Mexico Commercial Display Market Size, Share, Trends and Forecast by Product Type, Technology, Component, Panel Type, Size, Application, and Region, 2025-2033

Mexico Commercial Display Market Overview:

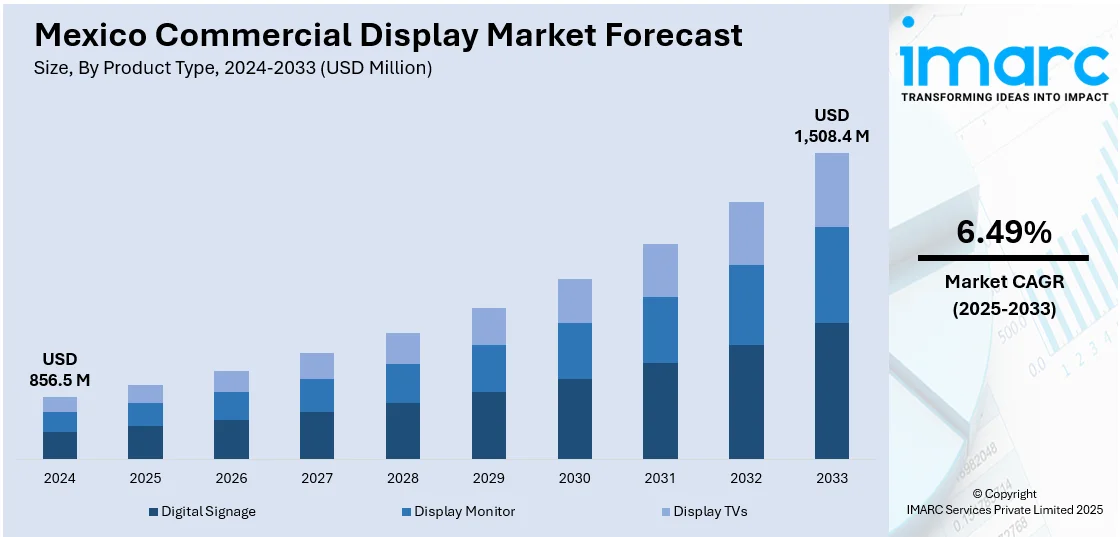

The Mexico commercial display market size reached USD 856.5 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,508.4 Million by 2033, exhibiting a growth rate (CAGR) of 6.49% during 2025-2033. The market is growing due to rising retail digitalization, demand for interactive and high-resolution signage, and the expansion of outdoor LED advertising. Technological advancements, cost-effective solutions, and smart city initiatives further propel adoption. Increased investments in advertising and retail infrastructure are also expanding the Mexico commercial display market share, supported by urbanization and omnichannel marketing trends.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 856.5 Million |

| Market Forecast in 2033 | USD 1,508.4 Million |

| Market Growth Rate 2025-2033 | 6.49% |

Mexico Commercial Display Market Trends:

Shift Toward Sustainable and Energy-Efficient Display Solutions

Sustainability is becoming a key trend in the market, with businesses prioritizing energy-efficient and eco-friendly solutions. LED-backlit LCDs and OLED displays are gaining popularity due to their lower power consumption and longer lifespans compared to traditional screens. For instance, Micro-LED display technology continues to progress rapidly, achieving pixel densities in the 30,000 PPI range and upwards of 1,000,000 nits in brightness. It is highly efficient and durable, ideal for use in a deeper purpose. Micro-LEDs are predicted to outperform traditional LCD and OLED for both performance and longevity, placing them in a prime position to revolutionize Mexico's commercial display market in areas such as high-end signage and immersive retail environments. Concurrently, innovations such as 5100 PPI arrays and 4μm chip sizes show substantial commercial potential. Additionally, manufacturers are adopting recyclable materials and reducing hazardous substances in display production to meet environmental regulations. Corporate social responsibility (CSR) initiatives and rising energy costs are pushing companies to invest in displays with automatic brightness adjustments and power-saving modes. Solar-powered digital billboards are also emerging in urban areas, aligning with Mexico’s renewable energy goals. As consumer and regulatory pressures for sustainability grow, the demand for green display technologies is rising, creating a positive Mexico commercial display market outlook.

Growth of Transparent LED Displays in Retail and Hospitality

Mexico’s commercial display market is seeing increased adoption of transparent LED screens, particularly in high-end retail stores, luxury showrooms, and hotel lobbies. These innovative displays allow businesses to showcase dynamic digital content while maintaining visibility through the screen, creating an immersive yet unobtrusive customer experience. Retailers use them for interactive product demonstrations, promotional campaigns, and augmented reality integrations that blend digital and physical elements seamlessly. . A research report from the IMARC Group indicates that the retail market in Mexico achieved a size of USD 454.5 Billion in 2024. It is projected to grow to USD 693.0 Billion by 2033, reflecting a compound annual growth rate (CAGR) of 4.56% from 2025 to 2033. Moreover, the hospitality sector leverages transparent LEDs for digital concierge services, event promotions, and artistic installations that enhance ambiance. As the technology becomes more affordable and energy-efficient, adoption is expanding beyond premium applications into mainstream retail and corporate environments. Thus, this is further driving the Mexico commercial display market growth. With Mexico’s growing focus on experiential marketing and futuristic store designs, transparent LED displays are poised to become a key differentiator for brands seeking innovative ways to engage customers.

