Mexico Commercial Insurance Market Size, Share, Trends and Forecast by Type, Enterprise Size, Distribution Channel, Industry Vertical, and Region, 2025-2033

Mexico Commercial Insurance Market Overview:

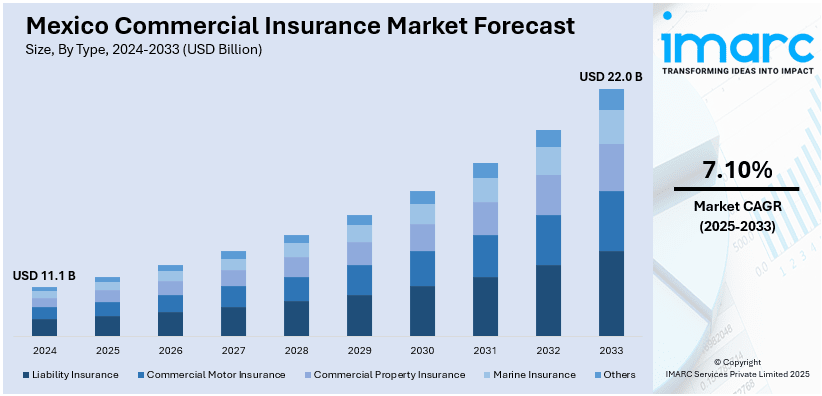

The Mexico commercial insurance market size reached USD 11.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 22.0 Billion by 2033, exhibiting a growth rate (CAGR) of 7.10% during 2025-2033. The market is growing attributed to the rising need for tailored solutions addressing natural disasters, environmental risks, and diverse business sectors, with increasing demand for customized insurance products that offer protection against specific operational risks, further supported by digital advancements and expanding product offerings.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 11.1 Billion |

| Market Forecast in 2033 | USD 22.0 Billion |

| Market Growth Rate 2025-2033 | 7.10% |

Mexico Commercial Insurance Market Trends:

Rising Natural Disasters and Environmental Risks

The vulnerability of natural disasters such as earthquakes, hurricanes, and floods greatly influence the growth of the commercial insurance sector in Mexico. Owing to its geographic position, the nation is extremely susceptible to different environmental threats that can significantly impact business activities. These natural occurrences not only harm infrastructure but also disrupt supply chains, resulting in monetary losses. As a result, companies are progressively acknowledging the significance of obtaining insurance policies to safeguard against these disastrous risks. Insurance options such as property coverage, business interruption coverage, and environmental liability coverage are becoming crucial, as businesses aim to protect their assets, operations, and reputations. The growing concerns about environmental hazards and the focus on sustainability is also spurring interest in eco-friendly insurance options that tackle environmental harm and sustainability-linked risks. In line with this trend, Descartes establishes a new office in Mexico City in 2024 to meet the growing need for parametric insurance products in Latin America. This expansion aimed at delivering protection for agriculture, tropical storms, renewable energy, and earthquakes, crucial sectors affected by Mexico's vulnerability to natural disasters. By enhancing its presence in the area, Descartes emphasized the rising demand for tailored insurance solutions that tackle the financial risks brought about by natural disasters and environmental issues. The increasing need for disaster readiness and tailored coverage is fueling the growth of the commercial insurance sector in Mexico.

Access to Broader Range of Insurance Products and Customization

The expansion and diversification of insurance products in Mexico are fueling the demand for commercial insurance solutions. With the growing sophistication of the insurance industry, companies are no longer limited to standard, one-size-fits-all policies. Insurance providers are presenting a wider array of personalized products designed to address the specific requirements of various sectors. Businesses can now select insurance options that closely match their operational risks, ranging from tailored coverage for technology firms to policies crafted for retail enterprises. For instance, in 2024, Redline Underwriting launched a new property reinsurance solution for commercial and industrial risks in Mexico, Central and South America, and the Caribbean. The product offered up to $5 million in coverage, with flexible terms such as primary, excess of loss, or proportional coverage. Supported by Lloyd's capacity, it strengthened Redline's position in the regional property insurance market, highlighting the growing accessibility of specialized and personalized policies. Such customized solutions allow businesses to enhance their control over risk management strategies, helping them to address particular threats more accurately. Moreover, the expansion of digital platforms is simplifying the process for companies to compare and obtain a broader range of insurance products, nurturing a more competitive and vibrant market. With the increasing demand for tailored coverage, the commercial insurance sector in Mexico keeps evolving to address the varied requirements of businesses.

