense cooperation, focusing on joint development, co‑production, and supplier integration across the region, reflecting deepening international collaboration and technology exchange in defense manufacturing. Expanding domestic defense manufacturing capabilities and increasing collaboration with international defense contractors are creating new opportunities for ceramic matrix composite adoption across military aerospace and ground-based applications.

Automotive Performance and Efficiency Demands

Mexico’s status as a major automotive manufacturing hub is driving growing demand for ceramic matrix composites (CMCs). Increasing focus on vehicle weight reduction, fuel efficiency, and high-performance braking systems is boosting adoption of advanced ceramic materials. CMC-based brakes provide superior stopping power, lower unsprung mass, and longer service life compared with conventional components. Premium and performance vehicle manufacturers are increasingly specifying ceramic composite parts in models produced at Mexican facilities. This trend not only enhances vehicle performance and safety but also expands the use of ceramic matrix composites beyond aerospace, highlighting Mexico’s role in supporting advanced material integration in the automotive sector.

Market Restraints:

What Challenges the Mexico Ceramic Matrix Composites Market is Facing?

High Production and Material Costs

Ceramic matrix composites rely on complex, labor-intensive manufacturing processes that require specialized equipment and high-purity raw materials. Multiple stages, including fiber reinforcement, matrix infiltration, and densification, significantly increase production costs. These high expenses limit adoption primarily to high-value applications where superior performance justifies premium pricing.

Limited Local Manufacturing Capabilities

Mexico has limited domestic ceramic matrix composite manufacturing infrastructure, resulting in strong dependence on imported materials. This dependence increases lead times, logistics expenses, and supply chain complexity while restricting customization and rapid prototyping. Establishing local production capabilities requires substantial capital investment, skilled labor development, and advanced technical expertise.

Stringent Certification Requirements

Aerospace and defense applications demand rigorous testing, validation, and certification processes, extending development timelines and raising costs. Lengthy qualification procedures for flight-critical components slow adoption of new materials. Moreover, meeting diverse regulatory standards across multiple international markets adds further complexity for manufacturers supplying global programs.

Competitive Landscape:

The Mexico ceramic matrix composites market features a moderately concentrated competitive structure with international advanced materials manufacturers serving primary demand. Global aerospace materials suppliers maintain market presence through partnerships with major aerospace OEMs operating manufacturing facilities across Mexican industrial clusters. Competition centers on technological innovation, product performance, supply reliability, and technical support capabilities. Market participants are investing in expanded production capacity, enhanced processing technologies, and localized service infrastructure to strengthen competitive positioning. Strategic collaborations between international materials companies and Mexican aerospace manufacturers are facilitating technology transfer and market development. The competitive landscape reflects broader aerospace industry dynamics emphasizing long-term supplier relationships and certified material qualification programs.

Recent Developments:

-

In November 2024, Safran Aircraft Engines inaugurated a new assembly line at its Querétaro, Mexico facility, expanding turbine engine manufacturing capacity and expected to boost demand for advanced ceramic matrix composite components in propulsion systems. The extension supports final assembly of CFM LEAP engines and reinforces Mexico’s role in aerospace production.

Mexico Ceramic Matrix Composites Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Composite Types Covered | Silicon Carbide Reinforced Silicon Carbide (SIC/SIC), Carbon Reinforced Carbon (C/C), Oxide-Oxide (Ox/Ox), Others |

| Fiber Types Covered | Short Fiber, Continuous Fiber |

| Fiber Materials Covered | Alumina Fiber, Refractory Ceramic Fiber (RCF), SiC Fiber, Others |

| Applications Covered | Aerospace and Defense, Automotive, Energy and Power, Electricals and Electronics, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico ceramic matrix composites market size was valued at USD 193.89 Million in 2025.

The Mexico ceramic matrix composites market is expected to grow at a compound annual growth rate of 8.28% from 2026-2034 to reach USD 396.56 Million by 2034.

Silicon Carbide Reinforced Silicon Carbide (SIC/SIC) dominates with 35.20% market share due to exceptional thermal stability and mechanical strength retention at elevated temperatures essential for aerospace propulsion systems.

Key factors driving the Mexico ceramic matrix composites market include expanding aerospace manufacturing ecosystem, defense modernization requirements, automotive lightweighting initiatives, and growing industrial applications demanding superior thermal stability.

Major challenges include high production and material costs, limited local manufacturing capabilities requiring import dependence, stringent aerospace certification requirements, and extended qualification timelines for flight-critical applications.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)