Mexico Commercial Telematics Market Size, Share, Trends and Forecast by Type, System Type, Provider Type, End Use Industry, and Region, 2025-2033

Mexico Commercial Telematics Market Overview:

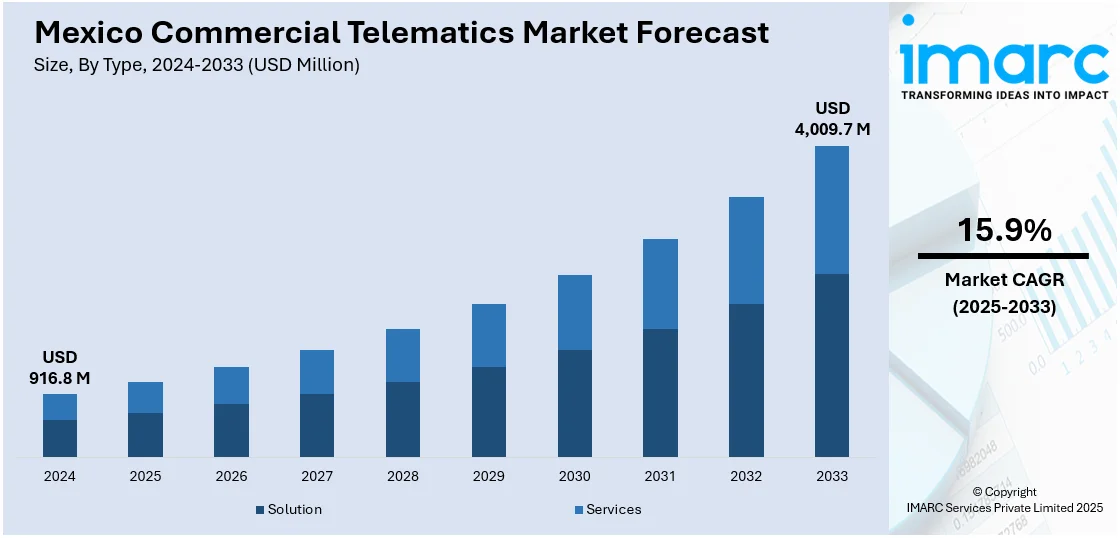

The Mexico commercial telematics market size reached USD 916.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 4,009.7 Million by 2033, exhibiting a growth rate (CAGR) of 15.9% during 2025-2033. The market is driven by the government’s emphasis on road safety, fuel efficiency, and transparency in logistics through strict regulation, rising fuel cost in Mexico, and heightened need for fast, traceable, and trustworthy delivery systems.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 916.8 Million |

| Market Forecast in 2033 | USD 4,009.7 Million |

| Market Growth Rate 2025-2033 | 15.9% |

Mexico Commercial Telematics Market Trends:

Government Regulations and Safety Mandates

The government of Mexico is placing emphasis on road safety, fuel efficiency, and transparency in logistics through strict regulation. These policies are a key driver of telematics adoption by commercial fleet operators. Regulatory bodies are implementing mandates calling for real-time tracking and monitoring of freight transportation, especially hazardous and high-value cargo. This regulatory landscape is driving the demand for global positioning system (GPS) tracking, driver behavior monitoring, and electronic logging devices (ELDs). These devices enable fleet managers to maintain driving hour compliance and route following, mitigating liability risk. Furthermore, tax benefits and regulatory measures favoring digital transformation in the logistics sector drive fleet digitization as well. The IMARC Group predicts that the Mexico logistics market size is expected to reach USD 141.8 Billion by 2033.

Rising Fuel Costs and Operational Efficiency Needs

According to federal legislator Guillermo Anaya, gasoline prices in Mexico might reach MX$30/L by 2025. The rising fuel cost in Mexico is compelling fleet operators to look for solutions that maximize fuel usage and enhance the overall efficiency of fleets. Commercial telematics solutions offer real-time analysis of fuel consumption, idling, engine performance, and route optimization, allowing companies to reduce unnecessary expenses. Telematics platforms enable operators to detect wasteful driving practices like hard braking, speeding, and excessive engine use, which are key causes of fuel wastage. By solving these problems, businesses can greatly reduce fuel expenses, minimize vehicle wear and tear, and prolong the working life of their fleets. Route optimization software can also decrease delivery times and enhance scheduling accuracy, which has a direct effect on customer satisfaction and profitability. With Mexican firms in logistics, distribution, and transportation industries coming under greater competition and slim margins, the potential to track and improve operational effectiveness through telematics becomes invaluable.

