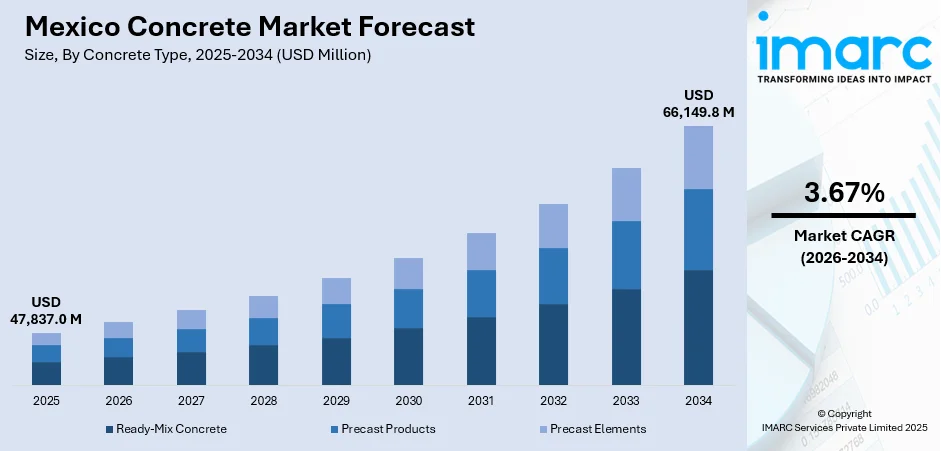

Mexico Concrete Market Size, Share, Trends and Forecast by Concrete Type, Application, End Use Industry, and Region, 2026-2034

Mexico Concrete Market Overview:

The Mexico concrete market size reached USD 47,837.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 66,149.8 Million by 2034, exhibiting a growth rate (CAGR) of 3.67% during 2026-2034. The market is driven by nationwide infrastructure upgrades and housing projects that demand high-durability, climate-resilient materials. Climate policy integration and industry-led decarbonization efforts are fostering adoption of low-carbon cement technologies across public and private construction, thereby fueling the market. Additionally, increased nearshoring activity is accelerating industrial park and logistics infrastructure development, requiring robust concrete applications for speed, strength, and sustainability, further augmenting the Mexico concrete market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 47,837.0 Million |

| Market Forecast in 2034 | USD 66,149.8 Million |

| Market Growth Rate 2026-2034 | 3.67% |

Access the full market insights report Request Sample

Mexico Concrete Market Analysis:

- Key Market Drivers: The Mexico concrete market is fueled by growing urbanization, heightened infrastructure spending, and growing residential and commercial construction activities. Government policies focused on sustainable construction and long-lasting building materials also drive demand. Heightened realization of high-performance concrete solutions fuels adoption at industrial, commercial, and residential construction projects across the country.

- Key Market Trends: The Mexico concrete market forecast indicates the market is shifting in the direction of greener and lower-carbon solutions for concrete. There are innovations in precast and readymix concrete, together with greater automation of batching and delivery, that are enhancing efficiency. Use of digital construction applications and intelligent concrete technologies is increasingly popular, allowing for enhanced quality control, real-time monitoring, and optimal utilization of resources.

- Competitive Landscape: The Mexican concrete market is intensified with strong regional competition among suppliers and specialized services providers. Product differentiation, technology incorporation, and increasing distribution networks are emphasized by companies. Partnerships with construction businesses and continuous investment in sustainable and high-performance concrete products reinforce market position and improve customer loyalty.

- Challenges and Opportunities: Growth challenges consist of high energy prices, volatile raw material prices, and strict environmental regulations. Green concrete, modernizing infrastructure, and urban development initiatives are opportunities. Market players can take advantage of Mexico's increasing demand for sustainable, high-quality building materials by capitalizing on innovations in concrete mixes, digital building, and reliable logistics.

To get more information on this market Request Sample

Mexico Concrete Market Trends:

Use of Sustainable and Low-Carbon Concrete Solutions

The Mexico concrete market is moving increasingly towards sustainable and low-carbon concrete solutions to conform to environmental regulations and minimize carbon footprints. Building construction is embracing blended cements, supplementary cementitious materials, and recycled aggregates to improve durability and lower environmental impact. The trend is facilitated by improved awareness among developers as well as regulatory support in the form of green building practices. Sustainable concrete solutions also help build energy-efficient buildings, enhance their thermal performance, and lower their operating costs, making them extremely desirable for domestic, commercial, and infrastructure developments. With increasing urbanization, the use of environmental materials in large-scale construction is also emerging as a differentiating factor, fueling the Mexico concrete market demand and the market's transition to green construction.

Increased Use of Precast and Ready-Mix Concrete

Precast and ready-mix concrete are experiencing rapid uptake in Mexico based on their potential to lower construction time, improve quality, and enhance project delivery. Precast elements make structural consistency and easy installation of large-scale infrastructure and home projects possible. Ready-mix concrete technologies enable real-time batching, accurate material proportioning, and quick delivery to sites, lowering labor intensity and enhancing operational efficiency. The trend is also supported by metropolitan growth and increasing need for standardized, high-performance building materials. Advanced networked logistics, together with technology integration in production and delivery, allow contractors to execute projects quicker and more efficiently, making precast and ready-mix concrete progressively critical in contemporary building practices.

