Mexico Connected Car Market Size, Share, Trends and Forecast by Technology, Connectivity Solution, Service, End Market, and Region, 2025-2033

Mexico Connected Car Market Overview:

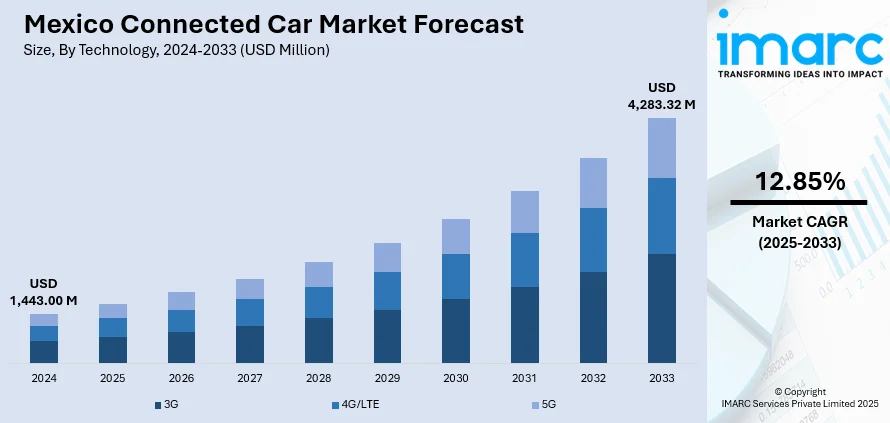

The Mexico connected car market size reached USD 1,443.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 4,283.32 Million by 2033, exhibiting a growth rate (CAGR) of 12.85% during 2025-2033. The growth of the market is driven by expanding 5G networks, increasing demand for telematics, and government policies promoting smart mobility. Consumer preferences for safety, real-time navigation, and in-car connectivity also fuel market expansion, while partnerships between automakers, insurers, and tech firms enhance innovation and adoption. Additionally, rising EV adoption, coupled with smart charging infrastructure, is further expanding the Mexico connected car market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,443.00 Million |

| Market Forecast in 2033 | USD 4,283.32 Million |

| Market Growth Rate 2025-2033 | 12.85% |

Mexico Connected Car Market Trends:

Increasing Adoption of 5G and Telematics in Connected Cars

The market is experiencing rapid growth due to the increasing adoption of 5G technology and advanced telematics systems. Mexico has reached 5G uptake with 6.6 million customers, representing 51% of the overall mobile subscriptions within the country. Industries such as logistics and transportation show strong interest. Over 70% of Mexico's executives plan to adopt 5G technology in 2024, driven by the promise of higher revenues and improved efficiency of operations. However, challenges including skill gaps and security concerns remain, highlighting the need for investments in connectivity, particularly in areas such as connected vehicles. As telecom providers expand 5G coverage across urban and semi-urban areas, automakers are integrating high-speed connectivity to enhance real-time navigation, over-the-air (OTA) updates, and vehicle-to-everything (V2X) communication. Telematics solutions, such as remote diagnostics, stolen vehicle tracking, and predictive maintenance, are gaining traction among consumers and fleet operators. Insurance companies are also promoting usage-based insurance (UBI) programs, leveraging telematics data to offer personalized premiums. Government initiatives supporting smart mobility and stricter safety regulations are further accelerating demand. With major automakers introducing connected features in their Mexican models, the market is poised for sustained expansion, driven by consumer preference for enhanced safety, convenience, and entertainment on the road.

Growth of Electric Vehicles (EVs) and Smart Charging Infrastructure

The rising popularity of electric vehicles (EVs) integrated with smart connectivity features is propelling the Mexico connected car market growth. Mexico became the fourth-largest auto parts producer in the world, and it is poised to become the fifth-largest vehicle manufacturer by the end of 2025. Having produced over 200,000 units and securing 68 new investments in electromobility just this year, the country is quickly moving towards EVs. With U.S. automotive giants and China's EV makers establishing localized supply chains for them, Mexico's fledgling foundry sector is fast becoming integral to the future of the automotive sector. Mexico is all set to play a key role as the future of auto technology in North America transforms, with over 170 Tier 1 and Tier 2 suppliers of EV components. As sustainability becomes a priority, both domestic and international automakers are launching EVs with embedded IoT sensors, battery management systems, and AI-driven analytics. These connected EVs enable drivers to locate charging stations, monitor battery health, and optimize routes for energy efficiency via mobile apps. The Mexican government is supporting this shift through incentives for EV adoption and investments in smart charging infrastructure, particularly in major cities including Mexico City and Monterrey. Additionally, partnerships between automakers, energy providers, and tech firms are fostering innovations such as vehicle-to-grid (V2G) technology, allowing EVs to supply power back to the grid. This trend aligns with global decarbonization efforts and positions Mexico as an emerging hub for connected and electric mobility solutions in Latin America.