Mexico Commercial Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, enterprise size, distribution channel, and industry vertical.

Type Insights:

- Liability Insurance

- Commercial Motor Insurance

- Commercial Property Insurance

- Marine Insurance

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes liability insurance, commercial motor insurance, commercial property insurance, marine insurance, and others.

Enterprise Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

A detailed breakup and analysis of the market based on the enterprise size have also been provided in the report. This includes large enterprises and small and medium-sized enterprises.

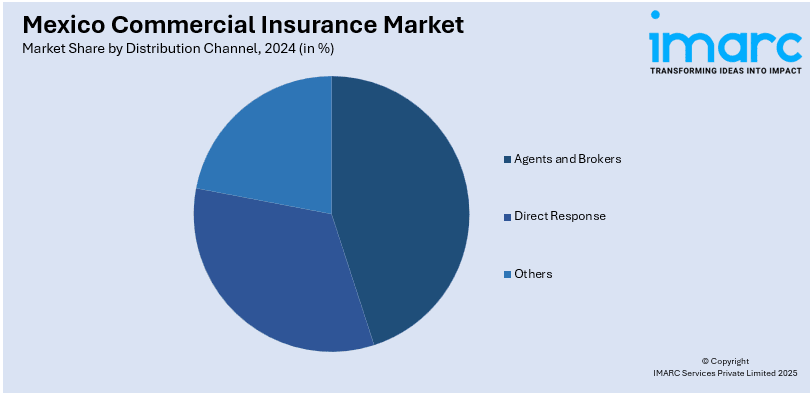

Distribution Channel Insights:

- Agents and Brokers

- Direct Response

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes agents and brokers, direct response, and others.

Industry Vertical Insights:

- Transportation and Logistics

- Manufacturing

- Construction

- IT and Telecom

- Healthcare

- Energy and Utilities

- Others

A detailed breakup and analysis of the market based on the industry vertical have also been provided in the report. This includes transportation and logistics, manufacturing, construction, IT and telecom, healthcare, energy and utilities, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Commercial Insurance Market News:

- In March 2025, HDI Global launched new environmental insurance solutions in Mexico to help businesses manage risks and ensure operational continuity. The coverage includes environmental liability, restoration, pollution liability, and business interruption insurance. These solutions aim to mitigate the significant environmental risks faced by Mexican companies, which cost about 4.6% of the country's GDP annually.

- In May 2024, Everest announced the launch of its operations in Mexico, after receiving regulatory approval from the Comisión Nacional de Seguros y Fianzas. The new entity, Compañía de Seguros Generales Everest México, was headquartered in Mexico City. Everest aimed to become a market leader in property, casualty, marine, and financial lines in the growing Mexican insurance market.

Mexico Commercial Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Liability Insurance, Commercial Motor Insurance, Commercial Property Insurance, Marine Insurance, Others |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises |

| Distribution Channels Covered | Agents and Brokers, Direct Response, Others |

| Industry Verticals Covered | Transportation and Logistics, Manufacturing, Construction, IT and Telecom, Healthcare, Energy and Utilities, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico commercial insurance market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico commercial insurance market on the basis of type?

- What is the breakup of the Mexico commercial insurance market on the basis of enterprise size?

- What is the breakup of the Mexico commercial insurance market on the basis of distribution channel?

- What is the breakup of the Mexico commercial insurance market on the basis of industry vertical?

- What is the breakup of the Mexico commercial insurance market on the basis of region?

- What are the various stages in the value chain of the Mexico commercial insurance market?

- What are the key driving factors and challenges in the Mexico commercial insurance market?

- What is the structure of the Mexico commercial insurance market and who are the key players?

- What is the degree of competition in the Mexico commercial insurance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico commercial insurance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico commercial insurance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico commercial insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)