Integration of Digital and Smart Construction Technologies

Smart and digital construction technologies are revolutionizing the Mexican concrete market by increasing precision, quality control, and monitoring of projects. Sensors, IoT sensors, and concrete-strength monitoring systems offer real-time observations of material performance, curing, and environmental status, enabling proactive adjustments to maximally guarantee structural integrity. Digital platforms enable automatic batching, scheduling, and supply chain management, enhancing efficiency and minimizing waste. The implementation of Building Information Modeling (BIM) and AI-based construction planning facilitates precise visualization, risk analysis, and resource management. Intelligent technologies also enhance predictive maintenance and durability testing, enabling longer-lasting structures. With more complex construction projects becoming the norm, the integration of digital solutions and intelligent concrete technologies is fueling innovation, operational excellence, and competitive differentiation in the Mexico concrete market.

Mexico Concrete Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on concrete type, application, and end use industry.

Concrete Type Insights:

- Ready-Mix Concrete

- Transit Mix Concrete

- Central Mix Concrete

- Shrink Mix Concrete

- Precast Products

- Paving Stones and Slabs

- Bricks

- AAC Blocks

- Others

- Precast Elements

- Facade

- Floor

- Building blocks

- Pipe

- Others

The report has provided a detailed breakup and analysis of the market based on the concrete type. This includes ready-mix concrete (transit mix concrete, central mix concrete, and shrink mix concrete), precast products (paving stones and slabs, bricks, AAC blocks, and others), and precast elements (facade, floor, building blocks, pipe, and others).

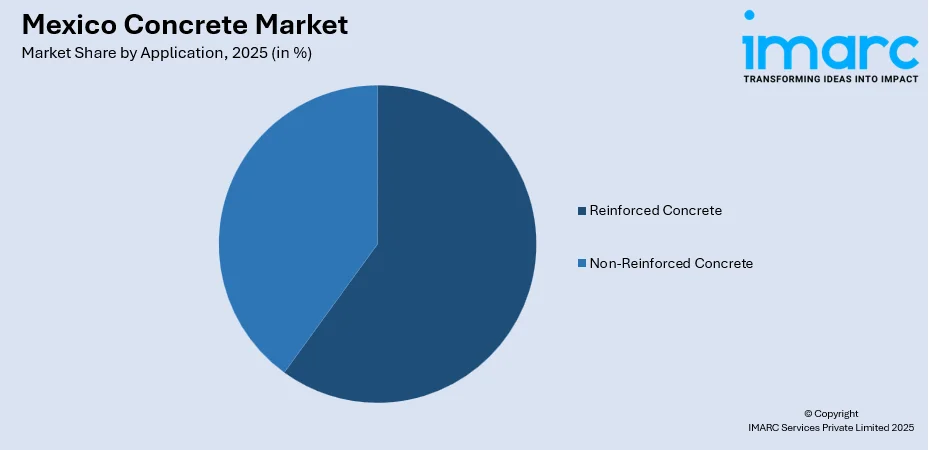

Application Insights:

To get detailed segment analysis of this market Request Sample

- Reinforced Concrete

- Non-Reinforced Concrete

The report has provided a detailed breakup and analysis of the market based on the application. This includes reinforced concrete and non-reinforced concrete.

End Use Industry Insights:

- Roads and Highways

- Tunnels

- Residential Buildings

- Non-Residential Buildings

- Dams and Power Plants

- Mining

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes roads and highways, tunnels, residential buildings, non-residential buildings, dams and power plants, mining, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Concrete Market News:

- On March 3, 2023, CRDC Mexico and Grupo Trivasa have signed an agreement to introduce concrete blocks containing up to 5% RESIN8™, a recycled plastic additive, into the Mexico market starting in spring 2023. The blocks, manufactured at Trivasa’s Xcitán Plant in Yucatan, aim to produce around 120,000 units monthly for eco-friendly construction projects across Yucatán, Campeche, Quintana Roo, and Tabasco. These RESIN8™-enhanced blocks offer benefits such as improved thermal insulation and reduced weight without requiring changes to current production or construction methods.

- In July 2024, Holcim México has invested MX$56 million (approximately US$2.96 million) to expand the production and distribution of ECOPact, its low-carbon concrete. The initiative includes the installation of 27 new silos across ready-mix plants nationwide, supporting the rising demand for sustainable construction materials in Mexico.

- In August 2024, Cemento Cruz Azul inaugurated a second industrial byproducts processing line at its Tepezalá plant in Aguascalientes. The US$8.5 million facility will convert over 66,000 tons per year of post-consumer materials into energy for cement production, supporting sustainability initiatives and enhancing efficiency in Mexico’s concrete and cement sector.

Mexico Concrete Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Concrete Types Covered |

|

| Applications Covered | Reinforced Concrete, Non-Reinforced Concrete |

| End Use Industries Covered | Roads and Highways, Tunnels, Residential Buildings, Non-Residential Buildings, Dams and Power Plants, Mining, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico concrete market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico concrete market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico concrete industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The concrete market in Mexico was valued at USD 47,837.0 Million in 2025.

The concrete market in Mexico is projected to exhibit a CAGR of 3.67% during 2026-2034, reaching a value of USD 66,149.8 Million by 2034.

The Mexico concrete market is driven by rapid urbanization and extensive infrastructure development, increasing demand in residential, commercial, and public projects. Significant government and private investments, adoption of sustainable construction materials, and technological advancements like smart batching and digital management systems are further enhancing efficiency, quality, and overall market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)