Mexico Cold Chain Pharmaceutical Logistics Market Size, Share, Trends and Forecast by Product, Service, and Region, 2026-2034

Mexico Cold Chain Pharmaceutical Logistics Market Size and Share:

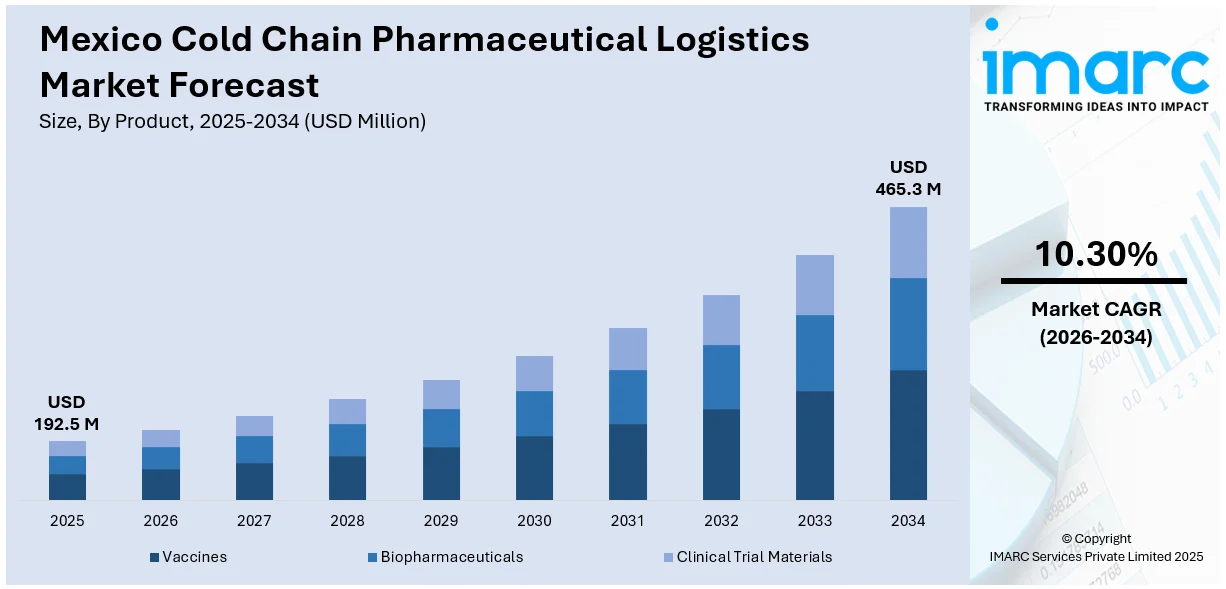

The Mexico cold chain pharmaceutical logistics market size was valued at USD 192.5 Million in 2025. Looking forward, the market is projected to reach USD 465.3 Million by 2034, exhibiting a CAGR of 10.30% during 2026-2034. The market is being fueled by rising demand for biopharmaceuticals and vaccines, which need strict temperature control. Ongoing advancements in technology like real-time tracking, automation, IoT, and Mexico being well-placed as a manufacturing and exporting base to the U.S. and Latin America are also increasing the Mexico cold chain pharmaceutical logistics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 192.5 Million |

| Market Forecast in 2034 | USD 465.3 Million |

| Market Growth Rate 2026-2034 | 10.30% |

The expansion of the market in Mexico is mainly driven by the surge in demand for biopharmaceuticals and vaccines that require strict temperature controls. Along the same lines, the increased aging population and the increased prevalence of chronic diseases have led to a rise in demand for temperature-sensitive pharmaceuticals. In addition, the rapid adoption of IoT technologies, local data centers, and real-time monitoring systems is increasing the efficiency and reliability of the supply chain, which is a major factor that is contributing to market growth. The facility aims to support local businesses by offering cloud-based solutions, including AI-driven innovations, to modernize IT infrastructures and scale operations. In addition to this, government policies and regulations supporting infrastructure development are bolstering the Mexico cold chain pharmaceutical logistics market growth.

To get more information on this market Request Sample

Besides this, Mexico’s strategic location as a manufacturing and export hub to the U.S. and Latin America is creating opportunities in the market. Also, the increasing shift towards more automated and smart cold chain solutions is driving the industry forward. In August 2025, Americold and Canadian Pacific Kansas City (CPKC) unveiled a new USD 100+ Million Import-Export Hub in Kansas City, designed to streamline food logistics across North America, with a focus on temperature-sensitive goods. The 335,000-square-foot facility serves as a key node in the Mexico Midwest Express, facilitating the movement of refrigerated goods between the U.S. and Mexico. The market is further enhanced by the rising investments in logistics infrastructure and the growing role of third-party logistics providers specializing in cold chain solutions. Apart from this, the development of sustainable practices and the increasing demand for traceability and compliance in pharmaceutical transportation are propelling the market.

