Mexico Cold Chain Transport Market Size, Share, Trends and Forecast by Type, Application, Equipment, and Region, 2026-2034

Mexico Cold Chain Transport Market Overview:

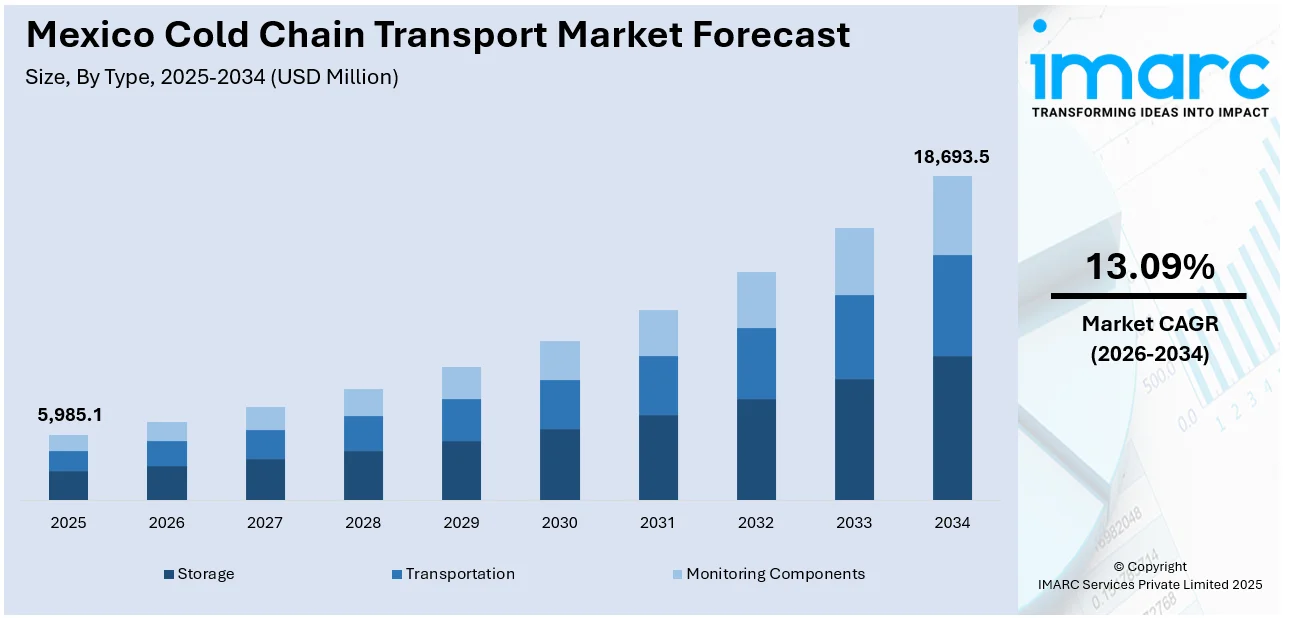

The Mexico cold chain transport market size reached USD 5,985.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 18,693.5 Million by 2034, exhibiting a growth rate (CAGR) of 13.09% during 2026-2034. Increasing demand for perishable goods, expansion of e-commerce, growing consumer preference for fresh food, regulatory requirements for food safety, and the rise of pharmaceutical logistics, fostering investments in temperature-controlled transportation infrastructure and technology, are some of the factors contributing to Mexico cold chain transport market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 5,985.1 Million |

|

Market Forecast in 2034

|

USD 18,693.5 Million |

| Market Growth Rate 2026-2034 | 13.09% |

Mexico Cold Chain Transport Market Analysis:

- Major Drivers: The Mexico cold chain transport market demand is primarily driven by increasing agricultural exports, expanding pharmaceutical sector, growing e-commerce penetration, rising consumer awareness about food safety, and government initiatives promoting cold chain infrastructure development across Mexico.

- Key Market Trends: Digital transformation through IoT integration, sustainability initiatives with eco-friendly refrigerants, automation in warehousing, strategic partnerships between international and domestic players, and the emergence of specialized pharmaceutical cold chain services are shaping the Mexico cold chain transport market outlook.

- Market Challenges: High initial investment costs, inadequate rural infrastructure, skilled workforce shortage, regulatory compliance complexities, and energy cost fluctuations pose significant challenges to market growth and operational efficiency in Mexico's cold chain transport sector.

- Market Opportunities: The Mexico cold chain transport market forecast reveals substantial opportunities in pharmaceutical logistics expansion, agricultural export growth, nearshoring trends, technology adoption incentives, and strategic partnerships with international cold chain leaders for market penetration and infrastructure development.

Mexico Cold Chain Transport Market Trends:

Expansion of Direct Shipping Routes Between China and Mexico

The establishment of direct container shipping services between China and Mexico is expected to improve logistical operations and trade efficiency, particularly in industries such as cold chain transit. With an emphasis on enhancing the flow of temperature-sensitive items, the new service shortens transit times, resulting in a more streamlined and dependable supply chain. This increased connection not only helps ease commerce between the two countries, but it also encourages the development of Mexico's cold chain infrastructure. As the demand for effective cold storage and transportation solutions grows, this growth is expected to draw further investment and spur innovation in Mexico's logistics industry. The growth of such services will help to optimize the movement of perishable commodities across North America and beyond. These factors are intensifying the Mexico cold chain transport market growth. For example, in July 2024, China COSCO Shipping launched a new "Dalian Port to Mexico" container express service, with the first vessel departing from Dalian Port. The ship is carrying nearly 800 TEUs of cargo, marking the start of direct container shipping between China and Mexico. This service aims to enhance trade efficiency and connectivity between the two countries, contributing to the growth of Mexico's cold chain transport and logistics sector.