Expansion of E-commerce Services and Logistics Operations

The development of the e-commerce platforms is creating a high need for fast, traceable, and trustworthy delivery systems. As top companies are heavily investing in last-mile logistics facilities, commercial telematics solutions are increasingly used to address these new operational needs. Telematics enables real-time tracking of vehicles, preventive vehicle maintenance, and scheduling of fleets, which are crucial in guaranteeing prompt deliveries and optimizing logistics networks. With increasing consumer demand for quicker, more transparent delivery, logistics suppliers are looking toward sophisticated telematics to enhance competitiveness. The demand for standardized performance measurements, route optimization, and real-time communication throughout delivery fleets makes commercial telematics a strategic imperative within Mexico's improving e-commerce logistics environment. The Mexico e-commerce market size is expected to reach USD 176.6 Billion by 2033, according to the predictions of the IMARC Group.

Mexico Commercial Telematics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, system type, provider type, and end use industry

Type Insights:

- Solution

- Fleet Tracking and Monitoring

- Driver Management

- Insurance Telematics

- Safety and Compliance

- V2X Solutions

- Others

- Services

- Professional services

- Managed services

The report has provided a detailed breakup and analysis of the market based on the type. This includes solution (fleet tracking and monitoring, driver management, insurance telematics, safety and compliance, V2X solutions, and others) and services (professional services and managed services).

System Type Insights:

- Embedded

- Tethered

- Smartphone Integrated

A detailed breakup and analysis of the market based on the system type have also been provided in the report. This includes embedded, tethered, and smartphone integrated.

Provider Type Insights:

- OEM

- Aftermarket

A detailed breakup and analysis of the market based on the provider type have also been provided in the report. This includes OEM and aftermarket.

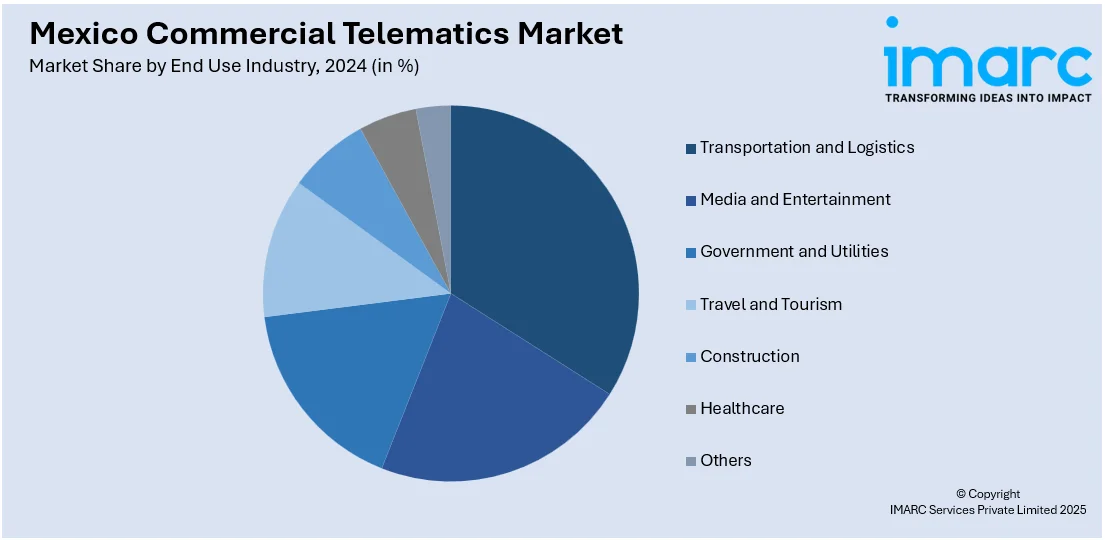

End Use Industry Insights:

- Transportation and Logistics

- Media and Entertainment

- Government and Utilities

- Travel and Tourism

- Construction

- Healthcare

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes transportation and logistics, media and entertainment, government and utilities, travel and tourism, construction, healthcare, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Commercial Telematics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| System Types Covered | Embedded, Tethered, Smartphone Integrated |

| Provider Type Covered | OEM, Aftermarket |

| End Use Industry Covered | Transportation and Logistics, Media and Entertainment, Government and Utilities, Travel and Tourism, Construction, Healthcare, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico commercial telematics market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico commercial telematics market on the basis of type?

- What is the breakup of the Mexico commercial telematics market on the basis of system type?

- What is the breakup of the Mexico commercial telematics market on the basis of provider type?

- What is the breakup of the Mexico commercial telematics market on the basis of end use industry?

- What is the breakup of the Mexico commercial telematics market on the basis of region?

- What are the various stages in the value chain of the Mexico commercial telematics market?

- What are the key driving factors and challenges in the Mexico commercial telematics market?

- What is the structure of the Mexico commercial telematics market and who are the key players?

- What is the degree of competition in the Mexico commercial telematics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico commercial telematics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico commercial telematics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico commercial telematics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)