Mexico Construction Chemicals Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

Mexico Construction Chemicals Market Overview:

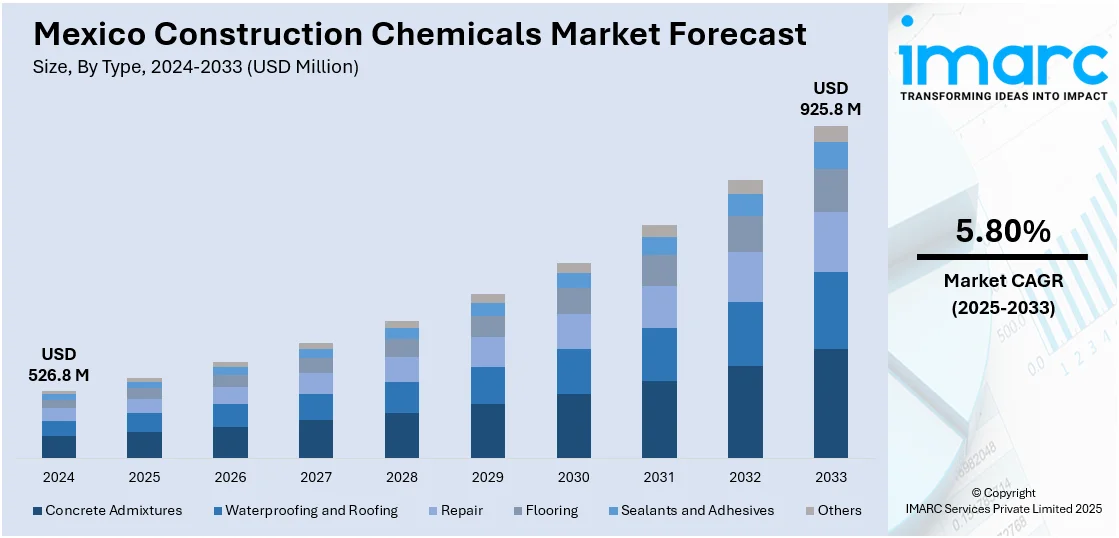

The Mexico construction chemicals market size reached USD 526.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 925.8 Million by 2033, exhibiting a growth rate (CAGR) of 5.80% during 2025-2033. The market is growing due to increasing infrastructure activity, stricter environmental regulations, and rising demand for sustainable building materials. Investments in eco-friendly raw materials and localized manufacturing are fostering innovation, enhancing supply reliability, and supporting the development of low-impact construction solutions nationwide.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 526.8 Million |

| Market Forecast in 2033 | USD 925.8 Million |

| Market Growth Rate 2025-2033 | 5.80% |

Mexico Construction Chemicals Market Trends:

Push Toward Greener Raw Materials

Mexico’s construction chemicals market is increasingly aligning with sustainability goals through the integration of low-emission raw materials. As environmental regulations across North America become more rigorous, producers in the construction sector are under mounting pressure to adopt greener inputs that support carbon reduction objectives. One major enabler of this transition is the rising availability of sustainable feedstocks that allow for eco-friendly formulations in concrete admixtures, waterproofing agents, and insulation chemicals without compromising performance or durability. In March 2025, Nextchem secured a licensing contract for an ultra-low carbon methanol plant in Mexico designed to supply green and blue methanol produced using carbon capture. Although the project primarily targets industrial uses, its impact on the domestic supply of low-carbon inputs could extend to construction chemicals manufacturing. This will help drive innovation in sustainable building materials and expand the local market for products that meet green certification standards. With reliable access to cleaner raw materials, Mexico is positioned to strengthen its role in the regional value chain for environmentally responsible construction solutions, supporting both public and private infrastructure development with lower carbon footprints.