Mexico Commercial Display Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type, technology, component, panel type, size, and application.

Product Type Insights:

- Digital Signage

- Display Monitor

- Display TVs

The report has provided a detailed breakup and analysis of the market based on the product type. This includes digital signage, display monitor, and display TVs.

Technology Insights:

- LCD

- LED

- Others

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes LCD, LED, and others.

Component Insights:

- Hardware

- Software

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware, software, and services.

Panel Type Insights:

- Flat Panel

- Curved Panel

- Others

A detailed breakup and analysis of the market based on the panel type have also been provided in the report. This includes flat panel, curved panel, and others.

Size Insights:

- Below 32 inches

- 32 to 52 inches

- 52 to 75 inches

- Above 75 inches

The report has provided a detailed breakup and analysis of the market based on the size. This includes below 32 inches, 32 to 52 inches, 52 to 75 inches, and above 75 inches.

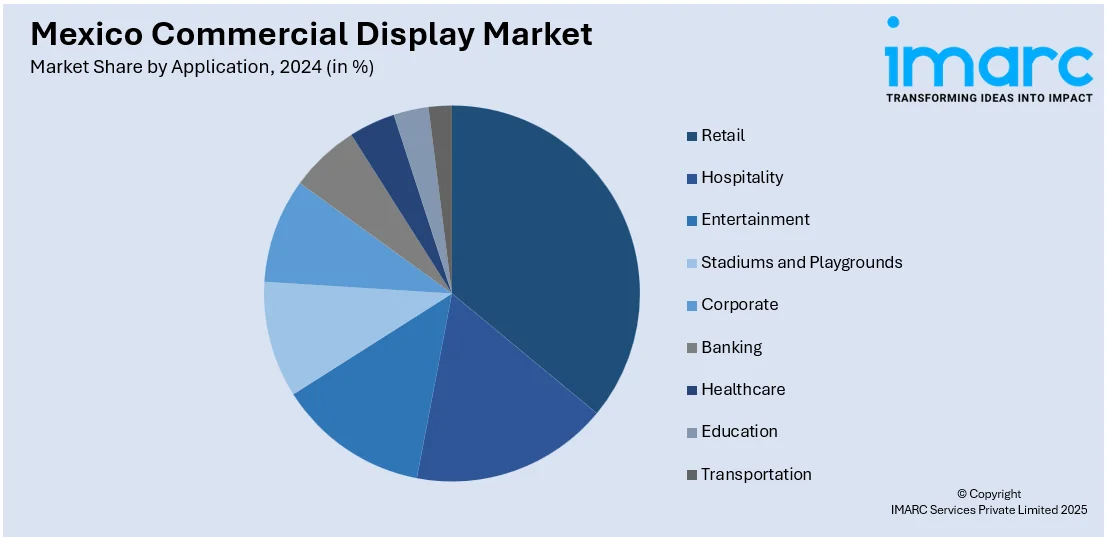

Application Insights:

- Retail

- Hospitality

- Entertainment

- Stadiums and Playgrounds

- Corporate

- Banking

- Healthcare

- Education

- Transportation

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes retail, hospitality, entertainment, stadiums and playgrounds, corporate , banking, healthcare, education, and transportation.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Commercial Display Market News:

- May 15, 2024: BLOQUE, a new technology and innovation center, launched one of the largest Naked Eye 3D LED displays in Mexico. The impressive installation currently occupies 316 m² with a pixel pitch of 3.9 mm and a resolution of 23 MP and is installed on its 10m x 10m and 21m x 10m façade. Built within an IP67/IP66-rated aluminum casing built to sustain admiration at 60°C, the display screens enticing 3D content to showcase BLOQUE’s digital skills programs. This launch strengthens BLOQUE’s leadership position within the commercial display sector of Mexico and reinforces its commitment to technology in education.

Mexico Commercial Display Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Digital Signage, Display Monitor, Display TVs |

| Technologies Covered | LCD, LED, Others |

| Components Covered | Hardware, Software, Services |

| Panel Types Covered | Flat Panel, Curved Panel, Others |

| Sizes Covered | Below 32 inches, 32 to 52 inches, 52 to 75 inches, Above 75 inches |

| Applications Covered | Retail, Hospitality, Entertainment, Stadiums and Playgrounds, Corporate, Banking, Healthcare, Education, Transportation |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico commercial display market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico commercial display market on the basis of product type?

- What is the breakup of the Mexico commercial display market on the basis of technology?

- What is the breakup of the Mexico commercial display market on the basis of component?

- What is the breakup of the Mexico commercial display market on the basis of panel type?

- What is the breakup of the Mexico commercial display market on the basis of size?

- What is the breakup of the Mexico commercial display market on the basis of application?

- What is the breakup of the Mexico commercial display market on the basis of region?

- What are the various stages in the value chain of the Mexico commercial display market?

- What are the key driving factors and challenges in the Mexico commercial display?

- What is the structure of the Mexico commercial display market and who are the key players?

- What is the degree of competition in the Mexico commercial display market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico commercial display market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico commercial display market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico commercial display industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)