Mexico Concrete Reinforcement Market Size, Share, Trends and Forecast by Product Type, Application, and Region, 2026-2034

Mexico Concrete Reinforcement Market Overview:

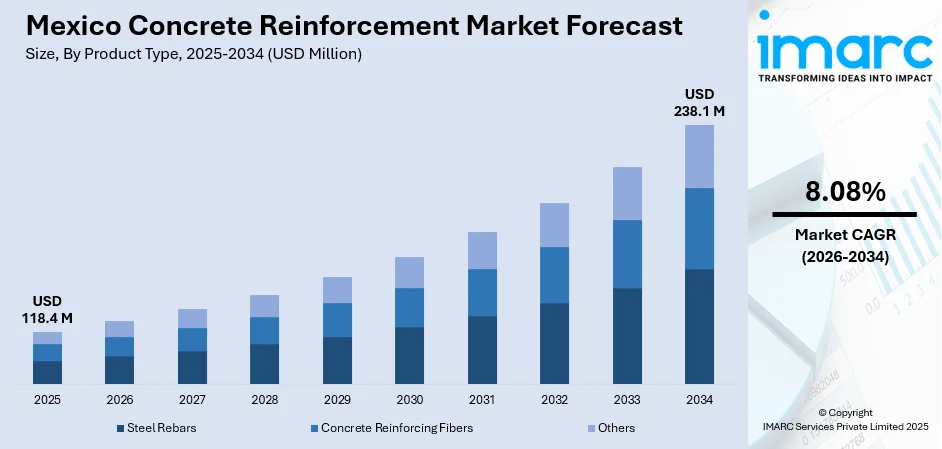

The Mexico concrete reinforcement market size reached USD 118.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 238.1 Million by 2034, exhibiting a growth rate (CAGR) of 8.08% during 2026-2034. The market is driven by tightening environmental regulations and rising demand for sustainable materials, which offer corrosion resistance and longer lifespans in high-humidity regions. Government-led infrastructure projects, including the Tren Maya and Felipe Ángeles International Airport, are accelerating demand for reinforced concrete, while private sector construction in urban hubs further stimulates growth. Coupled with post-pandemic recovery investments in roads and energy facilities, these factors are further augmenting the Mexico concrete reinforcement market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 118.4 Million |

|

Market Forecast in 2034

|

USD 238.1 Million |

| Market Growth Rate 2026-2034 | 8.08% |

Access the full market insights report Request Sample

Mexico Concrete Reinforcement Market Trends:

Growing Demand for Sustainable Reinforcement Materials

The market is witnessing a rising demand for sustainable and eco-friendly materials, driven by stricter environmental regulations and increased awareness of green construction practices. Mexico seeks to have 66% fewer emissions from commercial and residential buildings by 2030, according to worldwide efforts where the building sector accounts for 34% of CO₂ emissions, of which 18% come from materials such as concrete and steel. While there has been some progress, international green investments in buildings dropped 7% in 2023 to USD 270 Billion, and only 4% was invested in sustainable projects, highlighting strong prospects for Mexico's concrete reinforcement sector. Recycling construction materials rose to 18% in specific regions, indicating an increasing demand for low-carbon building materials and circular construction practices. Traditional steel rebar, while widely used, has a significant carbon footprint due to high energy consumption in production. As a result, builders and contractors are increasingly adopting alternatives such as fiber-reinforced polymer (FRP) rebars and recycled steel. FRP rebars, made from composite materials, including glass or carbon fiber, offer corrosion resistance, lighter weight, and longer lifespan, making them ideal for infrastructure projects in coastal and humid regions. Additionally, government initiatives promoting sustainable construction, such as the Ley General de Cambio Climático, are accelerating this shift. With Mexico’s construction sector expanding, particularly in urban and industrial projects, the adoption of green reinforcement solutions is expected to grow, presenting opportunities for manufacturers to innovate and capture this emerging market segment.

