Mexico Construction Demolition Waste Recycling Market Size, Share, Trends and Forecast by Material, Source, Service, and Region, 2025-2033

Mexico Construction Demolition Waste Recycling Market Overview:

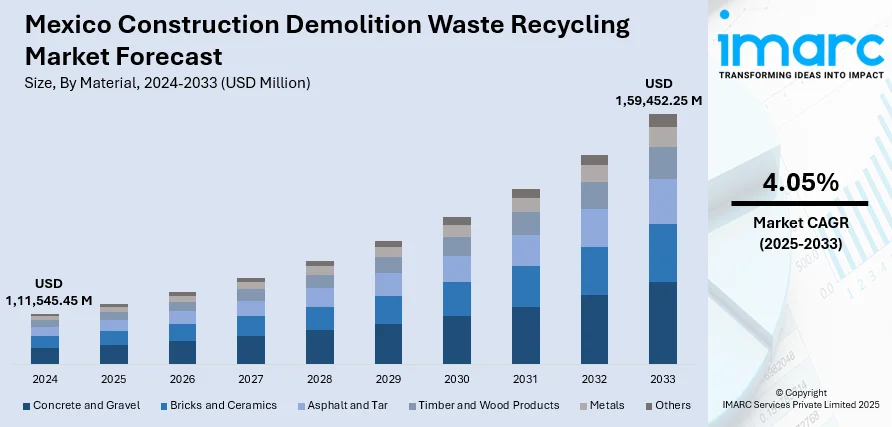

The Mexico construction demolition waste recycling market size reached USD 1,11,545.45 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,59,452.25 Million by 2033, exhibiting a growth rate (CAGR) of 4.05% during 2025-2033. The market is dominated significantly by stringent environmental policies that push businesses towards adopting recycling in a bid to achieve sustainability targets. Additionally, economic benefits in terms of material reuse and waste minimization also drive recycling activity expansion in construction. Advances in waste processing and sorting technologies in improving efficiency in recycling activity increase the Mexico construction demolition waste recycling market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,11,545.45 Million |

| Market Forecast in 2033 | USD 1,59,452.25 Million |

| Market Growth Rate 2025-2033 | 4.05% |

Mexico Construction Demolition Waste Recycling Market Analysis:

- Key Market Drivers: Mandatory recycling practice regulations by the government and growing environmental consciousness among construction firms are compelling the market demand. Cost savings due to lowered disposal costs and material retrieval further motivate adoption and underpin aggregate market growth.

- Key Market Trends: Technological innovation in computerized sorting technology and artificial intelligence-based waste handling machinery improves efficiency. Blockchain technologies come up for open material tracking and certification. Increasing usage of circular economy models and the inclusion of reused materials in green construction projects further accelerate market growth.

- Competitive Landscape: The industry is characterized by the presence of varied players ranging from big waste management companies to niche recycling plants. Major players are engaged in increasing processing capacity, creating innovative technologies, and entering into strategic alliances with construction firms to develop comprehensive value chains in the recycling space.

- Challenges and Opportunities: High upfront capital costs and limitations in infrastructure are challenges, and rising urbanization and government initiatives to ensure sustainability are opportunities. Increased development of advanced recycling technologies and secondary markets for recycling materials are major growth opportunities for market stakeholders.

Mexico Construction Demolition Waste Recycling Market Trends:

Economic Benefits of Recycling and Resource Recovery

Economic factors play a key role in the development of the market. Recycling offers significant cost-saving opportunities for businesses by reducing the need for new raw materials, cutting disposal fees, and avoiding landfill taxes. The ability to reuse construction debris lowers material costs, providing a competitive advantage to companies that integrate recycling into their operations. Additionally, resource recovery not only benefits construction companies but also creates jobs in the recycling sector, contributing to the local economy. Many businesses in Mexico are recognizing the potential financial advantages of recycling and repurposing construction materials, especially as raw material prices continue to rise globally. On January 25, 2023, Cemex officially launched Regenera, a global waste management business focused on processing municipal, industrial, and construction, demolition, and excavation waste across its operating regions, including Mexico. In Mexico alone, Regenera manages nearly 2 million tons of waste annually and processes over 80% of urban solid waste in cities like Querétaro. The economic benefits are amplified by the growing demand for sustainable and eco-friendly construction practices. Furthermore, as more projects seek environmental certifications, the use of recycled materials becomes essential, providing additional financial incentives for businesses to invest in recycling technologies. By implementing recycling strategies, construction companies are able to reduce operational costs, while simultaneously contributing to environmental sustainability. This combination of economic and environmental incentives is a key driver of Mexico construction demolition waste recycling market demand, making recycling an attractive and increasingly integral component of the market growth.

