Mexico Cold Chain Market Size, Share, Trends and Forecast by Type, Temperature Range, Application, and Region, 2025-2033

Mexico Cold Chain Market Overview:

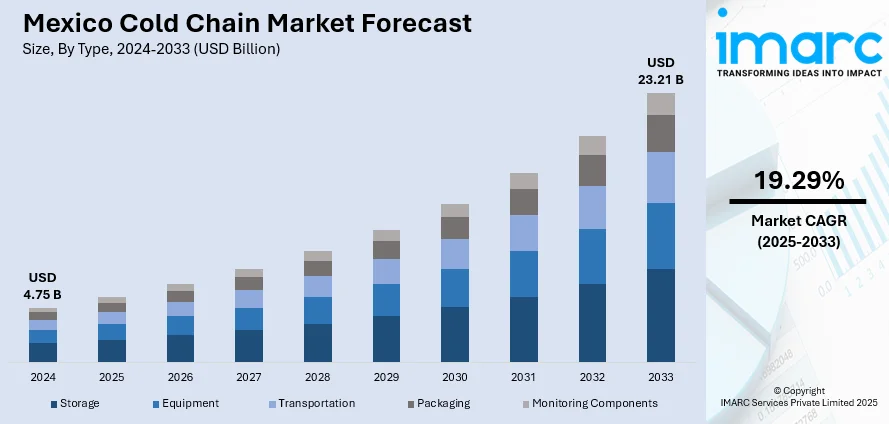

The Mexico cold chain market size reached USD 4.75 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 23.21 Billion by 2033, exhibiting a growth rate (CAGR) of 19.29% during 2025-2033. The market is primarily driven by rising demand for perishable food, pharmaceutical distribution growth, increasing cross-border trade with the U.S., expansion of organized retail, and evolving food safety regulations. Additionally, advancements in refrigeration technologies and rising e-commerce penetration are supporting infrastructure modernization and investment in temperature-controlled logistics.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.75 Billion |

| Market Forecast in 2033 | USD 23.21 Billion |

| Market Growth Rate 2025-2033 | 19.29% |

Mexico Cold Chain Market Trends:

Expansion of Cold Chain Infrastructure in Border States

Cold chain infrastructure development in Mexico’s northern states has accelerated, especially in Baja California, Sonora, Chihuahua, and Nuevo León, due to their proximity to U.S. trade routes. These regions serve as key export hubs for perishable goods like berries, avocados, and seafood. As export volumes grow, demand for cold storage warehouses and temperature-controlled transport rises. Investments from both private firms and public-private partnerships have focused on enhancing intermodal connectivity, integrating refrigerated rail and truck fleets. Cross-border compliance requirements with U.S. standards have also prompted upgrades in facility certifications and digital monitoring systems. This localized infrastructure growth is enabling producers to reduce spoilage, improve transit efficiency, and meet stringent international quality benchmarks, thereby strengthening Mexico’s position in the North American cold chain ecosystem. For instance, as per industry reports, the demand for Mexico’s cold chain logistics sector is rising due to e-commerce, pharmaceuticals, and agri-food exports, which totaled USD 51.87 Billion in 2023. With only 6.9% of Mexico’s fleet (92,256 trucks) refrigerated, investment is accelerating. Emergent Cold LatAm expanded in Nuevo León and raised USD 500 Million, while Lineage Logistics invested USD 79 Million in Texas. These moves, alongside digital upgrades and cross-border infrastructure enhancements, align with the trend of cold chain growth in Mexico’s northern export-focused states.