To get more information on this market Request Sample

Increasing Infrastructure Investments

The government’s focus on large-scale infrastructure development is significantly supporting the Mexico concrete reinforcement market growth. As per a 2024 report, Mexico's National Road Network totals 916,078 kilometers, including 184,969 kilometers of paved roads and 1,356 toll stations, as well as 22,036 kilometers spread out across 15 major logistics corridors. There are 4,508 kilometers of concessioned highways that Fonadin operates, including 47 that are currently active and three that are being constructed, which evidences a substantial demand for high-performance concrete reinforcement. In addition, there are 73 sustainable infrastructure projects that under Sustainable Development Goal 9 reflect high investments that foster structurally resilient transport corridors. Major projects, such as the Tren Maya and the Felipe Ángeles International Airport, require high volumes of reinforced concrete, enhancing the market for rebar and mesh products. Additionally, private sector investments in commercial and residential construction, particularly in cities such as Mexico City, Monterrey, and Guadalajara, are further driving growth. The post-pandemic economic recovery has also led to renewed public and private spending on roads, bridges, and energy facilities, increasing the need for durable reinforcement solutions. Local steel producers are expanding capacity to meet demand, while international suppliers are entering the market, intensifying competition. As Mexico continues to prioritize infrastructure modernization, the concrete reinforcement market is expected to experience steady growth, supported by both government initiatives and private sector developments.

Mexico Concrete Reinforcement Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product type and application.

Product Type Insights:

- Steel Rebars

- Concrete Reinforcing Fibers

- Polypropylene Fibers

- Steel Fibers

- Basalt Fibers

- Others

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes steel rebars, concrete reinforcing fibers (polypropylene fibers, steel fibers, basalt fibers, and others), and others.

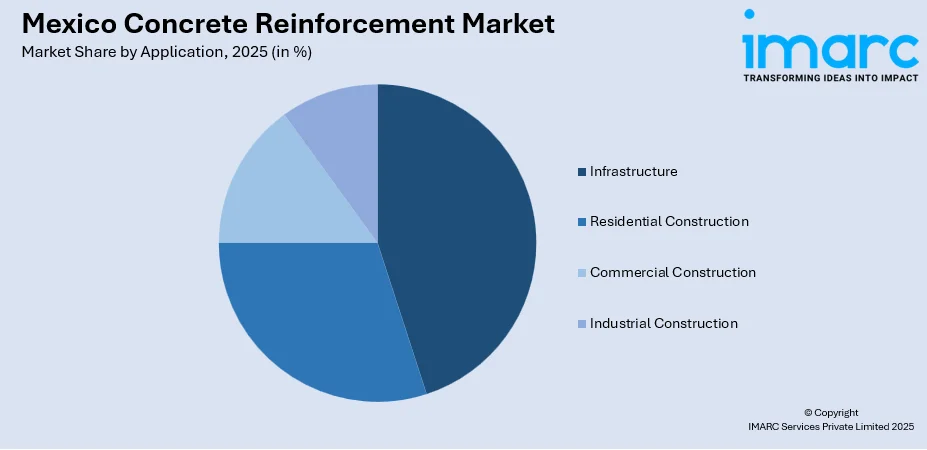

Application Insights:

To get detailed segment analysis of this market Request Sample

- Infrastructure

- Residential Construction

- Commercial Construction

- Industrial Construction

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes infrastructure, residential construction, commercial construction, and industrial construction.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Concrete Reinforcement Market News:

- December 28, 2024: WORKac and Ignacio Urquiza Architects completed a 447 m² neighborhood center with green-stained concrete in Mexico City's Azcapotzalco borough, built under PILARES. The three-story building utilized reinforced concrete, natural ventilation, and natural light to provide a space for skills acquisition and cultural programming in a high-density, low-income neighborhood. As part of an extended city grid, it highlights the growing demand for architecturally distinctive and structurally resilient reinforced concrete for public buildings.

Mexico Concrete Reinforcement Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Applications Covered | Infrastructure, Residential Construction, Commercial Construction, Industrial Construction |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico concrete reinforcement market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico concrete reinforcement market on the basis of product type?

- What is the breakup of the Mexico concrete reinforcement market on the basis of application?

- What is the breakup of the Mexico concrete reinforcement market on the basis of region?

- What are the various stages in the value chain of the Mexico concrete reinforcement market?

- What are the key driving factors and challenges in the Mexico concrete reinforcement?

- What is the structure of the Mexico concrete reinforcement market and who are the key players?

- What is the degree of competition in the Mexico concrete reinforcement market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico concrete reinforcement market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico concrete reinforcement market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico concrete reinforcement industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)