Mexico Connected Car Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on technology, connectivity solution, service, and end market.

Technology Insights:

- 3G

- 4G/LTE

- 5G

The report has provided a detailed breakup and analysis of the market based on the technology. This includes 3G, 4G/LTE, and 5G.

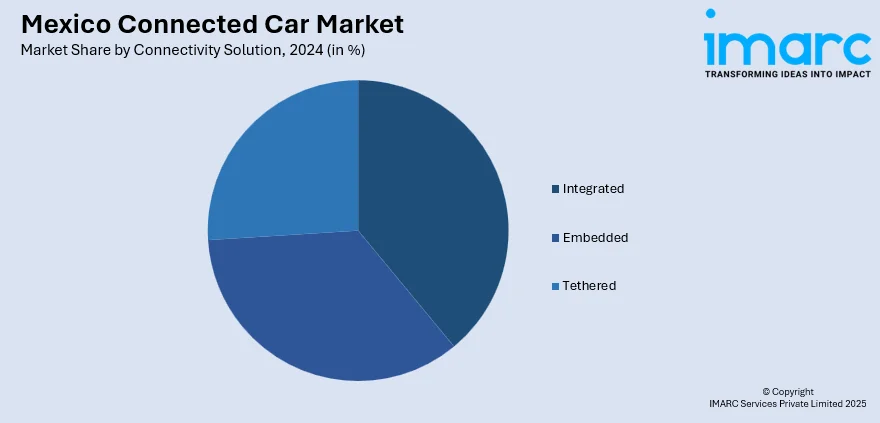

Connectivity Solution Insights:

- Integrated

- Embedded

- Tethered

A detailed breakup and analysis of the market based on the connectivity solution have also been provided in the report. This includes integrated, embedded, and tethered.

Service Insights:

- Driver Assistance

- Safety

- Entertainment

- Vehicle Management

- Mobility Management

- Others

The report has provided a detailed breakup and analysis of the market based on the service. This includes driver assistance, safety, entertainment, vehicle management, mobility management, and others.

End Market Insights:

- Original Equipment Manufacturer (OEMs)

- Aftermarket

A detailed breakup and analysis of the market based on the end market have also been provided in the report. This includes original equipment manufacturer (OEMs) and aftermarket.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Connected Car Market News:

- January 08, 2025: Mexico launched Olinia, its first local electric vehicle (EV) producer, with plans to roll out three models by 2030 in a price range of MXN 90,000 (approximately USD 4,591.80) to MXN 150,000 (approximately USD 7,653). These cars will prioritize personal transportation, local travel, and last-mile delivery, thus enhancing the country's growing electromobility sector. The move aligns with Mexico's pursuit of sustainable mobility and vehicle connectivity technology supported by solar power investments in Sonora and new regulations encouraging electromobility.

Mexico Connected Car Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | 3G, 4G/LTE, 5G |

| Connectivity Solutions Covered | Integrated, Embedded, Tethered |

| Services Covered | Driver Assistance, Safety, Entertainment, Vehicle Management, Mobility Management, Others |

| End Markets Covered | Original Equipment Manufacturer (OEMs), Aftermarket |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico connected car market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico connected car market on the basis of technology?

- What is the breakup of the Mexico connected car market on the basis of connectivity solution?

- What is the breakup of the Mexico connected car market on the basis of service?

- What is the breakup of the Mexico connected car market on the basis of end market?

- What is the breakup of the Mexico connected car market on the basis of region?

- What are the various stages in the value chain of the Mexico connected car market?

- What are the key driving factors and challenges in the Mexico connected car market?

- What is the structure of the Mexico connected car market and who are the key players?

- What is the degree of competition in the Mexico connected car market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico connected car market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico connected car market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico connected car industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)