Mexico Cold Chain Equipment Market Size, Share, Trends and Forecast by Equipment Type, Application, and Region, 2025-2033

Mexico Cold Chain Equipment Market Overview:

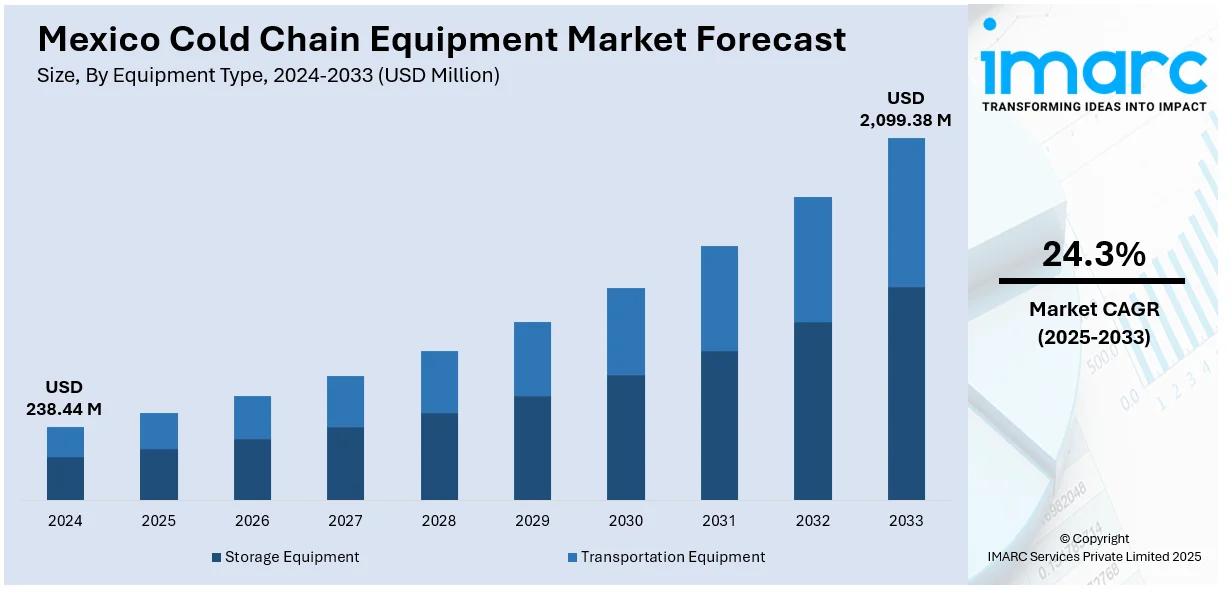

The Mexico cold chain equipment market size reached USD 238.44 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,099.38 Million by 2033, exhibiting a growth rate (CAGR) of 24.3% during 2025-2033. Rising demand for perishable foods due to changing consumer preferences and urbanization contributes to Mexico cold chain equipment market share. The expanding pharmaceutical sector, stringent food safety regulations, and increasing cross-border trade with the US also necessitate advanced cold chain equipment to maintain product integrity and reduce waste.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 238.44 Million |

| Market Forecast in 2033 | USD 2,099.38 Million |

| Market Growth Rate 2025-2033 | 24.3% |

Mexico Cold Chain Equipment Market Analysis:

- Major Market Drivers: Rising demand for perishable foods due to changing consumer preferences and urbanization significantly contributes to market share. The expanding pharmaceutical sector, stringent food safety regulations, and increasing cross-border trade with the US necessitate advanced Mexico cold chain equipment to maintain product integrity and reduce waste.

- Key Market Trends: Mexico cold chain equipment market analysis reveals expansion of temperature-controlled facilities in border states and pharmaceutical logistics advancement. Strategic nearshoring initiatives and government-backed policies drive investment in sophisticated temperature-controlled technologies. Integration of digital monitoring systems and enhanced intermodal connectivity strengthen Mexico's position in North American cold chain ecosystem.

