Mexico Circuit Breaker Market Size, Share, Trends and Forecast by Product Type, Voltage, Technology, End-Use, and Region, 2025-2033

Mexico Circuit Breaker Market Overview:

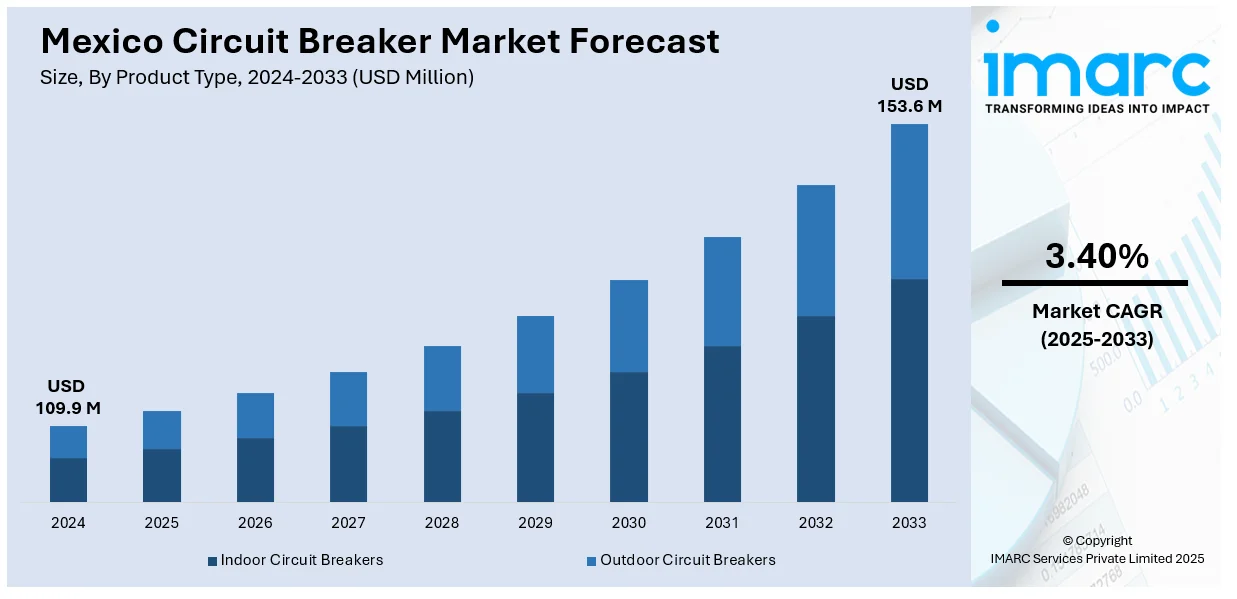

The Mexico circuit breaker market size reached USD 109.9 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 153.6 Million by 2033, exhibiting a growth rate (CAGR) of 3.40% during 2025-2033. The market is driven by the upgradation of the country's power infrastructure, rise in foreign direct investment (FDI) across industries like automotive, electronics, pharmaceuticals, and logistics, and increasing integration of renewable energy projects, especially in solar and wind power.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 109.9 Million |

| Market Forecast in 2033 | USD 153.6 Million |

| Market Growth Rate 2025-2033 | 3.40% |

Mexico Circuit Breaker Market Trends:

Rapid Expansion of Power Infrastructure and Grid Modernization

Mexico's circuit breaker sector is strongly influenced by the continuing growth and upgrading of the country's power infrastructure. The Federal Electricity Commission (CFE) is initiating several projects to fortify the grid, extend transmission lines, and incorporate renewable sources of energy. Increasing electricity consumption, especially in cities and industrial areas, further heightens the demand for dependable protection and control systems. Circuit breakers are used to guard electrical networks against faults and overloads, and by doing so, enhance power distribution resilience and efficiency. Modernization of the grid through, for instance, upgrades of substations and smart grid deployment requires sophisticated circuit protection devices with remote monitoring and auto-responder capabilities against faults. Furthermore, government incentives to enhance rural electrification and energy reliability further supports the market demand, making circuit breakers critical elements in facilitating national energy strategies and minimizing power losses. On March 18, 2025, President Claudia Sheinbaum signed into law a comprehensive energy reform package that shakes up Mexico's power industry on behalf of state-owned firms. The package adds eight new secondary laws and reforms three existing laws, putting in place the design set out by Sheinbaum's October 2024 constitutional reform.

Growing Industrial and Commercial Construction Activities

The rise in commercial and industrial buildings is contributing to the market growth. As Mexico is receiving foreign direct investment (FDI) across industries like automotive, electronics, pharmaceuticals, and logistics, the need for strong and efficient electrical infrastructure rises. Manufacturing plants, data centers, shopping centers, and office buildings need high-end circuit protection systems to guarantee operational safety and continuity. This is further driven by Mexico's strategic positioning as a production base under nearshoring concepts. All these developments require up-to-date circuit breakers that can manage high-load operations and minimize the chances of electrical breakdowns. Furthermore, compliance with safety standards and business sustainability objectives drives the application of energy-efficient and eco-friendly circuit protection products, hence creating greater opportunities for technologically sophisticated and eco-certified circuit breaker products in the industrial and commercial markets.

