Mexico Ceramic Tiles Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

Mexico Ceramic Tiles Market Overview:

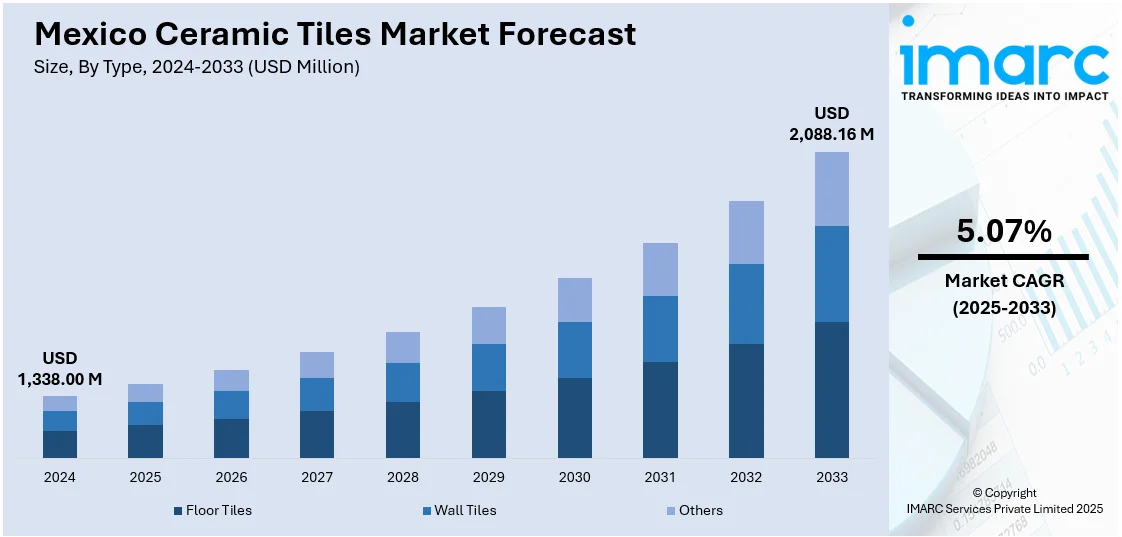

The Mexico ceramic tiles market size reached USD 1,338.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,088.16 Million by 2033, exhibiting a growth rate (CAGR) of 5.07% during 2025-2033. The market is driven by rapid urbanization, rising investments in residential and commercial construction, and growing demand for cost-effective and durable flooring solutions. Increasing exports to the United States and Latin America, coupled with government housing programs and improved infrastructure development, further support the market's expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,338.00 Million |

| Market Forecast in 2033 | USD 2,088.16 Million |

| Market Growth Rate 2025-2033 | 5.07% |

Mexico Ceramic Tiles Market Trends:

Rising Imports Driving Competitive Modernization in the Sector

Rising imports are prompting a wave of competitive modernization across Mexico’s ceramic tile sector. As international brands gain visibility with a broader range of styles, finishes, and price points, domestic manufacturers are accelerating investments in advanced production technologies to maintain market relevance. This includes upgrades in digital printing, kiln efficiency, and raw material processing to enhance both quality and design flexibility. Additionally, companies are expanding their product lines to cater to evolving consumer preferences, including demand for sustainable materials and larger format tiles. The push to remain competitive is also driving innovation in logistics and supply chain management, enabling faster turnaround times and customized solutions. Collectively, these shifts are strengthening the industry's capability to compete with imported products while reinforcing its position in both domestic and export markets. For instance, in February 2025, India and Mexico hosted the Vibrant Buildcon Roadshow in Mexico City to deepen trade ties in construction and building materials. India, now Mexico’s ninth-largest trading partner, has invested over USD 4 Billion in Mexico, including USD 500 Million in 2024 alone. Key exports include ceramic tiles, with a 93.45% year-on-year growth. Both countries see mutual benefits in scaling their construction sectors, including ceramics, infrastructure, and green building materials.

Growth in Urban Mid-Income Housing Projects

The Mexican government’s continued investment in affordable housing has spurred demand for budget-friendly and aesthetically appealing ceramic tiles. For instance, as per industry reports, in 2023, ceramic tile consumption in Mexico reached approximately 254 million square meters, making the country the tenth-largest consumer of ceramic tiles worldwide. Mid-income housing developments in urban zones increasingly use ceramic tiles for their cost-efficiency, ease of maintenance, and broad design range. Developers prefer locally manufactured tiles to reduce project timelines and costs, which further boosts domestic consumption. Additionally, new residential projects in metropolitan areas such as Guadalajara, Monterrey, and Mexico City contribute to steady market growth. Manufacturers are responding with differentiated tile lines tailored to multi-family housing requirements, including quick-to-install modular formats and non-slip surfaces suited for compact living spaces. This segment remains a key volume driver for tile producers across Mexico’s central and northern regions.