To get more information on this market, Request Sample

Technological Advancements in Recycling Methods

Technological progress has significantly influenced the market. With improvements in recycling methods, construction and demolition waste is now handled more efficiently, allowing for increased recycling rates and more effective recovery of resources. Innovations such as automated sorting systems, advanced crushing equipment, and enhanced materials processing techniques have greatly improved the effectiveness and profitability of recycling operations. These technological developments make it possible to recycle a wider range of materials, including concrete, metals, and wood, which were previously difficult to process. The integration of artificial intelligence (AI) as well as machine learning (ML) into waste management systems has optimized sorting and tracking of materials, improving efficiency and reducing labor costs. Moreover, waste-to-energy technologies have emerged as an alternative method for managing waste, turning construction debris into usable energy. These technological improvements not only lower the costs associated with recycling but also ensure that the process is more sustainable and scalable. On February 15, 2023, Ternium announced plans to build a 2.6-million-tons-per-year electric arc furnace (EAF) steel mill in Nuevo León, Mexico, with operations expected to begin in the first half of 2026. The facility will include a 2.1-million-tons-per-year direct reduced iron (DRI) module, featuring carbon capture and future hydrogen readiness, aligning with Ternium’s 2030 decarbonization targets. This development is relevant to Mexico construction demolition waste recycling market analysis, as increased steel recycling via EAF technology creates demand for ferrous scrap and supports circular material flows in regional construction supply chains. As Mexico's construction industry becomes more environmentally conscious, the continuous advancement of recycling technologies is expected to play a vital role in meeting sustainability goals. The ongoing development of these technologies will drive the market forward, helping the country meet its environmental targets while fostering a more sustainable construction sector.

Mexico Construction Demolition Waste Recycling Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on material, source, and service.

Material Insights:

- Concrete and Gravel

- Bricks and Ceramics

- Asphalt and Tar

- Timber and Wood Products

- Metals

- Others

The report has provided a detailed breakup and analysis of the market based on the material. This includes concrete and gravel, bricks and ceramics, asphalt and tar, timber and wood products, metals, and others.

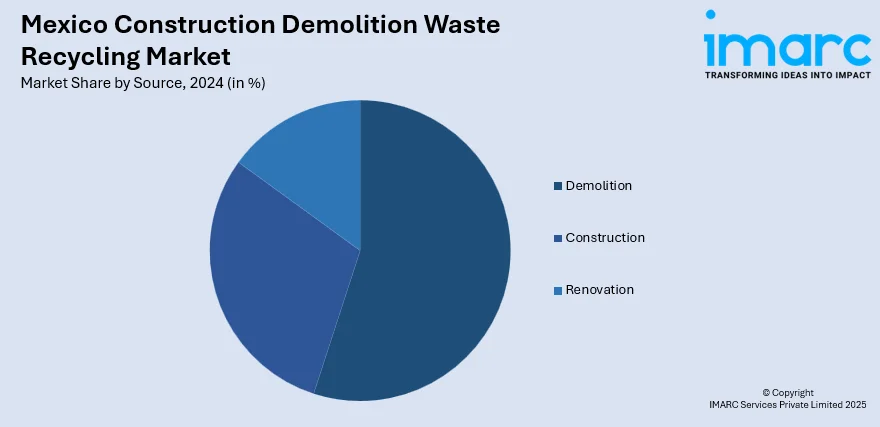

Source Insights:

- Demolition

- Construction

- Renovation

The report has provided a detailed breakup and analysis of the market based on the source. This includes demolition, construction, and renovation.

Service Insights:

- Disposal

- Collection

The report has provided a detailed breakup and analysis of the market based on the service. This includes disposal and collection.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Construction Demolition Waste Recycling Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Concrete and Gravel, Bricks and Ceramics, Asphalt and Tar, Timber and Wood Products, Metals, Others |

| Sources Covered | Demolition, Construction, Renovation |

| Services Covered | Disposal, Collection |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico construction demolition waste recycling market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico construction demolition waste recycling market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico construction demolition waste recycling industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The construction demolition waste recycling market in Mexico was valued at USD 1,11,545.45 Million in 2024.

The Mexico construction demolition waste recycling market is projected to exhibit a CAGR of 4.05% during 2025-2033, reaching a value of USD 1,59,452.25 Million by 2033.

The key factors driving the market include stringent government regulations promoting recycling, growing environmental awareness among construction companies, and economic incentives linked to reduced disposal costs and material recovery. Additionally, increasing adoption of circular economy principles and demand for sustainable construction practices further propel market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)