- Competitive Landscape: The market features diverse players focusing on storage and transportation solutions across multiple applications. Key positioning strategies include technology integration, facility expansion, and cross-border partnerships. Companies emphasize compliance with international standards and development of specialized Mexico cold chain equipment market demand to serve pharmaceutical and agricultural sectors effectively.

- Challenges and Opportunities: Infrastructure gaps in southern regions present development challenges while nearshoring trends create expansion opportunities. Regulatory compliance requirements and energy costs pose operational challenges. Growing pharmaceutical manufacturing, agricultural exports, and e-commerce growth offer significant market expansion potential for advanced cold chain solutions and technologies.

Mexico Cold Chain Equipment Market Trends:

Expansion of Cold Storage Facilities in Key Export Regions

Mexico's northern border states, including Baja California, Sonora, Chihuahua, and Nuevo León, are witnessing significant expansion in cold storage infrastructure. This growth is primarily driven by their strategic proximity to the US, a major export destination for Mexican perishable goods such as berries, avocados, and seafood. Increased export volumes necessitate enhanced cold storage capacities to maintain product quality and extend shelf life. Consequently, both private and public-private partnerships are investing in developing advanced temperature-controlled warehouses and improving intermodal connectivity, integrating refrigerated rail and truck fleets. These investments also focus on meeting stringent cross-border compliance requirements with US standards, including facility certifications and digital monitoring systems. This trend strengthens Mexico's position in the North American cold chain ecosystem by reducing spoilage and improving transit efficiency. These factors are intensifying the Mexico cold chain equipment market growth.

To get more information on this market, Request Sample

Expansion of Temperature-Sensitive Pharmaceutical Logistics

Mexico's strategic initiative to fortify its pharmaceutical supply chain and decrease its reliance on imports from Asia is creating a significant impetus for the growth of advanced cold chain infrastructure. The escalating domestic manufacturing of temperature-sensitive biological medications necessitates substantial investments in cutting-edge refrigerated storage facilities and transportation systems to ensure the integrity and efficacy of these critical products. Government-backed nearshoring policies are anticipated to further catalyze financial allocations towards sophisticated temperature-controlled technologies and solutions throughout Mexico's burgeoning pharmaceutical sector. This evolution underscores an increasing demand for specialized equipment, real-time monitoring systems, and validated processes to support the secure handling and distribution of pharmaceuticals within the country. The development of a robust cold chain network is becoming integral to Mexico's ambitions in pharmaceutical independence. For instance, based on a study published in June 2024, Mexico aims to strengthen its pharmaceutical supply chain, lessening dependence on Asian imports. This push for increased domestic production, particularly of temperature-sensitive biologics, signals a potential rise in demand for advanced cold chain equipment. Enhanced infrastructure for secure storage and transportation will be crucial to maintain the integrity of locally manufactured pharmaceuticals. Government initiatives supporting nearshoring could further drive investment in advanced temperature-controlled solutions within Mexico's expanding pharmaceutical sector.

Mexico Cold Chain Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on equipment type and application.

Equipment Type Insights:

- Storage Equipment

- On-Grid

- Walk-in Coolers

- Walk-in Freezers

- Ice-Lined Refrigerators

- Deep Freezers

- Off-Grid

- Solar Chillers

- Milk Coolers

- Solar Powered Cold Boxes

- Others

- Others

- On-Grid

- Transportation Equipment

The report has provided a detailed breakup and analysis of the market based on the equipment type. This includes storage equipment [on-grid (walk-in coolers, walk-in freezers, ice-lined refrigerators, and deep freezers), off-grid (solar chillers, milk coolers, solar powered cold boxes, and others), and others] and transportation equipment.