Mexico Ceramic Tiles Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Floor Tiles

- Wall Tiles

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes floor tiles, wall tiles, and others.

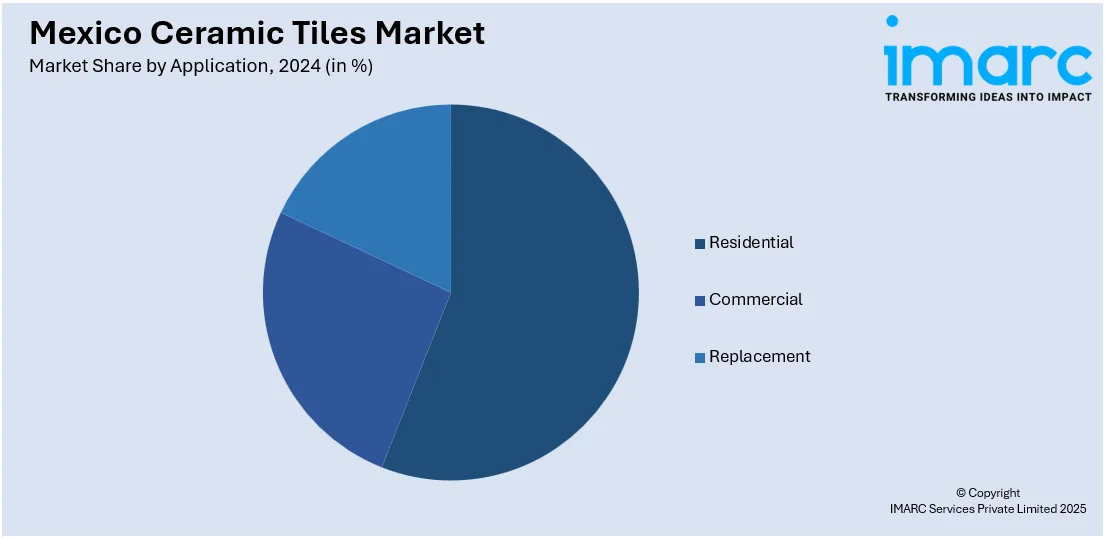

Application Insights:

- Residential

- Commercial

- Replacement

The report has provided a detailed breakup and analysis of the market based on the application. This includes residential, commercial, and replacement.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Ceramic Tiles Market News:

- In February 2024, Mexican ceramic giant Grupo Lamosa announced its investment in a Drupps Vapor system to be installed at its Peru plant. The Swedish-made technology will recover up to 25,000 tonnes of water annually from airborne wastewater, enabling the recovery of approximately 40% of the plant’s water use. The system can be expanded to recycle up to 80% of total water consumption. This initiative supports Lamosa’s long-term operational sustainability and water efficiency goals amid increasing concerns over water scarcity.

- In January 2024, Interceramic, one of Mexico’s leading ceramic tile manufacturers, formed a strategic partnership with Optilogic to enhance its supply chain operations using the Cosmic Frog platform. With over 430 retail outlets and eight manufacturing facilities, Interceramic aims to enhance inventory management, production planning, and delivery efficiency. The software will support smarter decision-making through simulation and network optimization, helping reduce stock imbalances and improve service levels. Guided by CPP Consulting, this move strengthens Interceramic’s competitive edge and supports its growth across Mexico’s ceramic tile market.

Mexico Ceramic Tiles Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Floor Tiles, Wall Tiles, Others |

| Applications Covered | Residential, Commercial, Replacement |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico ceramic tiles market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico ceramic tiles market on the basis of type?

- What is the breakup of the Mexico ceramic tiles market on the basis of application?

- What is the breakup of the Mexico ceramic tiles market on the basis of region?

- What are the various stages in the value chain of the Mexico ceramic tiles market?

- What are the key driving factors and challenges in the Mexico ceramic tiles market?

- What is the structure of the Mexico ceramic tiles market and who are the key players?

- What is the degree of competition in the Mexico ceramic tiles market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico ceramic tiles market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico ceramic tiles market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico ceramic tiles industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)