Mexico Cold Chain Pharmaceutical Logistics Market Trends:

Growing Demand for Biopharmaceuticals and Temperature-Sensitive Drugs

The Mexican drug market is witnessing increasing demand for biologics, vaccines, and other temperature-sensitive drugs. Such medicines typically demand rigid temperature maintenance between 2°C to 8°C during transportation and storage, leading to investments in next-generation cold chain infrastructure. Given Mexico's aging population and growing chronic disease incidence, specialty medication demand keeps rising and stressing logistics providers to adhere to stringent regulatory requirements (such as COFEPRIS regulations) and minimize temperature excursions. According to the American Association of Retired Persons (AARP) International, the number of individuals aged 65 years and older in Mexico is expected to surpass 30 Million by 2050. In addition, pharmaceutical companies are collaborating with third-party logistics (3PL) providers that specialize in cold chain capabilities, which is one of the major Mexico cold chain pharmaceutical logistics market trends. Spending on real-time monitoring platforms, GPS tracking, and IoT-based cold storage systems is becoming prevalent. This phenomenon is also endorsed by Mexico's increasing presence in clinical trials and vaccine delivery throughout Latin America, further underlining the demand for effective and scalable cold chain supply chains.

Infrastructure Expansion and Regional Logistics Hubs

Mexico is witnessing substantial investment in cold storage facilities, transport fleets, and regional distribution hubs to support its growing pharmaceutical industry. According to a report published by the IMARC Group, the pharmaceuticals market in Mexico reached USD 19.8 Billion in 2024 and is projected to reach USD 38.5 Billion by 2033, growing at a CAGR of 6.9% during 2025-2033. Domestic and international logistics companies are expanding, particularly near border states such as Nuevo León and Baja California, key transit points for U.S. exports. Monterrey, Nuevo León’s capital, attracted USD 69 billion in foreign direct investment in 2024, fueling infrastructure growth, including cold chain facilities. Mexico City and Guadalajara are also emerging as vital logistics hubs due to their strategic access to international airports and highways. Government initiatives promoting logistics modernization and private sector partnerships are driving the Mexico cold chain pharmaceutical logistics market growth. The development of regional hubs decentralizes pharmaceutical distribution, ensuring faster, more reliable delivery—even to rural areas. These infrastructural improvements are crucial for meeting rising domestic demand and supporting exports of temperature-sensitive products like vaccines, insulin, and biologics, which require strict temperature control throughout transit.

Technological Integration and Smart Cold Chain Solutions

Technology is transforming cold chain logistics in Mexico's pharmaceutical industry. IoT, blockchain, and AI adoption are revolutionizing temperature-controlled supply chains by increasing visibility, traceability, and efficiency. Real-time tracking of temperature, humidity, and location is now possible through IoT-enabled sensors that reduce product spoilage risk to a bare minimum. Blockchain provides immutable records that guarantee product integrity and health regulation compliance, crucial in an industry where patient safety is everything. In addition, artificial intelligence-based predictive analytics are being applied to route planning optimization and disruption prediction, reducing costs and enhancing delivery accuracy. The technologies are also enhancing automation in cold storage and bettering last-mile delivery performance. With Mexico further consolidating its role as a pharmaceutical manufacturing hub and export base, particularly to the U.S. and Latin America, demand for digitally integrated end-to-end cold chain solutions will grow appreciably. Overall, Mexico exported pharmaceutical products worth USD 1.58 Billion in 2023, representing a significant increase in comparison to 2022 at 1.48 Billion, according to the International Trade Administration (ITA).

Mexico Cold Chain Pharmaceutical Logistics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Mexico cold chain pharmaceutical logistics market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on product and service.

Analysis by Product:

- Vaccines

- Biopharmaceuticals

- Clinical Trial Materials

Vaccines are a critical segment in the cold chain pharmaceutical logistics market in Mexico due to their temperature-sensitive nature, requiring strict cold chain management. With the increasing focus on immunization programs, especially post-pandemic, the demand for vaccines has surged. Efficient logistics ensure timely delivery and maintain vaccine efficacy, essential for public health efforts. The growth in global vaccine distribution, including COVID-19 vaccines, highlights the importance of this segment. Proper cold chain infrastructure minimizes wastage and supports Mexico’s public health initiatives by ensuring high-quality vaccines reach remote regions, thereby creating a positive Mexico cold chain pharmaceutical logistics market outlook.