To get more information on this market Request Sample

Rising Demand for Temperature-Sensitive Pharmaceuticals

In Mexico, a significant trend in the cold chain transport market is the increasing demand for specialized solutions for the pharmaceutical sector. The expansion of domestic drug manufacturing and the establishment of distribution hubs by global pharmaceutical companies in Mexico are driving the need for ultra-reliable temperature-controlled logistics. This includes secure storage and transportation protocols, alignment with international regulatory standards, and the development of pharmaceutical-grade warehouses, particularly in major urban centers. The growing market for biologics and personalized medicine further necessitates precise temperature control throughout the supply chain, pushing for technology-integrated cold chain networks tailored to healthcare logistics. This trend is expected to continue, fueled by an aging population and increasing healthcare expenditure. For instance, in March 2024, Transport for NSW released a guide detailing safety technology for heavy vehicles, including automatic traction control (ATC) systems. The guide outlines the benefits of ATC in enhancing vehicle stability and reducing wheel slip, contributing to safer road transport operations in New South Wales.

Mexico Cold Chain Transport Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, application, and equipment.

Type Insights:

- Storage

- Transportation

- Monitoring Components

The report has provided a detailed breakup and analysis of the market based on the type. This includes storage, transportation, and monitoring components.

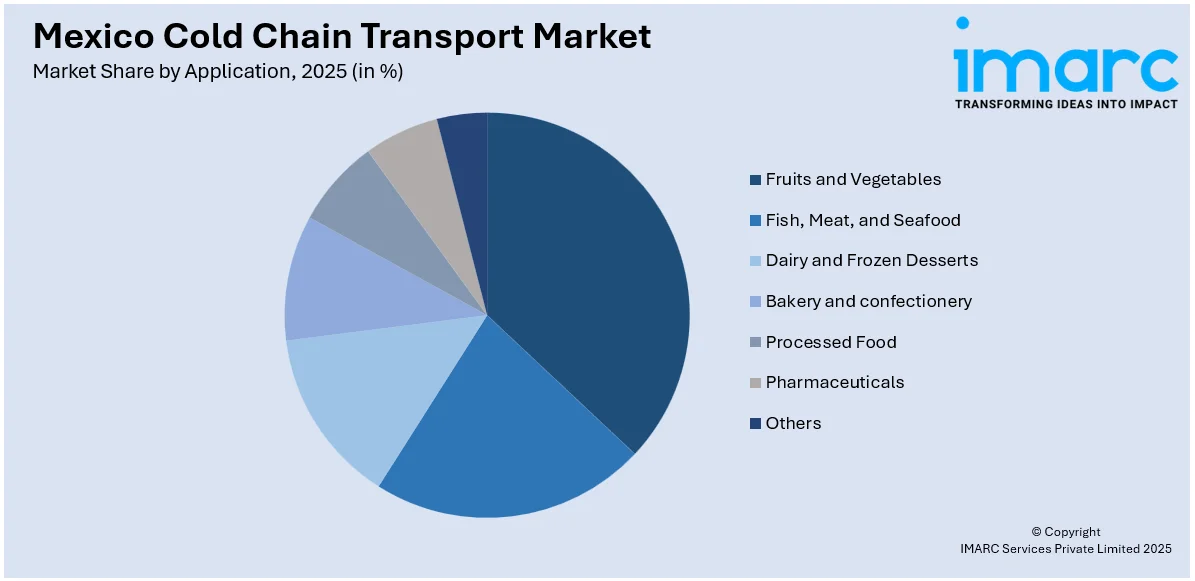

Application Insights:

Access the comprehensive market breakdown Request Sample

- Fruits and Vegetables

- Fish, Meat, and Seafood

- Dairy and Frozen Desserts

- Bakery and confectionery

- Processed Food

- Pharmaceuticals

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes fruits and vegetables, fish, meat, and seafood, dairy and frozen desserts, bakery and confectionery, processed food, pharmaceuticals, and others.

Equipment Insights:

- Storage Equipment

- Transportation Equipment

A detailed breakup and analysis of the market based on the equipment have also been provided in the report. This includes storage equipment and transportation equipment.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Cold Chain Transport Market News:

- In February 2025, UPS Healthcare launched a 10,700m² cold chain facility in Mexico City, alongside new centers in Milan and Frankfurt, to support temperature-controlled pharmaceutical shipments. Certified under IATA’s CEIV Pharma standard, the facilities handle ambient to frozen products, ensuring safe, timely delivery. The Mexico site enhances regional logistics, complementing UPS’s global network, and addresses growing demand for advanced healthcare treatments requiring strict temperature management, improving supply chain resilience and efficiency.

- In December 2024, Calgary-based CPKC and Americold Realty Trust Inc. expanded their partnership to explore co-development opportunities for cold chain transport in Mexico. This collaboration aims to enhance temperature-sensitive logistics among Mexico, the U.S., and Canada.

Mexico Cold Chain Transport Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Storage, Transportation, Monitoring Components |

| Applications Covered | Fruits and Vegetables, Fish, Meat, and Seafood, Dairy and Frozen Desserts, Bakery and confectionery, Processed Food, Pharmaceuticals, Others |

| Equipments Covered | Storage Equipment, Transportation Equipment |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico cold chain transport market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico cold chain transport market on the basis of type?

- What is the breakup of the Mexico cold chain transport market on the basis of application?

- What is the breakup of the Mexico cold chain transport market on the basis of equipment?

- What is the breakup of the Mexico cold chain transport market on the basis of region?

- What are the various stages in the value chain of the Mexico cold chain transport market?

- What are the key driving factors and challenges in the Mexico cold chain transport market?

- What is the structure of the Mexico cold chain transport market and who are the key players?

- What is the degree of competition in the Mexico cold chain transport market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico cold chain transport market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico cold chain transport market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico cold chain transport industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)