Mexico Clinical Nutrition Market Size, Share, Trends and Forecast by Product, Route of Administration, Application, End User, and Region, 2025-2033

Mexico Clinical Nutrition Market Overview:

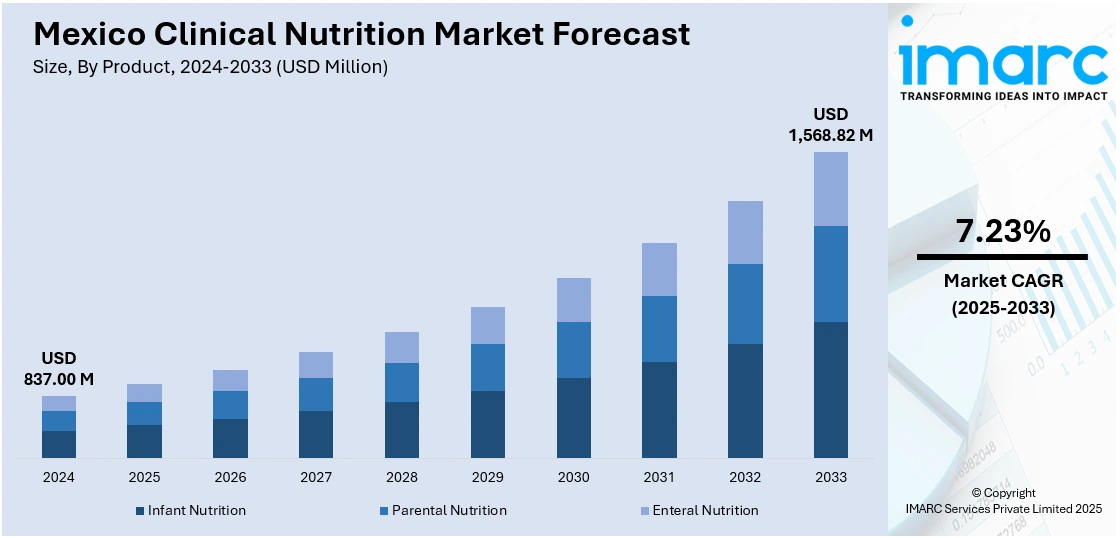

The Mexico clinical nutrition market size reached USD 837.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,568.82 Million by 2033, exhibiting a growth rate (CAGR) of 7.23% during 2025-2033. The market is driven by an aging population, rising chronic disease prevalence, and increasing malnutrition cases. In addition to this, rapid urbanization and sedentary lifestyles contribute to higher demand for nutritional support. Moreover, significant technological advancements and government healthcare initiatives further bolster the Mexico clinical nutrition market share, emphasizing the importance of clinical nutrition in patient care.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 837.00 Million |

| Market Forecast in 2033 | USD 1,568.82 Million |

| Market Growth Rate 2025-2033 | 7.23% |

Mexico Clinical Nutrition Market Trends:

Aging Population

Mexico’s aging population is significantly driving the clinical nutrition market. As life expectancy increases, more individuals are developing age-related conditions such as osteoporosis, sarcopenia, and chronic illnesses, which often require specialized nutritional intervention. Elderly patients frequently have trouble with nutrient absorption, appetite loss, or disease-related malnutrition, all of which heighten the need for clinical nutrition solutions. This demographic also relies more heavily on healthcare services, including hospitals and long-term care facilities, where clinical nutrition is a core part of treatment. Moreover, the government is increasingly focused on elderly health management, boosting demand for oral and enteral nutritional products. As the share of Mexico’s population aged 60 and above grows, so does the relevance of targeted nutritional care tailored to aging physiology and dietary needs.

Malnutrition and Public Health Concerns

Despite being a middle-income country, Mexico continues to battle dual burdens of malnutrition: undernutrition in poorer regions and overnutrition in urban areas. Undernutrition, especially among children and rural populations, fuels demand for clinical nutrition products that address growth deficiencies and immune support. Simultaneously, urbanization and poor diet patterns contribute to obesity and metabolic disorders, which require nutrition-focused interventions. Government campaigns aimed at improving national nutritional status, through hospitals, community programs, and maternal-child health initiatives, are accelerating demand for therapeutic nutrition solutions. Public health programs targeting vulnerable groups such as pregnant women, infants, and the elderly further reinforce the importance of clinical nutrition as a strategic healthcare tool. For instance, in April 2025, Mexico emphasized its commitment to nutrition-focused initiatives at the Nutrition for Growth Summit (N4G), which took place in Paris on March 27-28, 2025. Ramiro López, Mexico's Deputy Minister of Health Policy and Population Well-Being, underlined the importance of incorporating healthy food policies into national plans to combat malnutrition and enhance public health.