Pharmaceutical Sector Driving Specialized Cold Chain Solutions

The pharmaceutical industry is increasingly shaping Mexico’s cold chain market by demanding ultra-reliable temperature-controlled logistics for vaccines, biologics, and specialty drugs. With the expansion of domestic manufacturing and global pharma firms establishing distribution bases in Mexico, secure storage and transport protocols have become critical. Regulatory alignment with global standards, including COFEPRIS and WHO-GSDP, has encouraged third-party logistics providers to invest in validated cold rooms, real-time monitoring, and contingency response capabilities. Urban centers like Mexico City, Guadalajara, and Monterrey have seen a surge in pharmaceutical-grade warehouse development. The rise of biologics and personalized medicine is also spurring demand for more granular control over temperature bands (2°C–8°C, -20°C, -70°C), reinforcing the need for flexible, technology-integrated cold chain networks tailored to healthcare logistics. For instance, in February 2025, UPS Healthcare opened new CEIV Pharma-certified cold chain cross-dock facilities in Mexico City, Milan, and Frankfurt to meet rising global demand for temperature-sensitive pharmaceutical logistics. These sites handle ambient to frozen shipments, with Milan offering over 20,000 pallet positions. Located near major transport hubs, the facilities ensure rapid, compliant delivery for clinical trial and healthcare products.

Integration of Digital Technologies for Real-Time Monitoring

Digitalization is becoming a defining trend in the Mexico cold chain market, with real-time monitoring and predictive analytics improving operational reliability and product integrity. IoT-enabled sensors now provide end-to-end visibility across temperature-sensitive shipments, reducing risks of deviation and supporting immediate corrective action. Cloud platforms are being adopted to centralize control of multi-point cold storage facilities and transport fleets, enabling stakeholders to streamline inventory management, automate compliance reporting, and optimize route planning. These innovations are especially vital for high-value exports such as seafood, berries, and dairy, which are highly perishable and subject to international quality controls. As cyber-physical systems become mainstream, they are also helping to attract multinational clients who demand globally harmonized cold chain standards and seamless data traceability. For instance, in December 2024, Canadian Pacific Kansas City (CPKC) and Americold announced plans to expand their cold chain partnership into Mexico. The initiative aims to offer an alternative to trucking for moving temperature-controlled freight between Mexico and the U.S. CPKC emphasized leveraging its North American rail network to strengthen cold storage supply chains. Americold currently operates 239 temperature-controlled warehouses across North America, Europe, Asia-Pacific, and South America, and this expansion would further enhance its presence in Latin America.

Mexico Cold Chain Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, temperature range, and application.

Type Insights:

- Storage

- Facilities/Services

- Refrigerated Warehouse

- Cold Room

- Facilities/Services

- Equipment

- Blast Freezer

- Walk-in Cooler and Freezer

- Deep Freezer

- Others

- Transportation

- By Mode

- Road

- Sea

- Rail

- Air

- By Offering

- Refrigerated Vehicles

- Refrigerated Containers

- By Mode

- Packaging

- Crates

- Insulated Containers and Boxes

- Large (32 to 66 liters)

- Medium (21 to 29 liters)

- Small (10 to 17 liters)

- X-small (3 to 8 liters)

- Petite (0.9 to 2.7 liters)

- Cold Chain Bags/Vaccine Bags

- Ice Packs

- Others

- Monitoring Components

- Hardware

- Sensors

- RFID Devices

- Telematics

- Networking Devices

- Others

- Software

- On-premises

- Cloud-based

- Hardware

The report has provided a detailed breakup and analysis of the market based on the type. This includes storage [facilities/services (refrigerated warehouse and cold room), equipment (blast freezer, walk-in cooler and freezer, deep freezer, and others)], transportation [by mode (road, sea, rail, and air), by offering (refrigerated vehicles and refrigerated containers)], packaging [ crates, insulate containers and boxes (large (32 to 66 liters), medium (21 to 29 liters), small (10 to 17 liters), x-small (3 to 8 liters), petite (0.9 to 2.7 liters), cold chain bags/vaccine bags, ice packs, and others], and monitoring components [ hardware (sensors, RFID devices, telematics, networking devices, and others) and software (on-premises and cloud-based)].