Biopharmaceuticals, including monoclonal antibodies and biologics, are increasingly becoming a dominant part of the pharmaceutical sector. These products are highly sensitive to temperature variations, necessitating advanced cold chain solutions. The growing demand for personalized medicine, particularly in oncology and autoimmune diseases, drives the expansion of biopharmaceutical logistics in Mexico. Ensuring that these temperature-sensitive products maintain their efficacy through sophisticated tracking and monitoring systems is crucial for market growth. The sector's growth in Mexico reflects its rising importance in global health systems, emphasizing the need for secure and reliable cold chain logistics.

The clinical trial materials segment plays a vital role in the pharmaceutical logistics market as it supports research and development. These materials, often in the form of experimental drugs or biological samples, require stringent temperature controls to ensure the integrity of clinical trials. As Mexico becomes an increasingly important hub for pharmaceutical R&D in Latin America, this segment is crucial for attracting international clinical studies. Timely and secure logistics enable the transfer of materials between trial sites, ensuring that studies proceed efficiently and produce reliable results, thus contributing to the global drug development process.

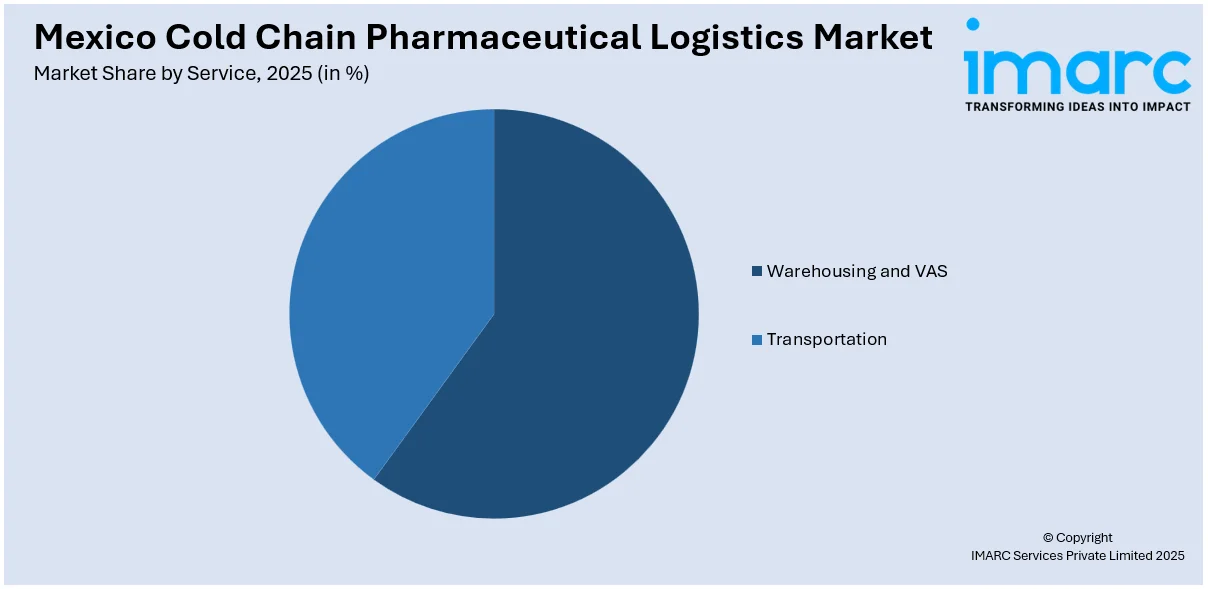

Analysis by Service:

Access the comprehensive market breakdown Request Sample

- Warehousing and VAS

- Transportation

Warehousing and value-added services (VAS) are essential components of the cold chain pharmaceutical logistics market in Mexico. Warehouses must comply with stringent temperature control regulations to store temperature-sensitive pharmaceutical products, including vaccines and biopharmaceuticals. VAS such as repackaging, labeling, and inventory management add value by increasing efficiency and reducing costs. With the expansion of the pharmaceutical sector, including biopharmaceuticals and clinical trials, the demand for temperature-controlled warehousing services in Mexico is increasing. These services ensure that products are safely stored, tracked, and distributed, meeting regulatory standards.

Transportation in the cold chain logistics industry is crucial, especially for products like vaccines and biopharmaceuticals that require consistent temperature maintenance during transit. The Mexican cold chain market is growing due to rising pharmaceutical exports and local demand, necessitating the development of reliable, temperature-controlled transport networks. This segment includes refrigerated trucks, air cargo, and rail transportation, all essential for ensuring the products remain within the required temperature range. The expansion of this segment is essential for meeting the growing demands of pharmaceutical manufacturers, especially in the rapidly evolving biopharma sector.