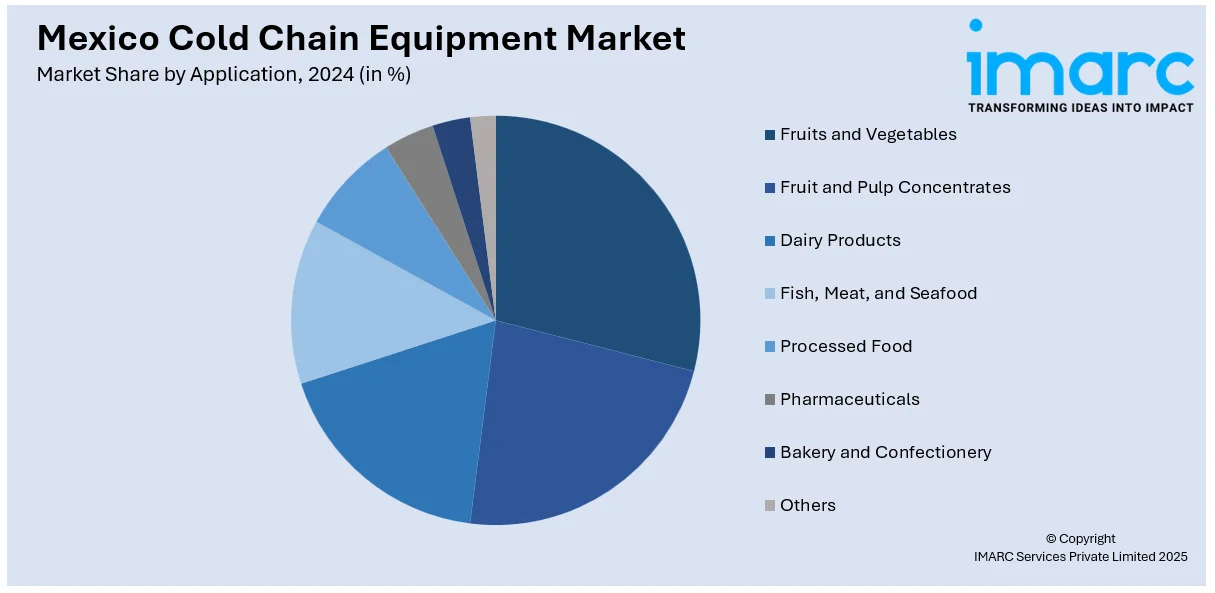

Application Insights:

- Fruits and Vegetables

- Fruit and Pulp Concentrates

- Dairy Products

- Fish, Meat, and Seafood

- Processed Food

- Pharmaceuticals

- Bakery and Confectionery

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes fruits and vegetables, fruit and pulp concentrates, dairy products, fish, meat, and seafood, processed food, pharmaceuticals, bakery and confectionery, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Cold Chain Equipment Market News:

- In February 2025, UPS Healthcare launched new CEIV Pharma-certified cross-dock facilities in Mexico City, Milan, and Frankfurt, enhancing pharmaceutical cold chain logistics. The 10,700m² Mexico site supports ambient to frozen ranges, ensuring safe, efficient delivery of critical healthcare products across global markets.

Mexico Cold Chain Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Equipment Types Covered |

|

| Applications Covered | Fruits and Vegetables, Fruit and Pulp Concentrates, Dairy Products, Fish, Meat, and Seafood, Processed Food, Pharmaceuticals, Bakery and Confectionery, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico cold chain equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico cold chain equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico cold chain equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cold chain equipment market in Mexico was valued at USD 238.44 Million in 2024.

The Mexico cold chain equipment market is projected to exhibit a CAGR of 24.3% during 2025-2033, reaching a value of USD 2,099.38 Million by 2033.

Key drivers include rising demand for perishable foods due to changing consumer preferences and urbanization, expanding pharmaceutical sector with temperature-sensitive biologics manufacturing, stringent food safety regulations compliance, and increasing cross-border trade with the US requiring advanced temperature-controlled solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)