Mexico Construction Equipment Rental Market Size, Share, Trends and Forecast by Equipment Type, Propulsion System, Application, and Region, 2025-2033

Mexico Construction Equipment Rental Market Overview:

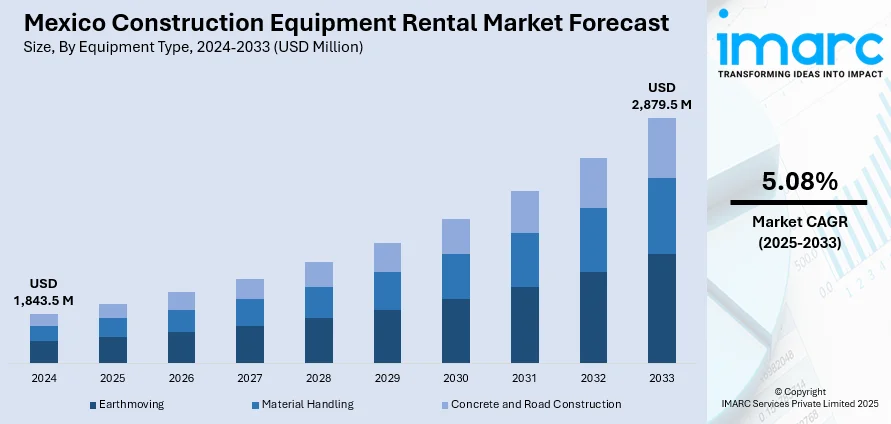

The Mexico construction equipment rental market size reached USD 1,843.5 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,879.5 Million by 2033, exhibiting a growth rate (CAGR) of 5.08% during 2025-2033. The market is expanding due to major infrastructure projects, such as roads and renewable energy developments, which are increasing demand for heavy machinery. Technological advancements and digital platforms streamlining equipment access and management, along with labor shortages, making rentals a practical solution for timely project completion, further fueling the Mexico construction equipment rental market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,843.5 Million |

| Market Forecast in 2033 | USD 2,879.5 Million |

| Market Growth Rate 2025-2033 | 5.08% |

Mexico Construction Equipment Rental Market Trends:

Infrastructure Expansion and Urbanization

Mexico's rapid urbanization and government-led infrastructure initiatives are significantly boosting the demand for construction equipment rentals. Construction and maintenance projects that build roads, bridges, and airports, along with public transport infrastructure, need multiple types of machinery for their completion. The renting of construction equipment enables contractors to get specialized machinery without having to commit funds for full ownership. Short-term large-scale projects, together with the ability to scale operations, benefit significantly from equipment rentals that enable flexible allocation of resources. The ongoing development in both urban and rural areas underscores the critical role of equipment rental services in meeting the dynamic needs of Mexico's evolving infrastructure landscape.

To get more information of this market, Request Sample

Cost Efficiency and Financial Flexibility

The high costs associated with purchasing and maintaining construction equipment make rentals an attractive option for many Mexican contractors, thereby driving the Mexico construction equipment rental market growth. The rental solution reduces ownership costs of storage and maintenance, and depreciation since it offers financial latitude for small to medium-sized business owners. A rental approach gives businesses better capital management, which enables them to invest resources into key areas like employee development, along with project management. Additionally, rental agreements often include maintenance services, reducing downtime and ensuring equipment reliability. The economic advantages of equipment rental are driving its adoption across various segments of the construction industry in Mexico.

Digitalization and Operational Efficiency

The integration of digital platforms in the construction equipment rental industry is streamlining operations and improving efficiency. Online rental platforms enable contractors to browse equipment options, compare prices, and schedule deliveries with ease. These platforms often include features such as real-time tracking, usage analytics, and maintenance alerts, allowing for better project planning and resource management. The convenience and transparency offered by digital solutions are enhancing customer experiences and fostering trust in rental services. As digital adoption continues to rise, it is playing a pivotal role in the expansion of Mexico's construction equipment rental market.

Mexico Construction Equipment Rental Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on equipment type, propulsion system, and application.

Equipment Type Insights:

- Earthmoving

- Excavator

- Loader

- Backhoe

- Motor Grader

- Others

- Material Handling

- Crawler Crane

- Trailer-Mounted Crane

- Truck-Mounted Crane

- Concrete and Road Construction

The report has provided a detailed breakup and analysis of the market based on the equipment type. This includes earthmoving (excavator, loader, backhoe, motor grader, and others), material handling (crawler crane, trailer-mounted crane, and truck-mounted crane), and concrete and road construction.

Propulsion System Insights:

- Electric

- ICE

A detailed breakup and analysis of the market based on the propulsion system have also been provided in the report. This includes electric and ICE.

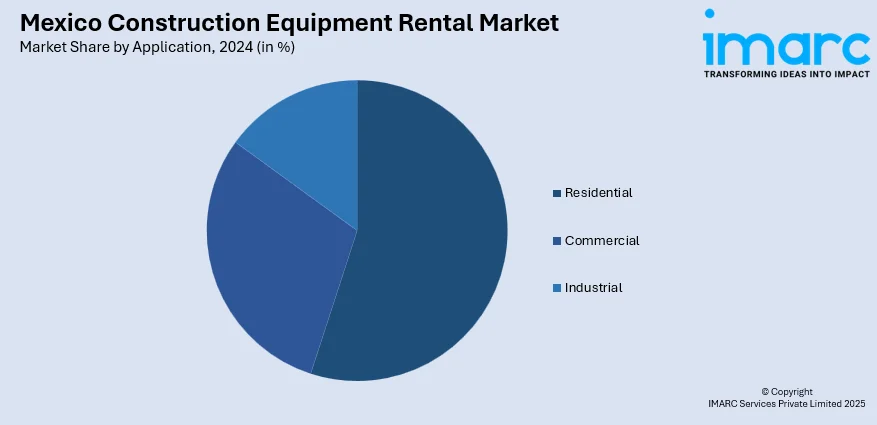

Application Insights:

- Residential

- Commercial

- Industrial

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential, commercial, and industrial.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Construction Equipment Rental Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Equipment Types Covered |

|

| Propulsion Systems Covered | Electric, ICE |

| Applications Covered | Residential, Commercial, Industrial |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico construction equipment rental market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico construction equipment rental market on the basis of equipment type?

- What is the breakup of the Mexico construction equipment rental market on the basis of propulsion system?

- What is the breakup of the Mexico construction equipment rental market on the basis of application?

- What is the breakup of the Mexico construction equipment rental market on the basis of region?

- What are the various stages in the value chain of the Mexico construction equipment rental market?

- What are the key driving factors and challenges in the Mexico construction equipment rental market?

- What is the structure of the Mexico construction equipment rental market and who are the key players?

- What is the degree of competition in the Mexico construction equipment rental market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico construction equipment rental market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico construction equipment rental market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico construction equipment rental industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)