Mexico Composite Market Size, Share, Trends and Forecast by Product, MFG Process, Application, and Region, 2026-2034

Mexico Composite Market Overview:

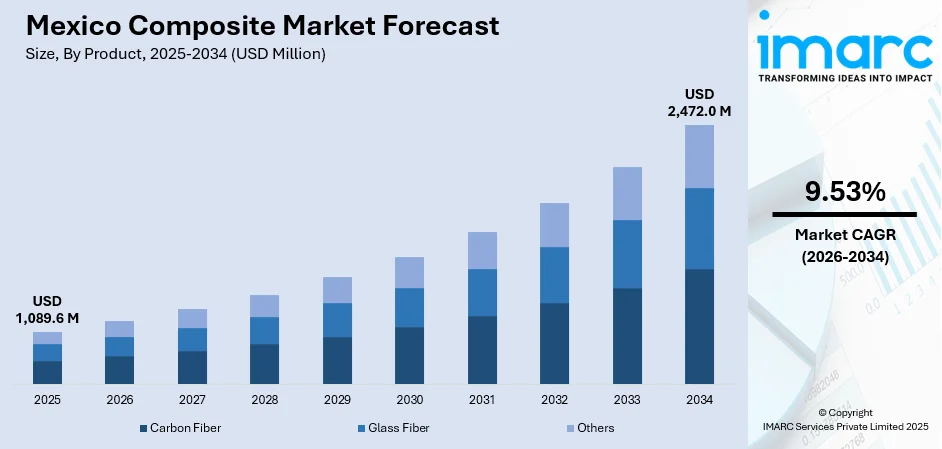

The Mexico composite market size reached USD 1,089.6 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 2,472.0 Million by 2034, exhibiting a growth rate (CAGR) of 9.53% during 2026-2034. The automotive and transportation sectors in Mexico are increasingly using composites for improved performance, fuel efficiency, and safety, especially in electric vehicles (EVs). Additionally, renewable energy projects, such as wind and solar power, are catalyzing the demand for composites in Mexico’s energy infrastructure. The Mexico composite market share is expected to expand significantly as these sectors continue to embrace composites for their advanced capabilities and sustainability benefits.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,089.6 Million |

| Market Forecast in 2034 | USD 2,472.0 Million |

| Market Growth Rate 2026-2034 | 9.53% |

Access the full market insights report Request Sample

Mexico Composite Analysis:

- Key Market Drivers: Increasing adoption in the automotive industry and renewable energy facility development propel the Mexico composite market analysis. Electric vehicle assembly expansion and wind turbine production necessitate advanced composite material for lightweight, high-strength parts. Government incentive for green energy projects further fuels demand for composite materials across various industries.

- Major Market Trends: Growing emphasis on carbon fiber composites for high-performance uses and glass fiber materials for low-cost solutions. The Mexican Composite Market exhibits robust growth in automotive lightweighting programs and renewable energy uses. Process innovations in manufacturing and sustainability issues drive market development trends strongly.

- Market Challenges: Large up-front capital investment for sophisticated manufacturing tools and shortage of skilled labor are major inhibitions. Volatility in raw material prices and intricate supply chain management are operational challenges. Difficulty in competing with substitute materials and high-quality standards augment market entry difficulties extensively.

- Market Opportunities: Increased electric vehicle manufacturing and renewable energy initiatives offer great growth opportunities. State-of-the-art manufacturing technologies and green materials development provide competitive strengths. Collaborative alliances with automotive and energy companies offer Mexico composite market demand through technological advancements.

To get more information on this market Request Sample

Mexico Composite Market Trends:

Expanding Applications in Renewable Energy

Increase in renewable energy initiatives, especially wind and solar power, is supporting the Mexico composite market growth. Materials like fiberglass and carbon fiber are vital in manufacturing wind turbine blades, providing significant advantages including strength, longevity, and corrosion resistance, which are necessary for effective energy production. These materials enable the production of lighter and longer blades, which excel at harnessing wind energy and enhancing overall turbine efficiency. Moreover, composites are widely utilized in the production of solar panel supports and frames, which need to withstand severe environmental conditions while preserving lightweight characteristics to facilitate easy installation and ensure durability over time. With Mexico's ongoing significant investment in renewable energy infrastructure, the need for composites in this industry is projected to increase swiftly. In 2025, Mexico launched its bold national electricity initiative (2025–2030), featuring 51 renewable energy projects that will add nearly 23 GW of new capacity, backed by a US$22.3 billion investment. This strategy emphasizes the growth of solar, wind, and natural gas facilities to enhance energy accessibility and sustainability nationwide. Mexico’s push for renewable energy development is catalyzing the demand for composite materials, driving further growth in the composite market and positioning it as a critical component in the country's transition to cleaner energy sources.