Regional Analysis:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico plays a critical role in the cold chain pharmaceutical logistics market due to its proximity to the U.S. and its importance as a logistics hub. The region’s well-developed infrastructure facilitates the movement of pharmaceutical products, including vaccines and biopharmaceuticals, across borders. Northern Mexico’s proximity to key ports and distribution networks further enhances its importance, allowing for efficient distribution of cold chain products to U.S. markets and other Latin American countries. This region’s strategic location and robust infrastructure are essential for meeting both domestic and international demand.

Central Mexico is home to major pharmaceutical manufacturing hubs, making it a key region for cold chain logistics. The Mexico cold chain pharmaceutical logistics market forecast indicates this area’s strong industrial base and large consumer market are fueling the demand for cold chain logistics, particularly for clinical trial materials and biopharmaceuticals. The region is also benefiting from an increase in warehousing facilities and distribution networks. Central Mexico's emphasis on industrial growth and health innovation creates opportunities for logistics companies to expand their cold chain services, ensuring the efficient movement of temperature-sensitive pharmaceutical products throughout the region.

Southern Mexico is emerging as a key market for cold chain pharmaceutical logistics due to its expanding healthcare infrastructure. While it historically lagged in terms of industrial activity compared to other regions, there is growing investment in healthcare and pharmaceuticals, creating a demand for reliable logistics. The government’s healthcare initiatives and the expansion of hospitals and clinics in this region are driving the need for temperature-controlled services. The logistics infrastructure is evolving to meet the growing demand for biopharmaceuticals and vaccines, ensuring that products are delivered efficiently and safely to underserved areas.

Competitive Landscape:

Key players in the cold chain pharmaceutical logistics market are focusing on enhancing infrastructure and technological advancements to ensure efficient product delivery. Companies are investing in state-of-the-art temperature-controlled storage facilities and expanding their transportation networks to cover more regions. Innovations in automation, AI, and IoT technologies are being integrated into operations for real-time tracking and data monitoring, improving product safety and minimizing losses. Additionally, players are collaborating with government agencies and regulatory bodies to ensure compliance with evolving standards. By offering value-added services such as customized packaging, enhanced tracking systems, and better cold chain visibility, they are positioning themselves to meet the increasing demand for temperature-sensitive pharmaceutical products, both domestically and globally.

The report provides a comprehensive analysis of the competitive landscape in the Mexico cold chain pharmaceutical logistics market with detailed profiles of all major companies.

Latest News and Developments:

- May 2025: PSA BDP, an international provider of logistics and supply chain solutions, including cold chain pharmaceutical logistics, successfully acquired a majority share in Mexican logistics services provider ED Forwarding. This acquisition will reinforce PSA BDP’s footprint in Mexico, improving the company’s capacity to better serve its clients by offering a wider range of supply chain solutions.

- February 2025: UPS Healthcare launched new cold chain cross-dock facilities in Mexico City, Milan, and Frankfurt to support temperature-sensitive pharmaceutical shipments. Certified by IATA’s CEIV Pharma standard, these centers ensure safe transport from ambient to frozen conditions. The Mexico facility spans 10,700m², enhancing regional logistics. These strategic locations enable faster deliveries, supporting rising demand for temperature-controlled healthcare products, and strengthening UPS’s global network for reliable, end-to-end cold chain solutions.

- January 2025: Emergent Cold LatAm completed the acquisition of a 45,000 m² refrigerated storage facility in Duque de Caxias, Rio de Janeiro, expanding its network in Brazil’s key distribution hub. This acquisition supports the company’s accelerated expansion plans, with five major projects planned across Brazil. Emergent Cold LatAm aims to strengthen its cold chain logistics capabilities and better serve customers throughout Latin America.

Mexico Cold Chain Pharmaceutical Logistics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Vaccines, Biopharmaceuticals, Clinical Trial Materials |

| Services Covered | Warehousing and VAS, Transportation |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico cold chain pharmaceutical logistics market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico cold chain pharmaceutical logistics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico cold chain pharmaceutical logistics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cold chain pharmaceutical logistics market in Mexico was valued at USD 192.5 Million in 2025.

The Mexico cold chain pharmaceutical logistics market is projected to exhibit a CAGR of 10.30% during 2026-2034, reaching a value of USD 465.3 Million by 2034.

The key drivers include rising demand for biopharmaceuticals and vaccines, an aging population requiring temperature-sensitive medications, advancements in technology like IoT and real-time tracking, and government policies supporting the development of cold chain infrastructure.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)