Rising Integration of Renewable Energy Projects

Mexico's circuit breaker industry is driven by the growing integration of renewable energy projects, especially in solar and wind power. Mexico, with its rich natural resources and good climatic conditions, is becoming a prime location for renewable energy investments. Government incentives and reforms under schemes like the Energy Transition Law have motivated both local and foreign players to construct large-scale clean energy facilities. These renewable power systems demand high-end circuit breakers designed to manage varying loads and safeguard high-voltage transmission cables and inverter-based systems. Additionally, circuit breakers are crucial for maintaining safety in case of power variations or grid instability, which is more prevalent in renewable systems. Decentralized energy generation, especially via distributed energy resources (DERs), increases the demand for high-reliability, high-end circuit breakers across geographies. Moreover, the IMARC Group predicts that the Mexico wind power market size is expected to reach 8.50 Gigawatt by 2033,

Mexico Circuit Breaker Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, voltage, technology, and end-use.

Product Type Insights:

- Indoor Circuit Breakers

- Outdoor Circuit Breakers

The report has provided a detailed breakup and analysis of the market based on the product type. This includes indoor circuit breakers and outdoor circuit breakers.

Voltage Insights:

- Low Voltage

- Medium Voltage

- High Voltage

A detailed breakup and analysis of the market based on the voltage have also been provided in the report. This includes low voltage, medium voltage, and high voltage.

Technology Insights:

- Air

- Vacuum

- Oil

- SF6

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes air, vacuum, oil, and SF6.

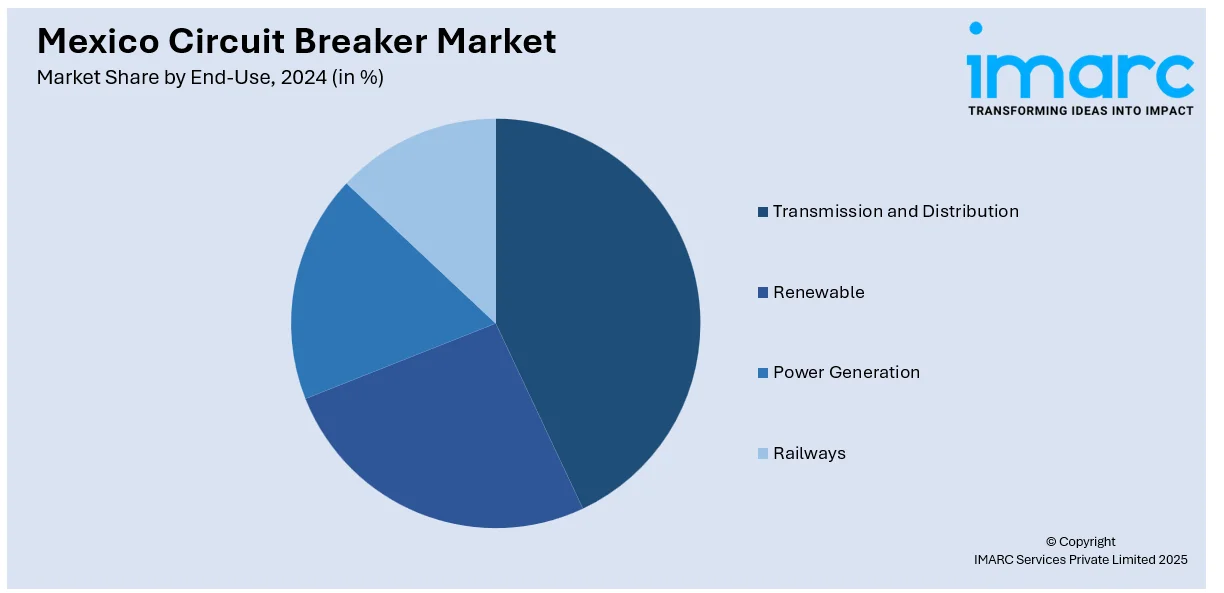

End-Use Insights:

- Transmission and Distribution

- Renewable

- Power Generation

- Railways

A detailed breakup and analysis of the market based on the end-use have also been provided in the report. This includes transmission and distribution, renewable, power generation, and railways.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Circuit Breaker Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Indoor Circuit Breakers, Outdoor Circuit Breakers |

| Voltages Covered | Low Voltage, Medium Voltage, High Voltage |

| Technologies Covered | Air, Vacuum, Oil, SF6 |

| End-Uses Covered | Transmission and Distribution, Renewable, Power Generation, Railways |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico circuit breaker market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico circuit breaker market on the basis of product type?

- What is the breakup of the Mexico circuit breaker market on the basis of voltage?

- What is the breakup of the Mexico circuit breaker market on the basis of technology?

- What is the breakup of the Mexico circuit breaker market on the basis of end-use?

- What is the breakup of the Mexico circuit breaker market on the basis of region?

- What are the various stages in the value chain of the Mexico circuit breaker market?

- What are the key driving factors and challenges in the Mexico circuit breaker market?

- What is the structure of the Mexico circuit breaker market and who are the key players?

- What is the degree of competition in the Mexico circuit breaker market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico circuit breaker market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico circuit breaker market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico circuit breaker industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)