Increased Adoption in Automotive and Transportation Industries

The automotive and transportation industries in Mexico are progressively embracing composite materials due to their potential to improve vehicle performance, fuel efficiency, and safety. Composites play a vital role in decreasing vehicle weight, enhancing fuel efficiency, and reducing carbon emissions, supporting worldwide sustainability goals. As the demand for EVs increases and the automotive sector moves towards lightweight, environment-friendly options, the requirement for high-performance composites is on the rise. These materials are utilized in manufacturing car body parts, interior elements, and EV batteries, as they enhance performance and improve energy efficiency. In 2024, Mexico's automotive sector experienced a notable rise in the uptake of electric and plug-in hybrid vehicles (PHEVs), with sales totaling 69,713 units, reflecting an 83.8% growth compared to 2023, according to the Electro Mobility Association (EMA). This rising trend in EV sales underscores the growing need for lightweight materials, as EVs necessitate efficient, low-weight structures to improve battery performance and energy efficiency. As an important contributor to automotive manufacturing, Mexico is experiencing significant growth in composite usage, anticipated to persist as the automotive industry increasingly prioritizes eco-friendly and efficient transportation options. This change emphasizes the importance of composite materials in meeting the industry's objectives of minimizing environmental impact while ensuring high performance.

Mexico Composite Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product, MFG process, and application.

Product Insights:

- Carbon Fiber

- Glass Fiber

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes carbon fiber, glass fiber, and others.

MFG Process Insights:

- Layup

- Filament

- Injection Molding

- Pultrusion

- Compression Molding

- RTM

- Others

A detailed breakup and analysis of the market based on the MFG process have also been provided in the report. This includes layup, filament, injection molding, pultrusion, compression molding, RTM, and others.

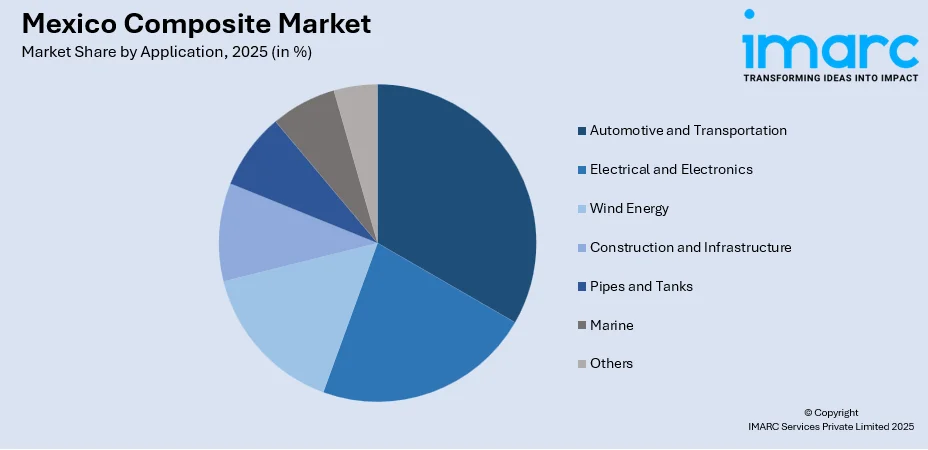

Application Insights:

To get detailed regional analysis of this market Request Sample

- Automotive and Transportation

- Electrical and Electronics

- Wind Energy

- Construction and Infrastructure

- Pipes and Tanks

- Marine

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes automotive and transportation, electrical and electronics, wind energy, construction and infrastructure, pipes and tanks, marine, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Composite Market News:

- In May 2025, Tata AutoComp Systems Ltd. and Katcon Global announced a joint venture in Mexico to manufacture advanced composite materials. The partnership aims to serve the North American market with lightweight solutions for vehicles and other sectors. This marks Tata AutoComp's first venture contributing core composite technology.

Mexico Composite Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Carbon Fiber, Glass Fiber, Others |

| MFG Processes Covered | Layup, Filament, Injection Molding, Pultrusion, Compression Molding, RTM, Others |

| Applications Covered | Automotive and Transportation, Electrical and Electronics, Wind Energy, Construction and Infrastructure, Pipes and Tanks, Marine, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico composite market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico composite market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico composite industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The composite market in Mexico was valued at USD 1,089.6 Million in 2025.

The Mexico composite market is projected to exhibit a CAGR of 9.53% during 2026-2034, reaching a value of USD 2,472.0 Million by 2034.

The increasing adoption in the automotive industry for improved performance and fuel efficiency, expanding electric vehicle manufacturing, renewable energy projects including wind and solar power infrastructure development, government incentives for green energy initiatives, and growing emphasis on lightweight, high-strength materials are driving the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)