Expanding Healthcare Infrastructure and Access

Mexico’s expanding healthcare infrastructure and growing access to medical services are further supporting the Mexico clinical nutrition market growth. Government investments in public health, alongside private sector growth, are leading to improved hospital networks and home healthcare services. This expanded reach is making clinical nutrition more accessible to a larger portion of the population, especially in semi-urban and rural regions. Furthermore, training programs for healthcare professionals now emphasize the role of nutrition in patient recovery and chronic disease management. Increased availability of outpatient care and insurance coverage for nutrition-related therapies also encourage patients to seek nutritional support. As healthcare modernization continues across the country, the integration of clinical nutrition into standard treatment protocols will further accelerate market adoption.

Mexico Clinical Nutrition Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, route of administration, application, and end user.

Product Insights:

- Infant Nutrition

- Parental Nutrition

- Enteral Nutrition

The report has provided a detailed breakup and analysis of the market based on the product. This includes infant nutrition, parental nutrition, and enteral nutrition.

Route of Administration Insights:

- Oral

- Enteral

- Parenteral

A detailed breakup and analysis of the market based on the route of administration have also been provided in the report. This includes oral, enteral, and parenteral.

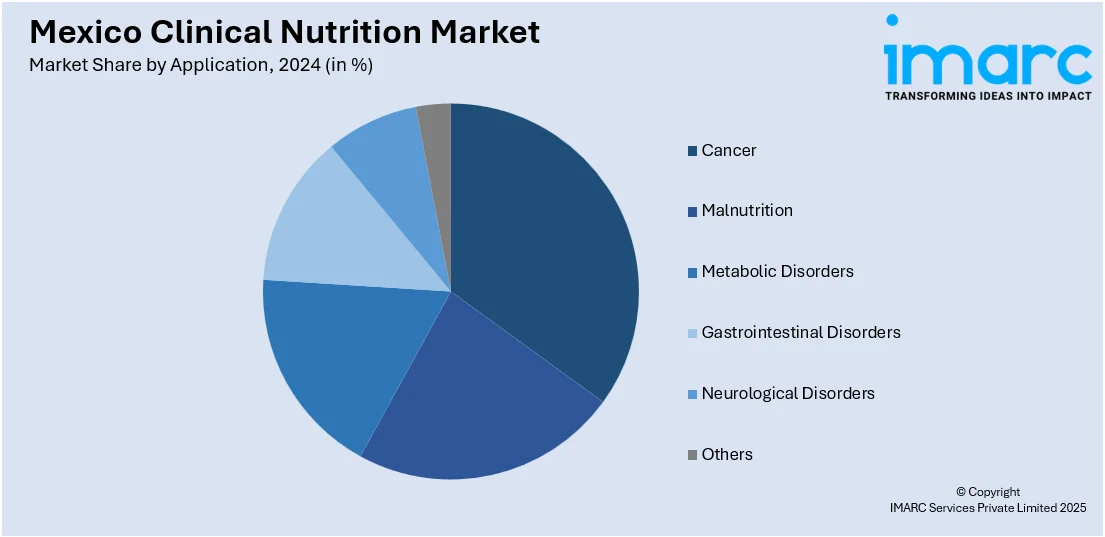

Application Insights:

- Cancer

- Malnutrition

- Metabolic Disorders

- Gastrointestinal Disorders

- Neurological Disorders

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes cancer, malnutrition, metabolic disorders, gastrointestinal disorders, neurological disorders, and others.

End User Insights:

- Pediatric

- Adults

- Geriatric

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes pediatric, adults, and geriatric.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Clinical Nutrition Market News:

- In March 2025, FrieslandCampina Institute was officially inaugurated in Mexico with a successful virtual symposium. The Institute seeks to provide current and evidence-based insights on infant nutrition. At this launch event, we were privileged to have Dr. Ericka Montijo Barrios provide insights on innovative tools and strategies in nutritional education for pediatricians.

- In February 2025, the JUMPstart Clinical Nutrition program serves as a mentorship opportunity aimed at early-career clinicians and researchers focusing on nutrition and research related to critical care and abdominal surgery. Following successful waves in 2018, 2020, and 2022, the program persists in expanding and solidifying its position as a crucial effort in clinical nutrition. It is currently in its fourth wave.

Mexico Clinical Nutrition Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Infant Nutrition, Parental Nutrition, Enteral Nutrition |

| Route of Administrations Covered | Oral, Enteral, Parenteral |

| Applications Covered | Cancer, Malnutrition, Metabolic Disorders, Gastrointestinal Disorders, Neurological Disorders, Others |

| End Users Covered | Pediatric, Adults, Geriatric |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico clinical nutrition market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico clinical nutrition market on the basis of product?

- What is the breakup of the Mexico clinical nutrition market on the basis of route of administration?

- What is the breakup of the Mexico clinical nutrition market on the basis of application?

- What is the breakup of the Mexico clinical nutrition market on the basis of end user?

- What is the breakup of the Mexico clinical nutrition market on the basis of region?

- What are the various stages in the value chain of the Mexico clinical nutrition market?

- What are the key driving factors and challenges in the Mexico clinical nutrition market?

- What is the structure of the Mexico clinical nutrition market and who are the key players?

- What is the degree of competition in the Mexico clinical nutrition market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico clinical nutrition market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico clinical nutrition market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico clinical nutrition industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)