Temperature Range Insights:

- Chilled (0°C to 15°C)

- Frozen (-18°C to -25°C)

- Deep-frozen (Below -25°C)

A detailed breakup and analysis of the market based on the temperature range have also been provided in the report. This includes chilled (0°C to 15°C), frozen (-18°C to -25°C), and deep-frozen (below -25°C).

Application Insights:

- Food and Beverages

- Fruits and Vegetables

- Fruit Pulp and Concentrates

- Dairy Products

- Milk

- Butter

- Cheese

- Ice Cream

- Others

- Fish, Meat, and Seafood

- Processed Food

- Bakery and Confectionary

- Others

- Pharmaceuticals

- Vaccines

- Blood Banking

- Others

- Others

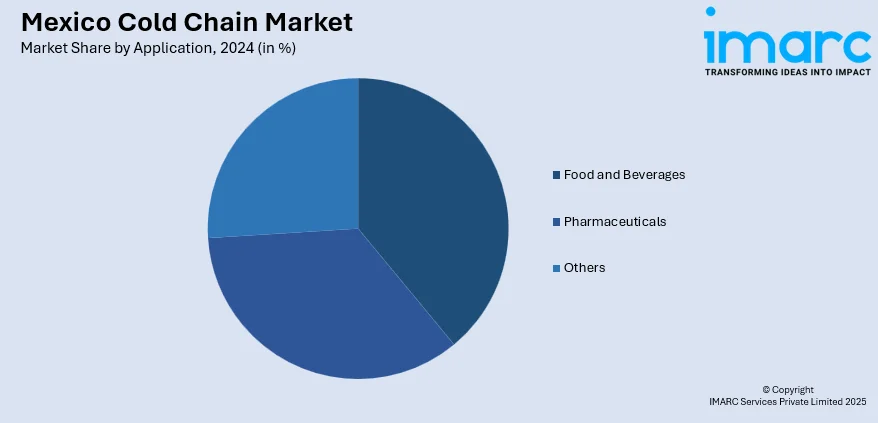

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes food and beverages [fruits and vegetables, fruit pulp and concentrates, dairy products (milk, butter, cheese, ice cream, and others), fish, meat, and seafood, processed food, bakery and confectionary, and others], pharmaceuticals (vaccines, blood banking, and others), and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Cold Chain Market News:

- In March 2025, ANETIF and the Global Cold Chain Alliance (GCCA) signed an agreement to strengthen Mexico’s cold chain infrastructure, particularly in regions with insufficient capacity and high demand. The alliance addresses challenges such as high energy costs, regulatory compliance, and temperature control in the face of climate change. The partnership aims to modernize cold storage, enhance workforce training, and promote certifications. ANETIF members will access training, legal support, and best practices through GCCA, supporting food safety, infrastructure development, and improved efficiency in Mexico’s temperature-controlled logistics sector.

- In March 2025, Emergent Cold LatAm inaugurated a new greenfield cold storage facility in Ciénega de Flores, Monterrey, with a 23,000-pallet capacity (approx. 23,000 tons of food). This marks the company’s first ground-up project in Mexico and is part of its broader investment plan in the country.

Mexico Cold Chain Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

|

Temperature Ranges Covered |

Chilled (0°C to 15°C), Frozen (-18°C to -25°C), Deep-frozen (Below -25°C) |

| Applications Covered |

|

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico cold chain market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico cold chain market on the basis of type?

- What is the breakup of the Mexico cold chain market on the basis of temperature range?

- What is the breakup of the Mexico cold chain market on the basis of application?

- What is the breakup of the Mexico cold chain market on the basis of region?

- What are the various stages in the value chain of the Mexico cold chain market?

- What are the key driving factors and challenges in the Mexico cold chain market?

- What is the structure of the Mexico cold chain market and who are the key players?

- What is the degree of competition in the Mexico cold chain market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico cold chain market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico cold chain market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico cold chain industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)