Localized Growth in Coatings Infrastructure

The importance of regional supply networks and domestic production capacity is growing within Mexico’s construction chemicals sector. Market participants are seeking to mitigate rising logistics costs, reduce dependency on imports, and serve local demand with greater speed and flexibility. These factors are driving investment in localized manufacturing and material integration capabilities across the country. In August 2024, Saint-Gobain announced its acquisition of Mexico-based OvniVer Group for USD 815 Million to expand its presence in the construction chemicals market. This strategic move strengthened local production infrastructure and bolstered R&D capabilities, supporting the development of application-specific construction chemical products. While the acquisition primarily focused on construction, it also contributed to enhancing the broader industrial ecosystem that benefits multiple chemical subsegments. The strengthened domestic footprint promotes supply chain efficiency and enables the creation of formulations suited to Mexico’s climate and construction practices. Moreover, the investment signaled long-term confidence in Mexico as a manufacturing hub, likely encouraging further expansion and innovation within the sector. As a result, the country is well-positioned to meet the increasing demand for advanced, durable, and sustainable construction materials while reducing external supply risks and improving responsiveness to market needs.

Mexico Construction Chemicals Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Concrete Admixtures

- Waterproofing and Roofing

- Repair

- Flooring

- Sealants and Adhesives

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes concrete admixtures, waterproofing and roofing, repair, flooring, sealants and adhesives, and others.

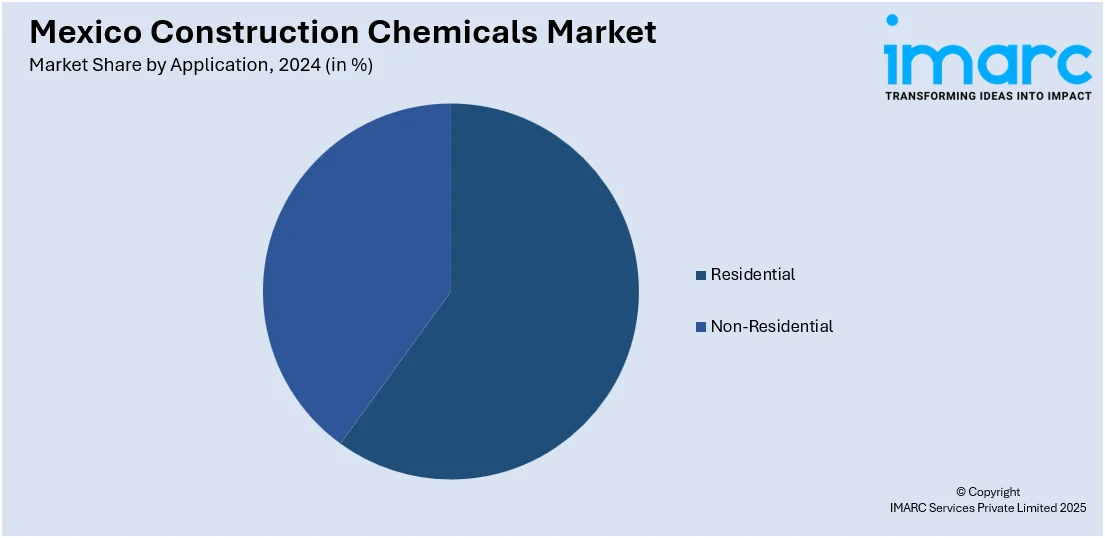

Application Insights:

- Residential

- Non-Residential

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential and non-residential.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Construction Chemicals Market News:

- March 2025: Nextchem secured a licensing contract for an ultra-low carbon methanol plant in Mexico, aimed at advancing sustainable chemical manufacturing. This development supported the Mexico construction chemicals market by enabling access to greener feedstocks, encouraging low-emission product innovation and sustainable material sourcing in construction applications.

- August 2024: Saint-Gobain announced its acquisition of Mexico-based OvniVer Group for USD 815 Million to strengthen its position in construction chemicals. The acquisition enhanced local production capabilities, boosted supply chain efficiency, and supported the growth of advanced, region-specific construction chemical solutions in the Mexican market.

Mexico Construction Chemicals Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Concrete Admixtures, Waterproofing and Roofing, Repair, Flooring, Sealants and Adhesives, Others |

| Applications Covered | Residential, Non-Residential |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico construction chemicals market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico construction chemicals market on the basis of type?

- What is the breakup of the Mexico construction chemicals market on the basis of application?

- What is the breakup of the Mexico construction chemicals market on the basis of region?

- What are the various stages in the value chain of the Mexico construction chemicals market?

- What are the key driving factors and challenges in the Mexico construction chemicals?

- What is the structure of the Mexico construction chemicals market and who are the key players?

- What is the degree of competition in the Mexico construction chemicals market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico construction chemicals market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico construction chemicals market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico construction chemicals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)