Mexico Cloud Storage Market Size, Share, Trends and Forecast by Component, Deployment Type, User Type, Industry Vertical, and Region, 2025-2033

Mexico Cloud Storage Market Overview:

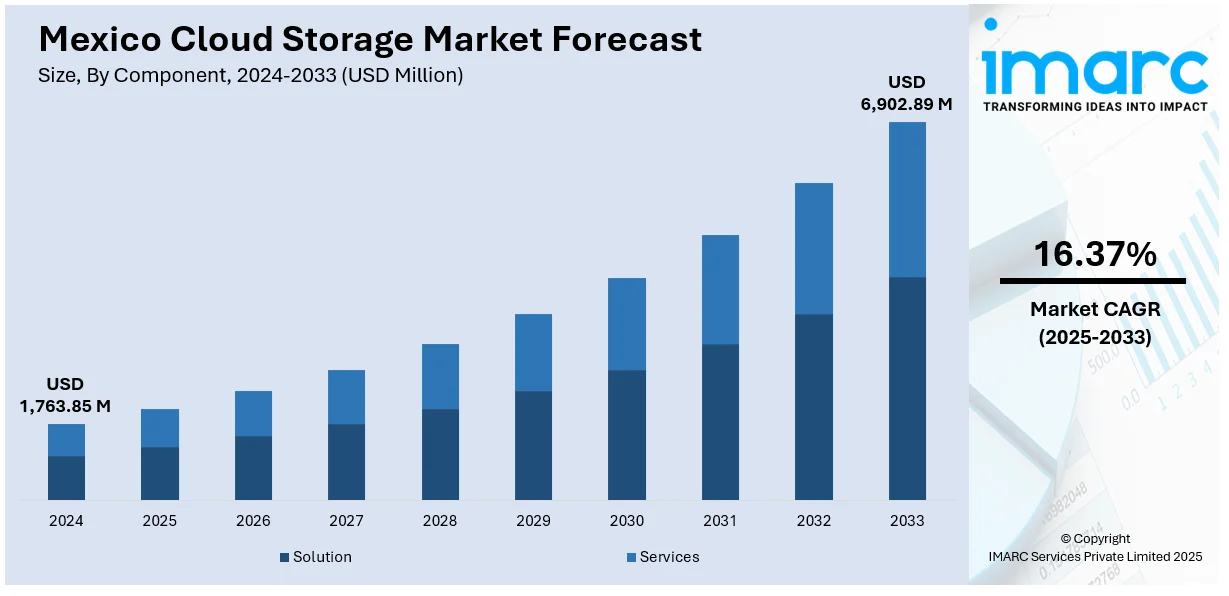

The Mexico cloud storage market size reached USD 1,763.85 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 6,902.89 Million by 2033, exhibiting a growth rate (CAGR) of 16.37% during 2025-2033. Significant investments by global cloud providers, establishment of local data centers, and enhanced connectivity infrastructure are major market contributors. Emphasis on data sovereignty, adoption of hybrid cloud solutions, and stringent regulatory compliance requirements are additional factors. Integration of multi-cloud strategies, focus on data residency, and alignment with national data governance policies are some of the factors positively impacting the Mexico cloud storage market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,763.85 Million |

| Market Forecast in 2033 | USD 6,902.89 Million |

| Market Growth Rate 2025-2033 | 16.37% |

Mexico Cloud Storage Market Trends:

Expansion of Cloud Infrastructure and Service Availability

One major driver shaping the market is the expansion of cloud infrastructure and the growing availability of cloud services across the country. As businesses across sectors pursue digital transformation strategies, there is a rising need for scalable, secure, and cost-effective storage solutions. Major global cloud providers are establishing local partnerships and infrastructure to meet increasing demand while addressing concerns around data latency and service reliability. The growth of regional data centers is facilitating faster access to cloud resources and providing businesses with greater assurance around data residency and regulatory compliance. Improvements in Mexico’s telecommunications network are also enabling more companies to shift operations to the cloud, particularly in urban and industrial hubs. Enterprises are recognizing the operational efficiencies and cost benefits associated with moving from traditional storage systems to flexible cloud-based models. On January 14, 2025, AWS announced the launch of its Mexico (Central) Region, the company’s first cloud infrastructure region in Mexico, marking a USD 5 Billion investment over the next 15 years. The new region, consisting of three Availability Zones, will offer improved latency, data residency, and disaster recovery for local businesses, and is projected to add approximately USD 10 Billion to Mexico's GDP. AWS plans to create over 7,000 full-time equivalent jobs annually and has committed USD 300,000 to the AWS InCommunities Fund to support local initiatives. This transition is directly contributing to Mexico cloud storage market growth, as businesses seek competitive advantages through enhanced data management and accessibility. Additionally, industries such as finance, retail, manufacturing, and education are adopting customized cloud storage solutions tailored to their specific regulatory and operational needs. The alignment of cloud service expansion with broader national digitization efforts is reinforcing the critical role of cloud storage in Mexico’s technology ecosystem.

Increasing Regulatory Focus on Data Protection and Privacy

Another significant driver advancing the market is the increasing regulatory emphasis on data protection and privacy standards. Strengthened by initiatives such as Mexico’s Federal Law on the Protection of Personal Data Held by Private Parties, companies are under growing pressure to ensure that customer and operational data is securely stored and managed. Organizations are responding by prioritizing cloud storage solutions that provide robust encryption, access control, and localized data hosting. This shift is encouraging cloud providers to enhance their service offerings with compliance-driven features that meet both domestic and international standards. As indicated by Mexico cloud storage market trends, sectors with high sensitivity to data governance, such as banking, healthcare, and legal services, are leading in the adoption of compliant cloud storage services. Enterprises are increasingly favoring cloud environments that offer auditability, transparency, and proactive security measures to align with regulatory expectations. On September 26, 2023, Oracle opened a second cloud region in Mexico in partnership with TELMEX-Triara, becoming the first hyperscaler to establish two cloud regions in the country. The new Oracle Cloud Monterrey Region offers over 100 Oracle Cloud Infrastructure (OCI) services and helps strengthen business continuity, meeting Mexico’s data residency and sovereignty requirements. This expansion makes Oracle's 46th cloud region globally and will benefit organizations with access to advanced technologies like AI and machine learning. Furthermore, consumer awareness around data privacy rights is growing, driving businesses to select storage partners who can guarantee high levels of information security and ethical data handling. These factors are creating a sustained demand for cloud storage solutions that are not only scalable and flexible but also legally compliant and trustworthy.

Mexico Cloud Storage Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, deployment type, user type, and industry vertical.

Component Insights:

- Solution

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution and services.

Deployment Type Insights:

- Private

- Public

- Hybrid

The report has provided a detailed breakup and analysis of the market based on the deployment type. This includes private, public, and hybrid.

User Type Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

The report has provided a detailed breakup and analysis of the market based on the user type. This includes large enterprises and small and medium-sized enterprises.

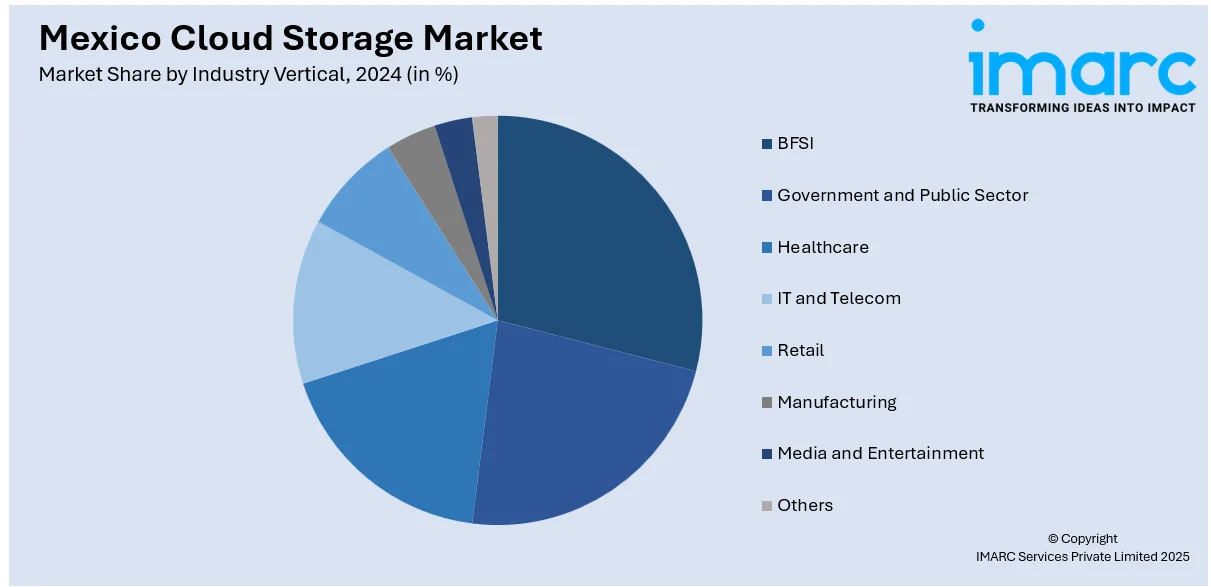

Industry Vertical Insights:

- BFSI

- Government and Public Sector

- Healthcare

- IT and Telecom

- Retail

- Manufacturing

- Media and Entertainment

- Others

The report has provided a detailed breakup and analysis of the market based on the industry vertical. This includes BFSI, government and public sector, healthcare, IT and telecom, retail, manufacturing, media and entertainment, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Cloud Storage Market News:

- On March 24, 2025, MongoDB announced that MongoDB Atlas is now available in Mexico through Amazon Web Services (AWS), Google Cloud, and Microsoft Azure infrastructure regions. This expansion enables organizations in Mexico to modernize applications in compliance with local data residency requirements, accelerating their digital transformation while utilizing cloud-native features like AI, search, and analytics. With 35,000+ developers in Mexico, MongoDB continues to support sectors like financial services, retail, and telecommunications.

Mexico Cloud Storage Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Services |

| Deployment Types Covered | Private, Public, Hybrid |

| User Types Covered | Large Enterprises, Small and Medium-sized Enterprises |

| Industry Verticals Covered | BFSI, Government and Public Sector, Healthcare, IT and Telecom, Retail, Manufacturing, Media and Entertainment, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico cloud storage market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico cloud storage market on the basis of component?

- What is the breakup of the Mexico cloud storage market on the basis of deployment type?

- What is the breakup of the Mexico cloud storage market on the basis of user type?

- What is the breakup of the Mexico cloud storage market on the basis of industry vertical?

- What is the breakup of the Mexico cloud storage market on the basis of region?

- What are the various stages in the value chain of the Mexico cloud storage market?

- What are the key driving factors and challenges in the Mexico cloud storage market?

- What is the structure of the Mexico cloud storage market and who are the key players?

- What is the degree of competition in the Mexico cloud storage market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico cloud storage market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico cloud storage market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico cloud storage industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)